Category: Economics

The Rise, Fall, and Rise Again of Privateers

In August 1812, the Hopewell, a 346-ton ship laden with sugar, molasses, cotton, coffee, and cocoa, set sail from the Dutch colony of Surinam. Her captain was pleased because he reckoned that in London the cargo would sell for £40,000–the equivalent of at least several million dollars in today’s economy. The Hopewell carried fourteen guns and a crew of twenty-five, and for protection she sailed in a squadron of five other vessels. It was difficult, however, to keep a squadron together in the vast expanse of the Atlantic Ocean, and on August 13 the Hopewell became separated from her sisters.

Two days later her crew spotted another ship, armed and approaching rapidly…

That’s the opening of my latest paper, The Rise, Fall, and Rise Again of Privateers.

Hat tip to Jesse Walker at Hit and Run and Instapundit both of whom spotted this before me!

In a wealthy society, could you buy a good job?

Let’s say that the world is so wealthy that most people don’t need to work. Still they might be bored. They might want to work.

What kinds of jobs could they buy? Under one view, the resulting jobs would always feel phony. The customers/laborers would never fear being fired. They would never have to try very hard, or could never feel that the enterprise really mattered. You might, for instance, buy a job as a blogger.

Under another view, markets in artificial jobs will be very advanced, a’ la Total Recall. Maybe it will be only twenty hours a week, but your phony job will feel quite real. It will feel better and more important than today’s jobs. Theatre, drugs, and self-deception all can be directed toward this end.

If need be, we can create a separate job in making your phony, purchased job matter (that job surely would matter). Contract to suffer twenty lashes if you screw up. Or hire a third party to start sending money to ten poor kids in India. If you are not a superior producer, the third party will stop sending the money. He will also send you photos of those Indian children, now kicked out of the orphanage and with distended bellies. Over time you will see them starve and die. Of course to accept such terms is, since you will likely work hard, an ex ante act of altruism.

I don’t expect this exact outcome, but only because there are cheaper ways of buying jobs that seem like they matter. I believe we will be able to buy very good and very fun jobs. I do not fear that we will all become dissolute recipients of trust funds.

I am indebted to Megan McArdle for a lunch conversation on this topic.

Sentences of wisdom

To the extent that the superrich are pulling away from the rest of us…the most parsimonious explanation seems to be the massive increase in the efficiency, and size, of American capital markets.

Here is more. Here are my views on the same.

Addendum: In the comments read the discussion between Jane Galt, James Surowiecki, and myself.

Planned obsolescence

Giles Slade’s new book, Made to Break: Technology and Obsolescence in America made me want to list coherent microeconomic theories of planed obsolescence:

1. Consumer tastes change rapidly and so new models are needed frequently.

2. Old models become rapidly obsolete because of technical progress.

3. We are playing a durable goods monopoly game and suppliers want consumers to know they must buy the wasting asset now, rather than waiting for its price to fall.

4. Suppliers can’t credibly signal true durability, so the market standard ends up being a cheap, short-lasting good, sold at a relatively low price.

#1 and #2 are optimal and indeed splendid reasons to have planned obsolescence. #3 is lame, and the time horizons for each decision don’t match up for this to be real. #4 I can believe, but this implies too many light bulbs under the kitchen sink, or too many trips to K-Mart, rather than any great tragedy of consumer rip-off.

Here is an interview with Slade. I found some useful material in his book, but no actual argument.

Expand the AMT!

We shouldn’t get rid of the AMT we should expand it. The AMT is a flat tax, it’s broad-based (few loopholes), it doesn’t allow for deduction of state and local taxes (which only increases the incentive of states and localities to raise taxes) and it’s simple. The AMT should be reformed along the edges e.g. by indexing it to inflation (after more people are covered!) but overall it’s a much better tax than the current income tax.

I assume that readers know that I am not in favor of raising taxes but let me be clear. We should expand the AMT but get rid of the income tax.

Interview with Robert Fogel

When I graduated from college, I had two job offers. One was from my father, to join him in the meat-packing business. That would have been quite lucrative. The other was as an activist for a left-wing youth organization. I chose the latter and worked as an activist from 1948 to 1956. At the time I was making that decision, my father told me: “If you really believe in that cause, come work with me. You will make a much higher wage and you could give your extra income to hire several people instead of just yourself.” I thought, well, that makes some sense. But I was convinced that this was a way to get me to change my views or at least lessen my commitment to an ideological cause that I found very important. Yes, the first year, I might give all of my extra money to the movement, but every year I would probably give less, and finally reach the point when I was giving nothing at all. I feared I would be co-opted. I thought this was my father’s way of indoctrinating me.

Here is much more; he mentions Simon Kuznets as the economist who influenced him most and talks of his forthcoming book of interviews with economists.

Optimistic claim of the day

…instead of the 28 percent depreciation [of the U.S. dollar] needed to induce a 1 percentage point improvement in the trade balance to GDP ratio, only about a 15 percent depreciation is required once on takes into account vertical specialization in the manner the WEO authors do.

If this is right, paying off America’s ongoing trade deficit won’t be nearly as hard as we used to think. Here is more.

The Golden Age of Medical Innovation

Writing in The American John Calfee surveys the recent history of medical innovation. I was especially struck by Lucentis, a new drug that Science magazine ranked sixth in its ten breakthroughs of the year (number one was the solution to Poincare’s conjecture). Lucentis has had stunning success in treating age-related macular degeneration, the leading cause of blindness in seniors.

What makes Lucentis, as Calfee notes, especially interesting is that Lucentis is what industry critics call a "me-too" drug, a simple twist on another drug. Moreover, it’s a twist on a drug originally approved to to treat cancer but subsequently used off-label to treat AMD.

Why won’t they allow cell phones on planes?

Notice that this post is filed under "Economics."

The airlines fear "crowd control" problems if cell phones are allowed

in flights. They believe cell phone calls might promote rude behavior

and conflict between passengers, which flight attendants would have to

deal with. The airlines also benefit in general from passengers

remaining ignorant about what’s happening on the ground during flights,

including personal problems, terrorist attacks, plane crashes and other

information that might upset passengers.

This is also relevant:

However, the airlines know that some kind of plane-to-ground

communication is coming, and they want to profit from it. Simply

allowing passengers to use their own cell phones in flight would leave

the airlines out of the profit-taking. Airlines would prefer that

phones be banned while they come up with new ways to charge for

communication, such as the coming wave of Wi-Fi access. Meanwhile, the

ban is potentially more profitable.

Here is more.

It’s only one data point, but…

Employers are not only hiring more, but they are paying more, too. The

average hourly earnings for workers rose 4 percent in March compared

with those a year earlier, to $17.22 an hour. The gains in weekly

earnings were even stronger, up 4.4 percent, to $583.67.

Here is the story. I believe that the much-heralded "real wage stagnation" consists of three major factors: a) potential real wage increases being absorbed by rising health care premiums in the broader employment package, b) unmeasured improvements in the quality of economic life, the internet being one example, and c) an unusually long lag between rising productivity and real wage gains. I am increasingly of the belief that the third factor no longer operates.

Markets in everything, or markets that will fail?

On-line flirting. You bid with real-valued points for the chance to contact members of the opposite sex. You lose points if you bid for women beyond your reach, you can get more points, it seems, by watching more advertisements. But is staged flirting any fun at all? And should a woman be more impressed if you can bid with more points?

Thanks to Jerry Brito for the pointer.

Can Marginal Utility be Measured?

Reporting in the current issue of Neuron, the scientists

reveal that when a small sum of money is on the line, poorer people

learn quickly how to maximize their profits, leaving their wealthier

counterparts in the dust.In a Pavlovian paradigm, a number of abstract shapes flashed

in front of 14 participants. After each shape appeared for three

seconds, a picture of either a 20-pence coin (roughly 40 cents) or a

scrambled image followed. A card of one particular shape was always

followed by the coin, and subjects were told that they could take a

20-pence piece home if they could accurately predict when the money

card was the next one up….The poorer people tended to figure out

which card signaled money ahead within about 12 trials… whereas the

richer people took about 35 trials.The team next repeated the experiment while the subject’s brains

were scanned by an fMRI (functional magnetic resonance imaging)

machine. …This time, however, the participants did not have to physically respond. "We

didn’t want them to do that because there are neurons in the striatum

that are responding to initiate an action of responding to reward,"

Tobler says. It was this response preparation that the researchers

timed.Once again, an inverse association between wealth and learning

appeared, with poor people displaying more increased activity in the

midbrain and striatum when compared with the more affluent subjects.

From Scientific American, the article is here.

Thanks to Rey Lehmann for the pointer.

Buffett on LTCM

According to Warren Buffet the ill-fated Long Term Capital Management had made the right bets but didn’t have the cash to stay solvent. Buffet wanted to step in and buy the firm but a holiday intervened. Thanks to Newmark’s Door for the pointer.

…Warren wished that he had been able to buy LTCM’s positions when the Fed forced

a resolution of the crisis that was crippling the government bond market.The LTCM crisis was a ready-made example of Warren’s philosophy of buying

firms when the economics was right, yet fear ruled the markets. He noted that

“off-the-run” (non-benchmark) government bonds were selling to yield 30 basis

points more than the “on-the-run” (benchmark) bonds that were maturing just six

months later. He rightly claimed that this made no sense economically.LTCM had taken a huge leveraged position in these bonds when the spreads were

much smaller, but didn’t have the collateral to hold on to it when the spread

widened. Buffett quoted John Maynard Keynes, who wrote in 1931 that “The market

can stay irrational longer than you can stay solvent.” As the spread widened,

Keynes’ dictum became devastatingly relevant for LTCM. But Berkshire, with its

huge cash hoard, could withstand the pressure of even more market irrationality

before the spread eventually returned to normal.Unfortunately, Warren was never able to consummate the deal. He had been

invited by Bill Gates to vacation in Alaska when the crisis broke and it was

hard to negotiate such a deal on a cell phone… “Bill Gates cost me about $3 billion,” he

shrugged.

The Italian shortage of small notes

Thomas Kaminski, a loyal MR reader and current resident of Italy, writes to me:

There doesn’t seem to be enough currency in small denominations in circulation. Wherever I buy something, the merchant or cashier seems to ask for smaller bills or coins. Back home in Chicago, if I go into a Starbucks, I don’t give it a second thought if I give the cashier a twenty dollar bill for a $2.50 purchase. They always have plenty of change. Here, even in some supermarket chains, the cashiers constantly ask for exact change or at least for notes in smaller denominations. And when I go to a museum, they often seem to have no change at all…My wife, who is not as familiar with the currency as I am, says that she hates carrying any bill larger than a 10; she constantly gets dirty looks or has to endure sighs of frustration if she tries to buy a cup of tea and doesn’t have small change. And you should see the complications if you try to buy something from a street vendor and don’t have exact change. What is equally annoying, whenever I go to a cash machine, all I get are 50-Euro notes.

I had the same problem in the old days of the Lira, but I am surprised it continues to plague the Euro in Italy and yes I’ve had the same experience here in Venice. Is the Italian central bank simply refusing to print up the right denominations? If so, given Eurofication why don’t the proper size notes flow into Italy where they are most needed? Or should I assume that Italians do not carry socially optimal cash balances at hand? Is there a heavy tax on cash registers and other forms of monetary storage? I remain puzzled.

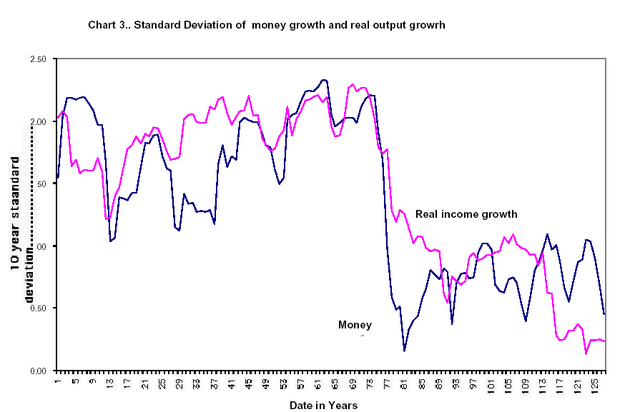

On the Variability of Money and Real Output

In one of Milton Friedman’s last papers (circa 2006) is this stunning graph. The graph (click to enlarge) shows the standard deviation of real output and money (M2) from 1879 to 2005. The sharp break in the series around the late 1970s and early 1980s is evident – the standard deviation of money fell dramatically and so did the standard deviation of output.

Money is partially endogenous so one could interpret this as running from output to money. The rapidity of the break, however, suggests otherwise. It’s easy to understand how policy could quickly have made money growth more stable. It’s much more difficult to understand how or why real output could quickly become more stable. Moreover, the fact that money stabilized as Volcker and then Greenspan headed the Fed is also suggestive of monetary policy as the driving force.

In one way this is a testament to better monetary policy beginning circa Volcker but in another it’s a damning indictment of how poor monetary policy has been over most of the history of the Federal Reserve.