Category: Economics

Do markets expect unaligned AGI risk?

Here is a new essay by Trevor Chow, Basil Halperin, and J. Zachary Mazlish, all favorite thinkers of mine, excerpt and these are their words I will not double indent:

“In this post, we point out that short AI timelines would cause real interest rates to be high, and would do so under expectations of either unaligned or aligned AI. However, 30- to 50-year real interest rates are low. We argue that this suggests one of two possibilities:

- Long(er) timelines. Financial markets are often highly effective information aggregators (the “efficient market hypothesis”), and therefore real interest rates accurately reflect that transformative AI is unlikely to be developed in the next 30-50 years.

- Market inefficiency. Markets are radically underestimating how soon advanced AI technology will be developed, and real interest rates are therefore too low. There is thus an opportunity for philanthropists to borrow while real rates are low to cheaply do good today; and/or an opportunity for anyone to earn excess returns by betting that real rates will rise.

In the rest of this post we flesh out this argument.

- Both intuitively and under every mainstream economic model, the “explosive growth” caused by aligned AI would cause high real interest rates.

- Both intuitively and under every mainstream economic model, the existential risk caused by unaligned AI would cause high real interest rates.

- We show that in the historical data, indeed, real interest rates have been correlated with future growth.

- Plugging the Cotra probabilities for AI timelines into the baseline workhorse model of economic growth implies substantially higher real interest rates today.

- In particular, we argue that markets are decisively rejecting the shortest possible timelines of 0-10 years.

- We argue that the efficient market hypothesis (EMH) is a reasonable prior, and therefore one reasonable interpretation of low real rates is that since markets are simply not forecasting short timelines, neither should we be forecasting short timelines.

- Alternatively, if you believe that financial markets are wrong, then you have the opportunity to (1) borrow cheaply today and use that money to e.g. fund AI safety work; and/or (2) earn alpha by betting that real rates will rise.

An order-of-magnitude estimate is that, if markets are getting this wrong, then there is easily $1 trillion lying on the table in the US treasury bond market alone – setting aside the enormous implications for every other asset class.”

TC again: I am pleased that they wrote a separate companion piece on Cowen’s Third Law.

J. Barkley Rosser, RIP

Alas Barkley has passed away. He was a friend of mine and to many of us at GMU, a well-known economist, a feisty commentator here at MR and much more…here is one profile.

Why did the gender wage gap stop narrowing?

During the 1980s, the wage gap between white women and white men in the US declined by approximately 1 percentage point per year. In the decades since, the rate of gender wage convergence has stalled to less than one-third of its previous value. An outstanding puzzle in economics is “why did gender wage convergence in the US stall?” Using an event study design that exploits the timing of state and federal family-leave policies, we show that the introduction of the policies can explain 94% of the reduction in the rate of gender wage convergence that is unaccounted for after controlling for changes in observable characteristics of workers. If gender wage convergence had continued at the pre-family leave rate, wage parity between white women and white men would have been achieved as early as 2017.

That is from a new NBER working paper by Peter Q. Blair and Benjamin Posmanick. Might the gender wage gap be one economics topic where a naive, mood-affiliated view on it best predicts a bunch of other bad views on totally separate topics?

Where are all the workers?

The subtitle of the paper is “From Great Resignation to Quiet Quitting”, here is the abstract:

To better understand the tight post-pandemic labor market in the US, we decompose the decline in aggregate hours worked into the extensive (fewer people working) and the intensive margin changes (workers working fewer hours). Although the pre-existing trend of lower labor force participation especially by young men without a bachelor’s degree accounts for some of the decline in aggregate hours, the intensive margin accounts for more than half of the decline between 2019 and 2022. The decline in hours among workers was larger for men than women. Among men, the decline was larger for those with a bachelor’s degree than those with less education, for prime-age workers than older workers, and also for those who already worked long hours and had high earnings. Workers’ hours reduction can explain why the labor market is even tighter than what is expected at the current levels of unemployment and labor force participation.

Dain Lee, Jinhyeok Park, and Yongseok Shin wrote that new NBER working paper, important work for understanding our current time.

The Extreme Shortage of High IQ Workers

At first glance it seems peculiar that semiconductors, a key item of national strategic interest, should be produced in only a few places in the world, most notably Taiwan, using devices produced only in Eindhoven in the Netherlands by one firm, ASML. Isn’t the United States big enough to be able to support all of these technologies domestically? Yes and no.

Semiconductor manufacturing is the most difficult and complicated manufacturing process ever attempted by human beings. A literal spec of dust can ruin an entire production run. How many people can run such a factory? Let’s look at the United States. The labor force is approximately 164 million people which sounds like a lot but half of the people in the labor force have IQs below 100. More specifically, although not everyone in semiconductor manufacturing requires a PhD, pretty much everyone has to be of above average intelligence and many will need to be in the top echelons of IQ.

In the entire US workforce there are approximately 3.7 million workers (2.3%) with an IQ greater than two standard deviations above the mean. (Mean 100, sd, 15, Normal dist.) Two standard deviations above the mean is pretty good but we are talking professor, physician, attorney level. At the very top of semiconductor manufacturing you are going to need workers with IQs at or higher than 1 in a 1000 people and there are only 164 thousand of these workers in the United States.

164 thousand very high-IQ workers are enough to run the entire semiconductor industry but you also want some of these workers doing fundamental research in mathematics, physics and computer science, running businesses, guiding the military and so forth. Moreover, we aren’t running a command economy. Many high-IQ workers won’t be interested in any of these fields but will want to study philosophy, music or English literature. Some of them will also be lazy! I’ve also assumed that we can identify all 164 thousand of these high-IQ workers but discrimination, poverty, poor health, bad luck and other factors will mean that many of these workers end up in jobs far below their potential–the US might be able to place only say 100,000 high-IQ workers in high-IQ professions, if we are lucky.

It’s very difficult to run a high-IQ civilization of 330 million on just 100,000 high-IQ workers–the pyramid of ability extends only so far. To some extent, we can economize on high-IQ workers by giving lower-IQ workers smarter tools and drawing on non-human intelligence. But we also need to draw on high-IQ workers throughout the world–which explains why some of the linchpins of our civilization end up in places like Eindhoven or Taiwan–or we need many more Americans.

Do pay transparency laws raise wages?

It seems not:

Labour advocates champion pay-transparency laws on the grounds that they will narrow pay disparities. But research suggests that this is achieved not by boosting the wages of lower-paid workers but by curbing the wages of higher-paid ones. A forthcoming paper by economists at the University of Toronto and Princeton University estimates that Canadian salary-disclosure laws implemented between 1996 and 2016 narrowed the gender pay gap of university professors by 20-30%. But there is also evidence that they lower salaries, on average. Another paper by professors at Chapel Hill, Cornell and Columbia University found that a Danish pay-transparency law adopted in 2006 shrank the gender pay gap by 13%, but only because it curbed the wages of male employees. Studies of Britain’s gender-pay-gap law, which was implemented in 2018, have reached similar conclusions.

Another misconception about pay-transparency laws is that they strengthen the bargaining power of workers. A recent paper by Zoe Cullen of Harvard Business School and Bobby Pakzad-Hurson of Brown University analysed the effects of 13 state laws passed between 2004 and 2016 that were designed to protect the right of workers to ask about the salaries of their co-workers. The authors found that the laws were associated with a 2% drop in wages, an outcome which the authors attribute to reduced bargaining power. “Although the idea of pay transparency is to give workers the ability to renegotiate away pay discrepancies, it actually shifts the bargaining power from the workers to the employer,” says Mr Pakzad-Hurson. “So wages are more equal,” explains Ms Cullen, “but they’re also lower.”

Here is more from The Economist.

Nathan Labenz on AI pricing

I won’t double indent, these are all his words:

“I agree with your general take on pricing and expect prices to continue to fall, ultimately approaching marginal costs for common use cases over the next couple years.

A few recent data points to establish the trend, and why we should expect it to continue for at least a couple years…

- OpenAI reduced core LLM pricing by 2/3rds last year.

- StabilityAI has recently reduced prices on Stable Diffusion down to a base of $0.002 / image – now you get 500 images / dollar. This is a >90% reduction from OpenAI’s original DALLE2 pricing.

- OpenAI has also recently reduced their embeddings price by 99.8% – not a typo! You can now index all 200M+ papers on Semantic Scholar for $500K-2M, depending on your approach.

- Emad from StabilityAI projects ~1M fold cost improvement over next 10 years – responding to Chamath who had predicted 1000X improvement

Looking ahead…

- continued application of RLHF and similar techniques – these techniques create 100X parameter advantage (already in use in force at OpenAI, Anthropic, and Google – but limited use elsewhere)

- the CarperAI “Open Instruct” project – also affiliated with (part of?) StabilityAI, aims to match OpenAI’s current production models with an open source model, expected in 2023

- 8-bit and maybe even 4-bit inference – simply by rounding weights off to fewer significant digits, you save memory requirements and inference compute costs with minimal performance loss

- pruning for sparsity – turns out some LLMs work just as well if you set 60% of the weights to zero (though this likely isn’t true if you’re using Chinchilla-optimal training)

- mixture of experts techniques – another take on sparsity, allows you to compute only certain dedicated sub-blocks of the overall network, improving speed and cost

- distillation – a technique by which larger, more capable models can be used to train smaller models to similar performance within certain domains – Replit has a great writeup on how they created their first release codegen model in just a few weeks this way!

- distributed training techniques, including approaches that work on consumer devices, and “reincarnation” techniques that allow you to re-use compute rather than constantly re-training from scratch

And this is all assuming that the weights from a leading model never leak – that would be another way things could quickly get much cheaper… ”

TC again: All worth a ponder, I do not have personal views on these specific issues, of course we will see. And here is Nathan on Twitter.

“Unveiling the Price of Obscenity”

Does legitimating sinful activities have a cost? This paper examines the relationship between housing demand and overt prostitution in Amsterdam. In our empirical design, we exploit the spatial discontinuity in the location of brothel windows created by canals, combined with a policy that forcibly closed some of the windows near these canals. To pin down their effect on housing prices, we apply a difference-in-discontinuity (DiD) estimator, which controls for the precise location of brothel windows and the effect of other policies and local developments. Our results show that the housing prices are discontinuous at the bordering canals, and this discontinuity nearly disappears after closures. The discontinuity is also found to decrease with the distance to brothels, disappearing after 300 yards. Our estimates indicate that homes right next to sex workers were 30 percent cheaper before the closures. This result seems unrelated to the presence of other businesses, such as bars and cannabis shops. Instead, the price discount is partly explained by petty crimes. However, 73 percent of the effect remains unexplained after controlling for many forms of crime and risk perception. Our findings suggest that households tend to be against the visible presence of sex workers and related nuisances, reaffirming their marginalization.

That is from a new paper by Erasmo Giambona and Rafael P. Ribas, via a highly reputable man.

Herbert Gintis has passed away, RIP

Is America suffering a ‘social recession’?

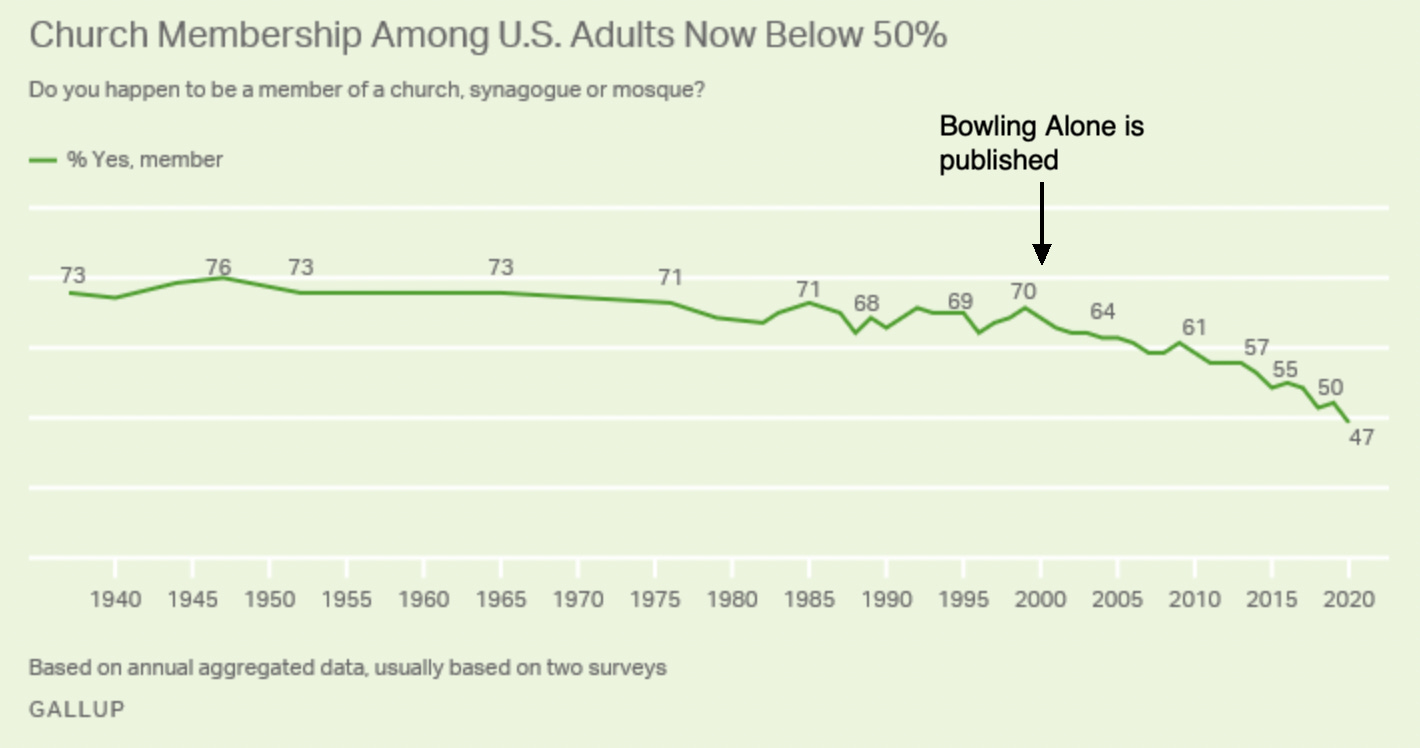

Anton Cebalo documents a decline in sex, friends and trust. Here’s a few points I found of interest. I had come to think about church membership in America as pretty much fixed around 70%. That was true for decades but not recently:

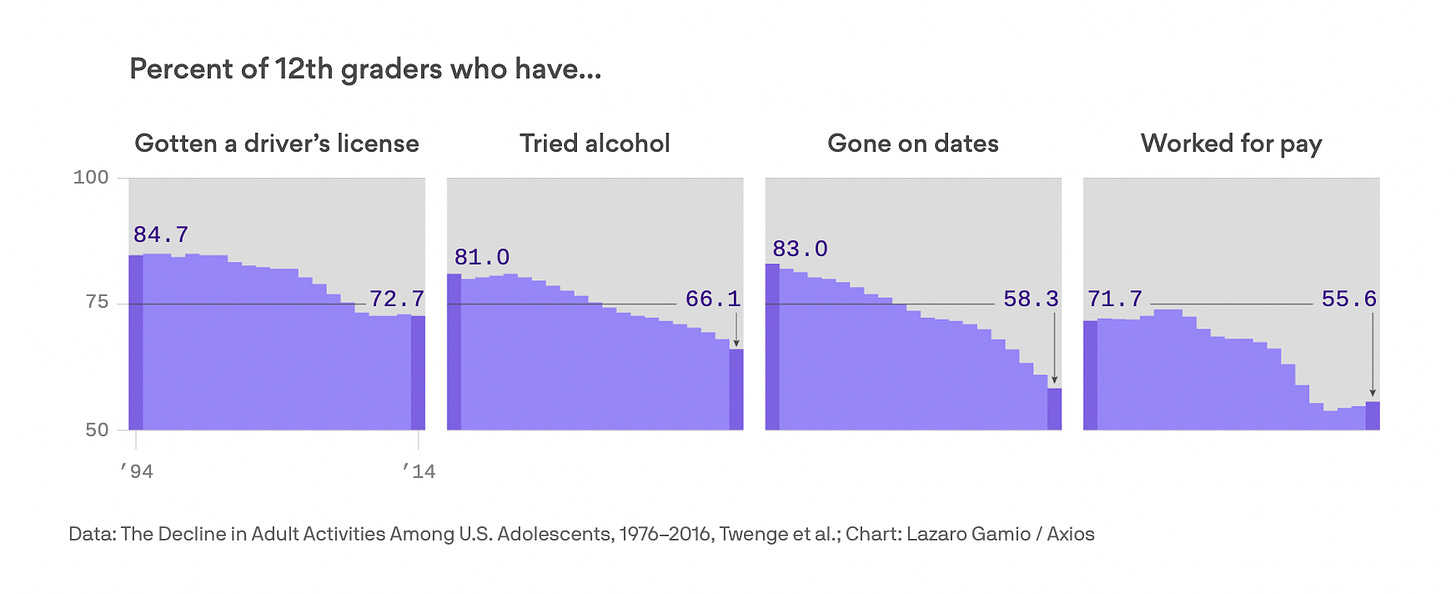

Here’s another trend, the extension of adoloscence. More and more we are treating young adults like children and in many respects they are more like children of earlier years.

There have been many psychological profiles of “late adulthood,” common among those born from the 1990s onward. Many of the milestones — getting a driver’s license, moving out, dating, starting work, and so on — have been delayed for many young adults.

The trend became obvious starting in the 2010s. In 2019, it was compiled in a comprehensive study titled The Decline in Adult Activities Among U.S. Adolescents, 1976-2016.

See Cebalo for more.

Privatization Improves Airports

Laurent Belsie summarizes a new NBER paper, All Clear for Takeoff: Evidence from Airports on the Effects of Infrastructure Privatization:

When private equity funds buy airports from governments, the number of airlines and routes served increases, operating income rises, and the customer experience improves.

…As of 2020, nearly 20 percent of the world’s airports had been privatized. Private equity (PE), usually through dedicated infrastructure funds, is playing an increasing role in privatization, purchasing 102 airports out of a total of 437 that have ever been privatized.

…A key metric of airport efficiency is passengers per flight. The more customers an airport can serve with existing runways and gates, the more services it can deliver and the more earnings it can generate. When PE funds buy government-owned airports, the number of passengers per flight rises an average 20 percent. There’s no such increase when non-PE private firms acquire an airport. Overall passenger traffic rises under both types of private ownership, but the rise at PE-owned airports, 84 percent, is four times greater than that at non-PE-owned private airports. Freight volumes and the number of flights, other measures of efficiency, show a similar pattern. Evidence from satellite image data indicates that PE owners increase terminal size and the number of gates. This capacity expansion helps enable the volume increases and points to the airport having been financially constrained under previous ownership.

…PE firms tend to attract new low-cost carriers to their airports, which in turn may lead to greater competition and offer consumers better service and lower prices. With regard to routes, PE acquirers increase the number of new routes, especially international routes, more than other buyers. International passengers are often the most profitable airport users, especially in developing countries.

A PE acquisition is also associated with a decline in flight cancellations and an increase in the likelihood of receiving a quality award. When an airport shifts from non-PE private to PE ownership, its odds of winning an award rise by 6 percentage points. The average chance of winning such an award is just 2 percent.

The fees that airports charge to airlines rise after airport privatizations. When the buyer is a PE firm, there is also a push to deregulate government limits on those fees. For example, after three Australian airports were privatized in the mid-1990s, the price caps governing airport revenues were replaced with a system of price monitoring that allows the government to step in if fees or revenues become excessive.

The net effect of a PE acquisition is a rough doubling of an airport’s operating income, due mostly to higher revenues from airlines and retailers in the terminal rather than cost-cutting. The driving forces behind these improvements appear to be new management strategies, which likely includes greater compensation for managers, alongside investments in new capacity as well as better passenger services and technology.

Beware the dangers of crypto regulation

That is the topic of my latest Bloomberg column, here is one bit:

No matter how strong the temptation, we should not overregulate.

Begin with two central facts. First, there are numerous ways for small and large investors to lose their money, including by investing in risky equities. Regulating crypto won’t end that danger. Second, despite being one of the largest financial frauds in history, FTX has not created systemic financial risk, which should be the main concern of regulators. And market forces already have made the risk from crypto much smaller: At the peak of crypto values in late 2021, crypto assets had a total value of about $2 trillion; as of this writing, that figure is about $845 billion.

And:

Crypto regulation is not easy to do well. If crypto institutions are treated like regular depository institutions, requiring heavy layers of capital and lots of legal staffing, crypto innovation is likely to dwindle. Such innovation has been more the province of eccentric geniuses than of mainstream regulated institutions. It is hard to imagine Satoshi Nakamoto or Vitalik Buterin at Goldman Sachs.

And what exactly should be the goal of crypto regulation? To make stablecoins truly stable in nominal value? Is that even possible? Or to encourage market participants to see those assets as inherently fluctuating in value?

Neither academic research nor market experience offers clear answers. With systemic risk currently low, perhaps it is better to wait and learn more before moving ahead with regulation. And on a purely practical level, very few members of Congress (or their staff members) have a good working knowledge of crypto and all of its current wrinkles and innovations.

There is much more of value at the link.

Why do so many prices end with 99 cents?

Firms arguably price at 99-ending prices because of left-digit bias—the tendency of consumers to perceive a $4.99 as much lower than a $5.00. Analysis of retail scanner data on 3500 products sold by 25 US chains provides robust support for this explanation. I structurally estimate the magnitude of left-digit bias and find that consumers respond to a 1-cent increase from a 99-ending price as if it were more than a 20-cent increase. Next, I solve a portable model of optimal pricing given left-digit biased demand. I use this model and other pricing procedures to estimate the level of left-digit bias retailers perceive when making their pricing decisions. While all retailers respond to left-digit bias by using 99-ending prices, their behavior is consistently at odds with the demand they face. Firms price as if the bias were much smaller than it is, and their pricing is more consistent with heuristics and rule-of-thumb than with optimization given the structure of demand. I calculate that retailers forgo 1 to 4 percent of potential gross profits due to this coarse response to left-digit bias.

That is from a forthcoming paper by Avner Strulov-Shlain. Via the excellent Kevin Lewis.

Wealth across the generations

“The main takeaways:

- Millennials are roughly equal in wealth per capita to Baby Boomers and Gen X at the same age.

- Gen X is currently much wealthier than Boomers were at the same age: about $100,000 per capita or 18% greater

- Wealth has declined significantly in 2022, but the hasn’t affected Millennials very much since they have very little wealth in the stock market (real estate is by far their largest wealth category)”

That is from Jeremy Horpendahl (no double indent performed by me), via Rich Dewey.

Alas, Bennett McCallum has passed away

He was a great monetary and macro economist, and among his many achievements he was a pioneer of ngdp targeting ideas…RIP…