A dialog

T.: I love you.

N.: Which number is that?

Is libertarianism the new “in” thing?

Here is the story. Nick Gillespie says:

"We’re the Sith Lords of American politics," he says, referring to

the "Star Wars" baddies. "We can show up in any group. We’re both

terrifying and devilishly attractive."

Since I’m not either of those things, and I’ve made other claims about the Sith Lords, I said something different:

Libertarian economist Tyler Cowen of George Mason University says

the new breed of Swiftian commentary found on shows such as "The Daily

Show" and "The Colbert Report," though not explicitly libertarian, also

has contributed to the current libertarian moment. "The way to be funny is to make fun of something," Mr. Cowen notes.

There is more by me at the very end of the article (yes, you too can look into my heart). In part libertarianism has become cool because Republicanism has become so uncool, thereby leaving a cultural gap which Hillary Clinton alone cannot fill.

What is wrong with Amtrak?

Megan McArdle tells us:

…why is America’s high-speed rail so dreadful? The Acela delivers

you, at enormous added expense, to Boston one hour ahead of the

regional. On the DC-to-NY run, the added benefit is 10-15 minutes. The

answer is that the Acela uses existing track, which is twisty, the

better to serve every congressional district between here and Boston.

Real high speed rail needs to be fairly straight, for the same reason

you don’t take hairpin turns at 120 mph in your car.

I had never heard the Congressional district argument before. I’ve also heard that freight railways crowd the lines and Amtrak doesn’t pay a high enough prices for access; the freight services had, way back when, pledged to the government to give Amtrak trains priority but of course that kind of cheap talk is not enough to get the job done; here is some relevant background, and more here. Here is a good summary of Amtrak critiques. It comes from a whole blog devoted to criticizing Amtrak.

Bryan Caplan peers into my heart

And I believe he doesn’t like what he sees:

Who wouldn’t want to see Tyler Cowen publicly debate Robin Hanson?

Well, aside from the masses? I think they’d both be willing, if they

could only pinpoint a good topic. A while back they had an extended

blog dialogue (see here, here, and here); can you extract a resolution from it?Personally, the bottom line of Tyler’s latest post

reminds me of a debate topic that someone suggested after a recent

seminar: "Few major changes in the policies of modern democracies are

desirable." Depending on when you ask him, Tyler might deny that he

believes this, but in his heart, he does. And no matter when you ask

Robin, he’ll be ready to argue the contrary.Other topic suggestions? If Tyler and Robin wind up using your novel suggestion, lunch is on me.

Here is the link.

Markets in Everything: Think Tanks

Why buy votes when you can buy the Bay Area Center for Voting Research? The BACVR analyzes voting trends in California and nationwide; they are best known for their ranking of the most liberal and most conservative cities (pdf) in the nation. The founders, however, want out and are selling all of BACVR’s intellectual assets, including the organization’s web site, past research, and well-known name on eBay. The perfect Christmas gift for that political junkie on your list.

Of course some people believe that all think tanks are for sale.

Eight reasons to be optimistic about today’s economy

From Charles Calomiris, via Mark Thoma. Here is my edited version of the list, without the (very good) explanations:

1. Housing prices may not be falling by as much as some economists say they are.

2. Although the inventory of homes for sale has risen, housing construction

activity has fallen substantially [which will support future prices].

3. The shock to the availability of credit has been concentrated primarily in

securitisations rather than in credit markets defined more broadly.

4. Aggregate financial market indicators improved substantially in September and

subsequently.

5. …nonfinancial firms are highly liquid and not overleveraged.

6. …households’ wealth is at an all-time high and continues to grow.

7. Of central importance is the healthy condition of banks.

8. Banks hold much more diversified portfolios today than they used to.

I find 3-8 more convincing than 1-2, noting of course that #7 is a relative judgment. Here is a longer version of the Calomiris paper.

Should we let people sell votes?

Mankiw says no, Caplan says the real problem is voting itself. Of course we let private shareholders sell their votes all the time, and uncontroversially, so the real issue is how politics is different.

Say society has a 9999 people. The marginal private value of a (political) vote is almost zero, except for its feel-good benefit (see also Gelman on altruistic motives to motivate voting). Yet the total value of 5000 votes — a winning tally — is the size of the largest wealth transfer that the winner could impose on everyone else. The result will mimic a model of self-interested voting but with only one self-interested voter — the owner of the purchased votes — having a say. And that winner will be the conscience-less (non-liquidity-constrained) person who has the most to gain from buying up votes and getting things his way.

Of course Bryan, in other contexts, has shown that expressive voting is more likely than the self-interested voting model, at least under standard democracy. I would rather have expressive voting than what is explained directly above, even though expressive voting is somewhat irrational.

Maybe voters will end up with sudden attacks of conscientiousness and be unwilling to sell their votes; to that extent vote-selling won’t much matter and of course then it can’t bring gains either.

Now let’s go back to the corporate case. When it comes to policy, shareholders might not agree on means but everyone favors the same end of profit maximization. A winning coalition of shareholders can’t do much to extract rents from other shareholders, unless of course they are exploiting those other shareholders in their other roles as consumers or input suppliers. But such effects are usually small (as opposed to the widespread possibilities for redistribution through politics) and thus vote selling works just fine for corporations. There is no simple way that shareholder A can buy up the votes of shareholders B and C and then just screw them over.

Coda: There is a potential problem with vote-selling in corporations, again relating back to the difference between marginal and average value for a vote. Shareholders might be afraid to sell to a takeover artist, instead wishing to hold on for the ride and reap gains from the change in corporate control. But if no one sells the takeover cannot take place and no one reaps the gains. In other words, there is too little vote selling; that’s Grossman and Hart, 1980. Alex once wrote an excellent paper on this problem (but where is the link Alex?) and showed that the free-rider problem among shareholders can usually be solved by random Nash strategies; note that the final outcome will depend on whether there is a countable or uncountable infinity of shareholders; please don’t laugh!

The bottom line: There are good economic arguments for why we allow corporate vote-selling but not political vote-selling.

Western Union

Migration is so central to Western Union that forecasts of border

movements drive the company’s stock. Its researchers outpace the Census Bureau

in tracking migrant locations. Long synonymous with Morse code, the

company now advertises in Tagalog and Twi and runs promotions for

holidays as obscure as Phagwa and Fiji Day. Its executives hail

migrants as “heroes” and once tried to oust a congressman because of

his push for tougher immigration laws…With five times as many locations worldwide as McDonald’s, Starbucks, Burger King and Wal-Mart

combined, Western Union is the lone behemoth among hundreds of money

transfer companies… Last year migrants from poor countries sent home $300 billion, nearly three times the world’s foreign aid budgets combined.

Here is the full story, which is consistently interesting throughout.

Thanks on Thanksgiving

Alex and I each have many things to be thankful for today. When it comes to blogging, we are thankful that we have an audience of readers — namely you all — that earlier economists could only have dreamt of, in terms of quantity, quality, and global distribution. We are also grateful for what is frequently the best comments section in the blogosphere.

Thank you all for reading and putting time into this venture; if I add you all up, you, collectively, put in much more time than we do! It is an honor to write for you all.

Happy Thanksgiving

Our corn did prove well, and God be praised, we had a good increase of Indian corn, and our barley indifferent good, but our peas not worth the gathering, for we feared they were too late sown. They came up very well, and blossomed, but the sun parched them in the blossom. Our harvest being gotten in, our governor sent four men on fowling, that so we might after a special manner rejoice together after we had gathered the fruit of our labors. They four in one day killed as much fowl as, with a little help beside, served the company almost a week. At which time, amongst other recreations, we exercised our arms, many of the Indians coming amongst us, and among the rest their greatest king Massasoit, with some ninety men, whom for three days we entertained and feasted, and they went out and killed five deer, which they brought to the plantation and bestowed on our governor, and upon the captain and others. And although it be not always so plentiful as it was at this time with us, yet by the goodness of God, we are so far from want that we often wish you partakers of our plenty.

Edward Winslow, Plymouth in New England this 11th of December, 1621.

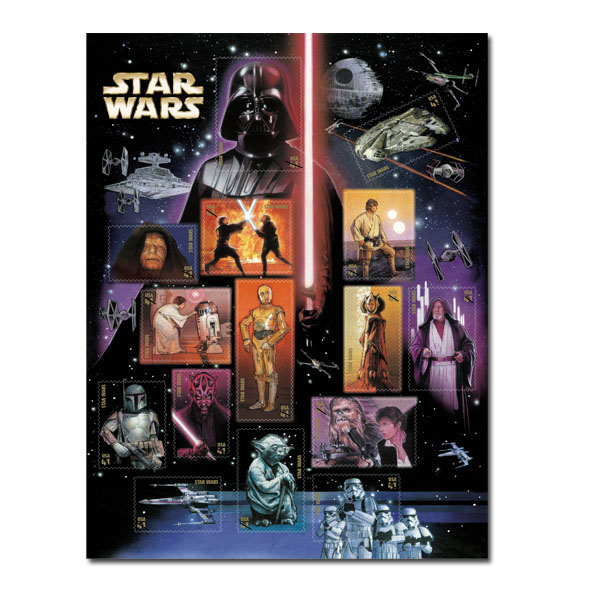

My Thanksgiving present from Yana

Available at your local post office, more information here.

Non (Anti?) Sequitur of the Day

Speaking on why it would be a terrible mistake to overturn Washington DC’s 31-year old ban on handguns, Assistant police chief Alfred Durham said today:

The ban on handguns is a matter of life and death because 80% of the murders in DC are caused by handguns.

Choosing linguistic autarchy

An indigenous language in southern Mexico is in danger of disappearing because its last two speakers have stopped talking to one another.

The two elderly men in the village of Ayapan, Tabasco, have drifted apart, said Fernando Nava, head of the Mexican Institute for Indigenous Languages.

Are they really the last two speakers left? The odd part of the story is this:

Dr Nava played down reports of an argument between the two Ayapan residents, both in their 70s. "We know they are not to say enemies, but we know they are apart. We know they are two people with little in common," he told the BBC News website.

They nonetheless have been nominated to play the role of linguistic saviors:

The indigenous languages institute is trying to encourage more local people to speak Ayapan Zoque, and hopes the two men will pass the language on to their families.

Do exchange rate overshooting models make sense?

Not so much. Here is the overshooting model for those of you who don’t know it.

So what is the problem? First, most observed exchange rate movements are unexpected ("news"), rather than forecast in earlier forward rates. The overshooting model, at best, explains expected movements in exchange rates.

Second, the model relies on a Keynesian money demand function. Specifically, inflation, operating through a portfolio effect, lowers nominal rates of interest in the initial stage of the mechanism. Well, sometimes, but don’t count on it. More generally, the currency vs. interest-bearing assets decision doesn’t have many implications for foreign exchange markets, if any.

Arnold Kling offers some further comments, including this bit:

But in the Dornbusch model, countries differ in terms of their

inflation rates. Inflation is described mathematically as a continuous

movement in prices ("Rudi Dornbusch is the master of the logarithmic

derivative," as Rogoff used to put it.) The swindle, which is present

in all modern macro, is to talk about sticky prices and

continuously-moving prices in the same breath.

Exchange rates are not well understood. The current best theory is a mix of random walk (but in exchange rates or returns?), noise traders, and possibly some predictable, very long-run, PPP-reverting swings, enabled by the possibility that perhaps traders’ time horizons are too short to compress all of the expected future into the present. But, unlike what the Dornbusch model predicts, these changes are not well-predicted by nominal interest rate differentials.

Here is a more favorable assessment of the model, from Ken Rogoff.

This Choir Does The Preaching!

let’s privatize, choice is the way

let corporations run our schools

let the free market make the rules

As sung by the Milton Friedman choir!

Hat tip to Mark Perry at Carpe Diem.