Category: Current Affairs

Bailouts Forever

When interest rates rise, the price of long-term assets falls. Consequently, when the Fed began raising interest rates in 2022, the value of bonds and mortgages dropped, causing significant accounting losses for banks heavily invested in these assets. Silicon Valley Bank went bust, for example, because depositors fled upon realizing it was holding lots of Treasury bonds.

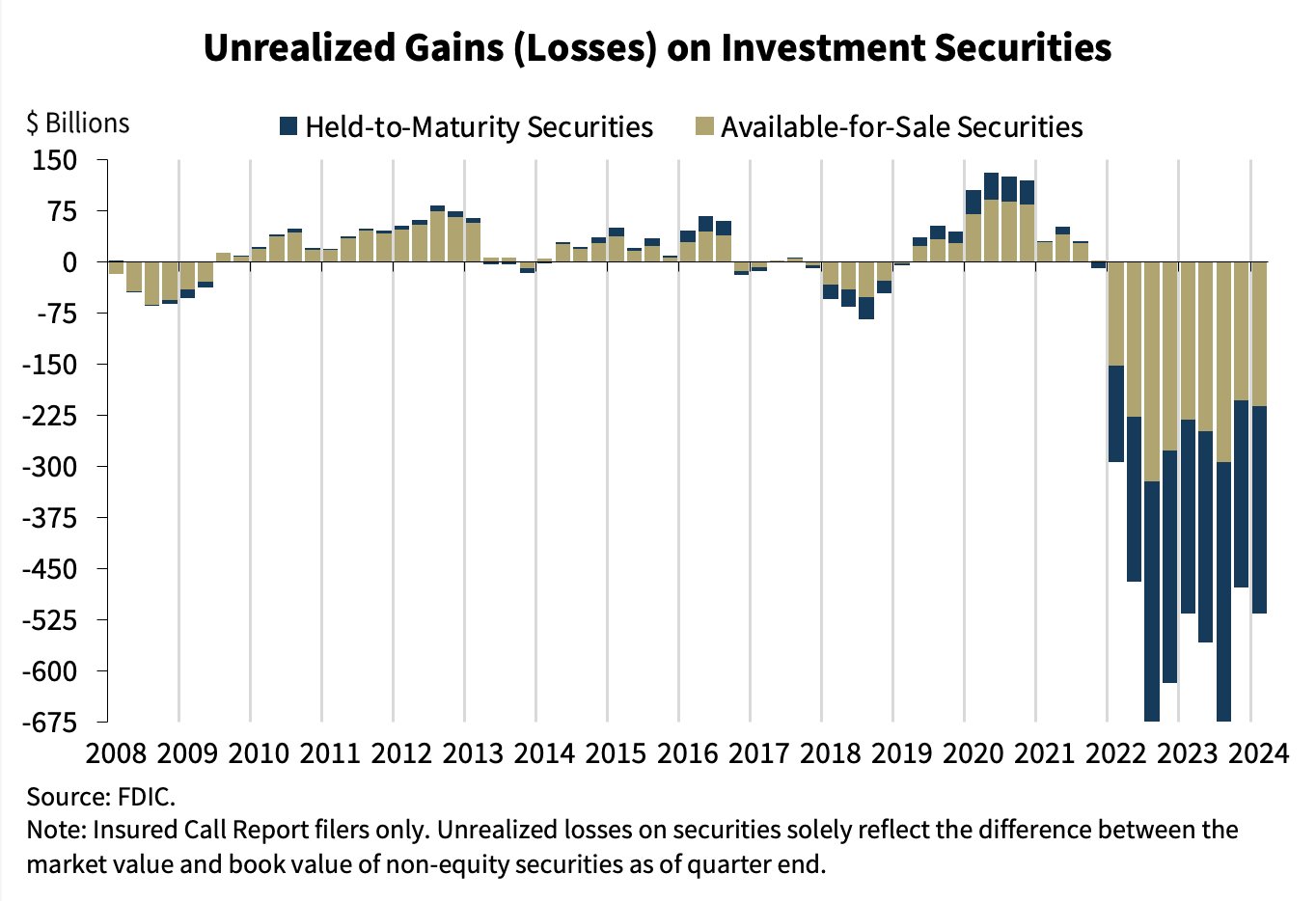

Interest rates remain high and many banks have large unrealized losses on their books. According to the latest FDIC data (see below) unrealized losses currently total $516.5 billion, far exceeding levels seen during the 2008-2009 financial crisis. Price risk is not the same as default risk and if the banks can hold onto their assets until maturity then they will be solvent. The real danger, as with SVB, is if unrealized losses are combined with a deposit run. So far that doesn’t seem to be happening but it’s well within the realm of possibility.

In other news, Hypertext has an issue devoted to Anat Admati and Martin Hellwig’s The Banker’s New Clothes. Admati and Hellwig write:

The 2010 Dodd-Frank Act in the United States promised the end of bank bailouts and “too-big-to-fail” institutions. The European Union’s 2014 legislation for dealing with banks likely to fail was claimed to provide “a framework” to “deal with banks that experience financial difficulties without either using taxpayer money or endangering financial stability.” In November 2014, Mark Carney, at the time the governor of the Bank of England and chair of the Financial Stability Board (FSB), a body of financial regulators from around the world, announced triumphantly that an agreement about new rules for the thirty largest and most complex, “globally systemic” financial institutions would prevent bailouts in the future. Many people in politics and the media believed these claims.

Two From the Tabarrok Brothers

Maxwell Tabarrok offers an excellent review of an important paper.

Taxation and Innovation in the 20th Century is a 2018 paper by Ufuk Akcigit, John Grigsby, Tom Nicholas, and Stefanie Stantcheva that provides some answers. They collect and clean new datasets on patenting, corporate and individual incomes, and state-level tax rates that extend back to the early 20th century. The headline result: taxes are a huge drag on innovation. A one percent increase in the marginal tax rate for 90th percentile income earners decreases the number of patents and inventors by 2%. The corporate tax rate is even more important, with a one percent increase causing 2.8% fewer patents and 2.3% fewer inventors.

Especially useful is Max’s back of the envelope calculation putting this result in the context of other methods to increases innovation.

Read the whole thing.

For something completely different, Connor Tabarrok offers an update on Charlotte the Stingray:

A “miracle pregnancy” picked up by national news brought huge business to a small-town aquarium, but months after the famous stingray was due, there are still no pups. Are we being scammed by a fish?

I particularly liked this line:

Taking all of this into account, my stance is that even if they got it on, it’s unlikely that this shark will have to dish out any child support to Charlotte’s pups.

Read the whole thing.

Are MR readers more interested in tax policy or virgin birth stingrays? We shall see.

Those circularity-inducing service sector jobs

Yes, in Tokyo women pay men in make-up to flatter them. But what does the whole market look like?

Yamada Kurumi, a client, works at a brothel to earn enough money to visit the clubs, which she does about once a week. She had boyfriends in the past but finds hosts more exciting. She is unsure whether to seek an office job after graduating from college or to carry on with sex work, which pays better. “A lot of people start losing touch with friends once they get addicted to host clubs,” says Ms Yamada. “My host is already part of my everyday life…If I get a normal job, I probably won’t be able to see him any more. That scares me.”

Here is more from The Economist.

Deadly Precaution

MSNBC asked me to put together my thoughts on the FDA and sunscreen. I think the piece came out very well. Here are some key grafs:

…In the European Union, sunscreens are regulated as cosmetics, which means greater flexibility in approving active ingredients. In the U.S., sunscreens are regulated as drugs, which means getting new ingredients approved is an expensive and time-consuming process. Because they’re treated as cosmetics, European-made sunscreens can draw on a wider variety of ingredients that protect better and are also less oily, less chalky and last longer. Does the FDA’s lengthier and more demanding approval process mean U.S. sunscreens are safer than their European counterparts? Not at all. In fact, American sunscreens may be less safe.

Sunscreens protect by blocking ultraviolet rays from penetrating the skin. Ultraviolet B (UVB) rays, with their shorter wavelength, primarily affect the outer skin layer and are the main cause of sunburn. In contrast, ultraviolet A (UVA) rays have a longer wavelength, penetrate more deeply into the skin and contribute to wrinkling, aging and the development of melanoma, the deadliest form of skin cancer. In many ways, UVA rays are more dangerous than UVB rays because they are more insidious. UVB rays hit when the sun is bright, and because they burn they come with a natural warning. UVA rays, though, can pass through clouds and cause skin cancer without generating obvious skin damage.

The problem is that American sunscreens work better against UVB rays than against the more dangerous UVA rays. That is, they’re better at preventing sunburn than skin cancer. In fact, many U.S. sunscreens would fail European standards for UVA protection. Precisely because European sunscreens can draw on more ingredients, they can protect better against UVA rays. Thus, instead of being safer, U.S. sunscreens may be riskier.

Most op-eds on the sunscreen issue stop there but I like to put sunscreen delay into a larger context:

Dangerous precaution should be a familiar story. During the Covid pandemic, Europe approved rapid-antigen tests much more quickly than the U.S. did. As a result, the U.S. floundered for months while infected people unknowingly spread disease. By one careful estimate, over 100,000 lives could have been saved had rapid tests been available in the U.S. sooner.

I also discuss cough medicine in the op-ed and, of course, I propose a solution:

If a medical drug or device has been approved by another developed country, a country that the World Health Organization recognizes as a stringent regulatory authority, then it ought to be fast-tracked for approval in the U.S…Americans traveling in Europe do not hesitate to use European sunscreens, rapid tests or cough medicine, because they know the European Medicines Agency is a careful regulator, at least on par with the FDA. But if Americans in Europe don’t hesitate to use European-approved pharmaceuticals, then why are these same pharmaceuticals banned for Americans in America?

Peer approval is working in other regulatory fields. A German driver’s license, for example, is recognized as legitimate — i.e., there’s no need to take another driving test — in most U.S. states and vice versa. And the FDA does recognize some peers. When it comes to food regulation, for example, the FDA recognizes the Canadian Food Inspection Agency as a peer. Peer approval means that food imports from and exports to Canada can be sped through regulatory paperwork, bringing benefits to both Canadians and Americans.

In short, the FDA’s overly cautious approach on sunscreens is a lesson in how precaution can be dangerous. By adopting a peer-approval system, we can prevent deadly delays and provide Americans with better sunscreens, effective rapid tests and superior cold medicines. This approach, supported by both sides of the political aisle, can modernize our regulations and ensure that Americans have timely access to the best health products. It’s time to move forward and turn caution into action for the sake of public health and for less risky time in the sun.

The Sea Change on Crypto-Regulation

In the last few weeks there has been a sea change in crypto regulation:

1. Bitcoin spot ETFs were approved–reluctantly, after a 3-judge Federal Appeals court ruled unanimously that the SEC had acted arbitrarily and capriciously–but nevertheless opening Bitcoin holdings to institutional investors. Case in point, The State of Wisconsin bought Bitcoin ETFs for its pension fund.

2. In a very unusual move, SAB 121, was overturned by the House and then, even more surprisingly, overturned by the Senate including the votes of many Democrats. < href=”https://www.sec.gov/oca/staff-accounting-bulletin-121″>SAB 121 is an SEC staff accounting bulletin (not law but guidance) that said to banks if you hold crypto for your customers, i.e. a custody service, you must account for it on your balance sheet. This guidance does not apply to custody of any other asset. Essentially, SAB 121 made it prohibitive for banks to offer custody services for crypto because that service would then impact all kinds of risk and asset regulations on the bank. Aside from singling out crypto, the SEC is not a regulator of banks so this seemed like a regulatory overreach.

President Biden said he will veto but that is no longer certain. It wasn’t just crypto lobbying against SAB 121 but traditional banks. The banks point to the approval of Bitcoin ETFs saying, quite logically, why can’t we custody these ETFs the way we do every other ETF? Senate Majority leader Chuck Schumer, D-N.Y., sometimes called Wall Street’s man in Washington, voted in favor of nullifying SAB 121. Schumer can read the room.

3. The House voted to ban the Fed from establishing a Central Bank Digital Currency (CBDC).

4. The House approved a wide-ranging bill to (finally!) establish regulations for digital assets markets. The vote was 279-136 in favor with many Democrats crossing party lines to support it.

5. After saying nothing for months, usually a bad sign, the SEC approved Ethereum spot ETFs. On the surface, this might have seemed logically inevitable given the approval of Bitcoin spot ETFs but many people thought the SEC would do everything it could to find daylight between Bitcoin and ETH. Instead, it tacitly acknowledged that ETH is a commodity and not a security.

Why is this happening? I see three main factors at play. First, crypto is becoming integrated with traditional finance. As the big banks get involved, the politics around crypto are shifting. Second, crypto is becoming normalized. Ironically, the prosecution of Sam Bankman-Fried, Changpeng Zhao and manipulators like Avraham Eisenberg may have convinced some U.S. regulators that crypto doesn’t have to be destroyed, it can be tamed. Nakamoto might not be pleased but realistically this was the only option to move forward. Eventually, everyone wants to pay their mortgage. Third, Trump’s strong endorsement of crypto has alarmed the Biden administration. Most political issues are firmly divided along party lines, but crypto remains an open issue. With millions of crypto owners in the United States, a significant number are highly motivated to vote their wallets. Biden doesn’t want to give the crypto issue to Trump.

None of this means we are entering crypto Nirvana but as far as regulation is concerned a lot has changed in just a matter of weeks.

Full Disclosure: I am an advisor to several firms in the crypto space including MultiversX, Bluechip and 0L.

Cross-border gunshot arbitrage markets in everything, Jean Baudrillard gone wrong edition

Federal prosecutors on Friday announced charges against five people in connection with a Chicago-based scheme that staged armed robberies so the purported victims could apply for U.S. immigration visas reserved for legitimate crime victims…

Officials believe hundreds of people, including some who traveled from out of town, posed as customers in dozens of businesses across Chicago and elsewhere, all hoping to win favorable immigration status by becoming “victims” of pre-arranged “armed robberies.”

During a staged hold-up in Bucktown last year, one of the “robbers” accidentally fired their gun, severely injuring a liquor store clerk, according to one source. During that caper alone, five “customers” were “robbed.”

Here is the full story, via Ian.

*Unit X*

The subtitle of this new and excellent book is How the Pentagon and Silicon Valley are Transforming the Art of War. It is written not by journalists but two insiders to the process, namely Raj M. Shah and Christopher Kirchoff. Here you can read about Eric Schmidt, Brendan McCord, Anduril, Palantir, and much more.

I am not yet finished with the book, in the meantime here is one short excerpt, one that sets the stage for much of what follows:

It turned out that before Silicon Valley tech could be used on the battlefield, we had to go to war to buy it. We had to hack the Pentagon itself — its archaic acquisition procedures, which prevent moving money at Silicon Valley speed. In Silicon Valley, deals are done in days. The eighteen- to twenty-four month process for finalizing contracts used by most of the Pentagon was a nonstarter. No startup CEO trying to book revenue can wait for the earth to circle the sun twice. We needed a new way.

And this bit:

Ukraine avoided power interruptions in part because its over-engineered power grid boasts twice the capacity that the country needs — ironically, the system was originally designed by the Soviets to withstand a NATO attack.

The authors understand both the worlds of tech and bureaucracy very well, kudos to them. Due out in July.

The Generalist interviews me

I was happy with how this turned out, here is one excerpt:

I think we’re overestimating the risks to American democracy. The intellectual class is way too pessimistic. They’re not used to it being rough and tumble, but it’s been that way for most of the country’s history. It’s correct to think that’s unpleasant. But by being polarized and shouting at each other, we actually resolve things and eventually move forward. Not always the right way. I don’t always like the decisions it makes. But I think American democracy is going to be fine.

Polarization has its benefits. In most cases, you say what you think, and sooner or later, someone wins. Abortion is very polarized, for example. I’m not saying which side you should think is correct, but states are re-examining it. Kansas recently voted to allow abortion, and Arizona is in the midst of a debate. Over time, it will be settled—one way or another. Slugging things out is underrated.

Meanwhile, being reasonable with your constituents is overrated. Look at Germany, which has non-ideological, non-polarized politics. They’ve gotten every decision wrong. Their whole strategy of buying cheap energy from Russia to sell to China was a huge blunder. They bet most of their economy on it, and neither of those two things will work out. They also have no military whatsoever. It’s not like, “Ok, they don’t spend enough.” They literally had troops that didn’t have rifles to train with and were forced to use broomsticks.

Germany is truly screwed and won’t face up to it. But when you listen to their politicians speak – and I do understand German – they always sound intelligent and reasonable. They could use a dose of polarization, but they’re afraid because of their history, which I get. But the more you look at their politics, the more you end up liking ours, I would say.

I would note that Germany’s various “centrist” or “coalition of the middle” regimes have brought us AfD, which is polarizing in the worst way and considered to be an extremist party worthy of being spied upon.

And this:

What craft are you spending a lifetime honing?

Shooting a basketball. I’ve done that for the longest, outside of eating and breathing. I’m just not very good at it.

I started doing it when I was about eight. We moved close to a house with a hoop, and all the other kids would gather there and play. It was a social thing, and I started doing it. I kept it going in all the different places I’ve lived. The only country I couldn’t keep the habit going was Germany. But when I was living in New Zealand, I made a special point of it. It’s good exercise, it’s relaxing, you get to be outside. It’s a little cold today, but I did it yesterday, and I’ll do it tomorrow.

It’s important to repeatedly do something you’re not that good at. Most successful people are good at what they do, but if that’s all they do, they lose humility. They find it harder to understand a big chunk of the world that doesn’t have their talent or is simply mediocre. It helps you keep things in perspective.

I’m not terrible at it. I have gotten better, even recently. But no one would say I’m really good.

Interesting throughout, as they like to say.

What is the new Dutch coalition government up to?

Here is one very good thread, here is more. Whatever you make think of these personally, my prediction is they will prove very popular with most European electorates, with local details varying of course.

Just to confirm…

Just to confirm:

– Climate change is unprecedented risk

– Mass adoption of EVs is vital

– Adoption has slowed bc lack of low-priced options

– US companies unable/unwilling to make low-priced EVs

– China is global leader in low-priced EVs

– US to hit China with 100% EV tariffs— John Arnold (@JohnArnoldFndtn) May 12, 2024

There is simply no good reason for such a ruling

A top Wall Street regulator has proposed outlawing election betting in the U.S. derivatives markets, with officials warning that the activity poses a threat to the sanctity of American elections.

The Commodity Futures Trading Commission, which is charged with regulating the vast and complex derivatives markets, voted 3-2 on Friday to issue a new rule proposal that would ban so-called event contracts that effectively act as wagers on political elections. The plan would also prohibit those contracts related to sporting events and even awards ceremonies like the Oscars.

And from the horse’s mouth:

“Contracts involving political events ultimately commoditize and degrade the integrity of the uniquely American experience of participating in the democratic electoral process,” CFTC Chair Rostin Behnam said. “Allowing these contracts would push the CFTC, a financial market regulator, into a position far beyond its Congressional mandate and expertise. To be blunt, such contracts would put the CFTC in the role of an election cop.”

Behnam was joined in supporting the proposal by fellow Democratic Commissioners Kristin Johnson and Christy Goldsmith Romero.

Here is the full Politico article. How can you put such people in charge of things? What else do they want to stop us from doing? Is it so difficult for them to imagine a world where the election forecasts we can find on Predictit — among other sources — simply continue and that is perfectly fine, as it has been for years?

A subculture that is German?

German far-left vandals break through police lines and run for Tesla’s Gigafactory, hoping to disrupt production.

These people clearly hate both fossil fuel cars and electric cars. They are modern-day luddites pic.twitter.com/5aVD6MeNZ3

— Visegrád 24 (@visegrad24) May 10, 2024

And here are some remarks on AI dating.

The manufacture of credibility?

Israel and Iran bombed each other like three weeks ago and now oil prices are low enough that the SPR [Strategic Petroleum Reserve] is looking at buying

That is from Matthew Zeitlin. One read of the current equilibrium is that both Iran and Israel have shown they really do not want to escalate, or perhaps are not able to escalate. Arguably that was less obvious two months ago.

It is hard to establish such credibility unless things get really hairy, and then both parties pull back from the brink.

I don’t think that is the only way to read recent events. An alternative would be “We are witnessing widening concentric circles of violence, and the next round is going to be a doozy.”

Maybe, but so far markets seem to believe the more optimistic scenario.

The US has Low Electricity Prices

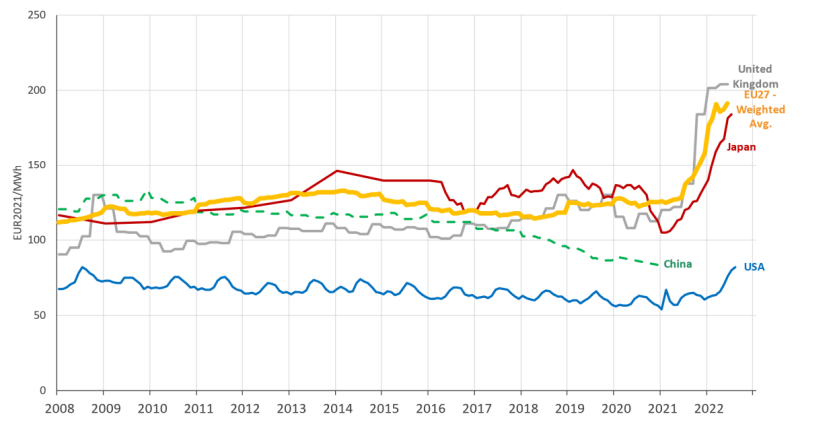

The US has some of the lowest electricity prices in the world. Shown below are industrial retail electricity prices in EU27, USA, UK, China and Japan. Electricity is critical for AI compute, electric cars and more generally reducing carbon footprints. The US needs to build much more electricity infrastructure, by some estimates tripling or quadrupling production. That’s quite possible with deregulation and permitting reform. I am pleased to learn, moreover, that we are starting from a better base than I had imagined.

FTX Customers Poised to Recover All Funds Lost in Collapse

Some of the recoveries stemmed from successful investments that Mr. Bankman-Fried made during his FTX tenure. In 2021, the company had put $500 million into the artificial intelligence company Anthropic. A boom in the A.I. industry made those shares much more valuable. This year, Mr. Ray’s team sold about two-thirds of FTX’s stake for $884 million.

FTX also reached a deal to recover more than $400 million from Modulo Capital, a hedge fund that Mr. Bankman-Fried had financed. And lawyers for FTX filed lawsuits to claw back funds from former company executives and others, including Mr. Bankman-Fried’s parents.

Here is the full NYT story, noting that account holders did not receive (significant) gains in the value of bitcoin that otherwise would have accrued.