Month: June 2016

Saturday assorted links

2. Were Spanish real wages higher in 1300 than in 1850?

3. “In fact, the economy is not a machine, and it does not have a gas pedal.” That is Arnold Kling on macro. And here is Yuval Levin on Arnold’s new macro book. And from the St. Louis Fed: “The new approach is based on the idea that the economy may visit a set of possible regimes instead of converging to a single, long-run steady state.”

4. Behavioral economics guide 2016.

5. Famous authors pick their favorite European novels. Quite a good list, not just the usual.

6. Japanese ad for Donald Trump, possible Straussian ending.

Which European financial centre would win at London’s expense?

Paris recently made a bold pitch to woo City of London bankers in the event of Brexit. But, HSBC aside, most banks scoff at the idea that Paris would be a natural venue. Frankfurt, home of the European Central Bank and the financial capital of Europe’s biggest economy, is also problematic. As a small city with a population of less than 700,000 people, it is seen as provincial and unpopular with staff. Dublin is English-speaking and attractive on tax grounds, but it is a relative backwater. The most likely outcome is that foreign banks with large operations in London would shift their staff to a spread of eurozone locations where they already have operations — including Frankfurt, Dublin, Paris, Warsaw and Lisbon. That would fragment the financial services industry in Europe, potentially weakening the continent’s ability to compete internationally.

It’s not Europe, but of course we have to add New York City to the list of alternative cities. The Patrick Jenkins FT article is interesting throughout.

Germany estimate of the day the core problem is the investment shortfall

From 2004 until 2010, the 30 leading German blue-chip DAX firms created more than 400,000 additional jobs abroad, according to a Handelsblatt analysis. During the same period, they cut over 200,000 jobs within Germany.

Here is the link, via David Wessel. And note that for all of its ostensible economic successes, real wages in Germany have barely risen since 2000.

I’ve long considered capital shortfall the “real problem,” rather than focusing on immigration or trade or for that matter consumer spending. Do note however that much of the investment flows out of the home country because the produced goods later can be traded back in, so in that sense trade is connected indirectly. Still, there is a big analytical difference between the notions of “capital shortfall at home” and “too many goods flowing in from abroad.”

By the way, here is a wee bit of good news:

Though the number of posts they’ve created overseas still far outweighs the total added within Germany, the imbalance is leveling out. Last year saw the net addition of more than 83,000 new posts abroad. Domestic positions grew by over 22,000 over the previous year.

I see overwhelming evidence for an “investment drought” in many of the countries with wage stagnation. As time passes, I find talk of a “global savings glut” to be increasingly misleading and ignoring the core fact of capital market segmentation.

I thank Edward Conard for a useful discussion related to this post, and I am looking forward to his next book.

New York retail markets in silly everything

Looking for something to do this weekend in New York? Story, a concept shop that completely changes theme every few months, has relaunched this week as a Mr. Robot-themed space. In addition to being a retail shop selling an assortment of gadgets, accessories, and Mr. Robot-themed wares, there’s an “Evil Corp” ATM at the front of the store that will dispense real money (up to $50) if you figure out the four-digit code. The clues are hidden around the store, and we’re told they’ll probably change often.

Here is the full story, with many photos and an address. To think that they closed Tower Records and Borders for this…sigh.

Brussels bleg

I’ll be there next week, in fact just in time for the Brexit vote. Above and beyond the obvious guidebook sights, what do you all recommend that I do? And where should I eat?

Here is a good Ian Buruma survey of where Brussels the city is at right now.

Friday assorted links

1. My favorite things Swiss, redux. These days I would add Peter Zumthor and the Vitra design museum outside of Basel.

2. Theatre of Harmonic Social Motion, a short essay by Anthony Morley. What are the invisible hand mechanisms governing science?

3. When do unions oppose the minimum wage?

4. 3 a.m. interview with philosopher David Estlund.

5. How did the Brexit idea rise to prominence?

6. Big hack and theft at Ethereum, ongoing story, a big setback for “this kind of stuff.” (Can I call it that?) Here is Izabella Kaminska.

Netherlands fact of the day

The Dutch are still consuming about 5 per cent less, on average, than they were almost a decade ago.

Furthermore:

Yet the employment rate for Dutch 25-54-year-olds, a reasonable measure of the economy’s underlying vigour, is still about 5 percentage points below the pre-crisis peak.

Here is a possible surprise in this context:

It has the biggest current account surplus, as a share of output, in the entire euro area, making Germany look almost Anglo-Saxon by comparison.

Much of the remainder of the Matthew C. Klein Alphaville post builds an interesting comparison between the Netherlands and Belgium, recommended. Part of the problem may be the Dutch housing market and tough bankruptcy law.

Universal background checks plus privacy?

I found this discussion of interest:

I believe I’ve sketched out an idea that enables all transfers to verify the recipient is not a prohibited person without communicating any distinguishing information to the government while optionally leaving an audit trail useful for prosecution.

-

When an individual applies for state-issued identification, let them choose a public-private key pair. Make the public key part of their identification card, and the private key remain private. Not even the issuing state would know it. Add their public key to a whitelist.

-

At the same time, perform a background check to determine if the individual is a prohibited person. If so, add their public key to a blacklist.

-

Publish the blacklist in bulk and make updates available daily. We all have access to the Internet. We can do this. Regularly update the blacklist according to adjudicating events associated with the definition of “prohibited person.” For example, at the time of conviction of a felony, and individual’s public key gets added to the blacklist.

-

Firearms sellers, private and commercial, must maintain a copy of the blacklist up-to-date at the time of sale. Perhaps use a blockchain of sorts and/or share via BitTorrent or some other distributed service.

-

At the time of sale, the recipient provides their public key to the seller. Seller verifies the public key is not on the blacklist. The seller constructs a secret cryptographic nonce and encrypts it with the recipient’s public key. Recipient decrypts with their private key and returns the nonce in plaintext to the seller to confirm their public-private key pair is valid. This form of handshaking is common place and may be automated.

-

If the recipient is on the whitelist and not on the blacklist, the transfer may proceed.

-

Optionally, the seller may record a log of the recipient’s public key, perhaps encrypted with their private key. On the event of a warranted search, the seller may choose to decrypt their log entry to reveal the identify of the recipient.This leaves the audit trail which we may be legislatively require.

Thus, no direct communication with the state on the event of a transfer is needed which prevents the creation of a registry. Prohibited persons cannot acquire firearms without unlawful behavior from the seller which satisfies the aims of universal background checks. We already have all the cryptographic primitives and communications infrastructure needed to implement this and verify its integrity.

Thoughts?

That is from kermudgeon on Reddit, via N. Some of the comments are quite good as well.

The top American coal companies have lost 99% of their value since 2011

…the market cap of four of the largest coal companies was more than $35 billion in 2011. After a flurry of regulation, it’s now a smudge on the graph below, a decline of 99 percent.

That is from Sam Batkins, via Rick Newman and Joanna Bryson 2.

Why banning AR-15s and other assault weapons won’t stop mass shootings

That is the new article by Michael Rosenwald, here is an excerpt:

From 1976 to 1994, there were about 18 mass shootings per year, according to Fox’s data, which is drawn from federal statistics. Between 1995 and 2004, a period covering the ban [on assault weapons], there were about 19 incidents per year. And from 2005 to 2011, after the ban expired, the average went up to nearly 21.

Fox makes an important point about what probably happened during the ban: Mass shooters can rather “easily” come up with “alternate means of mass casualty if that were necessary.”

In other words, if they can’t get an AR-15, they get a Glock.

Assault rifles are used in only about 27 percent of mass shootings, see Alex too.

Here is an additional piece worth reading: “common state and federal gun laws that outlaw assault weapons are unrelated to the likelihood of an assault weapon being used during a public shooting event. Moreover, results show that the use of assault weapons is not related to more victims or fatalities than other types of guns.”

There is more here.

Statistical sentences to ponder

A Washington Post review of federal campus safety data for more than 2,200 colleges that offer bachelor’s or advanced degrees found that more than 1,300 of the schools had no reports of rape on campus in 2014, the most recent year for which data is available.

Here is more from Nick Anderson.

Homicide Data by Weapon

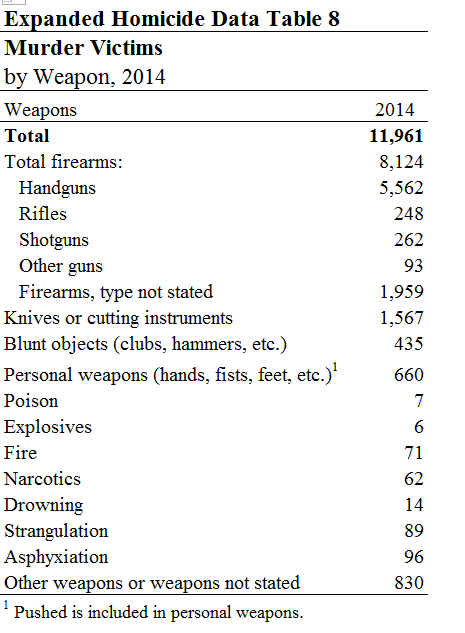

Here is FBI homicide data by weapon for 2014:

In 2014, 248 people were killed by rifles. Rifles would include “assault weapons”. Thus, more people are killed by knives than by assault weapons. Indeed, more than twice as many people are killed by “hands, fists, feet, etc.” than by assault weapons. (Some of these numbers could change slightly with “Firearms, type not stated” although most of these are probably handguns).

The data may be uncomfortable to both left and the right. The left because banning “rifles” would obviously not save many lives even if one assumed no substitution effect towards other weapons and banning “assault weapons”, however defined, would do even less. The right because handguns are by far the primary weapon used to kill.

Thursday assorted links

Academic average is over sentences to ponder

The percentage of new doctorate recipients without jobs or plans for further study climbed to 39% in 2014 from 31% in 2009, according to a National Science Foundation survey released in April. Median salaries for midcareer Ph.D.s working full time fell 6% between 2010 and 2013.

The reason: supply and demand.

And this:

Ph.D.s still earn a significant premium over others in the labor market and their overall rate of unemployment remains low, though a growing number are taking jobs that don’t use their education. At the same time, their median incomes have been falling. Computer scientists earned $121,300 in 2013, down from $129,839 in 2008; engineers saw a drop to $120,000 from $125,511 and social scientists fell to $85,000 from $90,887.

Here is the WSJ piece, via the excellent Samir Varma.

It’s not just repairing a bridge that takes longer than it used to

Remember the recent Op-Ed by Larry Summers on the difficulty of repairing bridges rapidly? Well, this problem has a new angle:

The Verrazano-Narrows Bridge, which connects Brooklyn and Staten Island, was named after an Italian explorer. There is just one problem: The man is widely known as Giovanni da Verrazzano, with two z’s.

More than a half-century after the bridge opened, some New Yorkers are calling for the spelling error to be corrected. An online petition taking up the cause has brought renewed attention to the enduring discrepancy.

“By rectifying Verrazzano’s name, we’re really saying to all Italians and Italian-Americans that we respect them and appreciate them,” said Joseph V. Scelsa, the president of the Italian American Museum in Lower Manhattan.

The Metropolitan Transportation Authority does not appear eager to tackle the issue. A spokesman for the authority, Christopher McKniff, said adjusting the bridge’s name would be an expensive and labor-intensive undertaking.

“At this time, we are not considering any name change for the Verrazano Bridge,” Mr. McKniff said in a statement that hewed to the one-z spelling.

Here is the full NYT story.