Month: March 2015

Ben Bernanke on the secular stagnation hypothesis

Here is his second real blog post. Excerpt:

My greatest concern about Larry’s formulation, however, is the lack of attention to the international dimension. He focuses on factors affecting domestic capital investment and household spending. All else equal, however, the availability of profitable capital investments anywhere in the world should help defeat secular stagnation at home. The foreign exchange value of the dollar is one channel through which this could work: If US households and firms invest abroad, the resulting outflows of financial capital would be expected to weaken the dollar, which in turn would promote US exports. (For intuition about the link between foreign investment and exports, think of the simple case in which the foreign investment takes the form of exporting, piece by piece, a domestically produced factory for assembly abroad. In that simple case, the foreign investment and the exports are equal and simultaneous.) Increased exports would raise production and employment at home, helping the economy reach full employment. In short, in an open economy, secular stagnation requires that the returns to capital investment be permanently low everywhere, not just in the home economy. Of course, all else is not equal; financial capital does not flow as freely across borders as within countries, for example. But this line of thought opens up interesting alternatives to the secular stagnation hypothesis, as I’ll elaborate in my next post.

Keep ’em coming Ben, but you’re not a real blogger until you’ve covered the infield fly rule…

China fact of the day

New brokerage accounts have surged since China’s bull market got running mid-2014. The number of new trading accounts hit a five-year high in early March. But as you can see in the chart above, a lot of those new investors probably aren’t the savviest.

Some 67.6% of households that opened new accounts in the past quarter haven’t graduated from high school, according Orlik’s chart, which comes from a large-scale quarterly national survey of household assets and income conducted by Gan Li of the Southwestern University of Finance and Economics. Only 12% have a college education. Among existing investors surveyed, only 25.5% lack a high school diploma; 40.3% have finished college.

From Gwynn Guilford, there is more here.

*Genealogy of American Finance*

By Robert E. Wright and Richard Sylla, Columbia Business School Publishing, this is both a beautiful picture book, coffee table style, and also a history of America’s “Big 50” financial institutions. It appears to be a very impressive creation, full of useful information.

File under “Arrived in my Pile”! You can order it on Amazon here.

Tuesday assorted links

Are more egalitarian societies more likely to adopt school vouchers?

Timothy Hicks has a new and recently published paper:

It is argued in this article that the marketisation of schools policy has a tendency to produce twin effects: an increase in educational inequality, and an increase in general satisfaction with the schooling system. However, the effect on educational inequality is very much stronger where prevailing societal inequality is higher. The result is that cross-party political agreement on the desirability of such reforms is much more likely where societal inequality is lower (as the inequality effects are also lower). Counterintuitively, then, countries that are more egalitarian – and so typically thought of as being more left-wing – will have a higher likelihood of adopting marketisation than more unequal countries. Evidence is drawn from a paired comparison of English and Swedish schools policies from the 1980s to the present. Both the policy history and elite interviews lend considerable support for the theory in terms of both outcomes and mechanisms.

There are less gated versions here, and for the pointer I thank the excellent Kevin Lewis.

The Aztec diet was more nutritious than it may seem at first

Colin M. MacLachlan, in his splendid Imperialism and the Origins of Mexican Culture, reports:

1. Corn gruel and tamales were reinforced with fish, seeds of various kinds, fruit, and honey.

2. Beans were supplemented with meat from iguanas, armadillos, and rabbits.

3. The calcium content of corn was (and still is) increased by alkaline cooking with lime (“nixtamalization,” duh).

4. “Pulque” has “substantial food value,” “whether fermented or fresh.”

5. Dried red maguey worms have 71 percent protein.

6. Axayacatl (a species of aquatic insect sometimes called “water boatmen“) have 68.7% protein.

7. Mesquite pods and seeds have high caloric value.

8.”Tecuitlatl (spirulina), the green scum collected from lakes with high saltwater content, was sold in the market to be eaten with chilies and tomatoes and has been shown to be a modern wonder food.”

As you can see, the world of food really could have evolved along very different lines.

I also enjoyed this line from the book:

The fundamental belief that the gods sacrificed themselves to create the Earth and continued to do so to sustain it locked the gods and humans into a circular dependency — a relationship characterized by fearful respect coupled with regulated violence.

Definitely recommended, and oh yes that reminds me, here is the livestream for my chat later today with Peter Thiel.

Headlines to ponder

Bank of Bird-in-Hand is the only new bank to open in the U.S. since 2010, when the Dodd-Frank law was passed

The WSJ story is here, via Binyamin Appelbaum.

Request for requests for Ben Bernanke, blogger

What would you like him to cover? Please don’t be rude, serious inquiries only. On Twitter Ben claims he will cover “economics, finances, and sometimes baseball.”

Peter Goettler is the new head of Cato

It is a busy morning, here is part of an email from Cato:

The Cato Institute welcomes Peter Goettler, a former managing director at Barclays Capital, as its new President and CEO, effective April 1. Current CEO John Allison is retiring after more than two exemplary years on the job.

Goettler retired in 2008 as a managing director and head of Investment Banking and Debt Capital Markets, Americas, at Barclays Capital, the investment banking division of Barclays Bank, PLC. He also served as chief executive officer for the firm’s businesses in Latin America and head of Global Loans and Global Leveraged Finance. He has been a member of the Cato Institute’s board since last year and a supporter of the Institute for 15 years.

Perhaps more information will pop up on their web site soon.

Ben Bernanke’s blog

For those of you who wonder what “self-recommending” means, now you ought to know…

Addendum: Modeled Behavior adds comment. So does Paul Krugman.

TEDx GMU

University

a part of the School of Recreation, Health and Tourism in the College of Education and Human

Development at George Mason University

Krasnow Institute for Advanced Study at George Mason University

of the School of Music at George Mason University

University

University

Jeff Biddle on migration and air conditioning

Here is the abstract of his piece “Air Conditioning, Migration, and Climate-Related Rent Differentials“:

This paper explores whether the spread of air conditioning in the United States from 1960 to 1990 affected quality of life in warmer areas enough to influence decisions about where to live, or to change North-South wage and rent differentials. Using measures designed to identify climates in which air conditioning would have made the biggest difference, I found little evidence that the flow of elderly migrants to MSAs with such climates increased over the period. Following Roback (1982), I analyzed data on MSA wages, rents, and climates from 1960 to 1990, and find that the implicit price of these hot summer climates did not change significantly from 1960 to 1980, then became significantly negative in 1990. This contrary to what one would expect if air conditioning made hot summers more bearable. I presented evidence that hot summers are an inferior good, which would explain part of the negative movement in the implicit price of a hot summer, and evidence consistent with the hypothesis that the marginal person migrating from colder to hotter MSAs dislikes summer heat more than does the average resident of a hot MSA, which would also exert downward pressure on the implicit price of a hot summer.

The pointer is from Ross Emmett in the MR comments section, very useful comments overall. Biddle has two other pieces on the history of air conditioning, and Biddle has other interesting pieces as well, he is apparently an underappreciated economist.

Here Scott Sumner details the import of state income taxes. In my view not the “main” factor, but a significant factor nonetheless, excerpt: “On the west coast, all states grew faster than the national average. Yes, its climate is nicer that the south central region. But look at the more detailed data and you’ll see that hot and sunny Washington state and Alaska grew the fastest of five bordering the Pacific. And oh by the way, Washington and Alaska are the only two with no state income tax.” I’ll add this point: to the extent income inequality is rising, a relatively small number of cross-state migrants can lead to a noticeable difference in cross-state growth and job creation rates. And the high earners are precisely those who are most able and most likely to leave a high-tax state for a low-tax state.

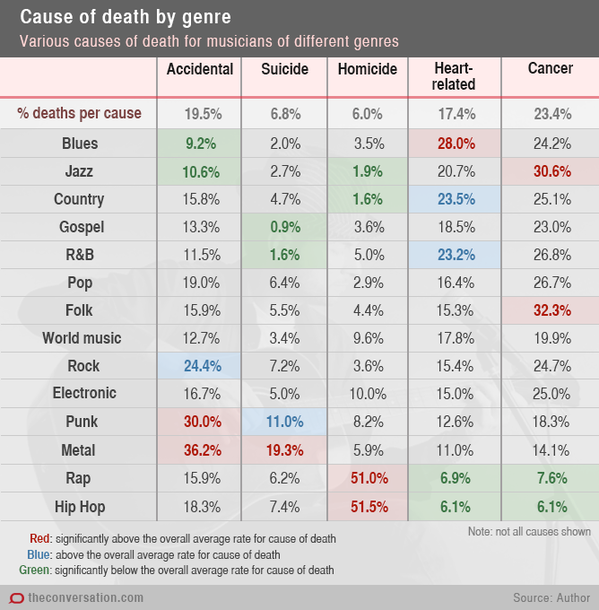

How a genre of music affects life expectancy of famous musicians in that genre

That is from Dianne Theodora Kenny, via Ted Gioia. Kenny notes:

For male musicians across all genres, accidental death (including all vehicular incidents and accidental overdose) accounted for almost 20% of all deaths. But accidental death for rock musicians was higher than this (24.4%) and for metal musicians higher still (36.2%).

Suicide accounted for almost 7% of all deaths in the total sample. However, for punk musicians, suicide accounted for 11% of deaths; for metal musicians, a staggering 19.3%. At just 0.9%, gospel musicians had the lowest suicide rate of all the genres studied.

Murder accounted for 6.0% of deaths across the sample, but was the cause of 51% of deaths in rap musicians and 51.5% of deaths for hip hop musicians, to date.

Beware selection, because of course most rap musicians aren’t dead yet. This problem will be more extreme, the younger is the genre. Another selection effect may be that getting killed, or dying in an unusual way, contributes to your fame.

Facts about MIT economics

1. It is believed that MIT graduating Ph.d. students are more likely to stay in academia than those from any other school or field.

2. Across 1977-2011, MIT economists made up 34 percent of the members of the CEA, and Robert Solow supervised one-third of that group.

3. Even in the early days of MIT, Paul Samuelson was not a major thesis advisor, and his students were not so likely to return to MIT as faculty.

4. Out of 35 J.B. Clark medalists until 2012, 47% of them have some affiliation with MIT, either a degree from there or teaching there.

5. As of a few years ago (I am not sure of the exact date), there were 1316 holders of an MIT Ph.d. in economics.

6. In the 2000s, Daron Acemoglu was the most active thesis advisor at MIT.

That is all from “MIT’s Rise to Prominence: Outline of a Collective Biography,” by Andrej Svorenčík. There are various versions of that article here, the jstor version here, and it is reprinted in MIT and the Transformation of American Economics, edited by E. Roy Weintraub.

Assorted links

1. Sam Cooke with the Soul Stirrers (music video).

2. How much does time spent with your kids matter, ages 3-11 edition?

3. The myth of Europe’s little ice age.

4. The intangible corporation. And competition and working conditions, a rebuttal to me from Stumbling and Mumbling.

5. There is no great stagnation.

6. Yuval Levin on what conservatives and libertarians share.