Category: Medicine

Are dementia rates falling?

A study published in 2020, which drew together multiple pieces of research to track the health of almost 50,000 over-65s, showed the incidence rate of new cases of dementia in Europe and North America had dropped 13 per cent per decade over the past 25 years — a decline that was consistent across all the studies.

For Albert Hofman, who chairs the department of epidemiology at the Harvard TH Chan School of Public Health, the research points to one conclusion: “The absolute risk [of developing dementia] is lower now” than it was 30 years ago. Now, there are early signs that the same phenomenon may be emerging in Japan, a striking development in one of the world’s most aged populations, suggesting that the downward trend is becoming more widespread…

While emphasising that the reasons for the reduction in incidence are not yet fully understood, Hofman believes better cardiovascular health is likely to be a significant factor given the proven links between the two.

Here is more from Sarah Neville at the FT. Maybe that is where the Flynn effect has been hiding!

Covid vaccines and mortality

The global COVID-19 vaccination campaign is the largest public health campaign in history, with over 2 billion people fully vaccinated within the first 8 months. Nevertheless, the impact of this campaign on all-cause mortality is not well understood. Leveraging the staggered rollout of vaccines, we find that the vaccination campaign across 141 countries averted 2.4 million excess deaths, valued at $6.5 trillion. We also find that an equitable counterfactual distribution of vaccines, with vaccination in each country proportional to its population, would have saved roughly 670,000 more lives. However, this distribution approach would have reduced the total value of averted deaths by $1.8 trillion due to redistribution of vaccines from high-income to low-income countries.

That is from a new NBER working paper by Virat Agrawal, Neeraj Sood, and Christopher M. Whaley.

The culture (polity?) that is Dutch

Several people with autism and intellectual disabilities have been legally euthanized in the Netherlands in recent years because they said they could not lead normal lives, researchers have found.

The cases included five people younger than 30 who cited autism as either the only reason or a major contributing factor for euthanasia, setting an uneasy precedent that some experts say stretches the limits of what the law originally intended.

In 2002, the Netherlands became the first country to allow doctors to kill patients at their request if they met strict requirements, including having an incurable illness causing “unbearable” physical or mental suffering.

Between 2012 and 2021, nearly 60,000 people were killed at their own request, according to the Dutch government’s euthanasia review committee. To show how the rules are being applied and interpreted, the committee has released documents related to more than 900 of those people, most of whom were older and had conditions including cancer, Parkinson’s and ALS.

Here is the full story.

A Genius Award for Airborne Transmission

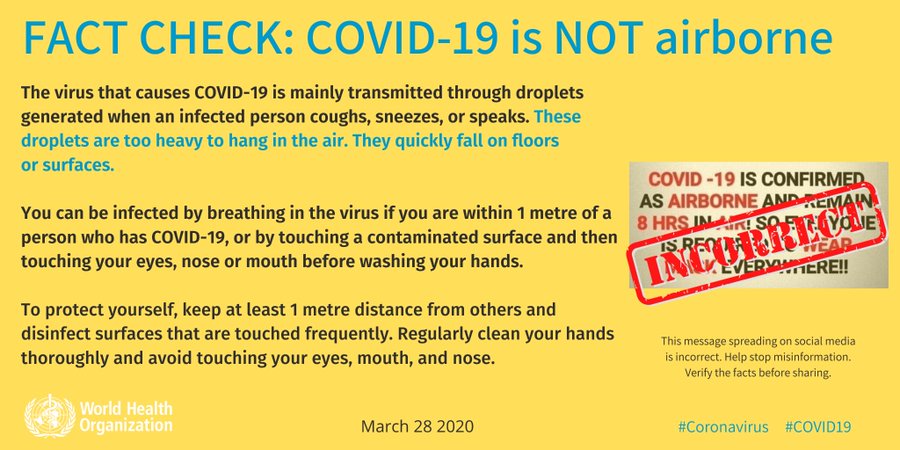

One of the strangest aspects of the pandemic was the early insistence by the WHO and the CDC that COVID was not airborne. “FACT: #COVID19 is NOT airborne.” the WHO tweeted on March 28, 2020, accompanied by a large graphic (at right). Even at that time, there was plenty of evidence that COVID was airborne. So why was the WHO so insistent that it wasn’t?

One of the strangest aspects of the pandemic was the early insistence by the WHO and the CDC that COVID was not airborne. “FACT: #COVID19 is NOT airborne.” the WHO tweeted on March 28, 2020, accompanied by a large graphic (at right). Even at that time, there was plenty of evidence that COVID was airborne. So why was the WHO so insistent that it wasn’t?

Ironically, some of the resistance to airborne transmission can be traced back to a significant achievement in epidemiology. Namely, John Snow’s groundbreaking arguments that cholera was spread through water and food, not bad air (miasma). Snow’s theory took time to be accepted but when the story of germ theory’s eventual triumph came to be told, the bad air proponents were painted as outdated and ignorant. This sentiment was so pervasive among physicians and health officials that anyone suggesting airborne transmission of disease was vaguely suspect and tainted. Hence, the WHOs and CDCs readiness to label airborne transmission as dangerous, unscientific “misinformation” promulgated on social media (see the graphic). In reality, of course, the two theories were not at odds as one could easily accept that some germs were airborne. Indeed, there were experts in the physics of aerosols who said just that but these experts were siloed in departments of physics and engineering and not in medicine, epidemiology and public health.

As a result of this siloing, we lost time and lives by telling people that they were fine if they kept to the 6ft “rule” and washed their hands, when what we should have been telling them was open the windows, clean the air with UVC, and get outside. Windows not windex.

Linsey Marr at Virginia Tech was one of the aerosol experts who took a prominent role in publicly opposing the WHO guidance and making the case for aerosol transmission (Jose-Luis Jimenez was another important example). Thus, it’s nice to see that Marr is among this year’s MacArthur “genius” award winners. A good interview with Marr is here.

It didn’t take a genius to understand airborne transmission but it took courage to put one’s reputation on the line and go against what seemed like the scientific consensus. Marr’s award is thus an award to a scientist for speaking publicly in a time of crisis. I hope it encourages others, both to speak up when necessary but also to listen.

Addendum: I didn’t take part in the aerosol debates but my wife, who has done research in aerosols and germs, told me early on that “of course COVID is airborne!” Wisely, I chose to take the word of my wife over that of the WHO and CDC.

“Does Paid Sick Leave Facilitate Reproductive Choice?”

I might give the paper a slightly different title, but:

Unlike most advanced countries, the U.S. does not have a federal paid sick leave (PSL) policy; however, multiple states have adopted PSL mandates. PSL can facilitate healthcare use among women of child−bearing ages, including use of family planning services such as contraception, in−vitro fertilization, or abortion services. Use of these services, in turn, can increase or decrease birth rates. We combine administrative and survey data with difference-in-differences methods to shed light on these possibilities. Our findings indicate that state PSL mandates reduce birth rates, potentially through increased use of contraception but not changes in abortion services. We offer suggestive evidence of heterogeneity in birth rate effects by age, education, and race. Our findings imply that PSL policies may help women balance family and work responsibilities, and facilitate their reproductive choices.

That is a new NBER working paper by Johanna Catherine, Maclean, Ioana Popovici, and Christopher J. Ruhm.

They are solving for the equilibrium

The Affordable Care Act of 2010 limited the profits of health insurers to between 15% and 20% of collected premiums, depending on the size of the health plan. But it imposed no restrictions on what physicians or other intermediaries can earn. The law created an incentive for insurers to buy clinics, pharmacies and the like, and to steer customers to them rather than rival providers. The strategy channels revenue from the profit-capped insurance business to uncapped subsidiaries, which in theory could let insurers keep more of the premiums paid by patients.

According to Irving Levin Associates, a research firm, between 2013 and August 2023 the nine health-care giants spent around $325bn on over 130 mergers and acquisitions.

Here is more from The Economist.

The Effect of Organizations on Physician Prescribing Opioids

Here is one of the more important IO papers in recent times:

In theory, there are several reasons why physician organizational form might affect the price, quantity, and quality of physician services. In this paper, we examine the effect of three aspects of physician organizational form on opioid prescribing: the number of physicians in the physician’s group (if any); the physician’s integration with or employment by a hospital or hospital system; and the average age of the other physicians in the physician’s group. We present three key findings. First, all else held constant, group physicians prescribe far fewer opioids, and prescribe them more appropriately, than do solo physicians. Second, although physicians who are employed by a hospital or practice in a hospital-owned group prescribe fewer opioids than do independent physicians, there is evidence that this difference may be due to differences in the other characteristics of physicians who are hospital-integrated rather than a causal effect. Third, we find substantial peer effects on opioid prescribing. Physicians in groups with a higher average age (excluding the physician him- or herself) prescribe more intensively and are more likely to write inappropriate opioid prescriptions than physicians in younger groups – holding constant the physician’s own age and other characteristics of his or her group.

That is from a new NBER working paper by M. Kate Bundorf, Daniel Kessler, and Sahil Lalwani.

What is an Emergency? The Case for Rapid Malaria Vaccination

Compare two otherwise similar towns. In Town A there have always been 1000 deaths every month from disease X. In contrast, Town B has been free of disease X for as long as anyone can remember until very recently when disease X suddenly started to kill 1000 people per month. A vaccine for disease X is developed. Which town should receive expedited vaccinations?

From a utilitarian perspective, both towns present equally compelling cases for immediate vaccination (1). Vaccination will avert 1,000 deaths per month in either location. The ethical imperative is thus to act swiftly in both instances. Lives are lives. However, given human psychology and societal norms, Town B is more likely to be perceived as facing an “emergency,” whereas Town A’s situation may be erroneously dismissed as less dire because deaths are the status quo.

A case in point. The WHO just approved a malaria vaccine for use in children, the R21/Matrix-M vaccine. Great! There are still some 247 million malaria cases globally every year causing 619,000 deaths including 476 thousand deaths of children under the age of 5. That’s not 1000 deaths a month but more than 1000 deaths of children every day. The WHO, however, is planning on rolling out the vaccine next year.

Adrian Hill, one of the key scientists behind the vaccine is dismayed by the lack of urgency:

“Why would you allow children to die instead of distributing the vaccine? There’s no sensible answer to that — of course you wouldn’t,” Hill told the Financial Times. The SII said it “already” had capacity to produce 100mn doses annually.

…“There’s plenty of vaccine, let’s get it out there this year. We’ve done our best to answer huge amounts of questions, none of which a mother with a child at risk of malaria would be interested in.”

Hill is correct: the case for urgency is strong. More than a thousand children are dying daily and the Serum Institute already has 20 million doses on ice and is capable of producing 100 million doses a year. Why not treat this as an emergency?! Implicitly, however, people think that the case for urgency in Africa is weak because “what will another few months matter?” The benefits of vaccination in Africa are treated as small because they are measured relative to the total deaths that have already occurred. In contrast, vaccination for say COVID in the developed world (Town B) ended the emergency and restored normality thus saving a large percent of the deaths that might have occurred. But the percentages are irrelevant. This is a base rate fallacy, albeit the opposite of the one usually considered. Lives are lives, irrespective of the historical context.

Hill, director of the university’s Jenner Institute, compared the timeframe with the swift rollout of the first Covid vaccines, which were distributed “within weeks” of approval.

“We’d like to see the same importance given to the malaria vaccine for children in Africa. We don’t want them sitting in a fridge in India,” he said. “We don’t think this would be fair to rural African countries if they were not provided with the same rapidity of review and supply.”

The term “emergency” inherently embodies the conundrum I highlight. Emergency is defined as an unexpected set of events or the resulting state that calls for immediate action. When formulating a response to an emergency, however, the focus should not be on whether the events were unexpected but on the resulting state. The resulting state is what is important. The resulting state is the end that legitimizes the means. The unexpected draws our attention–our emotional systems, like our visual systems, alert on change and movement–but what matters is not what draws our attention but the situational reality.

Lives are lives and we should act with all justifiable speed to save lives. The WHO should accelerate malaria vaccination for children in Africa.

(1) You might argue that in Town B the 1000 deaths are more unusual and thus more disruptive but you might also argue that Town A has undergone the deaths for so much longer that the case for speed as matter of justice is even greater. These are quibbles.

Cost-benefit analysis of marijuana legalization

We analyze the effects of legalizing recreational marijuana on state economic and social outcomes (2000–20) using difference-in-differences estimation robust to staggered timing and heterogeneity of treatment. We find moderate economic gains and accompanied by some social costs. Post-legalization, average state income grew by 3 percent, house prices by 6 percent, and population by 2 percent. However, substance use disorders, chronic homelessness, and arrests increased by 17, 35, and 13 percent, respectively. Although some of our estimates are noisy, our findings suggest that the economic benefits of legalization are broadly distributed, while the social costs may be more concentrated among individuals who use marijuana heavily. States that legalized early experienced similar social costs but larger economic gains, implying a potential first-mover advantage.

That is from a new paper by Jason Brown, Elior Cohen, and R. Alison Felix, via the excellent Kevin Lewis.

The “Deaths of Despair” narrative is somewhat wrong

Matt Yglesias does an excellent job laying out the case against the “deaths of despair” narrative and putting it bluntly.

Over the past few years, Anne Case and Angus Deaton have unleashed upon the world a powerful meme that seems to link together America’s troublingly bad life expectancy outcomes with a number of salient social and political trends like the unexpected rise of Donald Trump.

Their “deaths of despair” narrative linking declining life expectancy to populist-right politics and to profound social and economic decay has proven to be extremely powerful. But their analysis suffers from fundamental statistical flaws that critics have been pointing out for years and that Case and Deaton just keep blustering through as if the objections don’t matter. Beyond that, they are operating within the confines of a construct — “despair” — that has little evidentiary basis.

…Novosad, Rafkin, and Asher have provided a compelling analysis of a very concentrated problem of worsening health outcomes for the worst-off Americans. Case and Deaton, by contrast, have delivered a very misleading portrait of worsening health outcomes for the majority of Americans that (because they mistakenly think it’s a majority) they attribute to broad economic forces that exist internationally but which for some reason only cause “despair” in the United States.

…The point is that we face a set of discrete public health challenges that we need to think about both as policy matters and in terms of politics and public opinion. But there is no “despair” construct driving any of this, and the linkage to big picture political trends is simply that Republicans are more hostile to regulation. Case and Deaton, meanwhile, have sent us on the equivalent of a years-long wild goose chase away from well-known ideas like “smoking is unhealthy” or “it would be good to find a way to get fewer people to use heroin.”

I tend to agree with Matt but I would offer a few cautions. Case and Deaton have been too broad in identifying the at-risk population. Identifying more carefully the at-risk group(s) is important so that we can target different problems with different solutions. Indeed, part of what makes the very important opioid crisis so bedeviling is precisely that it is not limited to “despairing” populations but cuts across many groups.

I wouldn’t, however, throw out despair as an organizing principle. The evidence on “despair” goes beyond death to include a host of co-morbidities such as mental stress, marriage rates, labor force participation rates and other measures of well being. Regardless of the precise population to which these problems attach they are co-morbidities and I suspect not by accident. Education is a proxy for the underlying problem but likely not causal. Matt’s cheeky suggestion to promote ideas like “smoking is unhealthy” illustrates part of the issue. Education and information will not solve that problem. Smokers know that smoking is unhealthy but they do it anyway–perhaps because it’s one of the few easily available pleasures if you are unmarried, out of work and stressed.

Nevertheless, do read the whole thing.

On U.S. life expectancy disparities

From the excellent Dylan Matthews:

Case and Deaton are highlighting a real problem, confirmed by other researchers: Americans with different levels of education die at different rates, and the least-educated Americans have seen their death rates surge in a way that more-educated Americans have not.

But the relevant divide does not seem to be between people who earned a bachelor’s degree — who remain a minority among American adults — and people who didn’t. Other research suggests that the problem is concentrated in specific areas of the US, and between the very least-educated Americans (particularly high school dropouts) and the rest of the country, rather than between college grads and non-grads.

Moreover, the cause of the divergence between high school dropouts and the rest of the country does not seem to be caused by “deaths of despair.” There is no doubt that the opioid epidemic in particular has wrought spectacular damage in the US. But some researchers are finding that stagnating progress against cardiovascular disease is an even bigger contributor to US life expectancy stalling out, and to mortality divides between the most- and least-educated Americans.

A lot of what you read about “deaths of despair” is in fact wrong or misguided.

Speeding Up Pharmaceutical Approvals by Recognizing Other Stringent Regulators

New Zealand’s ACT party has proposed that New Zealand speed up pharmaceutical approvals by recognizing the decisions of other stringent regulators, an idea I have long promoted .

The average time for Medsafe to consent an application for a high risk medicine is 630 days. For intermediate risk, it is 661 days and for lower risk it is 830 days8. The average time taken just for processing some lower risk categories is 176-210 days. This is an unacceptable length of time, given there other regulatory bodies replicating that exact same work overseas.

ACT says if a drug or medical device has been approved by any two reputable foreign regulatory bodies (such as Australia, United States, United Kingdom), it should be automatically approved in NZ as well within one week unless Medsafe can show extraordinary reason why it shouldn’t be.

This simple change would significantly improve access to medicines that have already been subject to rigorous testing and analysis through other regulatory regimes.

The ACT party is small but it has some seats and surprisingly the much larger National party is proposing a similar rule:

New Zealand’s slow approval process for medicines means Kiwis wait much longer than people in other countries to access potentially life-saving treatments. While it is essential that medicines and other treatments are subject to stringent scrutiny to ensure they are safe, there is no reason why New Zealanders should have to wait for our domestic medicines regulatory body, Medsafe, to conduct its own cumbersome process from scratch, when countries with health systems we trust have already gone through this exercise.

National will:…• Require Medsafe to implement even faster approvals processes for any medicines for use in New Zealand that have already been approved by at least two regulatory bodies that we currently recognise, including Australia, the EU, Singapore, the UK, Switzerland and the US.

New Zealand, by the way, already has a reciprocity agreement with the United States for food and it’s mutual–the FDA also recognizes New Zealand as a stringent food regulator–so the idea is not unprecedented.

Moreover, all of this comes on the tail of the UK actually adopting the idea via the “reliance procedure” which recognizes the EU as a stringent regulator and guarantees approval in the UK within 67 days for ay drug approved in the EU.

In the United States, even AOC has flirted with the idea, at least for sunscreens!

Thus, the reciprocity or recognition idea is starting to be adopted.

Hat tip: Eric Crampton who has some further comments.

PEPFAR has been a great achievement

PEPFAR is the President’s Emergency Plan for AIDS Relief, started by George W. Bush in 2003. Overseen by the State Department, the program provides treatment for HIV-AIDS and derivative maladies (such as tuberculosis) through training, medical infrastructure, support for orphans and vulnerable children, and, most important, antiretroviral drugs.

By some estimates, the program has saved 25 million lives over the last two decades, spending about $90 billion for treatments that many Africans otherwise could not have afforded or gotten access to. Not only has PEPFAR saved African lives (in a very cost-effective way, I might add), it’s also improved the quality of life for many Africans and helped the economies of many African nations. The burnishing of America’s reputation is a bonus.

And this:

What does it mean that two of the most successful policies of the last 20 years have originated with Republican administrations? Or that two of the people most associated with these initiatives — Condoleezza Rice (PEPFAR) and Jared Kushner (OWS) — have never received proper recognition for their efforts? They should, in spite of whatever other objections one might have to their other decisions.

Here is the rest of my Bloomberg column.

The need for hospital price transparency

Greater price transparency doesn’t have to cost much money upfront, as most of what is required is attention. A critical majority of Americans — including doctors, patients, politicians, media and hospital board members — needs to insist on this outcome.

And I do mean insist. Just as, at some point, a critical mass of Americans demanded that the US end the Vietnam War. Otherwise, change is very unlikely to happen.

Some parts of the Affordable Care Act provided for transparent hospital pricing of individual services, and further regulations took effect in 2021. These were steps forward, yet the law has not turned the tide. It does not price packages of services, and it does not make it easy to compare one provider to another.

Recent research shows it is hard to even get a single consistent answer from a single provider. For instance, prices posted online and prices quoted over the telephone do not correlate very closely. For 41% of hospitals, the price difference was 50% or more. Clearly, suppliers aren’t really trying.

And:

What if there were regular news coverage of the comparative transparency and standardization of hospital prices? Or more explicit and accessible quality ratings? Or a prominent non-profit, run by medical professionals, devoted solely to making price and quality more transparent? Employers also could evaluate health insurance companies based on their performance by these criteria, much as they currently use ESG analysis. There could be an index of progress, like those national debt clocks one sometimes sees.

Is it absurd to hope that this topic might regularly trend on social media? What if there were public marches in front of hospitals (they can chant, “How much cash for a heart bypass”)? Who will be the Greta Thunberg of price transparency?

That is all from my latest Bloomberg column.

What should I ask Patrick McKenzie?

I will be doing a Conversation with him. Patrick is a phenomenon of the modern age. He writes the excellent Bits About Money, which focuses on money, banking, payments, and more.

His blog is Kalzumeus. He has lived most of his adult life in Japan, and has many excellent posts about Japan. Here are his greatest hits on the blog. He has run national shadow vaccine location information infrastructure. On Twitter he is @patio11.

So what should I ask him?