Month: April 2016

Friday assorted links

1. The movie picks of the major presidential candidates.

2. From which zip codes did people most likely grow up in a bubble?

3. Sapienza and Zingales on economic experts vs. ordinary Americans (pdf).

4. A fleet of trucks just drove themselves across Europe.

5. Chinese non-performing loans.

Declining Mobility and Restrictions on Land Use

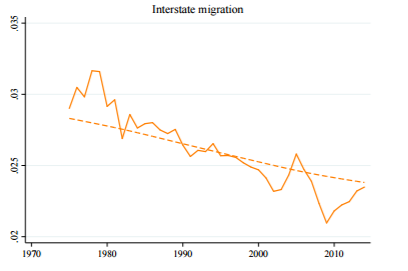

Mobility has been slowly falling in the United States since the 1980s. Why? One possibility is demographic changes. Older people, for example, are less likely to move than younger people so increases in the elderly population might explain declines in mobility. Mobility has declined, however, for people of all ages. In the 1980s, for example, 3.6% of people aged 25-44 had moved in the last year but in the 2000s only 2.2% of this age group had moved.

(Graph from Molloy, Smith, Trezzi and Wozniak).

(Graph from Molloy, Smith, Trezzi and Wozniak).In fact, mobility has declined within age, gender, race, home ownership status, whether your spouse works or not, income class, and employment status so whatever the cause of declining mobility it has to be big enough to affect large numbers of people across a range of demographics.

My best guess is that the decline in mobility is due to problems in our housing markets (I draw here on an important paper by Peter Ganong and Daniel Shoag). It used to be that poor people moved to rich places. A janitor in New York, for example, used to earn more than a janitor in Alabama even after adjusting for housing costs. As a result, janitors moved from Alabama to New York, in the process raising their standard of living and reducing income inequality. Today, however, after taking into account housing costs, janitors in New York earn less than janitors in Alabama. As a result, poor people no longer move to rich places. Indeed, there is now a slight trend for poor people to move to poor places because even though wages are lower in poor places, housing prices are lower yet.

Ideally, we want labor and other resources to move from low productivity places to high productivity places–this dynamic reallocation of resources is one of the causes of rising productivity. But for low-skill workers the opposite is happening – housing prices are driving them from high productivity places to low productivity places. Furthermore, when low-skill workers end up in low-productivity places, wages are lower so there are fewer reasons to be employed and there aren’t high-wage jobs in the area so the incentives to increase human capital are dulled. The process of poverty becomes self-reinforcing.

Why has housing become so expensive in high-productivity places? It is true that there are geographic constraints (Manhattan isn’t getting any bigger) but zoning and other land use restrictions including historical and environmental “protection” are reducing the amount of land available for housing and how much building can be done on a given piece of land. As a result, in places with lots of restrictions on land use, increased demand for housing shows up mostly in house prices rather than in house quantities.

In the past, when a city like New York became more productive it attracted the poor and rich alike and as the poor moved in more housing was built and the wages and productivity of the poor increased and national inequality declined. Now, when a city like San Jose becomes more productive, people try to move to the city but housing doesn’t expand so the price of housing rises and only the highly skilled can live in the city. The end result is high-skilled people living in high-productivity cities and low-skilled people live in low-productivity cities. On a national level, land restrictions mean less mobility, lower national productivity and increased income and geographic inequality.

From my answer on Quora.

Here is my post on occupational licensing and declines in mobility.

The socialization function of college — “school is to submit”

Robin Hanson has a good post on this, here is one bit:

How did the industrial era get at least some workers to accept more domination, inequality, and ambiguity, and why hasn’t that worked equally well everywhere? A simple answer I want to explore in this post is: prestigious schools.

While human foragers are especially averse to even a hint of domination, humans are especially eager to take “orders” via copying the practices of prestigious folks. Humans have a uniquely powerful capacity for cultural evolution exactly because we are especially eager and able to copy what prestigious people do. So if humans hate industrial workplace practices when they see them as bosses dominating, but love to copy the practices of prestigious folks, an obvious solution is to habituate kids into workplace practices in contexts that look more like the later than the former.

…centuries ago most young people did signal their abilities via jobs, and the school signaling system has slowly displaced that job signaling system. Pressures to conform to existing practices can’t explain this displacement of a previous practice by a new practice. So why did signaling via school did win out over signaling via early jobs?

Like early jobs, school can have people practice habits that will be useful in jobs, such as showing up on time, doing what you are told even when that is different from what you did before, figuring out ambiguous instructions, and accepting being frequently and publicly ranked relative to similar people. But while early jobs threaten to trip the triggers than make most animals run from domination, schools try to frame a similar habit practice in more acceptable terms, as more like copying prestigious people.

The post is interesting throughout. And via Brian S., here is Siderea on college, social class, and other matters.

What is the most obscure state according to Wonkblog and Google? And per capita?

The top five most-searched states are, in order, California, Texas, Florida, Illinois and Pennsylvania. And to answer Tyler Cowen’s original question, the bottom five states, in descending order, are Idaho, Vermont, North Dakota, South Dakota, and, at the absolute bottom of the 50-state barrel: Wyoming.

And searches relative to population?:

You can see that the biggest overperformer is, oddly enough, Alabama — it’s the 24th most populous state, but the 15th most frequently-searched state. It’s hard to say what’s driving the discrepancy, but Google’s data offer some clues. For instance, Google’s nifty Correlate tool shows that many Alabama-related searches have to do with sports scores and events — perhaps tied to the popularity of college sports at the University of Alabama. Or, there may be something unique about the state the causes its residents to use the state’s name in Google searches more often — searching for rules and regulations on things like drivers’ licenses and the like.

Other big overperformers include Hawaii and Alaska, Colorado and Connecticut.

On the other side of the ledger, the state that appears to generate the lowest amount of search interest relative to its size is Indiana.

…Louisiana, West Virginia, New Mexico and Idaho also are considerably under-searched compared to their population.

Separately, I received this email from a loyal MR reader:

I am following your most-obscure-state series with some fascination. However, I think the approach is a bit off, because in many cases small states are less obscure than larger ones. Rhode Island is not obscure precisely because most know of it as the smallest state. And even small states produce outlier individuals that elevate their states’ prominence. Rather, I think you should look at obscurity on a per-capita basis — that is, what state is disproportionately obscure compared to its population, economic footprint, &c.I would suggest Indiana. Our 16th-most-populous state, Indiana is nonetheless relatively obscure for its size.Consider:

- Indiana is overshadowed by many of its larger neighbors; northwestern Indiana is part of Chicagoland; southeast Indiana is tied to the Cincinnati and Louisville areas.

- The best-known historical political figures identified with Indiana are Benjamin Harrison and Dan Quayle — neither well-known.

- Indiana has far fewer Fortune 500 companies based there than any neighbor except Kentucky (and only one more than Kentucky). Indiana’s big firms tend to be major industrial companies like Eli Lilly and Cummins, important but not consumer-facing and thus contributing to obscurity.

- Indiana is a major producer of many products, agricultural commodities and mineral resources, but it is the top producer of few, and so doesn’t gain prominence for them (in the way that people associate dairy with Wisconsin or cars with Michigan).

- Indiana has only one large city, and it’s the 34th-largest U.S. metro area with about 2 million people. States of similar size tend either have much larger metro areas or they have multiple Indianapolis-sized metros.

- Indiana is not especially diverse — 85% white, and few prominent foreign ethnic minorities concentrated there.

- In education, Indiana’s best known big school is Notre Dame, which due to its Catholic heritage is not especially associated in the public mind with the state. Purdue is a strong school but ranked 61 by US News — lower than you might expect for a flagship in a state Indiana’s size.

- Indiana is a place where a lot of notable people are from but where few stay. Think John Roberts, Allan Bloom, Sydney Pollack, Steve McQueen, Kurt Vonnegut, Joseph Stiglitz, Paul Samuelson. (Indiana’s proximity to Chicago contributes to its obscurity by sucking away some of its greatest talents.)

Sports and culture are probably the only arena in which Indiana escape obscurity In sports, this is due to the Hoosier basketball tradition, Larry Bird, Bob Knight, John Wooden, and the Indy 500.

Culturally, Indiana has produced several highlights. In music, the Jackson 5 are indelibly associated with Indiana. The novels of Booth Tarkington stand out. Cole Porter was born and raised there. The Gaither gospel singers are from and based in Indiana. Vonnegut’s God Bless You, Mr. Rosewater, a minor classic, is set there. Ben-Hur author Lew Wallace was a lifelong Indianan. Indiana has produced some strong comics — Red Skelton, David Letterman, Jim Gaffigan — although they are not popularly associated with Indiana. Jim Davis of Garfield is from there. Films and TV shows set there? Hoosiers, Breaking Away, Rudy, Parks and Recreation.

…Despite these strong points, the relatively large size of Indiana weighs against them and leaves Indiana the most obscure state on a per-capita basis.Thanks — I continue to enjoy this series and am looking forward to your posts on Rhode Island and Delaware.

What happened when Easter secretly taped her surgeons

After Easter was sedated, the surgeon recounted their dispute to the other doctors. “She’s a handful,” he said in the recording. “She had some choice words for us in the clinic when we didn’t book her case in two weeks.”

“She said, ‘I’m going to call a lawyer and file a complaint,’” he recalled with a laugh. (Easter said she never mentioned a lawyer.)

“That doesn’t seem like the thing to say to the person who’s going to do your surgery,” another male voice retorted.

The comments afterward became personal. The surgeon and the anesthesiologist repeatedly referred to her belly button in jest. “Did you see her belly button?” one doctor said, followed by peals of laughter.

At another point in the procedure, the anesthesiologist appeared to refer to Easter as “always the queen,” to which the surgeon responded, “I feel sorry for her husband.”

The surgeon also used the name “Precious” several times in a manner that Easter interpreted as racial.

…After the doctors concurred that there had been many “teaching moments” that day, the anesthesiologist asked, “Do you want me to touch her?”

“I can touch her,” the surgeon is heard saying.

“That’s a Bill Cosby suggestion,” someone interjected. “Everybody’s got things on phones these days. Everybody’s got a camera.”

Here is the full story.

Field experiments in markets

There is a new NBER working paper from Omar Al-Ubaydli and John A. List:

This is a review of the literature of field experimental studies of markets. The main results covered by the review are as follows: (1) Generally speaking, markets organize the efficient exchange of commodities; (2) There are some behavioral anomalies that impede efficient exchange; (3) Many behavioral anomalies disappear when traders are experienced.

This is the best survey article on these claims that I know.

Thursday assorted links

2. “Great spirits” vs. “mediocre minds””.

3. One man’s plan to airlift rhinos to Australia.

4. Chinese Straussian takes on Zootopia.

6. Star Wars hyperinflation pending, maybe Abenomics should take a cue.

The Public Choice Outreach Conference

It’s time to apply or encourage your students to apply to the annual Public Choice Outreach Conference! This conference is a “crash course” in public choice with talks by Tyler Cowen, Robin Hanson, Bryan Caplan, Dan Houser, Johanna Mollerstrom and many others.

Graduate students and advanced undergraduates are eligible to apply. Students majoring in economics, history, international studies, law, philosophy political science, psychology, public administration, religious studies, and sociology have attended past conferences.

The conference is June 10-12 in Arlington VA, there are no fees, room and board are paid and some stipends are available.

You can find more information and an application here. Apply now!

Panama Papers observations

Buttonwood presents a trilemma:

The issue may be another example of that common political problem; the trilemma, under which three options are available, but only two at most can be selected. In this case, it is a simple tax system; independent national tax policies; and the existence of multinational companies and investors.

Here is Megan McArdle:

What we’ve seen from the papers so far is not so much an indictment of global capitalism as an indictment of countries that have weak institutions and a lot of corruption. And for all the outrage in the United States, so far the message for us is pretty reassuring: We aren’t one of those countries.

Consider the big names that have shown up so far on the list. With the notable exception of Iceland, these are not countries I would describe as “capitalist”: Russia, Pakistan, Iraq, Ukraine, Egypt. They’re countries where kleptocratic government officials amass money not through commerce, but through quasi-legal extortion, or siphoning off the till. This is an activity that has gone on long before capitalism, and probably before there was money.

From a Ray Lopez email:

5. Panama Papers fallout will be: (1) a drive to reduce large denomination bills, (2) a drive to make a ‘paperless’ payment system, (3) a drive to eliminate tax loopholes, (4) a drive towards negative interest rates once paper is abolished

6. Xi of China is the biggest loser. He ran on an ‘anti-corruption’ ticket and his Politburo members will be pissed if they see he is corrupt, unless he winks and tells them they are immune from his anti-corruption offensive. In which case, to pay them off, Xi, needs to appropriate the assets of his enemies to give to his friends. So possibly it’s a “double down bet” for Xi: he either folds or has to double down, redoubling his anti-corruption campaign, so he can seize assets to pay off his cronies keeping him in power. We live in interesting times.

7. The net effect of Panama Papers, along with the FATCA issues above, is that criminals no longer will use law firms, and decent people hiding money as well, which means these services will be offered by more informal channels like from a single proprietor “fixer”. “Nick the Greek money launderer” will profit, big law firm will suffer.

Here is China in the Panama Papers.

Can Currency Competition Work?

There is a new model and NBER paper to come from Jesus Fernandez-Villaverde and Daniel Sanches (pdf, ungated), here is the abstract:

Can competition among privately issued fiat currencies such as Bitcoin or Ethereum work? Only sometimes. To show this, we build a model of competition among privately issued at currencies. We modify the current workhorse of monetary economics, the Lagos-Wright environment, by including entrepreneurs who can issue their own fiat currencies in order to maximize their utility. Otherwise, the model is standard. We show that there exists an equilibrium in which price stability is consistent with competing private monies, but also that there exists a continuum of equilibrium trajectories with the property that the value of private currencies monotonically converges to zero. These latter equilibria disappear, however, when we introduce productive capital. We also investigate the properties of hybrid monetary arrangements with private and government monies, of automata issuing money, and the role of network effects.

I would stress a few points. First, the world is going to have some form of currency competition whether one likes it or not. That is already the case today, so these are very real questions, not just thought games for libertarians.

Second, the Bitcoin and broader cryptocurrency experience indicate that the marginal cost of issuing a new private currency is well above zero, contra some of the literature from the 1970s, which viewed the enterprise in terms of printing money and paying only for the additional paper. Bitcoin can be interpreted as a commodity currency of sorts, where the relevant expenditures are on codebreaking and electricity, rather than digging up gold from the ground. Once it is focal enough, it might be able to provide some version of rough price stability in terms of its unit.

Third, if your government is halfway legitimate and not broke, its currency is likely to be a dominant winner in these forms of currency competition, especially to the extent that currency is supported by the fiscal authority. In this sense it is almost impossible to get away from a legitimate or even semi-legitimate government-issued currency.

The functions of credit markets

Kasich supporters are in a league of their own. They have by far the best credit ratings, on average. Some 86% have “excellent” or “good” scores. No other candidate’s supporters even breaks 70%. Kasich’s supporters are half as likely to have bad or fair ratings as anyone else.

The second is that Donald Trump supporters are the least likely to have “good” scores. Only half of them do (49.8%), slightly behind Hillary Clinton supporters (50.7%) and Sanders supporters (51%) and well behind the supporters of the other Republicans. Trump supporters are also far more likely to have “bad” scores than supporters of the other Republican candidates.

Here is the Brett Arends article, via George Chen.

Assorted Wednesday links

1. The economics of Hamilton (the show).

2. In my own way, I too feel as if I have attended the University of Northern New Jersey (NYT).

3. “Touching a Robot’s ‘Intimate Parts’ Makes People Uncomfortable.”

4. A criticism of economics which I mostly don’t agree with.

5. “If you were in the middle of an asteroid belt, you probably wouldn’t see any asteroids at all.” (NYT)

Can fiscal stimulus save Japan? monetary stimulus?

But it’s very unlikely that fiscal stimulus would ever come to the rescue, at least in the sort of quantity that would be needed. Japan’s national debt soared in the 1990s and 2000s, and yet their NGDP actually fell over two decades (1993-2013)—the worst performance by NGDP for a developed country in world history. If even Japan’s huge deficits were not enough to boost AD at all, just imagine getting a future GOP Congress to do what it takes. In my view we need a conversation about changing the Fed’s target, to a new target which makes the zero bound much less of a problem—something like NGDPLT.

That is from Scott Sumner, and I very much agree.

I have a simple rule of thumb. If a discussion of Japanese fiscal policy notes that unemployment now is about 3.3%, it might be an interesting discussion. Otherwise, it is just assuming that lots of aggregate supply can be pulled forth…out of nothing. Not to mention they still need to pay all of that debt back.

By the way, here are some rumors that the BOJ may indeed move to a form of ngdp targeting. And (same link, by the excellent David Keohane) here is from a report from Jeffries:

Currently, the Bank of Japan is buying just over Y80 trillion of JGBs per annum or the equivalent of three times to the rate of JGB issuance. The BoJ is approaching a shortage of JGBs for the central bank to buy, as commercial banks, pension and insurance funds have run down their holdings. Indeed, an IMF working paper that we quoted in the Japan 2016 outlook ‘Portfolio rebalancing in Japan: Constraints and Implications for Quantitative Easing’ that given the collateral needs of banks and the asset-liability management constraints of insurers there is a natural limit to JGB purchases.

The next step, according to this analysis, is to get/keep rates down low, convert the current debt stock into perpetual zero coupon bonds, and then have outright debt monetization by the Bank of Japan, all at low rates of inflation of course. This may not stimulate output much, but perhaps it will stave off eventual bankruptcy.

Aeneid Book VI, Virgil translated by Seamus Heaney

A splendid book, here is Kate Kellaway at The Guardian:

There are two things this book requires. First, it is best read aloud – it comes thrillingly to life – it sounds tremendous. Second, it repays close reading. Studying it is to listen in on a poet with perfect pitch. Getting the diction right – so that the ancient is neither modern nor archaic – is the challenge. And Heaney shows that plain words are stormproofed. It is about more than George Orwell’s tired prescription: “Never use a long word where a short one will do.” It is about how plain language, like plain speaking, has integrity. And it is weight-bearing. It carries. When he introduces uncommon, eye-catching (sometimes longer) words – scaresome, asperging, hotbloods – they stand out but work harder against their plain backgrounds. Take the sighting of the golden bough. The word “refulgent” is strikingly charged, surrounded by “clear”, “green-leafed” and “cold”. Refulgent breaks Orwell’s rule and stands out like the golden branch itself. Or consider the description of Aeneas’s father, Anchises: “A man in old age, worn out, not meant for duress.” “Duress” is the pleasing surprise here (so much better than everyday “hardship”) seizing attention while “old age” and “worn out” do their unobtrusive work.

I will reread it shortly, you can buy it here.

The economics of pandemic influenza risk

There is a new NBER paper on this topic, by Victoria Y. Fan, Dean T. Jamison, and Lawrence H. Summers, here is the abstract:

Estimates of the long-term annual cost of global warming lie in the range of 0.2-2% of global income. This high cost has generated widespread political concern and commitment as manifested in the Paris agreements of December, 2015. Analyses in this paper suggest that the expected annual cost of pandemic influenza falls in the same range as does that of climate change although toward the low end. In any given year a small likelihood exists that the world will again suffer a very severe flu pandemic akin to the one of 1918. Even a moderately severe pandemic, of which at least 6 have occurred since 1700, could lead to 2 million or more excess deaths. World Bank and other work has assessed the probable income loss from a severe pandemic at 4-5% of global GNI. The economics literature points to a very high intrinsic value of mortality risk, a value that GNI fails to capture. In this paper we use findings from that literature to generate an estimate of pandemic cost that is inclusive of both income loss and the cost of elevated mortality. We present results on an expected annual basis using reasonable (although highly uncertain) estimates of the annual probabilities of pandemics in two bands of severity. We find:

1. Expected pandemic deaths exceed 700,000 per year worldwide with an associated annual mortality cost of estimated at $490 billion. We use published figures to estimate expected income loss at $80 billion per year and hence the inclusive cost to be $570 billion per year or 0.7% of global income (range: 0.4-1.0%).

2. For moderately severe pandemics about 40% of inclusive cost results from income loss. For severe pandemics this fraction declines to 12%: the intrinsic cost of elevated mortality becomes completely dominant.

3. The estimates of mortality cost as a % of GNI range from around 1.6% in lower-middle income countries down to 0.3% in high-income countries, mostly as a result of much higher pandemic death rates in lower-income environments.

4. The distribution of pandemic severity has an exceptionally fat tail: about 95% of the expected cost results from pandemics that would be expected to kill over 7 million people worldwide.

In other words, in expected value terms an influenza pandemic is a big problem indeed. But since, unlike global warming, it does not fit conveniently into the usual social status battles which define our politics, it receives far less attention.