Month: August 2017

What do we know about the economics of storms?

That is the topic of my latest Bloomberg column, here is one excerpt from the final section:

Greater federal aid to the victims is a likely option. Still, it will not be obvious to many Americans why those who lost homes might end up receiving higher government benefits than people elsewhere who never had homes in the first place, and who may have inferior income prospects, especially if they live in rural areas. Many Texas congressional representatives voted against federal aid when Hurricane Sandy hit New York and New Jersey in 2012. That sounds cruel, but we also have to guard against the tendency for aid decisions to be driven by media cycles rather than the nation’s most serious structural problems.

One commonly discussed “economist’s solution” is to limit federal bailouts, and get the federal government out of providing flood insurance, in the hope that homes will not be built on risky floodplains. It doesn’t make sense to have $663,000 in payouts sent to one Mississippi home, which has flooded out 34 times in 32 years.

That all makes sense in theory, but it also illustrates the limitations of economics. The homes are already built in precarious places, and in the Houston area the damage has already been incurred. Are we prepared to forgo giving federal aid, just to set a precedent for the future? If anything, acting tough could lead to a backlash against the politicians who do so, and make it all the more clear that future bailouts will be forthcoming. Maybe the best we can do is to price flood insurance more appropriately, in recognition that climate risks are higher now. Over the longer run, as housing stocks turn over, that will help limit homeowner and also fiscal exposure to extreme events.

In other words, doing better in response to storms won’t be that easy. At least so far, it seems the human logistical preparation and response has gone fairly well — relative to expectations — this time around.

Thursday assorted links

2. Can smart devices track your movement with music? Can machine learning master love?

3. Interview with Sujatha Gidla.

4. Did India block China in Doklam?

5. “In an illustrative simulation we find that scrapping Buy-America(n) would reduce U.S. employment in manufacturing but boost employment in the rest of the economy with a net gain of about 300 thousand jobs. Even in the manufacturing sector, there would be many winning industries including those producing machinery and other high-tech products. Employment would increase in 50 out of 51 states and 430 out of 436 congressional districts.” Link here.

Is storm damage getting worse?

On a global level, the University of Colorado’s Roger Pielke Jr. notes that disaster losses as a percentage of the world’s G.D.P., at just 0.3 percent, have remained constant since 1990. That’s despite the dollar cost of disasters having nearly doubled over the same time — at just about the same rate as the growth in the global economy. (Pielke is yet another victim of the climate lobby’s hyperactive smear machine, but that doesn’t make his data any less valid.)

Climate activists often claim that unchecked economic growth and the things that go with are principal causes of environmental destruction. In reality, growth is the great offset. It’s a big part of the reason why, despite our warming planet, mortality rates from storms have declined from .11 per 100,000 in the 1900s to .04 per 100,000 in the 2010s, according to data compiled by Hannah Ritchie and Max Roser. Death rates from other natural disasters such as floods and droughts have fallen by even more staggering percentages over the last century.

That is from Bret Stephens at the NYT.

British education, not British institutions, has driven British economic growth

Jakob B. Madsen

This paper constructs an original database on physical capital, labor, education, GDP, innovations, technology spillovers, and institutions to analyze the proximate determinants of British economic growth since 1270. Several approaches are taken in the paper to tackle endogeneity. We show that education has been the most important driver of income growth during the period 1270–2010, followed by knowledge stock and fixed capital, while institutions have not been robust determinants of growth. The contribution of education has been equally important before and after the first Industrial Revolution. Overall, the results give strong support to the predictions of Unified Growth Theories.

I would note two things. First, the growth equations do at some points rely on long and (possibly arbitrary?) lags. Second, often literacy is proxying for education, so this is more a paper about the origins of growth and the role of science, and less a study of whether formal education is about signaling or actual learning.

For the pointer I thank the excellent Kevin Lewis.

Excellent points about the changing nature of mark-ups

Do read the whole post (who wrote it?), but here are a few choice excerpts:

My take is that large US firms with dominant brands/market positions have always commanded monopolistic rents. What has changed is that the rents, which used to be more broadly shared by stakeholders, are now predominantly flowing to shareholders and top management. The change has been driven by the interplay of several developments–shareholder revolution, globalization, rising equity valuations, diminished growth expectations.

And:

…the categories of variable and fixed costs are not iron-clad. Obviously, over long enough time frames, all costs are variable. Leaving that aside, even production-line workers have firm-specific capital. So, the costs related to training them or firing them are not entirely variable. More important, the question is how businesses view employee costs. There is circumstantial evidence that businesses have gone from treating most employees as relatively fixed costs to relatively variable costs. Note that since 1980, the proportion of job losers as a share of those unemployed has risen, suggesting that firms increasingly view employees as a variable cost.

And:

Interestingly, note that depreciation as a share has really flattened since 2001–the period in which the NIPA data show the biggest rise in mark-up!

And:

Moreover, industry concentration is only back to the levels of early 1980s.

And:

Globalization probably has played some role in the increase in mark-up. First, the shift of low-end manufacturing means that what is left is high-end manufacturing with greater monopolistic power. So, mark-ups should increase simply from that shift. Unsurprisingly, the NIPA mark-up show that the rise in mark-up coincided with China’s entry into WTO and is also consistent with Autor’s findings about impact of Chinese competition. Second, if firms already have some pricing power, reducing costs through outsourcing should result in higher mark-ups.

You can see that there is much more to be contributed to this debate.

Do dictators and autocracies build more impressive monuments?

I was having an email exchange about the possibility that dictatorships and autocracies do centralized monument-building much better than the freer democracies do. But while this is probably true on average, some of the deviations are of interest. Here is an excerpt from my response:

In some ways France looks like an autocracy, whereas in Singapore (not a dictatorship of course, but not a full democracy either) the government buildings are deliberately underwhelming (a kind of counter-signaling?).

Almaty and Skopje go overboard in the autocratic direction, the latter being a democracy. Washington, D.C. does centralized monuments very well, better than anything modern China has come up with. Cuban government buildings do not at all impress, nothing like Pyongyang.

Morocco invested in what was then the world’s largest mosque, in lieu of a government building upgrade. Ivory Coast has done much more monument-building than the other African autocracies.

So I wonder what the deeper model looks like…

Here are a few options:

1. Insecure nation-states invest in monuments. That is correlated with autocracy, but imperfectly.

2. Perhaps nation-states invest in monuments in lieu of concrete achievements for their citizenries.

3. Cuba has not built many monuments because its “origin story” is so strong, and its ideology for a long time has had a fair amount of support from the Cuban people. Alternatively, Castro himself was the monument.

4. Is Singapore itself the monument to Singapore? The same might be said of Dubai. What artificial monuments could top those?

Advocates of Confederate monuments, by the way, ought to ponder the possibility that those very structures are a sign of weakness not strength.

Wednesday assorted links

1. Is it better if the audience for classical music is growing older? Here is one chart of best-selling classical albums.

2. Register for my September 6th DC chat with Larry Summers.

3. Interview with Jesse Shapiro.

4. Jewish-Americans soldiers in WWII (pdf). They fought very hard.

5. “Cortana, open Alexa!” Having one of your voice assistants give orders to the other (NYT). And Chinese hyperloop at 1,000 kmh?

6. They are starting to build major arenas for e-Sports (NYT).

The culture that is Icelandic horse nationalism

Recently, the International Federation of Icelandic Horse Association (FEIF) passed a new law stating that Icelandic horses may not be named any name not registered in the WorldFeng database. If a horse owner wants to name the horse something else, their suggestion needs to be approved by the horse naming committee.

According to Vísir, a horse farmer in Skeggsstaðir farm, Guðrún hrafnsdóttir, suggest the name Mósan for her mare. The committee rejected the name since it doesn’t conform to Icelandic name traditions.

The Icelandic Ministry of Industries and Innovation is currently investigating if rulings of the horse naming committee are legal or not. So far, Guðrún has waited for 5 months for a reply from the ministry, Vísir reports.

China retailers face food vigilantes

1. Xue Yanfeng has now filed 40 lawsuits against supermarkets and retailers for violating food safety laws.

2. Under Chinese law, it is no longer the case that a victimized customer has to prove personal injury or loss to receive compensation.

3. Xue has found raisins with no nutritional labels, potato chips with proscribed additives, and biscuits with multiple production dates.

4. In the past 18 months, he has been awarded somewhat over $10,000 in compensation, plus there are 18 other settled cases where compensation was not disclosed.

5. Some provincial reports indicate that 80 to 90 percent of food safety complaints are from “specialist” plaintiffs.

China, of course, has had notoriously lax food safety practices in the past. So might the actions of these individuals be efficiency-enhancing? But more than 2/3 of the cases are based on labeling mistakes.

The above is from Bloomberg News.

Is full expensing the right path for tax reform?

That is the topic of my latest Bloomberg column, here is one excerpt:

Since 2008, the federal government has extended “bonus expensing,” which allows for a 50 percent deduction for many investments and covers about two-thirds of all investment. There are already various expensing provisions for investing in equipment, advertising, and research and development, and many forms of accelerated depreciation. By one estimate, corporations in 2012 were able to deduct more than 87 percent of the value of their investments, over time. So moving to “full expensing” may not be a complete economic game changer.

If nothing else, full expensing would benefit businesses by accelerating when the relevant deductions could be taken (right away, rather than over a multiyear period), and for that reason it would boost investment. But that in turn benefits some kinds of businesses more than others. What about businesses that invest a lot today, but earn back the cash slowly and turn a profit only years later? Without a big tax bill, they won’t get a significant tax reduction now, which would blunt the benefits of full expensing. That’s OK, but again it means not to expect a miracle from tax reform.

And near the end:

But so often the devil is in the details, and the simple idea of applying economic logic to the tax code can be harder to pull off than it might seem at first.

Do read the whole thing.

Headlines of 2017

Burger King launches WhopperCoin crypto-cash in Russia

That is from the BBC, sprightly throughout, via Stuart Harty.

Tuesday assorted links

1. Over 44,000 Haitians have entered Chile so far this year.

2. Facebook removes posts by people smugglers.

3. My podcast with David Lizerbram, including a discussion of movies vs. TV.

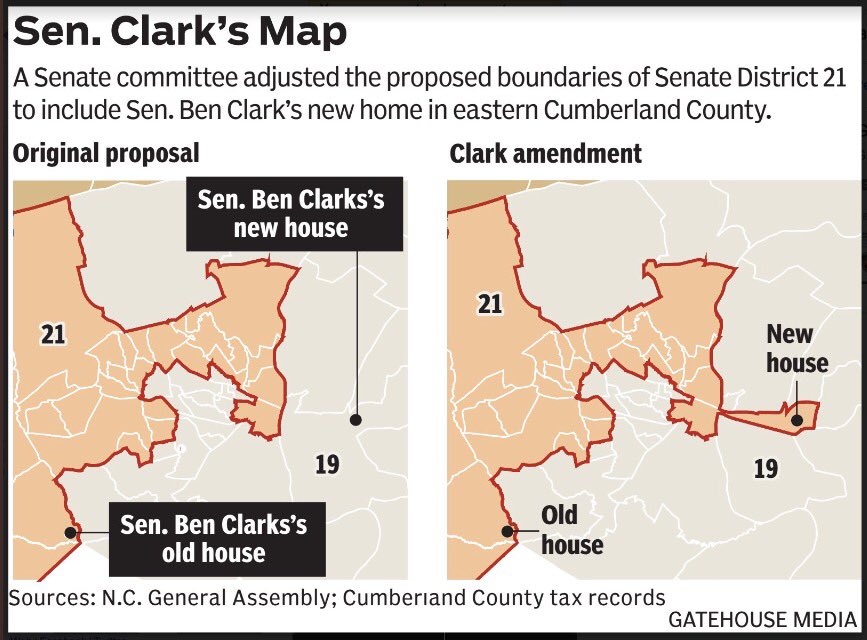

A Classic Gerrymander

In North Carolina, the Senate Redistricting Committee adjusted the boundaries of a state-Senate district to include a senator’s new house.

More from the Fayetteville Observer.

More on Houston and flood insurance

But the climate is not changing fast enough to explain the dramatic spikes in disaster costs; all seven of the billion-dollar floods in American history have made landfall in the 21st century, and Harvey will be the eighth. Experts believe the main culprit is the explosive growth of low-lying riverine and coastal development, which has had the double effect of increasing floods (by replacing prairies and other natural sponges that hold water with pavement that deflects water) while moving more property into the path of those floods. An investigation last year by ProPublica and the Texas Tribune found that the Houston area’s impervious surfaces increased by 25 percent from 1996 to 2011, as thousands of new homes were built around its bayous. Houston is renowned for its anything-goes zoning rules, but the feds have also promoted those trends by providing extremely cheap insurance in high-risk areas.

Created in 1968, the national flood program was actually supposed to help prevent risky development. Its complex rules required new construction within designated 100-year floodplains to meet higher floodproofing standards, and “substantially damaged” properties that received claims worth half their value to be relocated or elevated. But most of the program’s 100-year flood maps are woefully obsolete, relocation almost never happens, and Uncle Sam has continued to cut multiple checks for repetitive losses. A recent Pew Foundation study found that the Higher Ground problems have not been solved; about 1 percent of insured properties have sustained repetitive losses, accounting for more than 25 percent of the nation’s flood claims. One $69,000 home in Mississippi flooded 34 times in 32 years, producing $663,000 in payouts. The government routinely dishes out more in claims than it takes in through premiums, and the program has gradually drifted deeper and deeper into debt.

That is from a superb Politico piece by Michael Grunwald.

How many sellers are needed for markets to become competitive?

…competitive conduct changes quickly as the number of incumbents increases. In markets with five or fewer incumbents, almost all variation in competitive conduct occurs with the entry of the second or third firm…once the market has between three and five firms, the next entrant has little effect on competitive conduct.

That is from Bresnahan and Reiss, “Entry and Competition in Concentrated Markets.”

Part of their method is to compare doctor and dentist pricing practices across towns of different size, and thus across different numbers of providers. Then they see where bigger numbers makes a difference in terms of pricing. Plumbers and tire dealers are considered too. One lesson seems to be that market concentration has to rise to very high levels to make a big difference in outcomes.

If you are wondering, the “sweet spot” for a town to have a single dentist or doctor is population between 700 and 900, at least circa the early 1990s.