Category: Data Source

Do conservative magazines take liberty seriously?

Daniel Klein and Jason Briggeman say maybe not:

Abstract:

Conservatives say they are for small government and individual liberty,

but a

content analysis of leading conservative magazines shows that most have

preponderantly failed to take pro-liberty positions on sex, gambling,

and

drugs. Besides many anti-liberty commissions, the magazines may be

criticized

for anti-liberty omission–that is, failing to oppose anti-liberty

policies.

Magazines investigated include National

Review, The Weekly Standard, The

American Enterprise,

and

The American Spectator. We find that National

Review has had the strongest

record on liberty on the issues treated, while the others have

preponderantly

failed to be pro-liberty or have even been anti-liberty.

Eastern Europe fact of the day

It's a little scary:

borrowed $1.7 trillion abroad, much on short-term maturities. It must

repay – or roll over – $400bn this year, equal to a third of the

region's GDP. Good luck. The credit window has slammed shut….

"This is the largest run on a currency in history," said Mr Jen.

Do people get more depressed in winter?

Some people do, but is it true on average? Maybe not, says Ben Goldacre (via Andrew Sullivan):

Back in 1883

Esquirol commented on the higher incidence of suicide in spring and

early summer. Swinscow showed the same thing with all UK suicides from

1921-1948. So that’s not really winter blues. A study in 2000 looked at all UK suicide data from 1982-96 and found that even this seasonal pattern had pretty much disappeared.

What about elsewhere? A 1974 study on all suicides in North Carolina

(3,672) and admissions to their Veterans Hospital Psychiatry Service

(3,258) from 1965 to 1971 showed no seasonal variation. A 1976 Ontario

study found peaks of suicide and admissions for depression in spring

and autumn. Suicide is highest in Summer, says a paper from Australia in 2003. I’m really not getting this Blue January thing.

Maybe you want data from the general population on mood. A study in 1986

looked at 806 representative males from Finland and found low mood more

common in the summer. Some studies do find higher rates of depressive

symptoms in the winter (Nayyar and Cochrane, 1996; Murase et al.,

1995), but then, some find the opposite results, like a peak in the

spring (Nayham et al., 1994) or summer (Ozaki et al., 1995). One study

from just last month proactively asked 360 patients to rate

their mood regularly, rather than waiting for an event, and found no

relationship, again, between mood and season.

Maybe there are other sources of data you could explore? A paper

looking at GP prescriptions for antidepressants in 1984 found a spring

peak. An earlier paper from 1981 (Williams and Dunn) looks at

prescriptions from 1969-75 and finds peaks in February, May and

October. Another

from the same year looked at GP consultations for depression and found

peaks in May-to-June and November-to-January (they found similar

results for osteoarthritis, oddly).

Hail Ben Goldacre! Here is my previous post on Ben Goldacre.

Parenthetical remarks

That is from Felix Salmon. Felix also points us to this useful piece explaining credit default swaps.

The evolution of income volatility

Shane Jensen and Stephen Shore report:

Recent research has documented a significant rise in the volatility (e.g., expected squared change) of individual incomes in the U.S. since the 1970s. Existing measures of this trend abstract from individual heterogeneity, eff ectively estimating an increase in average volatility. We decompose this increase in average volatility and find that it is far from representative of the experience of most people: there has been no systematic rise in volatility for the vast majority of individuals. The rise in average volatility has been driven almost entirely by a sharp rise in the income volatility of those expected to have the most volatile incomes, identified ex-ante by large income changes in the past. We document that the self-employed and those who self-identify as risk-tolerant are much more likely to have such volatile incomes; these groups have experienced much larger increases in income volatility than the population at large. These results color the policy implications one might draw from the rise in average volatility. While the basic results are apparent from PSID summary statistics, providing a complete characterization of the dynamics of the volatility distribution is a methodological challenge. We resolve these difficulties with a Markovian hierarchical Dirichlet process that builds on work from the non-parametric Bayesian statistics literature.

It is difficult to make the different papers on this topic commensurable, so I would say this is not the final word. Still, it does raise the possibility that rising income volatility is not as fearful as it at first sounds. You'll find many other posts on topic by searching for Jacob Hacker posts on this blog and over at Mark Thoma's, among other places.

Stimulus timing

For travel reasons, I won't get a chance to read through this right away, but here is a CBO report on the stimulus. (and this time the real report) Here is one summary paragraph:

Here is the CBO Director's blog, which offers and links to more information. What do you all think?

I thank Bruce Bartlett for the pointer.

Summing up the AEAs

In case you missed the AEAs, Paul Kedrosky created a tag cloud (using Wordle) from the titles of all 505 papers. Paul is a little surprised that Keynes and crisis are not more prominent – don't worry just wait till next year!

Comparing Recessions

It you look at job losses in this recession compared to previous recessions this recession looks very bad but the labor force is much bigger today than in previous recessions. Thus, if you look at the percentage change in employment you get a different story. The Minneapolis Fed crunches the numbers:

and

Of course, this recession is not yet over but this is useful information. We might not like it but recessions are normal.

Important Addendum: The Fed defines Mildest, Median, Harshest by taking the Mildest employment drop of any recession in that quarter and plotting that. Thus, the Mildest, Median, and Harshest recessions are Frankenstein recessions, cobbled together from other recessions. I do not think this is a good way to express the data. See this update for a better method.

Markets in everything, but out of stock

Transcend 8 GB SDHC SD Class 6 Flash Memory Card TS8GSDHC6E [Amazon Frustration-Free Packaging]

That’s $24.45 on Amazon but out of stock.

The regular version, with "frustration packaging" (my phrase, not theirs), is in stock for $17.45.

I thank Beth for the pointer.

Gift card rescue: bid-ask spreads

On the secondary market, a $100 Brooks Brothers gift card is worth $90 but a $100 Home Depot card is worth $95. Here are further prices (update: the link is now shut down).

For the pointer I thank Robert, a loyal MR reader.

GM fact of the day

As Mark Steyn pointed out on NRO, GM now has a market valuation about a third of Bed, Bath and Beyond.

Here is the link. The Steyn article also offers this:

GM has 96,000 employees but provides health benefits to a million people.

Gold fact of the day

…the world produces a cube of gold that is about 4.3 meters (about 14

feet) on each side every year. In other words, all of the gold produced

worldwide in one year could just about fit in the average person’s

living room!

The total amount of gold, ever produced by mankind, is estimated to fill only one-third of the Washington Monument. Here are the calculations, including an estimate for the even more scarce platinum. Hat tip to Jason Kottke.

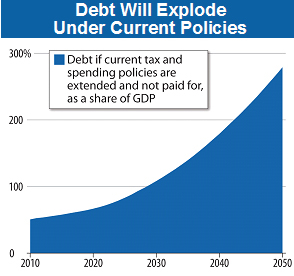

Pre-stimulus picture

Here is my source. Call it crude extrapolation, or say that we should have been running a surplus for the last eight years, but in any case this is where we are at.

Safest and most dangerous U.S. cities

Here is a list, via Craig Newmark. For the large cities, note that of the five safest (San Jose, Honolulu, El Paso, New York, Austin), I believe four have substantial Latino populations. San Diego and San Antonio are next in line for safety. Of the five least safe major cities (Detroit, Baltimore, Memphis, Washington, Philadelphia), none has an especially large Latino population.

Here is a bit more. Here is a lot more.

Infrastructure fact of the day

Spending [on infrastructure] is up 50 percent over the last 10 years, after adjusting for inflation. As a share of the economy, it will be higher this year than in any year since 1981.

That’s from another excellent column by David Leonhardt. The real problem, of course, is the quality of our decisions on infrastructure.