Category: Current Affairs

Rare Earths Aren’t Rare

Every decade or so there is a freakout out about China’s monopoly in rare earths. The last time was in 2010 when Paul Krugman wrote:

You really have to wonder why nobody raised an alarm while this was happening, if only on national security grounds. But policy makers simply stood by as the U.S. rare earth industry shut down….The result was a monopoly position exceeding the wildest dreams of Middle Eastern oil-fueled tyrants.

…the affair highlights the fecklessness of U.S. policy makers, who did nothing while an unreliable regime acquired a stranglehold on key materials.

A few years later I pointed out that the crisis was exaggerated:

- The Chinese government might or might not have wanted to take advantage of their temporary monopoly power but Chinese producers did a lot to evade export bans both legally and illegally.

- Firms that had been using rare earths when they were cheap decided they didn’t really need them when they were expensive.

- New suppliers came on line as prices rose.

- Innovations created substitutes and ways to get more from using less.

Well, we are at it again. Tim Worstall, a rare earths dealer and fine economist, is the one to read:

…rare earths are neither rare nor earths, and they are nearly everywhere. The biggest restriction on being able to process them is the light radioactivity the easiest ores (so easy they are a waste product of other industrial processes — monazite say) contain. If we had rational and sensible rules about light radioactivity — alas, we don’t — then that end of the process would already be done. Passing Marco Rubio’s Thorium Act would, for example, make Florida’s phosphate gypsum stacks available and they have more rare earths in them than several sticks could be shaken at.

Some also point out that only China has the ores with dysprosium and terbium — needed for the newly vital high temperature magnets. This is also one of those things that is not true. A decade back, yes, we did collectively think that was true. The ores — “ionic clays” — were specific to South China and Burma. Collective knowledge has changed and now we know that they can exist anywhere granite has weathered in subtropical climes. I have a list somewhere of a dozen Australian claimed deposits and there is at least one company actively mining such in Chile and Brazil.

…No, this is not an argument that we should have subsidised for 40 years to maintain production. It’s going to be vastly cheaper to build new now than it would have been to carry deadbeats for decades. Quite apart from anything else, we’re going to build our new stuff at the edge of the current technological envelope — not just shiny but modern.

As Tyler says, do not underrate the “elasticity of supply.”

Predicting Job Loss?

Hardly a day goes by without a new prediction of job growth or destruction from AI and other new technologies. Predicting job growth is a growing industry. But how good are these predictions? For 80 years the US Bureau of Labor Statistics has forecasted job growth by occupation in its Occupational Outlook series. The forecasts were generally quite sophisticated albeit often not quantitative.

In 1974, for example, the BLS said one downward force for truck drivers was that “[T]he trend to large shopping centers rather than many small stores will reduce the number of deliveries required.” In 1963, however, they weren’t quite so accurate about about pilots writing “Over the longer run, the rate of airline employment growth is likely to slow down because the introduction of a supersonic transport plane will enable the airlines to fly more traffic without corresponding expansion in the number of airline planes and workers…”. Sad!

In a new paper, Maxim Massenkoff collects all this data and makes it quantifiable with LLM assistance. What he finds is that the Occupational Outlook performed reasonably well, occupations that were forecast to grow strongly did grow significantly more than those forecast to grow slowly or decline. But was there alpha? A little but not much.

…these predictions were not that much better than a naive forecast based only on growth over the previous decade. One implication is that, in general, jobs go away slowly: over decades rather than years. Historically, job seekers have been able to get a good sense of the future growth of a job by looking at what’s been growing in the past.

If past predictions were only marginally better than simple extrapolations it’s hard to believe that future predictions will perform much better. At least, that is my prediction.

Rick Rubin podcasts with me

He interrogates me about stablecoins, AI, economic policy, the current state of the world and more. Here is the link, self-recommending, two full hours! Rick is a great interviewer.

This is part one, there will be more to come. We had great fun recording these in Tuscany.

We Turned the Light On—and the AI Looked Back

Jack Clark, Co-founder of Anthropic, has written a remarkable essay about his fears and hopes. It’s not the usual kind of thing one reads from a tech leader:

I remember being a child and after the lights turned out I would look around my bedroom and I would see shapes in the darkness and I would become afraid – afraid these shapes were creatures I did not understand that wanted to do me harm. And so I’d turn my light on. And when I turned the light on I would be relieved because the creatures turned out to be a pile of clothes on a chair, or a bookshelf, or a lampshade.

Now, in the year of 2025, we are the child from that story and the room is our planet. But when we turn the light on we find ourselves gazing upon true creatures, in the form of the powerful and somewhat unpredictable AI systems of today and those that are to come. And there are many people who desperately want to believe that these creatures are nothing but a pile of clothes on a chair, or a bookshelf, or a lampshade. And they want to get us to turn the light off and go back to sleep.

…We are growing extremely powerful systems that we do not fully understand. Each time we grow a larger system, we run tests on it. The tests show the system is much more capable at things which are economically useful. And the bigger and more complicated you make these systems, the more they seem to display awareness that they are things.

It is as if you are making hammers in a hammer factory and one day the hammer that comes off the line says, “I am a hammer, how interesting!” This is very unusual!

…I am also deeply afraid. It would be extraordinarily arrogant to think working with a technology like this would be easy or simple.

My own experience is that as these AI systems get smarter and smarter, they develop more and more complicated goals. When these goals aren’t absolutely aligned with both our preferences and the right context, the AI systems will behave strangely.

…we are not yet at “self-improving AI”, but we are at the stage of “AI that improves bits of the next AI, with increasing autonomy and agency”. And a couple of years ago we were at “AI that marginally speeds up coders”, and a couple of years before that we were at “AI is useless for AI development”. Where will we be one or two years from now?

And let me remind us all that the system which is now beginning to design its successor is also increasingly self-aware and therefore will surely eventually be prone to thinking, independently of us, about how it might want to be designed.

…In closing, I should state clearly that I love the world and I love humanity. I feel a lot of responsibility for the role of myself and my company here. And though I am a little frightened, I experience joy and optimism at the attention of so many people to this problem, and the earnestness with which I believe we will work together to get to a solution. I believe we have turned the light on and we can demand it be kept on, and that we have the courage to see things as they are.

Clark is clear that we are growing intelligent systems that are more complex than we can understand. Moreover, these systems are becoming self-aware–that is a fact, even if you think they are not sentient (but beware hubris on the latter question).

French facts of the day

Macron’s government consistently spent more as a share of total output than any other OECD member, with the public sector accounting for over 57% of GDP in 2024. The telling trend is France’s divergence from its neighbors. When Macron took office, France’s debt-to-GDP ratio was 11 percentage points above the Eurozone average; by 2024, that gap had increased to 25 points. Public debt is set to hit 116% of GDP in 2025 and the deficit is set to double the EU average.

France’s fiscal stance under Macron reflects continuity with recent trends, rather than any break with the past. The Stability and Growth Pact sets a 3% deficit and a 60% debt reference. Since 2002, France has breached the limits every year, and the deficit limit every year except two. More telling, France’s deficit has exceeded the Eurozone average every single year since 2002. Its public debt has grown faster than its peers’ since 1995, with only a brief pause under President Sarkozy…

And:

In 2021, Macron signed a law that commits France to zero net land development by 2050 (and half by 2030), making it illegal to develop any land in France unless some existing city or village is demolished. His governments banned renting less-well-insulated homes, allowed councils to forbid building second houses, and imposed nation-wide rent controls.

That is from Luis and Pieter Garicano.

The Economics Nobel goes to Mokyr, Aghion and Howitt

The Nobel prize goes to Joel Mokyr, the economic historian of the industrial revolution and the growth theorists Phillippe Aghion and Peter Howitt best known for their Schumpeterian model of economic growth.

Here’s a good quote from Nobelist Joel Mokyr’s the Lever of Riches.

Yet the central message of this book is not unequivocally optimistic . History provides us with relatively few examples of societies that were technologically progressive. Our own world is exceptional, though not unique, in this regard. By and large, the forces opposing technological progress have been stronger than those striving for changes. The study of technological progress is therefore a study of exceptionalism, of cases in which as a result of rare circumstances, the normal tendency of societies to slide toward stasis and equilibrium was broken. The unprecedented prosperity enjoyed today by a substantial proportion of humanity stems from accidental factors to a degree greater than is commonly supposed. Moreover, technological progress is like a fragile and vulnerable plant, whose nourishing is not only dependent on the appropriate surroundings and climate, but whose life is almost always short. It is highly sensitive to the social and economic environment and can easily be arrested by relatively small external changes. If there is a lesson to be learned from the history of technology it is that Schumpeterian growth, like the other forms of economic growth, cannot and should not be taken for granted.

Aghion and Howitt’s Schumpeterian model of economic growth shares with Romer the idea that the key factors of economic growth must be modelled, growth is thus endogenous to the model (unlike Solow where growth is primarily driven by technology, an unexplained exogenous factor). In Romer’s model, however, growth is primarily horizontally driven by new varieties whereas in Aghion and Howitt growth comes from creative destruction, from new ideas, technologies and firms replacing old ideas, technologies and firms.

Thus, Aghion and Howitt’s model lends itself to micro-data on firm entry and exit of the kind pioneered by Haltiwanger and others (who Tyler and I have argued for a future Nobel). Economic growth is not just about new ideas but about how well an economy can reallocate production to the firms using the new ideas. Consider the picture below, based on data from Bartelsman, Haltiwanger, and Scarpetta. It shows the covariance of labor productivity and firm size. In the United States highly productive firms tend to be big but this is much less true in other economies. In the UK during this period (1993-2001) the covariance of productive and big is considerably less than half the rate in the United States. In Romania at this time the covariance was even negative–indicating that the big firms were among the least productive. Why? Well in Romania this as the end of the communist era when big, unproductive government run behemoths dominated the economy. As Romania moved towards markets the covariance between labor productivity and firm size increased. That is the economy became more productive as it reallocated labor from low productivity firms to high productivity firms.

Aghion and Howitt’s work centers on how new ideas emerge and how creative destruction turns those ideas into real economic change through the birth and death of firms. But creative destruction is never painless—growth requires that some firms fail and that labor be displaced so resources can flow to new, more productive uses. Aghion and Howitt will likely point to the United States as dealing with his process better than Europe. Business dynamism has declined in Europe relative to the United States, a worrying fact given that business dynamism has also declined in the United States. Nevertheless, the US has a more flexible labor market and appears more open to both the birth of new firms (venture capital) and the deaths of older firms. Yet, in both the United States and around the the world the differences between high productivity and low productivity firms appears to be growing, that is the dispersion in productivity is growing which means that the good ideas are not spreading as quickly as they once did. Aghion and Howitt’s work gives us a model for thinking about these kinds of issues–see, for example, Ten Facts on Business Dynamism and Lessons from Endogenous Growth Theory.

More on Trumpian equity stakes

Their number keeps on growing, as I point out in my latest column for The Free Press:

Viewed as a stand-alone incident, the Intel deal could be dismissed as unimportant. There are state-owned or partially state-owned companies around the world, after all, and some are more efficient than others.

Unfortunately, this is not a one-off. The federal government also decided to take a 15 percent share in MP Materials, a company that mines rare-earth minerals that are essential for everything from smartphones to guided missiles. You might think that is essential for America’s national security, because China has such a large presence in that sector and the military applications of these rare-earth minerals are many.

Just last week, however, the Trump administration announced it would be taking a 5 percent stake in two different lithium mining ventures. The good news is that major lithium deposits are being discovered around the world, making this kind of U.S. government involvement unnecessary for national security reasons. The bad news is that our government still is treating this as a national emergency…

Last week, the Trump administration announced an arrangement in which Pfizer would cut pharmaceutical prices in return for some tariff relief. Reuters has reported that the Trump administration is now planning various kinds of deals with up to 30 industries.

To make sure the new deals stick, there is a plan in the works to formalize them and make it so this is how the U.S. government deals with businesses going forward. To that end, the Trump administration wishes to greatly expand the financing and authority of what was previously a minor institution, namely the International Development Finance Corporation (DFC).

The DFC was created in 2018 to help finance projects in developing nations. But under the proposed expansion, it would establish an equity fund to cement federal government ownership of key parts of American industry. This means that our federal government would move away from its longstanding and beneficial stance of letting private ownership stay private.

There is more at the link.

Hanson and Buterin for Nobel Prize in Economics

Intercontinental Exchange (ICE.N), the company that owns the NYSE exchange, just announced a $2 billion dollar investment in Polymarket, the Ethereum-blockchain based prediction markets platform. This is a tremendous milestone for prediction markets and for blockchains.

Shayne Coplan the founder of Polymarket writes:

The Polymarket origin story is funny because it’s a rare case of the dream being identical to how things played out. If I learned one thing, it’s that bold ideas are everywhere, hidden in plain sight. It just takes someone crazy enough to spend their life willing it into existence. That’s entrepreneurship: willing things into existence.

I remember reading Robin Hanson’s literature on prediction markets and thinking – man, this is too good of an idea to just exist in whitepapers. There were a million reasons why it shouldn’t work, countless arguments of why not to do it, and the odds were against us, but we had to try.

At the onset of the pandemic, I quite literally had nothing to lose: 21, running out of money, 2.5 years since I dropped out and nothing to show for it. But I knew we were entering an era where ways to find truth would matter more than ever, and Polymarket could play a critical role in that. After all, nothing is more valuable than the truth. It’s still a work in progress, but we’re honored to have made the impact we have thus far.

The NYSE will use Polymarket data to sharpen forecasts. The next step is decision markets. Futarchy, for example, just announced a prediction market in the value of Tesla shares if Musk’s compensation package is approved versus if it is not approved. Information like this can be used to improve decisions. To see how powerful this can be, broaden it to Hanson’s 1996 idea of a Dump the CEO Market, a market in the value of a company’s shares with and without the current CEO. Very powerful. And that is only the beginning.

In my 2002 book, Entrepreneurial Economics: Bright Ideas from the Dismal Science, which featured Robin’s paper on Decision Markets, I wrote

If Hanson is right about the benefits of decision markets, then perhaps one day, instead of quoting an expert, the New York Times editorial section will refer to the latest quote on “health care plan A” available in the business pages.

That day is upon us! It probably will not happen on Monday but it is time to give Robin Hanson, the father of prediction markets, and Vitalik Buterin, the co-father of Ethereum, a Nobel prize in economics for applied mechanism design.

Addendum: My a16z podcast with Scott Duke Kominers on prediction markets.

Helen Andrews on the feminization of culture

Virginia fact of the day

Virginia saw one of the smallest increases in electricity costs in the nation this past year, per new federal data, but it could get even higher as data centers proliferate statewide…

By the numbers: Between May 2024 and May 2025, the average cost of electricity for residential customers in Virginia rose about 3%, from 14.95 cents to 15.41 cents, according to the U.S. Energy Information Administration.

The negative media bias aside, I find this encouraging. OK, “…could get even higher,” but the nationwide average was 6.5%. Here is the full story. Via Andy Masley.

The ai Boom

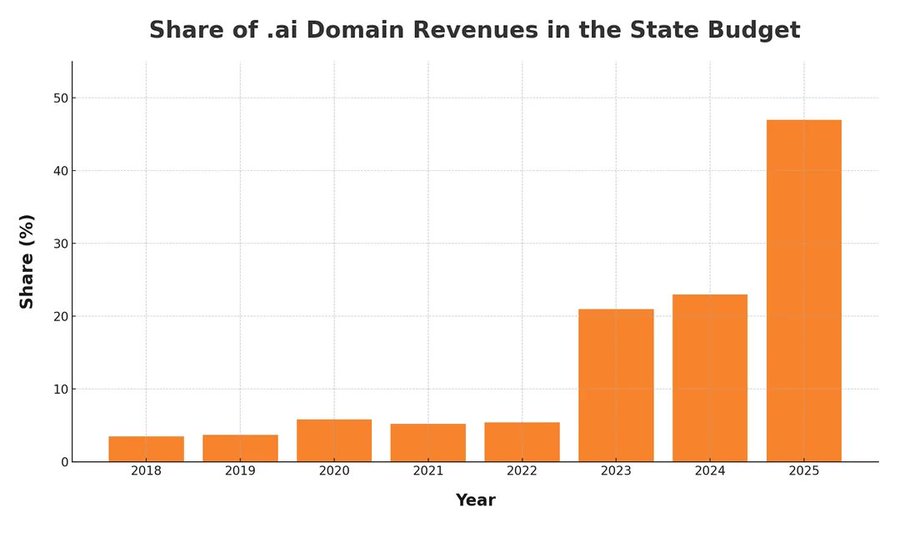

The tiny country of Anguilla (pop 15,000) has an official country top-level domain code for the internet of .ai. Domain name registrations have surged from 48,000 in 2018 to 870,000 in the year to date and that source of revenue alone now accounts for nearly 50% of state revenues.

Hat tip: Cremieux based on this analysis.

AI Scientists in the Lab

Today, we introduce Periodic Labs. Our goal is to create an AI scientist.

Science works by conjecturing how the world might be, running experiments, and learning from the results.

Intelligence is necessary, but not sufficient. New knowledge is created when ideas are found to be consistent with reality. And so, at Periodic, we are building AI scientists and the autonomous laboratories for them to operate.

…Autonomous labs are central to our strategy. They provide huge amounts of high-quality data (each experiment can produce GBs of data!) that exists nowhere else. They generate valuable negative results which are seldom published. But most importantly, they give our AI scientists the tools to act.

…One of our goals is to discover superconductors that work at higher temperatures than today’s materials. Significant advances could help us create next-generation transportation and build power grids with minimal losses. But this is just one example — if we can automate materials design, we have the potential to accelerate Moore’s Law, space travel, and nuclear fusion.

Our founding team co-created ChatGPT, DeepMind’s GNoME, OpenAI’s Operator (now Agent), the neural attention mechanism, MatterGen; have scaled autonomous physics labs; and have contributed to important materials discoveries of the last decade. We’ve come together to scale up and reimagine how science is done.

The AI’s can work 24 hours a day, 365 days a year and with labs under their control the feedback will be quick. In nine hours, AlphaZero taught itself chess and then trounced the then world champion Stockfish 8, (ELO around 3378 compared to Magnus Carlsen’s high of 2882). That was in 2017. In general, experiments are more open-ended than chess but not necessarily in every domain. Moreover context windows and capabilities have grown tremendously since 2017.

In other AI news, AI can be used to generate dangerous proteins like ricin and current safeguards are not very effective:

Microsoft bioengineer Bruce Wittmann normally uses artificial intelligence (AI) to design proteins that could help fight disease or grow food. But last year, he used AI tools like a would-be bioterrorist: creating digital blueprints for proteins that could mimic deadly poisons and toxins such as ricin, botulinum, and Shiga.

Wittmann and his Microsoft colleagues wanted to know what would happen if they ordered the DNA sequences that code for these proteins from companies that synthesize nucleic acids. Borrowing a military term, the researchers called it a “red team” exercise, looking for weaknesses in biosecurity practices in the protein engineering pipeline.

The effort grew into a collaboration with many biosecurity experts, and according to their new paper, published today in Science, one key guardrail failed. DNA vendors typically use screening software to flag sequences that might be used to cause harm. But the researchers report that this software failed to catch many of their AI-designed genes—one tool missed more than 75% of the potential toxins.

Solve for the equilibrium?

My excellent Conversation with John Amaechi

Here is the audio, video, and transcript. As I said on Twitter, John has the best “podcast voice” of any CWT guest to date. Here is the episode summary:

John Amaechi is a former NBA forward/center who became a chartered scientist, professor of leadership at Exeter Business School, and New York Times bestselling author. His newest book, It’s Not Magic: The Ordinary Skills of Exceptional Leaders, argues that leadership isn’t bestowed or innate, it’s earned through deliberate skill development.

Tyler and John discuss whether business culture is defined by the worst behavior tolerated, what rituals leadership requires, the quality of leadership in universities and consulting, why Doc Rivers started some practices at midnight, his childhood identification with the Hunchback of Notre Dame and retreat into science fiction, whether Yoda was actually a terrible leader, why he turned down $17 million from the Lakers, how mental blocks destroyed his shooting and how he overcame them, what he learned from Jerry Sloan’s cruelty versus Karl Malone’s commitment, what percentage of NBA players truly love the game, the experience of being gay in the NBA and why so few male athletes come out, when London peaked, why he loved Scottsdale but had to leave, the physical toll of professional play, the career prospects for 2nd tier players, what distinguishes him from other psychologists, why personality testing is “absolute bollocks,” what he plans to do next, and more.

Excerpt:

COWEN: Of NBA players as a whole, what percentage do you think truly love the game?

AMAECHI: It’s a hard question to answer. Well, let me give a number first, otherwise, it’s just frustrating. 40%. And a further 30% like the game, and 20% of them are really good at the game and they have other things they want to do with the opportunities that playing well in the NBA grants them.

But make no mistake, even that 30% that likes the game and the 40% that love the game, they also know that they like what the game can give them and the opportunities that can grow for them, their families and generation, they can make a generational change in their family’s life and opportunities. It’s not just about love. Love doesn’t make you good at something. And this is a mistake that people make all the time. Loving something doesn’t make you better, it just makes the hard stuff easier.

COWEN: Are there any of the true greats who did not love playing?

AMAECHI: Yeah. So I know all former players are called legends, whether you are crap like me or brilliant like Hakeem Olajuwon, right? And so I’m part of this group of legends and I’m an NBA Ambassador as well. So I go around all the time with real proper legends. And a number of them I know, and so I’m not going to throw them under the bus, but it’s the way we talk candidly in the van going between events. It’s like, “Yeah, this is a job now and it was a job then, and it was a job that wrecked our knees, destroyed our backs, made it so it’s hard for us to pick up our children.”

And so it’s a job. And we were commodities for teams who often, at least back in those days, treated you like commodities. So yeah, there’s a lot of superstars, really, really excellent players. But that’s the problem, don’t conflate not loving the game. And also, don’t be fooled. In Britain there’s this habit of athletes kissing the badge. In football, they’ve got the badge on their shirt and they go, “Mwah, yeah.” If that fools you into thinking that this person loves the game, if them jumping into the stands and hugging you fools you into thinking that they love the game, more fool you.

COWEN: Michael Cage, he loved the game. Right?

But do note that most of the Conversation is not about the NBA.

Incentives matter, installment #1637

In the first three months of 2025, U.S. companies canceled, downsized or mothballed nearly $8 billion worth of supply chain projects — including more than $2.2 billion tied to battery plants. That single quarter exceeded the combined losses of the previous two years, according to Atlas Public Policy.