Category: Current Affairs

To what extent will factories return to cities?

Cities and small towns have tried to revitalize their downtowns by rolling back certain rules and requirements to help promote new developments and bring life to empty streets.

Now, they’re returning to an earlier era, when craftspeople such as food makers, woodworkers and apparel designers were integral parts of neighborhood life, and economic activity revolved around them.

New York City changed its zoning rules last year for the first time in decades to allow small-scale producers in neighborhoods where they had long been restricted. The City of Elgin, a suburb of Chicago, approved a code change last fall allowing retailers to make and sell products in the same space. In 2022, Baltimore passed a bill that allows small-scale food processing and art-studio-related businesses in commercial zones.

And Seattle’s City Council will vote in September on a plan that includes changing rules to allow artisan manufacturers in residential neighborhoods. Supporters said the proposal would help create the kind of walkable mixed-use neighborhoods that were common in an earlier era.

…Over the past decade, hundreds of U.S. cities and small towns have revised their land-use codes to allow small-scale producers — from coffee roasters to makers of jewelry and furniture — in downtowns and neighborhoods. Many small producers started to disappear from those areas around the turn of the 20th century with the advent of mass production; as large-scale factories generated enormous waste and pollution, cities restricted them near residences. Now, most of the businesses allowed to operate under the new rules employ between one and 30 people.

Blame Canada! Measles Edition

Polimath has a good post on measles. The recent spike in U.S. cases has drawn alarm. As the New York Times reports:

There have now been more measles cases in 2025 than in any other year since the contagious virus was declared eliminated in the United States in 2000, according to new data released Wednesday by the Centers for Disease Control and Prevention.

The grim milestone represents an alarming setback for the country’s public health and heightens concerns that if childhood vaccination rates do not improve, deadly outbreaks of measles — once considered a disease of the past — will become the new normal.

But as Polimath notes, U.S. vaccination rates remain above 90% nationally. The problem isn’t broad domestic anti-vax sentiment but rather concentrated gaps in coverage, often within insular religious communities. These local shortfalls do explain how outbreaks spread once they begin—but how do they begin in the first place, given these communities are islands within a largely vaccinated country? Polimath says blame Canada! (and Mexico!)

The greater concern in my mind is not the problem of low measles vaccination coverage in the United States, but among our immediate neighbors. In Ontario, the MMR vaccination rate among 7-year-olds is under 70%. As in the examples above, this rate seems to be particularly low “in specific communities”, whatever that is supposed to mean. This has resulted in the ongoing spread of measles such that Ontario’s measles infection rate is 40 times higher than the United States. Canada officially “eliminated” measles in 1998. But with vaccine rates as low as they are, it seems like Canada is at risk for losing that “elimination” status and becoming an international source for measles.

Similarly, Mexico is having a measles outbreak that is substantially worse than the US outbreak. Importantly, the Mexican outbreak has been the worst in the Chihuahua province (over 3,000 cases), which borders Texas and New Mexico.

I’m less interested in blame than in the useful reminder that not all politics is American politics. Vaccination rates have dipped worldwide and not in response to U.S. politics or RFK Jr. In fact, despite RFK Jr. the U.S. is doing better than some of its North American and European peers. Outbreaks here may be triggered by cross-border exposure, not failures in U.S. public health alone. Not all politics is American—and not all American outcomes are made in America.

Hat tip: the excellent Stephen Landry.

Polymarket on the next Fed chair

Scott Bessent, Kevin Warsh, and Kevin Hassett are the clear leaders, in that order.

Surveillance is growing

California residents who launched fireworks for the 4th of July have tickets coming in the mail, thanks to police drones that were taking note. One resident, for example, racked up $100,000 in fines last summer due to the illegal use of fireworks. “If you think you got away with it, you probably didn’t,” said Sacramento Fire Department Captain Justin Sylvia. “What may have been a $1,000 fine for one occurrence last year could now be $30,000 because you lit off so many.” Homeowners who weren’t even present at the property also have tickets coming in the mail due to the social host ordinance.

Here is the source. Elsewhere (NYT):

Hertz and other agencies are increasingly relying on scanners that use high-res imaging and A.I. to flag even tiny blemishes, and customers aren’t happy…

Developed by a company called UVeye, the scanning system works by capturing thousands of high-resolution images from all angles as a vehicle passes through a rental lot’s gates at pickup and return. A.I. then compares those images and flags any discrepancies.

The system automatically creates and sends damage reports, Ms. Spencer said. An employee reviews the report only if a customer flags an issue after receiving the bill. She added that fewer than 3 percent of vehicles scanned by the A.I. system show any billable damage.

I await the next installment in this series.

The Sputnik vs. DeepSeek Moment: Why the Difference?

In 1957, the Soviet Union launched Sputnik triggering a national reckoning in the United States. Americans questioned the strength of their education system, scientific capabilities, industrial base—even their national character. The country’s self-image as a global leader was shaken, creating the Sputnik moment.

The response was swift and ambitious. NSF funding tripled in a year and increased by a factor of more than ten by the end of the decade. The National Defense Education Act overhauled universities and created new student loan programs for foreign language students and engineers. High schools redesigned curricula around the “new math.” Homework doubled. NASA and ARPA (later DARPA) were created in 1958. NASA’s budget rocketed upwards to nearly 5% of all federal spending and R&D spending overall increased to well over 10% of federal spending. Immigration rules were liberalized (perhaps not in direct response to Sputnik but as part of the ethos of the time). Foreign talent was attracted. Tariff barriers continued to fall and the US engaged with international organizations and promoted globalization..

The U.S. answered Sputnik with bold competition not an aggrieved whine that America had been ripped off and abused.

America’s response to rising scientific competition from China—symbolized by DeepSeek’s R1 matching OpenAI’s o1—has been very different. The DeepSeek Moment has been met not with resolve and competition but with anxiety and retreat.

Trump has proposed slashing the NIH budget by nearly 40% and NSF by 56%. The universities have been attacked, creating chaos for scientific funding. International collaboration is being strangled by red tape. Foreign scientists are leaving or staying away. Tariffs have hit highs not seen since the Great Depression and the US has moved away from the international order.

Some of this is new and some of it is an acceleration of already existing trends. In Launching the Innovation Renaissance, for example, I said that by the Federal budget numbers, America is a warfare-welfare state not an innovation state. However, to be fair, there are some bright spots. Market‑driven research might partially offset public cuts. Big‑tech R&D now exceeds $200 billion annually—more than the entire federal government spending on R&D. Not everything we did post-Sputnik was wise nor is everything we are doing today foolish.

Nevertheless, the contrast is stark: Sputnik spurred investment and ambition. America doubled down. DeepSeek has sparked defensiveness and retreat. We appear to be folding.

Question of the hour. Why has America responded so differently to similar challenges? Can understanding that pivot help to reverse it? Show your work.

The revival of socialism is an example of negative emotional contagion

That is the theme of my latest Free Press column. Rather than present the argument again, let me move directly to the trolling part of the piece:

Even the Soviet Union had some positive and forward-looking elements to its socialist doctrine. The stated goal was to overtake the United States, not “degrowth.” You were supposed to have kids to support the glory of communism, not give up on the idea because the world was too dreadful. Socialist labor was supposed to be fun and rewarding, not something to whine about. Furthermore, there were top performers in every category, including in the schools. Moscow State University was a self-consciously elite institution that intended to remain as such. However skewed the standards may have been, there was an intense desire to measure the best and (sometimes) reward them with foreign travel, as in chess and pianism. In an often distorted and unfair way, some parts of the Soviet system respected the notion of progress. For all the horrors of Soviet communism, at least along a few dimensions it had better ideals than some of those from today, including the undesirability of having children, and a dislike of economic growth.

There is much more at the link.

What should I ask Anne Appelbaum?

Yes, I will be doing a Conversation with her. From Wikipedia:

Anne Elizabeth Applebaum…is an American journalist and historian. She has written about the history of Communism and the development of civil society in Central and Eastern Europe. She became a Polish citizen in 2013.

Applebaum has worked at The Economist and The Spectator magazines, and she was a member of the editorial board of The Washington Post (2002–2006). She won the Pulitzer Prize for General Nonfiction in 2004 for Gulag: A History. She is a staff writer for The Atlantic magazine, as well as a senior fellow of the Agora Institute and the School of Advanced International Studies at Johns Hopkins University .

But she has done more yet, including work on a Polish cuisine cookbook. So what should I ask her?

The Paradox of India

Tyler often talks about cracking cultural codes. India is the hardest—and therefore the most fascinating—cultural code I’ve encountered. The superb post The Paradox of India by Samir Varma helps to unlock some of these codes. Varma is good at describing:

In 2004, something extraordinary happened that perfectly captured India’s unique nature: A Roman Catholic woman (Sonia Gandhi) voluntarily gave up the Prime Ministership to a Sikh (Manmohan Singh) in a ceremony presided over by a Muslim President (A.P.J. Abdul Kalam) in a Hindu-majority country.

And nobody commented on it.

Think about that. In how many countries could this happen without it being THE story? In India, the headlines focused on economic policy and coalition politics. The religious identities of the key players were barely mentioned because, well, what would be the point? This is how India works.

This wasn’t tolerance—it was something deeper. It was the lived experience of a civilization where your accountant might be Jain, your doctor Parsi, your mechanic Muslim, your teacher Christian, and your vegetable vendor Hindu. Where festival holidays meant everyone got days off for Diwali, Eid, Christmas, Guru Nanak Jayanti, and Good Friday. Where secularism isn’t the absence of religion but the presence of all religions.

But goes beyond that:

You might be thinking: “This is fascinating, but I’m not Indian. I can’t draw on 5,000 years of civilizational memory. How does any of this help me navigate my increasingly polarized world?”

Here’s what I’ve learned from watching India work its magic: The mental moves that make pluralism possible aren’t mystical—they’re learnable. Think of them as cognitive tools:

The And/And Instead of Either/Or: When faced with contradictions, resist the Western urge to resolve them. Can something be both sacred and commercial? Both ancient and modern? Both yours and mine? Indians instinctively answer yes.

Contextual Truth Over Universal Law: What’s right for a Jain isn’t right for a Bengali, and that’s okay. Truth can be plural without being relative. Multiple valid perspectives can coexist without canceling each other out.

Strategic Ambiguity as Wisdom: Not everything needs to be defined, categorized, and resolved. Sometimes the wisest response is a head waggle that means yes, no, and maybe all at once.

Code-Switching as a Life Skill: Indians don’t just switch languages—they switch entire worldviews depending on context. At work, modern. At home, traditional. With friends, fusion. This isn’t hypocrisy; it’s sophisticated social navigation.

The lesson isn’t “be more tolerant.” It’s “develop comfort with unresolved multiplicity.” In a world demanding you pick sides, the Indian model suggests a radical alternative: Don’t.

In our age of rising nationalism and cultural purism, when countries are building walls and communities are retreating into echo chambers, India stands as a glorious, maddening, inspiring mess—proof that diversity isn’t just manageable but might be the secret to civilizational immortality.

After all, it’s hard to kill something that contains multitudes. When one part struggles, another thrives. When one tradition calcifies, another innovates. When one community turns inward, another builds bridges.

It’s not a bug. It’s a feature.

And maybe, just maybe, it’s exactly what the world needs to remember right now.

Read the whole thing. Part 1 of 3.

Labour considers fast-tracking approval of big projects

There are a few modest signs of progress in the UK (and Canada):

Ministers are exploring using the powers of parliament to cut the time it takes to approve new railways, power stations and other infrastructure projects.

In an attempt to promote growth, the government is examining whether it could pass legislation that would allow transport, energy and new town housing projects to circumvent swathes of the planning process.

The move could limit the ability of opponents to challenge projects in the courts and reduce scrutiny of some developments. It is loosely modelled on a Canadian scheme that was the brainchild of Mark Carney, the new prime minister and a former governor of the Bank of England.

The One Canadian Economy Act was passed by Canada’s parliament in June and gives Carney’s government powers to fast-track national projects. The Treasury is understood to be examining how a UK version could speed up the approval process for nationally significant infrastructure projects, such as offshore wind farms or even a third runway at Heathrow.

Here is more from The Times.

I write on the BBB for The Free Press

I view the Big Beautiful Bill of Trump as one of the most radical experiments in fiscal policy in my lifetime.

In essence, Trump has decided to push all of his chips to the center of the table and bet on the American economy. I would not have proposed this bill, as critics are correct to note that it increases the estimated U.S. debt by $3 to $4 trillion over the next 10 years. That is a massive boost in leverage at a time when America’s fiscal position already appeared unsustainable.

Nonetheless it is worth trying to steelman the Trump decision, and understand when it might pay off. The biggest deficit buster in the bill is the extension—and indeed boost to cuts—in corporate income tax rates. That means more resources for corporations, and stronger incentives to invest. The question is what the American economy can expect to get from that.

Since 1980, returns on resources invested in American corporations have averaged in the 9 to 11 percent range. There is no guarantee such returns will hold in the future, or that they will hold for the extra investment induced by the corporate tax cuts (e.g., maybe companies will just stash the new profits in Treasury bills). Still, an optimist might believe we can get a high rate of return on that money, thereby making America much wealthier and also more fiscally stable.

A second possible ace in the hole is pending improvements in artificial intelligence and their potential economic impact. It is already the case that U.S. productivity has risen over the last few years, and perhaps it will go up some more. That could make our new debt burden more easily affordable.

My view of the fiscal authority—Congress—is that its primary fiduciary duty is to act responsibly. The Big Beautiful Bill is not that. Nonetheless, I am reminded of the classic scene in the 1971 movie Dirty Harry when Clint Eastwood (Harry) asks, “Do I feel lucky?” Here’s to hoping.

Here is the link, there are numerous other interesting contributions, including from Furman, Summers, Scanlon, Salaam and others.

Tom Tugendhat on British economic stagnation

Second, and even more detrimental to younger generations, is a set of policies that have artificially created a highly damaging cult of housing. For many decades, too few houses have been built in the UK. Thanks in part to the tax system, housing has been transformed from a place to live and raise a family into a de facto tax free retirement fund that excludes the young. More than 56 per cent of the UK’s total housing wealth is owned by those over 60, while home ownership among those under 35 has collapsed to just 6 per cent. This has had profound social and economic consequences as fewer people marry and have children, further impairing long-term demographic regeneration. The result? More than 80 per cent of the growth in real per capita wealth over the past 30 years has come from appreciation of real estate, not from the financial investment that powers the economy.

Michael Tory, co-founder of Ondra Partners, has argued that this capital misallocation has created a self-reinforcing cycle, weakening our national and economic security. Without productive capital, we are wholly dependent on foreign investment and imported labour, straining housing supply and public services. These distortions can only be corrected through a rebalancing of our national capital allocation that puts long-term national interest above narrow electoral calculation. That means levelling the investment playing field to reduce the taxes on those whose long-term savings and investments in Britain’s future actually employ people and generate growth. Along with building more houses and stricter migration controls, this would bring home ownership into reach for younger generations.

British pension funds should invest more in British businesses as well. Here is more from the FT.

Trump Accounts are a Big Deal

Trump’s One Big Beautiful Bill Act was signed into law on July 4, 2025. It’s so big that many significant features have been little discussed. Trump Accounts are one such feature under which every newborn citizen gets $1000 invested in the stock market. These accounts could radically change social welfare in the United States and be one important step on the way to a UBI or UBWealth. Here are some details:

- Government Contribution: A one-time $1,000 contribution per eligible child, invested in a low-cost, diversified U.S. stock index fund.

- Eligibility: U.S. citizen children born between January 1, 2025, and December 31, 2028 (with a valid Social Security number and at least one parent with a valid Social Security number).

- Employer Contributions: Employers can contribute up to $2,500 annually per employee’s child, and these contributions are excluded from the employee’s gross income for tax purposes. These are subject to the overall $5,000 annual contribution limit (indexed for inflation) per child (which includes parental contributions).

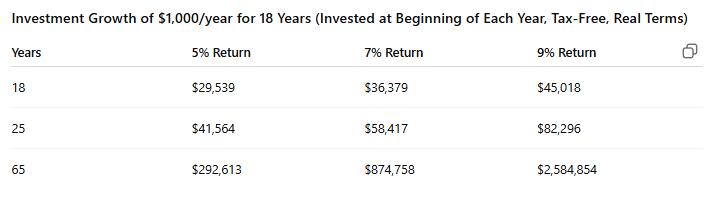

The employer contribution strikes me as important. Suppose that in addition to the initial $1000 government payment that on average $1000 is added per year for 18 years (by a combination of parent and parent employer contributions). Note that this is below the maximum allowed annual contribution of $5000. At a historically reasonable 7% real rate of return these accounts will be worth ~36k at age 18 (when the money can be fully withdrawn), $58k at age 25 and $875k at age 65 subject to uncertainty of course as indicated below.

The $1000 initial payment is available only for newborns but, as I read the text, the parent and employer donations can be made for any child under the age of 18 so this is basically an IRA for children. It’s slightly complicated because if the child or parents put after-tax money into the account that is not taxed at withdrawal (you get your basis back) but everything else is taxed on withdrawal as ordinary income like an IRA. There are approximately 3.5 million citizen births a year so the program will have direct costs of $3.5 billion plus indirect costs from reduced taxes due to the tax-free yearly contribution allowance, which as noted could be quite large as it can go to any child. Thus the program could be quite expensive. On the other hand, it’s clear that the accounts could reduce reliance on social security if held for long periods of time. The $1000 initial contribution is limited to four years but once 14 million kids get them, the demand will be to make them permanent.

BBB on drug price negotiations

The sweeping Republican policy bill that awaits President Trump’s signature on Friday includes a little-noticed victory for the drug industry.

The legislation allows more medications to be exempt from Medicare’s price negotiation program, which was created to lower the government’s drug spending. Now, manufacturers will be able to keep those prices higher.

The change will cut into the government’s savings from the negotiation program by nearly $5 billion over a decade, according to an estimate by the nonpartisan Congressional Budget Office.

…the new bill spares drugs that are approved to treat multiple rare diseases. They can still be subject to price negotiations later if they are approved for larger groups of patients, though the change delays those lower prices.

This is the most significant change to the Medicare negotiation program since it was created in 2022 by Democrats in Congress.

Here is more from the NYT. Knowledge of detail is important in such matters, but one hopes this is the good news it appears to be.

New York facts of the day

It’s truly astonishing how fiscally irresponsible New York is. The state budget proposal calls for $254 billion in spending, which is 8.3 percent higher than last year. That comes despite New York’s population having peaked in 2020. It’s a spending increase far in excess of the rate of inflation to provide government services for fewer people.

Ditch compares the New York state budget to the Florida state budget, a sensible comparison since both are big states with major urban and rural areas and high levels of demographic and economic diversity. He finds:

- New York’s spending per capita was 30 percent higher than Florida’s in 2000. It was 133 percent higher last year.

- New York’s Medicaid spending per capita was 112 percent higher than Florida’s in 2000. It was 208 percent higher last year. Florida has not expanded Medicaid under Obamacare, while New York has expanded it more aggressively than any other state. “For perspective, in 2024 New York spent nearly as much per capita on Medicaid ($4,551) as Florida did for its entire state budget ($5,076).”

- New York’s education spending per student is highest in the country, at about $35,000. Florida spends about $13,000 per student. Florida fourth-graders rank third in the country in reading and fourth in math. New York fourth-graders rank 36th and 46th.

- Florida has surpassed New York in population and continues to boom.

Here is more from Dominic Pino.

Amazon’s Robotic Revolution

Amazon now employs almost as many robots as humans leading to huge productivity improvements. From the second graph, “end-to-end” packages handled by Amazon rose from 175 in 2015 to nearly 4000 in 2025. Incredible. Excellent piece in the WSJ.

Hat tip: Edward Conard.