Month: June 2016

Geneva bleg

I’ll be there for two days, soon. Please outline an optimal recipe for avoiding boredom, noting that I have been there three times before, though not recently. Your suggestions are most appreciated.

Advice on Choosing a Career

One branch of the effective altruism movement emphasizes the rigorous evaluation of charities. A second branch is focused on a different but related aspect, career choice. Choosing a career to benefit others actually strikes me as a bit of a downer–get out the sackcloth and ashes, repent, renounce your sins and all that.

The 80,000 hours research charity, co-founded by William MacAskill, can be a bit preachy but they have assembled and reviewed a large amount of research on careers–not just on what makes a career useful but also what makes it enjoyable. Young people spend surprisingly little time thinking about a career. There’s a lot more advice about choosing and getting into a college than there is serious advice about choosing a major let alone figuring out a practical plan towards a career.

The 80,000 hours career guide, offers quite a bit of practical, scientifically-based advice and it’s not the usual join the Peace Corp kind of thing.

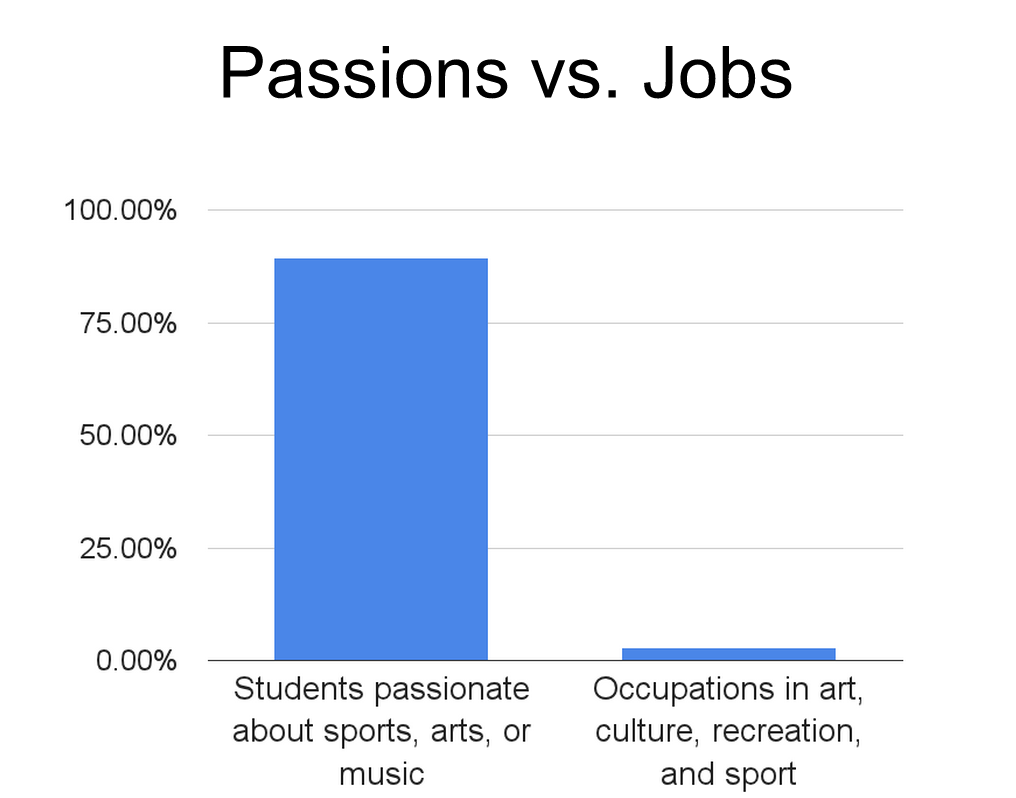

Here’s two lovely hard-headed graphs that skewer common wisdom and give a taste of their approach:

If you know a young person nearing college, the career guide is well worth a few hours of their time.

Not all complaints can be true at the same time

How sticky are real wages anyway? The mainstream view is that real wages are almost completely acyclical. But a new paper by Basu and House challenges this, here is part of their conclusion:

…there are indications that the allocative wage — the wage that governs hours worked and that firms internalize when making production and pricing decisions — may not equal the contemporaneous remitted wage. In particular, firms and workers may well have an implicit understanding that the remitted wage will be a smoothed version of the expected allocative wage. By estimating the expected present value of wage payments, one can construct a “user cost of labor,” which should measure the underlying allocative wage.

You can think of the employer as adjusting the “career ladder” of the worker while the contemporaneous wage remains more or less constant. So in good times that “true” real wage goes up, and in bad times it goes down.

I would say the verdict on this idea remains out, but I found this a stimulating piece to read and it also offers an excellent survey of the literature.

Here’s the catch: on the internet I’ve read dozens — no, hundreds of times — that real wages haven’t gone up more because the Fed chokes off real wage hikes every time the economy nears recovery. You will notice that this claim is simply flat out wrong if the mainstream view of real wage acyclicality is correct. Somehow that never seems to come up. (Yet it seems this ability of the Fed to stifle real wage hikes feels like it is true.)

Now, the Basu and House paper, if it is correct, actually creates an avenue through which you could start (partially) viewing the Fed as a real wage villain. Maybe. If some other auxiliary hypotheses were to kick in, which is not guaranteed.

But then here is the thing: you could no longer believe in traditional doctrines of wage stickiness. And you would have to change many of your views on macroeconomics, and indeed on the efficacy of labor markets more generally.

People, repeat after me: Not all complaints can be true at the same time. I know it is hard to live with that reality, but maybe it is worth a try. And if you don’t like it, you can complain about that too.

Intimate partner violence against women and the Nordic paradox

That is the title of a new and interesting paper by Enrique Garcia and Juan Merlo, here is the (to me) rather surprising summary:

The Nordic countries are the most gender equal nations in the world, but at the same time, they also have a disproportionately high rate of intimate partner violence against women. This is perplexing because logically violence against women would be expected to drop as women gained equal status in a society. A new study explores this contradictory situation, which has been labeled the ‘Nordic paradox.’

Denmark clocks in at about 32%, Finland at 30%, and Sweden at 28%; Denmark and Finland by the way should disabuse you from blaming this phenomenon on immigrants.

My first response was to think this must be a data reporting issue. Perhaps Nordic women are more willing to step forward, or somehow those systems are more efficient in recording such complaints. But the paper does not support that interpretation:

…the same FRA survey provides data suggesting lower levels of disclosure of IPV [intimate partner violence] to the police by women in Nordic countries as compared to other EU countries. For example the average percentage for the EU of women indicating that the most serious incident of IPV came to the attention of the police is 20%, whereas for Denmark and Finland is 10% and 17% for Sweden. In any case, the ‘higher disclosure’ explanation, however, would not solve the Nordic paradox, as these more ‘reliable’ levels of disclosure would rather reinforce the paradox posited by very high levels of IPV prevalence (prevalence rates around 30% is by all means disproportionate) in countries with high levels of gender equality.

So this remains a puzzle. Here is an earlier post on a very different form of the Nordic gender equality paradox. And here is a recent post on (non-Nordic) brutishness.

For the pointer I thank Eric Barker.

The new economics of cybercrime

“We’re living through an historic glut of stolen data,” explains Brian Krebs, who writes the blog Krebs on Security. “More supply drives the price way down, and there’s so much data for sale, we’re sort of having a shortage of buyers at this point.”

…But cybercriminals’ most crucial adaptation in recent years has little to do with their technical tools and everything to do with their business model: They have started selling stolen data back to its original owners. To keep cybercrime profitable, criminals needed to find a new cohort of potential buyers, and they did: all of us. At the heart of this new business model for cybercrime is the fact that individuals and businesses, not retailers and banks, are the ones footing the bill for data breaches.

Here is the full Josephine Wolff piece.

Wednesday assorted links

FAA Grounds Uber of the Sky

Uber is not only fast and convenient it spreads the capital cost of an automobile over a large group of people, thereby increasing efficiency. A typical general aviation aircraft costs ten times or more the price of an automobile so the case for an Uber of the sky is strong. Indeed, shortly after the Wright Brothers flew, informal ride-sharing bulletin  boards and word of mouth connected pilots with passengers who wanted to hitch a ride and were willing to share the cost.

boards and word of mouth connected pilots with passengers who wanted to hitch a ride and were willing to share the cost.

Flytenow created an app to more easily connect pilots to “passengers” who would pay a share of the “cost” (the reason for the quotes will become clear) but was shut down by the FAA. Flytenow argued that they were simply modernizing the bulletin board system but the FAA worried that they were doing an end run around regulation. The Federal Aviation Act of 1958 requires pilots who are being compensated for their services to have a commercial license. Flytenow was shut down.

Jared Meyer interviewed the founders:

Jared Meyer: …from what I understand, it is still completely legal to find people to share flights (and their costs) by using old-fashioned tools such as bulletin boards or telephone calls. Why does the FAA not allow people to use peer-to-peer online interaction to make the process much more efficient and inclusive?

Alan Guichard: You’re exactly right. Pilots have always been allowed to share flights as long as the pilot and the passenger share a common purpose, which they clearly have on an online bulletin board such as Flytenow. The FAA’s concern is that online interaction will lead to sharing beyond what they refer to as “friends and acquaintances.”

For example, the FAA explained that advertising a shared flight on Facebook would be permissible if a person only had a few friends, but that the same flight would transform the pilot into Delta or American Airlines if he or she had “thousands” of friends.

An Uber of the sky would increase the number of private flights and put pressure on the airlines. It would also create some safety issues. Right now only the rich regularly risk their life in a small airplane. Do we want more people to have access? It’s debatable but there is certainly some level of safety where we would want more passenger-carrying small-aircraft. But which is chicken and which is egg? Safety doesn’t just happen–safety is in part an endogenous consequence of investment and demand. How will we get flying cars if we restrict investment?

The economics of *Hamilton*, and money left on the table

The average resale of “Hamilton” tickets on StubHub is roughly $872, according to a New York Times analysis, a markup of $700 above the current average original ticket sale price.

For any given performance, roughly 13 to 22 percent of the seats at the Richard Rodgers — somewhere between 180 and 300 tickets — are available on the secondary market, according to The Times’s research and interviews with ticket sellers. So for each performance of “Hamilton,” ticket sellers and brokers are reaping roughly $150,000. With the Broadway cast putting on more than 400 shows per year, that means these sellers could reap about $60 million per year, just in New York — money the producers, investors and Mr. Miranda will never see.

I still find this equilibrium puzzling. By the way, here are some numbers on book tie-ins:

“Hamilton” can even sell books. “Hamilton: The Revolution,” a behind-the-scenes book about the creation of the musical by Jeremy McCarter and Mr. Miranda, went on sale in April with a list price of $40. In less than two months, it sold more than 101,000 copies, according to Nielsen, and hit the No. 1 spot on the New York Times hardcover nonfiction best-seller list. (Other authors have benefited from “Hamilton” fever, too: Ron Chernow’s 2004 biography, which inspired Mr. Miranda to write the musical, has spent 33 weeks on the paperback best-seller list. This fall, Three Rivers Press will publish Jeff Wilser’s self-help book “Alexander Hamilton’s Guide to Life.”)

Here is the Michael Paulson and David Gelles NYT piece, it has much more of interest on the economics of the show.

The resurrection of the Lucas supply function at the hands of Keynesians

Wolfgang Munchau has perhaps the clearest statement of the view that an extra dose of current inflation will boost output:

A helicopter drop means that the ECB would print and distribute money to citizens directly. If it were to distribute, say, €3,000bn or about €10,000 per citizen over five years, that would take care of the inflation problem nicely. It would provide an immediate demand boost, and drive up investment as suppliers expanded their capacity to meet this extra demand.

I don’t mean to pick on Munchnau, who is one of the two or three best columnists in the world (thus the clarity), but I view this as incorrect as stated. And it is symptomatic of a mistake which I see more and more frequently, including from reputable economists. Given the genesis of the Great Recession, commentators have become obsessed with stimulating demand, but “mere inflation” does not on its own put people back to work, at least not by much.

To be clear, if aggregate demand is on the verge of falling, and expansionary monetary policy maintains aggregate demand, that will indeed prevent a big increase in unemployment. And typically that is very much worth doing, and most of all what is useful is an ex ante AD maintenance rule from the get-go. But that does not mean inflation in any particular state of affairs will boost employment significantly.

Let’s go back in time to the 1970s and 1980s. Bob Lucas developed a monetary misperceptions version of business cycle theory, in which boosts of inflation encouraged people to work more, at least temporarily, and set off a cyclical pattern of boom and bust. Fortunately the Keynesians stepped in and criticized Lucas in a rather devastating manner. The measured responsiveness of labor supply, or for that matter investment, to inflation, or for that matter relative price changes, simply wasn’t that large. That also was a big problem with the core labor market mechanisms of real business cycle theory; for instance read the prescient critique by Larry Summers (pdf). Those same arguments imply that today more inflation will boost employment by only small amounts.

And consistent with that claim, the Phillips Curve is not exactly stable as of late.

There are also plenty of papers on inflation and investment. They are hard to summarize, but overall it is easier to argue that more inflation harms investment rather than helping it (pdf). And at the most general level, it is real cash flow that predicts investment well, not nominal cash flow. So I am not so optimistic about more inflation today boosting investment by very much, even though I agree that a higher price inflation or ngdp target in the steady state would be very useful for preventing aggregate demand collapses.

Now you might think we are in special circumstances with rates of price inflation at especially low levels. What harm is there in risking more inflation and having prices rise at 2 percent, 2.5 percent, or even three percent a year? I agree with this argument. (I’d be happy to see higher rates of price inflation if only to erode the value of academic tenure.) Still, if we ask ourselves what is the best point estimate for how much more an extra dose of inflation today will boost investment (and not just the stock market), any strongly positive answer is based more on faith than on clear evidence. The mere fact that you know “demand hasn’t been high enough” — which is true — doesn’t have to mean current doses of price inflation are going to get us very far. Yet that is the mistake I see people making again and again.

People, economists have known this for a long time, it’s just that they now are starting to forget it.

One more point: demand could go up through yet another mechanism. Imagine the economy becomes more productive, wages rise, and stronger consumer demands percolate throughout the broader economy. That too is an increase in demand, and for that matter supply, and a decline in the risk premium. It is quite possible the effect of that kind of demand increase on output is stronger than the effects of higher price inflation. We should not conflate these two scenarios, and I get nervous when I see the word “demand” without further qualifiers or description.

Here are related remarks from Matthew C. Klein.

How do changes in sectoral composition affect wages?

From Isaac Sorkin (pdf, or try this link):

… changes in sectoral composition depressed real pay growth by 2.9 percentage points from 1990 to 2016. This change in pay, however, overstates the change in the overall value of jobs because the economy is moving toward sectors that are more desirable along nonpay dimensions. Changes in nonpay compensation offset about half of the decline in pay, so that sectoral composition changes led to the equivalent of a 1.4 percentage point decline in pay since 1990. Is the role of changing sectoral composition big or small? From 1990 to 2016, real weekly earnings grew by 11.2%. All else being equal, then, these sectoral shifts were the equivalent of about three or four years of real wage growth.

The importance of manufacturing jobs — in good and bad ways — is one of the ideas which has risen in status most rapidly in the last five years.

Tuesday assorted links

1. “Not a single person needs to touch a cow during any 24-hour milking cycle.”

2. “Parley’s Seventh, one of Salt Lake City’s singles wards, had 429 women on its rolls in 2013 versus only 264 men, according to an article in the Salt Lake Tribune newspaper.“…”One consequence: A culture of plastic surgery has taken root among Mormon women.”

3. The evidence: ” In contrast to the predictions of the model, positive productivity shocks are estimated to be more expansionary at the ZLB compared to normal times.”

4. Give a caption to this armadillo photo.

Can War Foster Cooperation?

There is a new NBER working paper on this question by Michal Bauer, Christopher Blattman, Julie Chytilová, Joseph Henrich, Edward Miguel, Tamar Mitts:

In the past decade, nearly 20 studies have found a strong, persistent pattern in surveys and behavioral experiments from over 40 countries: individual exposure to war violence tends to increase social cooperation at the local level, including community participation and prosocial behavior. Thus while war has many negative legacies for individuals and societies, it appears to leave a positive legacy in terms of local cooperation and civic engagement. We discuss, synthesize and reanalyze the emerging body of evidence, and weigh alternative explanations. There is some indication that war violence especially enhances in-group or “parochial” norms and preferences, a finding that, if true, suggests that the rising social cohesion we document need not promote broader peace.

That is an all-star line-up of authors, and no this doesn’t mean any of those individuals are in favor of war. That would be the fallacy of mood affiliation, and we all know that MR readers never commit the fallacy of mood affiliation…

Artists, writers, and academics on Brexit

That is a Mary Beard feature in the 3 June 2016 edition of the Times Literary Supplement. Various luminaries were asked what they thought of Brexit. My favorite answer came from Colm Tóibín:

The European Union, despite its flaws, or perhaps because of them, is a wholly rational institution. Like most of us, it is in constant need of urgent reform and can handle anything except a crisis. Even though it is deeply secular, the EU has performed miracles. It has allowed France and Germany to move close to each other; it has allowed Irish and British ministers to meet as equals, which the Irish have enjoyed. It can also make us laugh — the group photographs of the EU leaders after their meetings and the antics of the European Parliament are wholly ludicrous…

More brutal was Jan Morris:

Being politically in or out of Europe has had no impact at all on my own work, and I have no idea what it’s done for or to the cultural life of Britain. For myself, I have long argued for a federal Britain within a federal Europe, but it was always a dream anyway, and I’ve woken up now. If reasons you require, look around you!

Declan Kiberd had a good point:

They [the English] realized that in some ways England’s was an immensely stressed society, whose people had been so distracted by the British cultural project that they still faced an unresolved identity question of their own. It’s a long time since Bernard Shaw described England as the last, most fully penetrated of the British colonies — which could be why its people feel such ambivalence about the more recent transnational scheme.

I do recommend that you all subscribe to the TLS. If you would like yet another point of view, from Dissent, here is Richard Tuck with the Left case for Brexit.

On nicknames and their political uses

That is a William Hazlitt essay from the Edinburgh Magazine of 1828, reprinted in Table-Talk (scroll to p.165), focusing on why the political uses of nicknames are so problematic. It retains some relevance today:

The only meaning of these vulgar nicknames and party distinctions, where they are urged most violently and confidently, is, that others differ from you in some particular or other (whether it be opinion, dress, clime, or complexion), which you highly disapprove of, forgetting that, by the same rule, they have the very same right to be offended at you because you differ from them. Those who have reason on their side do not make the most obstinate and grievous appeals to prejudice and abusive language.

…a nickname…is a disposable force, that is almost always perverted to mischief. It clothes itself with all the terrors of uncertain abstraction, and there is no end of the abuse to which it is liable but the cunning of those who employ, or the credulity of those who are gulled by it. It is a reserve of the ignorance, bigotry, and intolerance of weak and vulgar minds, brought up where reason fails, and always ready, at a moment’s warning, to be applied to any, the most absurd purposes…a nickname baffles reply.

…the passions are the most ungovernable when they are blindfolded. That malignity is always the most implacable which is accompanied with a sense of weakness, because it is never satisfied with its own success or safety. A nickname carries the weight of the pride, the indolence, the cowardice, the ignorance, and the ill-nature of mankind on its side. It acts by mechanical sympathy on the nerves of society.

…”A nickname is the heaviest stone that the devil can throw at a man.”

There is more excellent analysis at the link, most of all on how the uses of nicknames avoids and runs away from the careful making and unpacking of specific charges. Hazlitt notes the nickname can on the surface sound quite innocent yet nonetheless be a form of powerful invective. For a while the Whigs were called “the Talents,” yet in a manner reeking of implicit scorn.

From Hazlitt, here is another scary part:

I have heard an eminent character boast that he had done more to produce the late war by nicknaming Buonaparte “the Corsican,” than all the state papers and the documents put together.

Here is a brief summary of the essay. Hazlitt remains under-read and underappreciated.

For the pointer to this essay I thank Hollis Robbins.

Monday assorted links

1. Against the translations of Richard Pevear and Larissa Volokhonsky.

3.”Or perhaps we should read it, as some have read More’s Utopia, as a satire on current society.” And here Robin Hanson reviews his reviews.

4. Unearned wealth doesn’t change lives that much. And first female Vietnamese billionaire runs a bikini airline.