Wednesday assorted links

Tech and economic growth in the Book of Genesis

That is the topic of my latest Bloomberg column, worth reading as an integrated whole. Here is one excerpt:

The stories have so much religious significance that it is easy to miss the embedded tale of technology-led economic growth, similar to what you might find in the work of Adam Smith or even Paul Romer. Adam and Eve eat of “the tree of knowledge, good and evil,” and from that decision an entire series of economic forces are set in motion. Soon thereafter Adam and Eve are tilling the soil, and in their lineage is Tubal-Cain, “who forged every tool of copper and iron.”

Living standards rise throughout the book, and by the end we see the marvels of Egyptian civilization, as experienced and advised by Joseph. The Egyptians have advanced markets in grain, and the logistical and administrative capacities to store grain for up to seven years, helping them to overcome famine risk (for purposes of contrast, the U.S. federal government routinely loses track of assets, weapons, and immigrant children). It is a society of advanced infrastructure, with governance sophisticated enough to support a 20 percent tax rate (Joseph instructs the pharaoh not to raise it higher). Note that in modern America federal spending typically has run just below 20 percent since the mid-1950s.

Arguably you can find a story of quantitative easing in Genesis as well. When silver is hard to come by, perhaps because of deflationary forces, the Egyptian government buys up farmland and compensates the owners with grain.

Most of all, in the Genesis story, the population of the Middle East keeps growing. I’ve known readers who roll their eyes at the lists of names, and the numerous recitations of who begat whom, but that’s the Bible’s way of telling us that progress is underway. Neither land nor food supplies prove to be the binding constraints for population growth, unlike the much later canonical classical economics models of Malthus and Ricardo.

There is much more at the link.

The complacent class

The students who had taken over her office were a conscious throwback to the activism of the 1960s, when Hampshire [College] was conceived as an experiment in higher education. Now they were fighting for its survival in a different time, and it was not looking good. The college announced in January that it was facing “tough financial trends” and was looking for a partner to stay afloat…

Founded in 1965 and opened to students five years later, Hampshire, a liberal arts college in western Massachusetts, is an embodiment of the progressive education principles that arose from the spirit of individualism and self-expression of that era. There are no grades, only narrative assessments, and there are no prescribed majors; students design their own courses of study.

Hampshire and a few dozen other schools founded on similar principles were once the cutting edge of academia. But now, families facing sky-high tuitions are looking for a more direct link between college and career, college officials say. As a result, many of these small, experimental schools are being forced to re-examine their missions, merge with more traditional institutions or, in some cases, shut down.

The culture and polity that is Arlington, Virginia

Arlington officials say Amazon’s arrival will boost the number of visitors staying in hotels, motels and other lodgings. Starting in June 2019, 15 percent of any increase in its “transient occupancy tax” would go to Amazon, if the company meets specific targets for how much office space the new headquarters facility occupies.

The agreement says Amazon needs to occupy 64,000 square feet of office space by July 31, 2020, in order to qualify for the 15 percent payment. The required amount of space increases to 252,800 square feet by July 31, 2021, and to 5.576 million by July 31, 2034, the last year of incentive payments.

Here is more from WaPo.

Tuesday assorted links

1. Status networks and proof of work.

2. Zack Beauchamp interviews Brad DeLong. And commentary from Ross (NYT).

3. “…unfunded pension benefits grow faster under Democratic-party mayors.”

4. Summers on MMT. And Scott Sumner on MMT.

5. Boston is the most politically intolerant place in the U.S.

6. The average age of U.S. college presidents is rising rapidly.

7. David Brooks on Medicare For All (NYT).

Modern Principles of Economics

If you are teaching principles of economics next year do check out our textbook, Modern Principles of Economics.

Modern Principles means modern content and modern delivery. We cover material that many other textbooks ignore, such as how managers should choose between piece rates and tournaments and how firms can increase their profits using clever forms of price discrimination such as bundling and tying. In macroeconomics, we have created a simple yet powerful AD-AS model that combines insights from New Keynesian and Real Business Cycle models. We have also created the Super Simple Solow model which for the first time makes the Solow model of economic growth accessible to principles of economics students.

High-quality videos integrated directly into the textbook make Modern Principles a new kind of textbook, one born in the age of the internet. No other textbook has the quantity and quality of supplementary material available with Modern Principles. Whether you are looking to flip the classroom or just for the occasional video to grab the student’s attention before the lecture, you will find what you need in Modern Principles. The superb course management system also makes it easy to assign videos and grade questions.

Teachers can request a free examination copy here.

Here’s a video overview of Modern Principles of Economics:

The value of exploitative loans

I show that the same bias that causes someone to take an exploitative loan may also imply that the loan benefits them by causing them to purchase a product or service that they should, but wouldn’t otherwise, buy. I demonstrate the importance of this effect in a study of tax refund anticipation loans. I find that regulation curtailing these loans reduced the use of paid tax preparers and the takeup of the earned income tax credit, which is the second largest federal transfer to low-income households.

That is from a paper by Andrew T. Hayashi, via the excellent Kevin Lewis.

*Publisher’s Weekly* on my next book *Big Business*

My subtitle is A Love Letter to an American Anti-Hero, and here is the review:

Cowen (The Great Stagnation), an economics professor at George Mason University, counters complaints of fraudulent corporate behavior, excessive CEO pay, invasions of privacy, oppressive work culture, and corporate influence on government in this spirited defense of big business. He creatively mines polls, economic data, and even social psychology to argue that big business has, on balance, been unfairly judged. Disarmingly, he acknowledges that it’s not perfect—he criticizes the health care industry, notes that corporate cultures have not responded well to sexual harassment, and recognizes threats to privacy from the technology sector—but then he hedges: health care consolidation, he says, is at least partly the result of government regulation; corporations are now responding to sexual harassment; and traditionally generated gossip may well be a bigger threat than breaches of data privacy. Cowen is a smart, original thinker with a knack for reframing criticisms in the context of a larger, utilitarian perspective (drugs produced by pharmaceutical companies save lives, Google Maps gets us where we want to go) that implicitly endorses the current economic system; he comes off more like a lawyer than an ideologue. This analysis is unlikely to convince readers skeptical of big business of its virtue, but it provides food for thought.

Here is information to purchase the book.

Google decides it is underpaying its men

When Google conducted a study recently to determine whether the company was underpaying women and members of minority groups, it found that more men than women were receiving less money for doing similar work.

The surprising conclusion to the latest version of the annual study contrasted sharply with the experience of women working in Silicon Valley and in many other industries.

In response to the finding, Google gave $9.7 million in additional compensation to 10,677 employees for this year. Men account for about 69 percent of the company’s work force, but they received a disproportionately higher percentage of the money. The exact number of men who got raises is unclear. [TC: I don’t fully understand the metric here.]

But the study did not tell the whole story of women at Google or in the technology industry more broadly, something that company officials acknowledged.

Monday assorted links

No Urban Wage Premium for Non-College Educated Workers

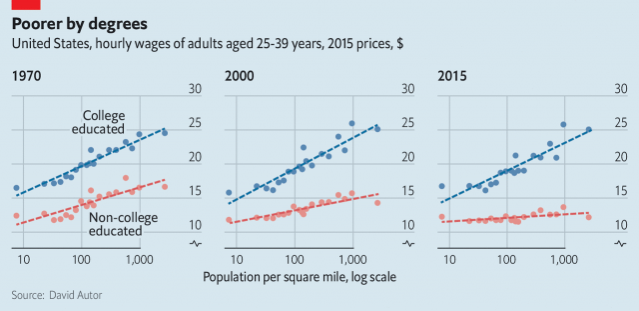

The Economist has a nice graph and article on the urban wage premium based on David Autor’s work. The graphs shown that in the past both college and non-college educated workers earned higher wages in more densely populated areas but today only college-educated workers experience an urban wage-premium.

Housing costs eat a large share of the college wage-premium so even college educated workers are not as better off in cities as the graphs make it appear. Autor’s point, however, is that wages for the non-college educated aren’t higher in cities so they might not move to cities even with lower housing costs. That could be true but I also suspect that the urban wage premium for the non-college educated is endogenous–firms employing these workers have moved out of the city but could move back in with lower housing and land costs.

CEOs play games cooperatively, and well

We study whether CEOs of private firms differ from other people with regard to their strategic decisions and beliefs about others’ strategy choices. Such differences are interesting since CEOs make decisions that are economically more relevant, because they affect not only their own utility or the well-being of household members, but the utility of many stakeholders inside and outside of the organization. They also play a central role in shaping values and norms in society. We expect differences between both groups, because CEOs are more experienced with strategic decision making than comparable people in other professional roles. Yet, due to the difficulties in recruiting this high-profile group for academic research, few studies have explored how CEOs make incentivized decisions in strategic games under strict controls and how their choices in such games differ from those made by others. Our study combines a stratified random sample of 200 CEOs of medium-sized firms with a carefully selected control group of 200 comparable people. All subjects participated in three incentivized games—Prisoner’s Dilemma, Chicken, Battle-of-the-Sexes. Beliefs were elicited for each game. We report substantial and robust differences in both behavior and beliefs between the CEOs and the control group. The most striking results are that CEOs do not best respond to beliefs; they cooperate more, play less hawkish and thereby earn much more than the control group.

Here is the paper, by Håkan J. Holm, Victor Nee, and Sonja Opper, via the excellent Rolf Degen.

The culture and polity that is Brazil

Pentecostalist Churches, like Macedo’s Igreja Universal do Reino de Deus, which promise instant wealth, offer competing live prophecies and other supernatural theatre, and exorcise demons in public. The leading Brazilian polling organisation, Datafolha, estimated them at 30 per cent of the voting population this time around, and they have electoral discipline…

The evangelists are everywhere. In the prisons, in the favelas, among the black poor, but increasingly also appealing to the financially insecure middle classes. Over the last decade, defections from the Catholic population are estimated at 1 per cent per year, but this is arguably accelerating. Bolsonaro may not achieve much else, but he may well prove to be the first president of post-Catholic Brazil, with a new moral order perpetuated by a new television regime. The rest of Latin America is not far behind.

Such is life in Bolsonaro’s Brazil! Here is the full piece, a letter to the LRB by Christopher Lord, via Alexander Papazian.

The impact of the Trump trade war

We analyze the short-run impacts of the 2018 trade war on the U.S. economy. We estimate import demand and export supply elasticities using changes in U.S. and retaliatory war tariffs over time. Imports from targeted countries decline 31.5% within products, while targeted U.S. exports fall 9.5%. We find complete pass-through of U.S. tariffs to variety-level import prices, and compute the aggregate and regional impacts of the war in a general equilibrium framework that matches these elasticities. Annual losses from higher costs of imports are $68.8 billion (0.37% of GDP). After accounting for higher tariff revenue and gains to domestic producers from higher prices, the aggregate welfare loss is $6.4 billion (0.03% of GDP). U.S. tariffs favored sectors located in politically competitive counties, suggesting an ex ante rationale for the tariffs, but retaliatory tariffs offset the benefits to these counties. Tradeable-sector workers in heavily Republican counties are the most negatively affected by the trade war.

Here is the full paper, by Pablo D. Fajgelbaum, Pinelopi K. Goldberg, Patrick J. Kennedy, and Amit K. Khandelwal. Full pass-through, of course, means that monopoly in these markets is likely not such a big deal.