Month: January 2014

F.A. Hayek, *The Market and Other Orders*

That is the new University of Chicago Press volume of Hayek’s collected works, this time volume 15. It is the best single-volume introduction to Hayek’s thought, if you are going to buy or read only one. It has the best of the early essays, as you might find in Individualism and Economic Order, and then the best later essays which build upon those earlier insights.

Here is Bruce Caldwell’s introduction to the volume, for e-purchase. The book’s table of contents is here. Here is our MRU course on Friedrich Hayek.

Assorted links

1. Fun Twitter source of German words.

2. Not safe for work uses of Google Glass.

3. “Cataluña tiene un superávit de 4.000 millones.”

4. The true power of the Blockchain?

5. Update on The Orange County Register.

6. Too negative, too polemic, and too unreasonable, but if you wish to read an argument that Jane Austen was not in fact a game theorist, here goes.

Venezuela fact of the day

I knew gas in Venezuela was underpriced, but I had not known by how much. Nick Miroff brings us the latest:

Venezuela sits atop the world’s largest oil reserves, and its government sets the price of premium gasoline at about 5 cents a gallon. Its real price — adjusted to the soaring street value of the U.S. dollar — is half a penny per gallon.

But rest assured, there will be a move toward international prices:

The projected price hike is likely to push gas closer to 17 cents a gallon, at unofficial exchange rates.

There is more here.

How well does a minimum wage boost target the poor?

There has been a recent kerfluffle over the Sabia and Burkhauser paper (ungated here) suggesting that minimum wage increases do not very much help the American poor. Sabia and Burkhauser report facts such as this:

Only 11.3% of workers who will gain from an increase in the federal minimum wage to $9.50 per hour live in poor households…Of those who will gain, 63.2% are second or third earners living in households with incomes three times the poverty line, well above 50,233, the income of the median household in 2007.

That’s what I call not very well targeted toward helping the poor. To the best of my knowledge, these numbers have not been refuted or even questioned.

There has been a significant campaign lately to elevate this Arindrajit Dube piece (pdf) into a rebuttal of Sabia and Burkhauser. I’ve now read through it, and while it is pretty dense, I don’t see that it supplies any such effective rebuttal (it is however a valuable paper, and survey paper, in its own right).

Here is an excerpt from the Dube paper:

An additional contribution of the paper is to apply the recentered influence function (RIF) regression approach of Firpo, Fortin and Lemieux (2009) to estimate unconditional quantile partial effects (UQPEs) of minimum wages on the equivalized family income distribution.

Dube also writes:

The elasticity of the poverty rate with respect to the minimum wage ranges between -0.12 and -0.37 across specifications with alternative forms of time-varying controls and lagged effects; most of these estimates are statistically significant at conventional levels.

Dube in fact counts up twelve papers on the side of “minimum wage hikes can make a reasonably-sized dent in poverty.”

Now, I don’t intend this as any kind of snide, anti-theory, or anti-technique comment, but when there is a clash between simple, validated observations and complicated regressions, no matter how state of the art the latter may be, I don’t always side with the regressions.

One interpretation of the Dube results is:

a) although a minimum wage hike applies only to some members of a community, its morale or network effects spread its benefits much more widely, or,

b) through some kind of chain link effect, a minimum wage hike pushes up the entire distribution of wages for lower-income workers

Alternatively, I would try

c) the public choice critique of econometrics is correct, these minimum wage hikes are all endogenous to complex factors, and no one has a properly specified model. We are seeing correlations rather than causation, despite all attempts to adjust for confounding variables.

So far I am voting for c). And there is a very simple story to tell here, namely that states which are good at fighting poverty, through whatever means, also tend to have higher minimum wages for political economy reasons. It seems unlikely that controls are going to pick up that effect fully.

Or try another model, more tongue in cheek but instructive nonetheless. If government is quite benevolent and omniscient, and has always done exactly the right thing in the past, we will see in the data that the minimum hikes of the past are at least somewhat effective in fighting poverty. At the same time, the remaining options on possible minimum wage hikes will not help at all.

Dube’s paper, econometrically speaking, is a clear advance over Sabia and Burkhauser. But Dube pays little heed to integrating econometric results with common sense facts and observations about the economy. As Bryan Caplan has stated, the knowledge and judicious invocation of simple facts about the economy is one of the most underrated skills in professional economics.

I also get a bit nervous when the number of studies on one side of a question is counted and weighed up against common facts. Some of these pieces are simply measuring the same correlation in (somewhat) differing ways, and the number of them says more about the publication process than anything else. These pieces also are not all in what I would call great journals. Maybe that is an unfair metric of judgment — I am writing this on a blog, after all. Nonetheless I looked at the list of cited sources and pulled out the two clumps with what appeared to be the highest academic pedigree, in terms of both economist and outlet.

The first clump is a group of papers by David Neumark, with co-authors. I find that Neumark does not himself think that minimum wage hikes do much if anything to help poverty, and he has a good claim at being the world’s number one expert on the economics of minimum wages. In fairness to Dube, he does have some good (although I would not say decisive) criticisms of one of Neumark’s papers pushing this line.

The second source is a paper by Autor, Manning, and Smith, an NBER working paper. They write “…the implied effect of the minimum wage on the actual wage distribution is smaller than the effect of the minimum wage on the measured wage distribution.”

Of course that hardly settles it.

You might call this one a draw, but then we return to the question of where the burden of proof lies. I’m still stuck on, to repeat the above quotation, this:

Only 11.3% of workers who will gain from an increase in the federal minimum wage to $9.50 per hour live in poor households…Of those who will gain, 63.2% are second or third earners living in households with incomes three times the poverty line, well above 50,233, the income of the median household in 2007.

Unemployment benefits and Google job search

I had not known of this Scott R. Baker and Andrey Fradkin paper until recently, here is the abstract:

The large-scale unemployment caused by the Great Recession has necessitated unprecedented increases in the duration of unemployment insurance (UI). While it is clear that the weekly payments are beneficial to recipients, workers receiving benefits have less incentive to engage in job search and accept job offers. We construct a job search activity index based on Google data which provides the first high-frequency, state-specific measure of job search activity. We demonstrate the validity of our measure by benchmarking it against the American Time Use Survey and the comScore Web-User Panel, and also by showing that it varies with hypothesized drivers of search activity. We test for search activity responses to policy shifts and changes in the distribution of unemployment benefit duration. We find that search activity is greater when a claimant’s UI benefits near exhaustion. Furthermore, search activity responses to the passage of bills that increase unemployment benefits duration are negative but short-lived in most specifications. Using daily data, we estimate that an increase by 1% of the population of unemployed receiving additional benefits results in a decrease in aggregate search activity of 1.7% lasting only one week.

One way (not the only way) of reading these results is to wonder if some of the unemployed feel they ought to increase their shirking in response to an extension of benefits, but they actually don’t really want to do so. They shirk a bit more, for a short while, not to feel like fools, and then return either to active search or fruitless despondent search, as the case may be. For better or worse, habit dies hard.

For the pointer I thank John Horton.

Conor Sen, by the way, tells us that “ask for a raise” is at a post-recession high on Google Trends.

Is ACA leading to less hiring?

There is a new study from West Michigan (pdf), by Leslie A. Muller, Paul Isely, & Adelin Levin, based on questionnaire responses. I would take this with a grain of salt, but still it is useful information to throw into the pot. Here is one excerpt:

Many firms have decided however to minimize their exposure to ACA costs by limiting the employees that must be covered. Questions 14a – 14c show that 36 percent of firms are considering (or using) temporary workers, 44 percent are considering or have reduced/limited hiring over the next 12 months, and 51 percent are considering or have already reduced/limited hours so that the employee is considered part-time.

You may find the tables on the last few pages of the paper of interest. The results are based on fewer than 180 observations and presumably involve some selection bias as well.

The pointer is from W.E. Heasley.

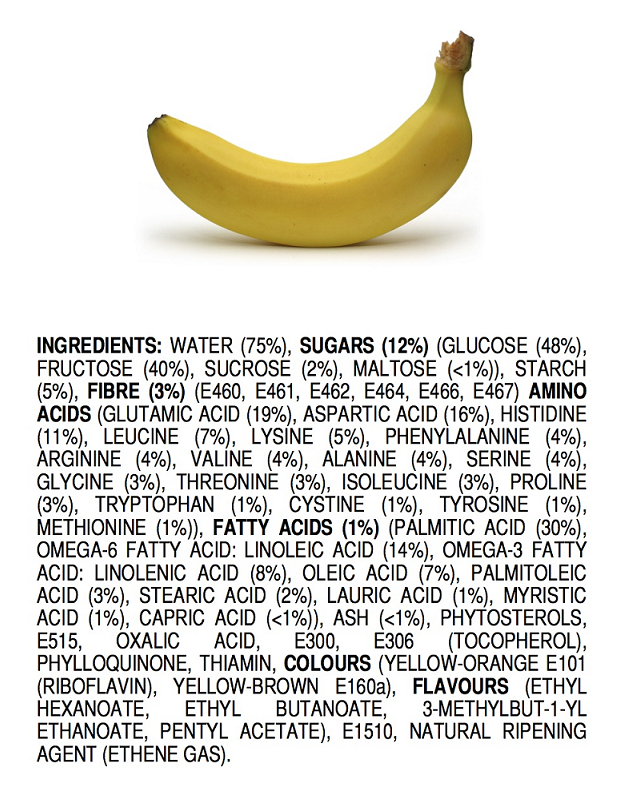

The Chemicals in Our Food

More here.

Assorted links

2. Joe Pass plays “Donna Lee” (video).

3. Booth School debate over Obamacare, with Gentzkow, Cochrane, and Notowidigdo (video).

4. “The driver presents the paperwork to the unsuspecting nut processor.”

5. “When is it normal to be weird?” (MR from 2006)

How much does America benefit from the growth of emerging nations?

Charles Kenny writes:

And growth in the developing world, even if it means that some populous economies may eventually grow larger than the United States, also means that there are more places for Americans to travel in security and comfort, and more places to learn, work or while away our retirement years. Americans can get health care at Bumrungrad International Hospital in Bangkok — accredited by the Joint Commission International, which certifies health-care organizations worldwide — for a fraction of the cost they can in Bethesda. Or their kids can attend college at the University of Cape Town, rated higher than Georgetown University in international rankings but one-fifth as expensive. Or perhaps they can get jobs at one of the new breed of world-class multinational firms based in the developing world, such as Tata or Huawei.

I sometimes think of this issue in terms of the gravity equation and the inward-looking propensities of large countries. Relative say to Swedes, Americans are relatively unwilling to travel abroad, educate themselves abroad, or work abroad. Some of this may be misguided arrogance, and some of it is a rational response from those living in a large, prosperous country and (often) knowing only the global language, namely English. In other words, Americans benefit less (per capita) from the new opportunities abroad than do Swedes. We do benefit to the extent foreign countries generate innovations which make their way to the United States, but so far not so many of those have come from emerging economies. I expect that to change, although when is a very important and underexplored question.

I believe that for many educated but not super-elite Americans the best opportunities already are abroad, but most of that group is reluctant to exploit them, if only for reasons related to personal lifestyles and family connections and a general unfamiliarity with living abroad. We can expect to see more anecdotally-based feature stories on this theme, however. And there is some longer-run elasticity where the underlying American social norms change.

In the meantime, homebody Americans pay more for gasoline, due to the demands from emerging economies, and pay less at Walmart, and otherwise wonder what the fuss is about.

For more on related points, read Charles’s new and excellent book The Upside of Down, not to be confused with Megan McArdle’s new and excellent The New Up Side of Down, a single space can make all the difference in the world.

Assorted links

1. Phone lets you send smells rather than texts.

2. Reports of the death of net neutrality are much exaggerated.

3. The Wall Street Journal reviews the new Tim Harford book, which is excellent and now out. And a good Pearlstein review of The Second Machine Age.

4. How has the Swedish housing market changed?

5. What is the best question to ask on a first date?

6. Short Term 12, set in a foster home, is in fact a good movie.

Tennis quant betting

For someone who says he bets millions of dollars on tennis a year, sports gambler Elihu Feustel doesn’t watch many matches.

“Which one is Granollers?” Feustel says, referring to Marcel Granollers, a Spaniard ranked 35th in the world. “Is he the one that’s good on clay courts?”

Feustel, from South Bend, Indiana, says he doesn’t need to pay attention to who the players on the men’s ATP World Tour are to double his money. He relies on an algorithm he created using data from 260,000 matches to make about 30 bets a day on Grand Slams such as the Australian Open, which started Jan. 13.

Gamblers and investment funds are increasingly vying for profits from tennis by using computer models to win money from more casual bettors, according to Scott Ferguson, a former Betfair Group Plc (BET) education officer. Such quantitative analysts, or so-called quants, are focusing on tennis in the same way their counterparts are employed by hedge funds to predict moves for stocks, bonds and other assets.

Betfair, a London-based company that enables bettors to wager against each other online, matched almost 50 million pounds ($82 million) of bets on the 2012 final in which Novak Djokovic beat Rafael Nadal. Djokovic is an 8-11 favorite to win a fourth straight title in Melbourne with U.K. bookmaker William Hill Plc, meaning a successful $11 wager would return $8 plus the original stake.

Granollers prefers clay courts, according to his men’s tour profile, and lost his first-round match with Marin Cilic of Croatia in five sets on the second day of play on the hard courts of this year’s Australian Open.

…Tennis is an “attractive” sport to create an algorithm for because there are only two players in a singles match and statistics are freely available, according to William Knottenbelt, an associate professor of computing at London’s Imperial College. He co-wrote a tennis algorithm that he says would have made a 3.8 percent return on bets on 2,173 ATP matches in 2011.

Feustel, who says he puts in a 60-hour week checking and improving his model, works with a computer programmer and trader. The programmer trawls the Internet for data such as serve speed and break-point conversions. That’s plugged into the model which comes up with “fair” betting prices for scheduled games.

If those odds diverge from market prices, Feustel says, his trader — who lives outside the U.S. — will gamble as much as the market will allow at bookmakers including Pinnacle Sports, based on the Caribbean island of Curacao. That can be about $30,000 on a match result in later tournament rounds.

There is more here, and for the pointer I thank Hugo Lindgren, who is joining Hollywood Reporter as acting editor.

Markets in everything, 3-D printed babies

As far as I can tell, this is not from Japan:

The custom lifesize baby figurine is 8 inches (crown to rump). The lifesize baby is so called, because a 23-24 week old fetus is about 8 inches from crown to rump. It comes customized to resemble your baby. Provide between 1 and 5 images of your baby. For best results, include a portrait and a side view image.

Don’t forget the Grandparents. Order more than one 3D Baby and receive 10% off your order by using the Promotional Code LOVE.

Now if only they became taxpayers…

There are good pictures here. These pictures are even better. For the pointer I thank Samir Varma.

Early data on ACA enrollees

Christopher Weaver and Anna Wilde Matthews report:

Early signals suggest the majority of the 2.2 million people who sought to enroll in private insurance through new marketplaces through Dec. 28 were previously covered elsewhere, raising questions about how swiftly this part of the health overhaul will be able to make a significant dent in the number of uninsured.

Insurers, brokers and consultants estimate at least two-thirds of those consumers previously bought their own coverage or were enrolled in employer-backed plans.

The data, based on surveys of enrollees, are preliminary. But insurers say the tally of newly insured consumers is falling short of their expectations, a worrying trend for an industry looking to the law to expand the ranks of its customers.

I would emphasize that we still don’t really know quite what is going on here. But the view that everything is now in the clear simply is not warranted by the available evidence.

Hat tip goes to Megan McArdle.

Back to the Amazon future (sign me up)

Amazon.comAMZN +0.43% knows you so well it wants to ship your next package before you order it.

The Seattle retailer in December gained a patent for what it calls “anticipatory shipping,” a method to start delivering packages even before customers click “buy.”

There is more here. And here are our previous posts on Amazon.

The pointer is from @MattYglesias.

Assorted links

1. Plane eating in Ghana. Yum.

2. The future of jobs and work, a Ryan Avent survey from The Economist. And will a computer hire you?

3. What motivates young musicians to try to be great?

4. Why we like to watch rich people; the people writing these answers are mostly into total denial.

5. The “world’s biggest music store” — HMV in London — is no more.