Results for “age of em” 16717 found

My favorite things China

1. Novel: Soul Mountain, by Gao Xingjian. Parts of Dream of the Red Chamber are splendid, but it is hard to keep track of the whole thing and also I wonder whether any of the available editions in English are satisfactory.

2. Movie: The Story of Qiu Ju. A real charmer.

3. Comedian: Jackie Chan.

4. Movie, set in, but not a Chinese movie: How about Transsiberian? Shanghai Noon? Are any of those old movies set in China any good?

5. Book, non-fiction: James Fallows, China Airborne. I am also a fan of the book where the guy drives a car around China. The Private Life of Chairman Mao is a stunner, maybe the best book I know on tyranny.

6. Book, set in, fiction (not by Chinese author): Edgar Snow, Red Star Over China. Pearl Buck I find boring.

7. Sculpture: Tang horses, some images are here.

8. Contemporary Chinese artist: Cai Guo-Qiang, images here. His one man show at the Guggenheim is one of the best exhibitions I’ve ever seen. Try this video, apologies for the ad at the beginning.

9. Chinese traditional music: I am interested in Chinese opera, but don’t quite feel I’ve heard the real thing. I once heard an electrified performance, but my sense is the music is all about the timbre and needs to be heard in an nowadays-almost-impossible-to-achieve setting, given that I am not a 17th century Chinese noble. Any advice? By the way, here is a good article on recent developments in Chinese (semi-classical) music.

10. Cookbooks: Fuchsia Dunlop’s two Chinese cookbooks are not only two of the best cookbooks ever they are two of the best books ever.

11. Best book about Chinese fiction: Sabina Knight, Chinese Literature: A Very Short Introduction. This short book is a marvel of economy, substance, and style.

12. Pianist: Yundi Li, try this video of Chopin’s 2nd Scherzo.

13. Architect: I.M. Pei. We have friends who live in a Pei-designed house, and it is splendid.

14. Movie director: John Woo was born in China. The Killer might be his best movie, but Once a Thief is arguably the most underrated. WindTalkers is quite good too and also underrated.

I am not counting either Hong Kong or Taiwan for these categories. I also am not counting American-born, ethnic Chinese, such as Maya Lin. And J.G. Ballard was born in Shanghai, but what category do I put him in?

Assorted links

1. Does money make us write better?

2. Is peak oil dead?

3. Interview with Enrico Moretti.

4. Ngram viewer for “Risk Management,” via Andrew Schroeder.

The value of microfoundations

Here is Noah Smith on microfoundations, responding to Matt Yglesias (here and here, here is also a Krugman post on the topic). I am usually pro-microfoundations, though without any particular philosophy of science-derived attachment to the idea. Here is why:

1. In some very important, simple, and intuitive models, there is nominal stickiness but money is still neutral. Caplin and Spulber 1980 is one of my favorite pieces and time spent studying their model will be repaid with value. I don’t think the model applies to 2007-2009, or say 1929-1933, when we have “out of the ordinary” shocks, but it may apply to many other time periods.

2. Often the data suggest that money is neutral or roughly neutral or at least the data are not inconsistent with neutrality. I know that one does not hear much about that in today’s economics blogosphere, but I kid you not. Again, I differ strongly from this literature for “the times which really matter,” such as 2007-2009 or 1929-1933, but still I take the data seriously. Try this relatively “atheoretical” piece by Harald Uhlig, which does not reject monetary neutrality (nor does it cover 2007-2009). Nominal stickiness models have trouble explaining why money doesn’t matter more than in fact it does. Understanding microfoundations will keep you out of the trouble you will get in if you keep trying to use money to expand output.

3. We can try to nudge people into more flexible wages, but again that requires some understanding of microfoundations. The Fed can prevent any risk of a deflationary downward spiral, and please note it is no coincidence we are in the two percent inflation range. You don’t have to view this as a high return activity to favor it (it is funny how the mere mention of wage nudges will cause many people to suddenly turn against the nudge idea, at least temporarily.)

4. Microfoundations don’t have to mean intertemporal maximization with extreme assumptions about rational or well-behaved preferences. George Akelof has written some of the best papers on microfoundations. Nor do microfoundations have to mean staking out an extreme position on the Lucas critique.

5. There are plenty of flex-wage professions which still have been seeing high unemployment. Like real estate agents. Or what happened to all those Mexicans who used to stand around on street corners? Were their wages sticky too? I don’t think so. Does their return to unemployment or underemployment in Puebla refute the sticky wage model? I personally don’t think so, but it’s hard to answer that question — an obvious one to a critical observer — without a clear sense of microfoundations.

6. Just how bad is monopoly? We wish to know when designing a competition policy. Under some microfoundations models, the existence of market power is essential for ongoing stickiness, in other models not. This question matters, and we need microfoundations to better resolve it.

7. Should a government subsidize, tax, or be neutral toward contract indexation? Try answering that question, or even getting started on it, without some sensible microfoundations.

8. If you are trying to end a hyperinflation or high rate of inflation, do you need to get fiscal policy right, in some kind of credible manner, before enacting monetary restraint? It is hard to imagine answering this question without good microfoundations.

I could go on. I am worried that people are rejecting microfoundations because they think microfoundations imply objectionable attitudes toward macro policy. But note: if those attitudes are objectionable and indeed wrong, they won’t be implied! It is entirely defensible to argue “we should have a more expansionary monetary policy today, even without the microfoundations to support that view.” It is much tougher to argue “economics should deemphasize microfoundations altogether.” The broader the range of questions one considers, the more important microfoundations turn out to be.

Sicily fact of the day

In lieu of the Austerians:

Today, Sicily’s regional government has 1,800 employees — more than the British Cabinet Office — and the island employs 26,000 auxiliary forest rangers; in the vast forestlands of British Columbia, there are fewer than 1,500.

Out of a population of five million people in Sicily, the state directly or indirectly employs more than 100,000 of them and pays pensions to many more. It changed its pension system eight years after the rest of Italy. (One retired politician recently won a case to keep an annual pension of 480,000 euros, about $584,000.)

Here is more.

There Will Be Blood

Economists often reduce complex motivations to simple functions such as profit maximization. Writing in The Economist, Buttonwood ably criticizes such simplifications. Buttonwood is too quick, however, to conclude that simplification falsifies. For example, Buttonwood argues:

If there is a shortage of blood, making payments to blood donors might seem a brilliant idea. But studies show that most donors are motivated by an idea of civic duty and that a monetary reward might actually undermine their sense of altruism.

As loyal readers of this blog know, however, the empirical evidence is that incentives for blood donation actually work quite well. Mario Macis, Nicola Lacetera, and Bob Slonim, the authors of the most important work on this subject (references below), write to me with the details:

The decision to donate blood involves complex motivations including altruism, civic duty and moral responsibility. As a result, we agree with Buttonwood that in theory incentives could reduce the supply of blood. In fact, this claim is often advanced in the popular press as well as in academic publications, and as a consequence, more and more often it is taken for granted.

But what is the effect of incentives when studied in the real world with real donors and actual blood donations?

We are unaware of a single study of real blood donations that shows that offering an incentive reduces the overall quantity or quality of blood donations. From our two studies, both in the United States covering several hundred thousand people, and studies by Goette and Stutzer (Switzerland) and Lacetera and Macis (Italy), a total of 17 distinct incentive items have been studied for the effects on actual blood donations. Incentives have included both small items and gift cards as well as larger items such as jackets and a paid-day off of work. In 16 of the 17 items examined, blood donations significantly increased (and there was no effect for the one other item), and in 16 of the 17 items studied no significant increase in deferrals or disqualifications were found. No study has ever looked at paying cash for actual blood donations, but several of the 17 items in the above studies involve gift cards with clear monetary value.

Although many lab studies and surveys have found differing evidence focusing on other outcomes than actual blood donations (such as stated preferences), the empirical record when looking at actual blood donations is thus far unambiguous: incentives increase donations.

Given the vast and important policy debate regarding addressing shortages for blood, organ and bone marrow in developed as well as less-developed economies, where shortages are especially severe, it is important to not only consider more complex human motivations, but to also provide reliable evidence, and interpret it carefully. The recent ruling by the 9th Circuit Court of Appeals allowing the legal compensation of bone marrow donors further enhances the importance of the debate and the necessity to provide evidence-based insights.

Here is a list of references:

Goette, L., and Stutzer, A., 2011: “Blood Donation and Incentives: Evidence from a Field Experiment,” Working Paper.

Lacetera, N., and Macis, M. 2012. Time for Blood: The Effect of Paid Leave Legislation on Altruistic Behavior. Journal of Law, Economics and Organization, forthcoming.

Lacetera N, Macis M, Slonim R 2012 Will there be Blood? Incentives and Displacement Effects in Pro-Social Behavior. American Economic Journal: Economic Policy 4: 186-223.

Lacetera N, Macis M, Slonim R.: Rewarding Altruism: A natural Field Experiment, NBER working paper.

Immigration to Australian jail

MANDATORY sentencing — a key element of Labor’s policy to deter asylum boats — is having the opposite effect, encouraging Indonesian crew attracted by Australia’s relatively high prison pay.

Lawyer and former diplomat Anthony Sheldon says jailed crew members can make $20 a day in Australian jails, in his submission to the Gillard government’s expert panel on asylum-seekers.

Sadly, the rest is gated…but there is also this bit:

“The preference of a number of older fishermen is to remain in detention in Australia,” Mr Sheldon says in the submission.

“Depending on their jobs in prison, they can earn up to $20 per day, making them wealthy beyond comparison upon their return to their villages after their sentence is served.

“They also receive free dental and medical services during their imprisonment. “Combined with the relative safety of their work in prison compared to the dangerous work at sea, Australian imprisonment is very desirable.”

For the pointer I thank Philip Hegarty.

Assorted links

1. Noah Smith’s dissertation, plus a mention of my most fundamental view: “”Larry Summer’s maxim,“It isn’t easy to understand how the world works.””

2. Spanish baby stealing as an approach toward social change, and an old argument for the minimum wage.

3. Henry’s music bleg, with lots of comments.

4. Arnold Kling on education, disruption, and Benjamin Lima.

5. China’s railway arteries, photographed.

6. Olympic runner to compete, without a passport or home country.

Mere exposure to money

The paper is by Eugene M. Caruso, Kathleen D. Vohs, Brittani Baxter and Adam Waytz. The title of the paper is “Mere Exposure to Money Increases Endorsement of Free-Market Systems and Social Inequality.” Abstract:

The present research tested whether incidental exposure to money affects people’s endorsement of social systems that legitimize social inequality. We found that subtle reminders of the concept of money, relative to nonmoney concepts, led participants to endorse more strongly the existing social system in the United States in general (Experiment 1) and free-market capitalism in particular (Experiment 4), to assert more strongly that victims deserve their fate (Experiment 2), and to believe more strongly that socially advantaged groups should dominate socially disadvantaged groups (Experiment 3). We further found that reminders of money increased preference for a free-market system of organ transplants that benefited the wealthy at the expense of the poor even though this was not the prevailing system (Experiment 5) and that this effect was moderated by participants’ nationality. These results demonstrate how merely thinking about money can influence beliefs about the social order and the extent to which people deserve their station in life.

For the pointer I thank Robin Hanson.

*Affluence and Influence*

The author is Martin Gilens and the subtitle is Economic Inequality and Political Power in America. A few points:

1. It is an interesting book.

2. It is poorly written and the first fifty pages should have been abolished.

3. It argues, using a comprehensive data set, that the preferences of poor and even middle income people are neglected or underrepresented in the policy process. The preferences of the wealthiest ten percent seem to have more sway.

4. It should take greater care to distinguish the preferences of the (often ill-informed) poor across means and ends. Say a poor or middle class person feels “I want tariffs” and also “I want prosperity.” The elites then push through free trade to produce prosperity and for that matter to get reelected and perhaps also to serve commercial interests and donors. Have they met or frustrated the preferences of the poor? By the metrics of Gilens the poor did not get their way but that is not obviously the correct conclusion. Matt makes a related point.

5. Many lower- or middle-income voters decide to vote retrospectively over outcomes (mostly), rather than over policy inputs. That suggests we should judge the responsiveness of the system in terms of how well it aims toward those outputs, not whether it gives lower-income voters their preferred policy inputs.

6. What is wrong with this simple alternative hypothesis?: Politicians seek some measure of redistribution-weighted prosperity to get reelected. Wealthier voters are better educated and smarter, so they have a better sense of which policies will bring that about. It seems the wealthier voters are getting their way on policy inputs, but a deeper look shows the pressures on politicians are quite general.

7. I would be falling prey to the fallacy of mood affiliation if I simply assumed the author wanted policy to be more responsive to the wishes of the poor and middle class. Still I can ask whether this would be a desirable end. Aren’t they less educated and less well-informed on average? Don’t they also care about politics less and derive less of their status from political processes and outcomes? Do I want them to have a greater say over social issues, including gay marriage? No.

Here is a Boston Review symposium on the book, including many responses from the notables on the sidebar, along with a response from the author.

Singapore R&D there is no great stagnation

Here is one description (with photo and a very good video):

Unveiled at a design conference in the UK recently, Kissenger is basically an egg-like orb outfitted with two soft plastic lips packed with sensors and actuators. When a human on one end of the kiss transaction plants a kiss on the robot lips, the sensors record the shape changes the kisser creates on the lips and translates those pressure patterns into a mirror image that can be beamed over the Web to another Kissenger. That Kissenger then reproduces the sender’s unique kiss for a human on the other end.

Here is another:

Kissing Bot. Singaporean robotics studio Lovotics has a new robot in the news. Kissenger is an advanced and intimate form of telepresence robot specially designed to transmit the senstions of a kiss. Two units are able to record and remotely reproduce the unique pressure sensations from a kiss … although the design looks pretty chaste and seems to lack an option to go French. Research like this while seeming silly is crucial for innovating next-gen avatar robot tech.

Here is more. Hat tip goes to @GrishinRobotics.

Self-recommending!

The new Ron Unz piece on IQ

A new piece by Ron Unz, in The American Conservative, is subtitled “What the Facts Tell Us About a Taboo Subject.” Excerpt:

Consider, for example, the results from Germany obtained prior to its 1991 reunification. Lynn and Vanhanen present four separate IQ studies from the former West Germany, all quite sizable, which indicate mean IQs in the range 99–107, with the oldest 1970 sample providing the low end of that range. Meanwhile, a 1967 sample of East German children produced a score of just 90, while two later East German studies in 1978 and 1984 came in at 97–99, much closer to the West German numbers.

These results seem anomalous from the perspective of strong genetic determinism for IQ. To a very good approximation, East Germans and West Germans are genetically indistinguishable, and an IQ gap as wide as 17 points between the two groups seems inexplicable, while the recorded rise in East German scores of 7–9 points in just half a generation seems even more difficult to explain.

And:

Next, consider Greece. Lynn and Vanhanen report two IQ sample results, a score of 88 in 1961 and a score of 95 in 1979. Obviously, a national rise of 7 full points in the Flynn-adjusted IQ of Greeks over just 18 years is an absurdity from the genetic perspective, especially since the earlier set represented children and the latter adults, so the two groups might even be the same individuals tested at different times. Both sample sizes are in the hundreds, not statistically insignificant, and while it is impossible to rule out other factors behind such a large discrepancy in a single country, it is interesting to note that Greek affluence had grown very rapidly during that same period, with the real per capita GDP rising by 170 percent.

And:

Interestingly enough, these rapid rises in IQ due to changes in the general socio-economic environment appear completely absent when we examine the international or domestic IQ data for East Asian populations, for whom even tenfold differences in real per capita GDP seem to have little or no impact on IQ. Missing this unexpected contrast between the impact of socio-economic factors on Europeans and on East Asians may have been a major reason that Lynn and Vanhanen failed to notice the serious flaws in their “Strong IQ Hypothesis.”

There is much more at the link, interesting throughout. Here is a short profile of Ron Unz, noting rumors that he has an IQ of 214. Here is his Wikipedia page. Here is Unz’s new website.

College fact of the day

What do families actually pay for college? On average, the answer was $20,902 in 2011-2012, which is down from $24,097 in 2009-2010.

That is from Timothy Taylor. That is not deflation due to higher productivity, but rather mostly the result of a series of substitutions, including living at home and switching to two-year colleges.

File under “Further reasons why the current revenue model is unsustainable.”

Elsewhere, Mark Edmundson, a U Va. English professor, writes:

Internet learning promises to make intellectual life more sterile and abstract than it already is — and also, for teachers and for students alike, far more lonely.

Boo hoo! Poor you! Poor me! Poor Alex, que triste!

File under “The Empire Strikes Back.”

Assorted links

1. It is far from obvious that he is wrong.

3. One look at our deepest structural problem (no recession for college grads, terrible job market for others).

Those three links are enough to think about for the entire day and more.

Clifford Whinston on driverless cars

Here is one good point of many:

Driverless cars don’t need the same wide lanes, which would allow highway authorities to reconfigure roads to allow travel speeds to be raised during peak travel periods. All that is needed would be illuminated lane dividers that can increase the number of lanes available. Driverless cars could take advantage of the extra lane capacity to reduce congestion and delays.

Another design flaw is that highways have been built in terms of width and thickness to accommodate both cars and trucks. The smaller volume of trucks should be handled with one or two wide lanes with a road surface about a foot thick, to withstand trucks’ weight and axle pressure. But the much larger volume of cars—which apply much less axle pressure that damages pavement—need more and narrower lanes that are only a few inches thick.

Building highways that separate cars and trucks by directing them to lanes with the appropriate thickness would save taxpayers a bundle. It would also favor the technology of driverless cars because they would not have to distinguish between cars and trucks and to adjust speeds and positions accordingly.

The full piece is here.

Firefighters Don’t Fight Fires

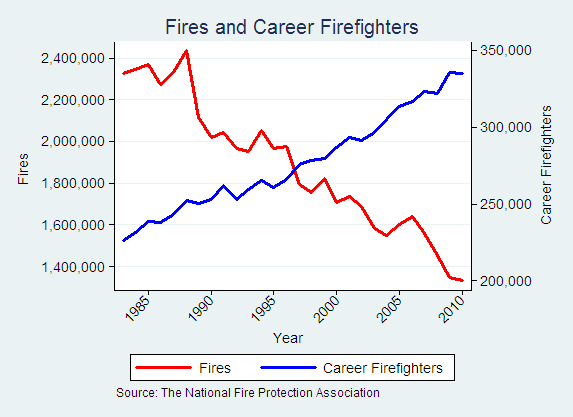

Over the past 35 years, the number of fires in the United States has fallen by more than 40% while the number of career firefighters has increased by more than 40% (data).

(N.B. Volunteer firefighters were mostly pushed out of the big cities in the late 19th century but there are a surprising number who remain in rural areas and small towns; in fact, more in total than career firefighters. The number of volunteers has been roughly constant and almost all of them operate within small towns of less than 25,000. Thus, you can take the above as approximating towns and cities of more than 25,000.)

The decline of demand has created a problem for firefighters. What Fred McChesney wrote some 10 years ago is even more true today:

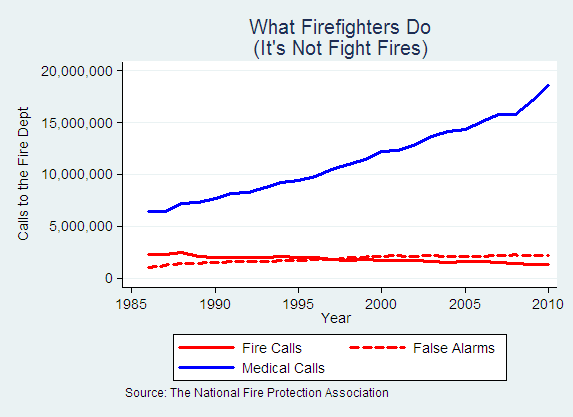

Taxpayers are unlikely to support budget increases for fire departments if they see firemen lolling about the firehouse. So cities have created new, highly visible jobs for their firemen. The Wall Street Journal reported recently, “In Los Angeles, Chicago and Miami, for example, 90% of the emergency calls to firehouses are to accompany ambulances to the scene of auto accidents and other medical emergencies. Elsewhere, to keep their employees busy, fire departments have expanded into neighborhood beautification, gang intervention, substitute-teaching and other downtime pursuits.” In the Illinois township where I live, the fire department drives its trucks to accompany all medical emergency vehicles, then directs traffic around the ambulance—a task which, however valuable, seemingly does not require a hook-and-ladder.

Here’s some data. Note that medical calls dwarf fire calls. Twenty five years ago false alarms were half the number of fires, today false alarms significantly exceed the number of fires.

According to Nightline it costs $3,500 every time a fire truck pulls out of a fire station in Washington, DC (25 calls in a 24 hour shift is not uncommon so this adds up quickly). Moreover, most of the time the call is not for a fire but for a minor medical problem. In many cities, both fire trucks and ambulances respond to the same calls. The paramedics do a great job but it is hard to believe that this is an efficient way to deliver medical care and transportation. A few locales have experimented with more rational systems. For example:

For calls that are not a life or death, Eastside Fire and Rescue stations [in WA state] will no longer send out a fire truck but instead an SUV with one certified medic firefighter.

Sounds obvious, but it’s hard to negotiate with heroes especially when they are unionized with strong featherbedding contracts.