Saturday assorted links

*Jena 1800*

Jena had only about five thousand inhabitants at the time, but for a while in the early nineteenth century it was the center of German intellectual life. In one house (Leutragasse 5) you had living, at the same time, Friedrich and August Wilhelm Schlegel, Caroline Schlegel, Dorothea Veit, Friedrich Wilhelm Joseph Schelling, Friedrich von Hardenberg (“Novalis”), and Ludwig Tieck.

How is that for “small group theory“?

Fichte, Goethe, and Hegel show up as well!

The author of the book is Peter Neumann, and the subtitle is The Republic of Free Spirits. It is not captivating (Germanic style, then translated), but I found it valuable nonetheless. Which other contemporary work covers this remarkable assemblage of talent?

A short disquisition on Cowen’s Third Law

“All propositions about real interest rates are wrong,” and this one is in the form of a Bloomberg column. Here is one part:

The law of demand is one of the sacrosanct principles of economics: If the price of apples goes up, the demand for apples will go down. Yet when real interest rates go up, it is not obvious that the demand to invest goes down, even if the numbers are adjusted for possible reasons why real interest rates might have changed in the first place. This raises a profound question: If the law of demand doesn’t apply, how well do we understand investment and real interest rates at all?

The puzzles deepen. There was a longstanding debate in economics about whether the U.S. Federal Reserve, using monetary policy, could affect real rates of interest. After extensive research, the conclusion was reached that the Fed can indeed have a marginal effect by supplying more liquidity to markets. Yet the effect is sufficiently small that there can be a plausible debate about whether, statistically speaking, it exists at all.

These days, however, the real federal funds rate measures as below -4%, based on measures of core inflation. No one doubts that the monetary expansions of the Fed, which have brought much higher inflation, are a major factor behind that shift. In other words, the Fed’s impact on real rates is far more potent now than in times past.

It gets worse yet. Most observers were not anticipating that expected short rates could fall and stay below -4%. Why hold those assets at all? I don’t have a good answer to that question.

Recently the term structure of interest rates has become inverted, by which it is meant that the short-term rates are higher than the long-term rates. Economists have debated for decades whether such a sign might be a good predictor of a recession. (The theory is that low long-term rates mean that future demand to invest will be low, a bearish sign.) Yet the current data are ambiguous. So not only are real interest rates often hard to predict, but they themselves are not typically clear predictive signals on their own.

There are further conundrums at the link.

U.S.A. fact of the day

In 1980, some 35% of cars produced in the U.S. were manuals. Today that figure is closer to 1%, and only 3.7% of Carmax sales are for stick shifts—shockingly low considering that 80% of cars sold in Europe have manual transmissions. Some car makers, including Audi, no longer offer manual transmissions in the U.S. market at all…

Only around 18% of American drivers can handle a manual transmission, according to U.S. News and World Report.

What happened? Here is more from the WSJ.

Friday assorted links

1. Charo revisionism (NYT), Department of Why Not?

2. Interview with Dubov (chess, Russia, Karjakin, etc.).

3. Scott Sumner on #TheGreatForgetting.

4. Should you send a Scot to prison for a rude tweet?

5. Giorgio Agemben thread from Zohar Atkins.

Tax Russian Oil

A tax on Russian oil would be paid mostly by Russia and would not greatly raise the price of oil. I often assign a question like this to my Econ 101 students. Ricardo Hausmann runs through the argument:

At first sight, imposing a tax on a good must increase its price, making energy even more expensive for Western consumers. Right? Wrong! At issue is something called tax incidence analysis, which is taught in basic microeconomics courses. A tax on a good, such as Russian oil, will affect both supply and demand, changing the good’s price. How much the price changes, and who bears the cost of the tax, depends on how sensitive both supply and demand are to the tax, or what economists call elasticity. The more elastic the demand, the more the producer bears the cost of the tax because consumers have more options. The more inelastic the supply, the more the producer – again – bears the tax, because it has fewer options.

Fortunately, this is precisely the situation the West now confronts. Demand for Russian oil is highly elastic, because consumers do not really care if the oil they use comes from Russia, the Gulf, or somewhere else. They are unwilling to pay more for Russian oil if other oil with similar properties is available. Hence, the price of Russian oil after tax is pinned down by the market price of all other oil.

At the same time, the supply of Russian oil is very inelastic, meaning that large changes in the price to the producer do not induce changes in supply. Here, the numbers are staggering. According to the Russian energy group Rosneft’s financial statements for 2021, the firm’s upstream operating costs are $2.70 per barrel. Likewise, Rystad Energy, a business-intelligence company, estimates the total variable cost of production of Russian oil (excluding taxes and capital costs) at $5.67 per barrel. Put differently, even if the oil price fell to $6 per barrel (it’s above $100 now), it would still be in Rosneft’s interest to keep pumping: Supply is truly inelastic in the short run.

…In other words, given very high demand elasticity and very low short-term supply elasticity, a tax on Russian oil would be paid essentially by Russia. Instead of being costly for the world, imposing such a tax would actually be profitable.

Addendum: Many people in the comments aren’t getting this so let me note that there is a big difference between taxing oil and taxing Russian oil, it’s only for the latter good that demand is relatively elastic.

Formative experiences matter over long periods of time

Formative experiences shape behavior for decades. We document a striking feature about those who came of driving age during the oil crises of the 1970s—they drive less in the year 2000. The effect is not specific to these cohorts; price variation over time and across states indicates that gasoline price changes between ages 15–18 generally shift later-life travel behavior. Effects are not explained by recessions, income, or costly skill acquisition and are inconsistent with recency bias, mental plasticity, and standard habit-formation models. Instead, they likely reflect formation of preferences for driving or persistent changes in its perceived cost.

That is from a newly published paper (AEA gate) by Christopher Severen and Arthur A. van Benthem.

What I’ve been reading

1. Alan Bollard, Economists at War: How a Handful of Economists Helped Win and Lose the World Wars. A useful book on a much underrated topic. Keynes, Kantorovich, and Leontief receive the most attention, though the book also covers of Takahashi Korekiyo of Japan. My main complaint is the absence of Thomas Schelling.

2. Elizabeth Wilson, Playing with Fire: The Story of Maria Yudina, Pianist in Stalin’s Russia. She converted from Judaism to Orthodox Christianity, and her career spanned from the 1920s through 1970. She was at times out of favor, other times Stalin’s favorite pianist. Called a “holy fool” by many, this is an excellent biography that brings its subject to life. And her playing was full of depth, albeit with often creaky sound..

3. Ian Barnes, Restless Empire: A Historical Atlas of Russia. One of the very most useful books for understanding Russian history — about half of this one is maps! Changing maps over the ages. These are the maps that Putin looks at, you should too. A high quality book in all regards.

4. Sarah Weinman, Scoundrel: How a Convicted Murderer Persuaded the Women Who Loved Him, the Conservative Establishment, and the Courts to Set Him Free. The murderer is Edgar Smith and the conservative is William F. Buckley — how could anyone have been fooled by these remorseless criminals? A good look at what had been becoming a forgotten episode. A tale of self-deception to the nth degree.

5. Caroline Elkins, Legacy of Violence: A History of the British Empire. Yes, the empire truly was based in unacceptable levels of violence, and at its very core. This excellent book is the very best demonstration of those propositions. Historically thorough, and covers more than just a few cases.

There is a new reissue, with a new and good introduction, of Orlando Patterson, The Sociology of Slavery: Black Society in Jamaica, 1655-1838.

Ben Westhoff, Little Brother: Love, Tragedy, and my Search for the Truth is a very good narrative by a very good author.

Jeevan Vasagar, Lion City: Singapore and the Invention of Modern Asia is a decent first book to read on Singapore, although mostly it was interior to my current knowledge set.

How to improve conferences

That is the topic of my latest Bloomberg column, here is one bit:

The next time you are attending a formal presentation at a conference, ask yourself these questions: Is this better than all of those Zoom calls I am turning down? Is this better than the next best YouTube clip I might be watching? For most people, the answers are obvious. Conference organizers need to be willing to pull the trigger and usher the presentation into a gentle retirement.

Charismatic presentations still can be important to motivate a sales force or to build the unity of a crowd. But informational presentations are obsolete.

Earlier in my career, I went to presentations not to listen, but rather to meet the other people interested in the topic. That made sense at the time, but these days information technology provides superior alternatives. For instance, I have been to conferences that have “speed dating” sessions (without the date part, to be clear, and with vaccine and testing requirements) where you meet many people for say two minutes and then move on to the next meeting. This should become a more regular practice. Conference organizers also can create “speed dating pools” where everyone interested in a particular topic area has a chance to meet.

Another marvelous practice prompted by the pandemic that should be continued and indeed extended at all conferences: outside sessions, especially with group discussions.

Recommended, there is more at the link. What other ideas do you have?

Thursday assorted links

1. “According to a Pew Research Center analysis of Census Bureau data, women younger than 30, on average, earn at least as much as or more than men in D.C., New York, Los Angeles and 19 other major metro areas…” Link here.

2. Everyone is offended: “G.I. Jane hairstylist Enzo Angileri doesn’t get why Jada Pinkett Smith rolled her eyes at Chris Rock’s G.I. Jane 2 joke at the Oscars.” (Daily Mail)

3. In the very best studies, Ivermectin always flunks — yet again. Time to give up the ghost on this one…there is really nothing there, and people’s lives are at stake. When stuff works, it works in studies like this.

4. The problem with the Donbas.

5. What Hyun Bin and Son YeJin’s wedding says about the evolution of Korean celebrity culture.

6. “The University of Florida has dropped Karl Marx’s name from a library study room in the wake of Russia’s invasion of Ukraine, Orlando Weekly reported.” ??? And I guess Marx’s anti-Semitism — or how about his um…”Marxism” — wasn’t a good enough reason for cancelling him? Link here.

NIH sentences to ponder

“I mean, everybody is frustrated about how slow things are,” said Walter Koroshetz, the director of the National Institute of Neurological Disorders and Stroke and a co-chair of the initiative, in an interview with STAT. He added, however, that while starting enrollment “took way too much time,” the NIH stood up the study “much faster than we’ve done anything else before,” pointing out the agency’s usual pace can be even slower.

Here is the full story, via a loyal MR reader. So far they have brought in just three percent of the patients they plan to recruit. Why oh why is our public health establishment failing us?

Will Studying Economics Make You Rich?

A bit!:

We investigate the wage return to studying economics by leveraging a policy that prevented students with low introductory grades from declaring a major. Students who barely met the grade point average threshold to major in economics earned $22,000 (46 percent) higher annual early-career wages than they would have with their second-choice majors. Access to the economics major shifts students’ preferences toward business/finance careers, and about half of the wage return is explained by economics majors working in higher-paying industries. The causal return to majoring in economics is very similar to observational earnings differences in nationally representative data.

That is from a newly published paper by Zachary Bleemer and Aashish Mehta.

Wednesday assorted links

1. Left-center critique of State Capacity Libertarianism.

2. How Duke University Press stayed relevant (New Yorker). And what is wrong with Yale?

3. Who is Putin’s immediate successor? And is he a nice guy?

4. Which states back Will Smith?

5. The current status of AI in medicine.

6. Obituary for architectural theorist Christopher Alexander (NYT).

Bounty Hunter the Dog

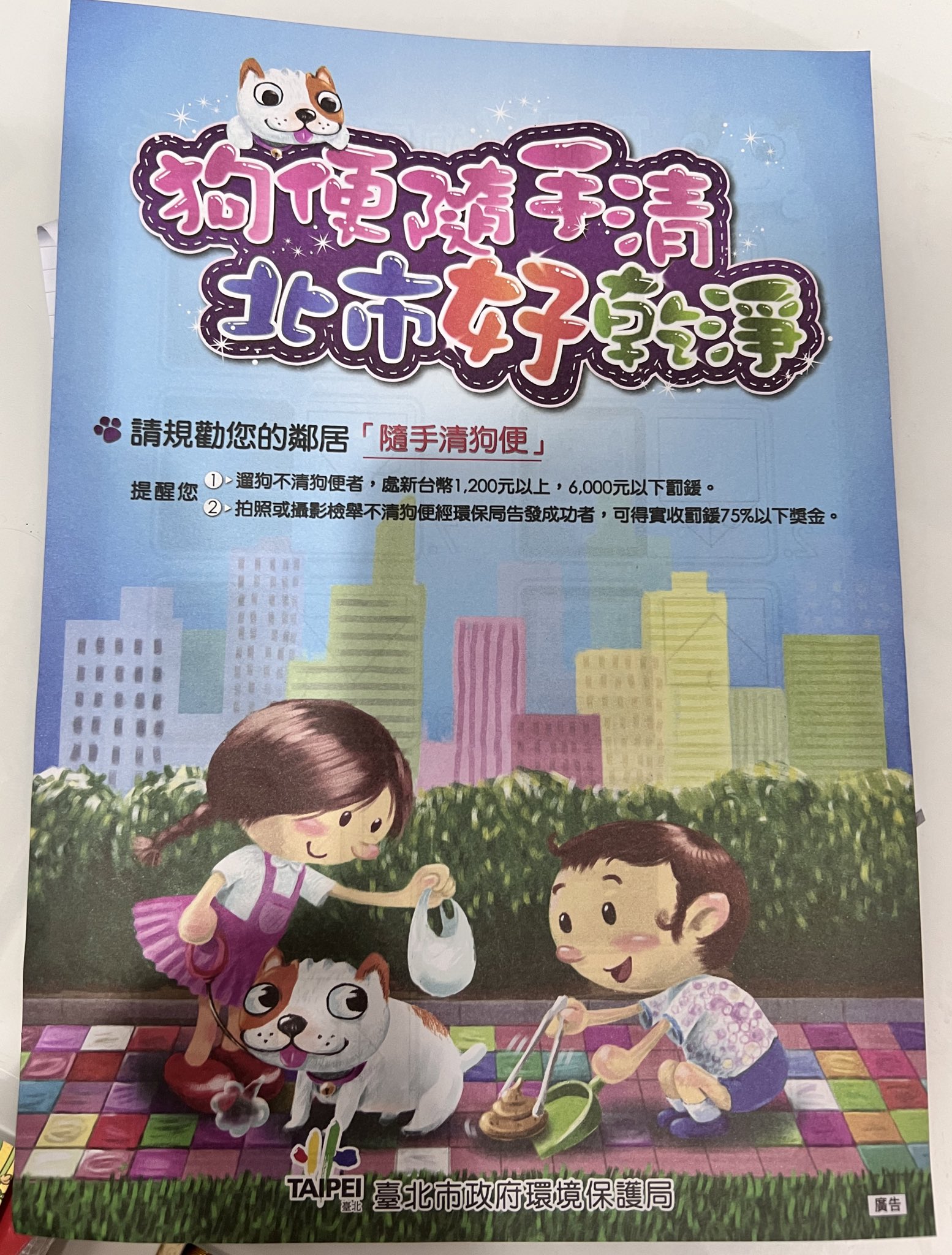

I posted earlier on a NYC program where idling cars can be reported to earn a share of the fine. Tapei has just started a similar program to earn a share of the fine assessed on people who don’t pick up their dog’s poop.

As before the virtue of efficiency in the prosecution of the laws depends on the quality of the law.

Hat tip: Michael Story.

Addendum: Here’s my paper on bounty hunters.

The new equilibrium, solved for

Ticket sales for Chris Rock’s comedy shows have reportedly spiked since Sunday night.

Live event ticketing site TickPick sold more tickets to see Chris Rock overnight than it had in the past month combined, according to a tweet from the company Monday.

Rock is set to perform standup at Boston’s Wilbur Theater on Wednesday. On March 18, the cheapest tickets were sold for $46, but had increased to $411 by Monday, according to TickPick’s public relations representative Kyle Zorn.

Here is the full story. Now solve for the next one!