Category: Political Science

Seb Krier

I think this is spot on. The most useful work in the coming years will be about leveraging AI to help improve and reform liberal democracy, the rule of law, separation of powers, free speech, coordination, and constitutional safeguards.

One heuristic I have for AI is: if somone can instantiate their preference or desire really easily, if principal agent problems are materially reduced, if you can no longer rely on inefficiency or bloat as indirect hedge – then the ‘rules of the game’ matter more than ever.

These are all very difficult questions with or without AI. And I’m concerned with two things in particular: first, the easy appeal of anti-elite populism – people who just think ‘well let’s have vetocracy everywhere, let’s leverage the emotions of the masses for short term gain’.

And second, the appeal of scheme-y behaviour – instrumental convergence for political operators. This is harder to pin down, but basically a variant of “I want goal X, so anything that gets me closer to this goal is good” – what leads to all sorts of bad policy and unsavoury alliances.

And instead of trying to 4D chess it or try to recreate politics from first principles, I think technologists should actively enage with experts in all sorts of discplines: constitutional scholars, public choice economists, game theorists etc. Converesely, many of these experts should engage with technologists more instead of coping with obsolete op-eds about how AI is fake or something.

Lastly, improved AI capabilities means you can now use these systems for more things than you could have before. I couldn’t write software a year ago and now I can create a viable app in a day. This dynamic will continue, and will reward people who are agentic and creative.

Are you a local councillor? Well now you have 1000 agents at your disposal – what can you now that that was otherwise unthinkable? Are you someone who lives in their district? Now you have even better tools to hold them to account. Are you an academic? Great, now consider how the many bylaws, rules, structures, institutions, incentives are messing up incentives and progress, what should be improved, and how to get streamlined coordination rather than automated obstruction.

Here is the link. Here is the related Dean Ball tweet.

What Davos (and Mark Carney) get wrong

That is the topic of my latest Free Press column, here is one excerpt:

Though Donald Trump seems to be calling off his latest trade war, the United States has indeed retreated from free trade with a new era of tariffs. It’s a development I rue. But Canada just opened its market to Chinese cars. So Trump did in fact find the recipe to nudge an oft-protectionist Canada toward freer trade, though it is the opposite of what he might have been wishing for. Soon, Canada will have access to better and cheaper electric cars than what we can get in the United States. And even if you think that spyware could make those cars a security risk in Washington, D.C., due to spying possibilities, I am less worried about their proliferation in Quebec and Nova Scotia. Keep them out of Ottawa if need be.

The European Union just worked out a free trade agreement, pending final approval, with Mercosur, a trade bloc encompassing hundreds of millions of people in South America, a region that is likely to be more economically important in the future. The EU also announced it is likely to strike a free trade agreement with India, the most populous nation in the world and one of its fastest-growing economies. However imperfect these agreements may turn out to be, has there been any recent short period with so much progress in free trade?

And this on Mark Carney:

Canadian prime minister Mark Carney’s speech on Tuesday garnered a lot of attention, but I think for the wrong reasons. He proclaimed the ability of “middle powers”—that is, Europe and countries like his own—to stand their ground against America and China, but he mentioned AI only in passing. He had no solution to an immediately pending world where Canada is quite dependent on advanced AI systems from American companies (often, incidentally, developed by Canadian researchers in the U.S.). That is likely to be the next major development in this North American relationship, and it will not increase the relative autonomy of Canada or of any other middle powers.

Carney has garnered praise for staking out such bold ground and standing up to Trump. The deeper reality is that Carney can “talk back” in the North American partnership because he knows America will defend Canada, including against Russia, no matter what. Most European countries cannot relax in the same manner, and thus they are often more deferential. What the reactions from Carney and the Europeans show is not any kind of growing independence for the middle powers, but rather a reality where you are either quite tethered to a major power—as Canada is to America—or you live in fear of being abandoned, which is the current status of much of Europe.

Recommended.

Growth Experiences and Trust in Government*

From a new QJE paper by Timothy Besley, Christopher Dann, and Sacha Dray:

This paper explores the relationship between economic growth and trust in government using variation in GDP growth experienced over a lifetime since birth. We assemble a newly harmonized global dataset across eleven major opinion surveys, comprising 3.3 million respondents in 166 countries since 1990. Exploiting cohort-level variation, we find that individuals who experience higher GDP growth are more prone to trust their governments, with larger effects found in democracies. Higher growth experiences are also associated with improved perceptions of government performance and living standards. We find no similar channel between growth experience and interpersonal trust. Second, more recent growth experiences appear to matter most for trust in government, with no detectable effect of growth experienced during one’s formative years, closer to birth or before birth. Third, we find evidence of a “trust paradox” whereby average trust in government is lower in democracies than in autocracies. Our results are robust to a range of falsification exercises, robustness checks and single-country evidence using the American National Election Studies and the Swiss Household Panel.

Via Alexander Berger.

Negative political externalities from migration to Britain?

Following up on my recent post, which suggested less skilled immigration into the UK has not been a disaster, the question has been raised about long-term negative political externalities. Will not migrants enter the country and make electoral outcomes worse? I would offer a few points in response:

1. If this is the argument, one needs to admit that immigration has gone well enough in the UK to date. This argument is about the future, not the past.

2. The UK has indeed had a variety of poor leaders as of late. It is very difficult to hold immigrants responsible for them, mostly it is the native white Brits who have been at fault. You might not like how UK Muslims have shaped some of the Middle Eastern statements of Labour, but that is hardly a relevant factor behind the slowdown of the British economy, or of British gridlock.

3. There is a very real risk that Reform will win the next election and then implement bad economics policies, above and beyond whatever you think of their approach to immigration. But if that is the real fear, it would be good to limit their popularity by talking up the positive side of immigration. I am not suggesting that any of us should tell anything less than the full truth, but obviously there are many positive aspects of migration that even professional economists can get wrong. Does immigration mean “higher home prices” or “capital gains for domestic homeowners”? Well, both, but you hear much more about the former than the latter (even Gemini got that one wrong). Let’s redress the balance, and lower the risk of future bad economic policy while we are at it.

4. Sometimes immigration weakens the demand for welfare state transfers, since the immigrants are viewed as outsiders. In Britain, that would currently be a positive at current margins. I recognize that is by no means the only political effect, but in any case do not assume that all of the political externalities are negative.

Above all else, it is difficult to paint immigrants as major villains for Britain’s troubles so far. Just read through the original analysis again. It has not been seriously countermanded, and do most of their problems are indeed the fault of the white people.

That all said, I would readily admit, and indeed stress, that a better set of migration policies could have put Britain in a much better position than it is today.

They are solving for the (electoral) equilibrium

Social Security also got quietly more generous during this period. Each year, the Social Security Administration compares the C.P.I.-W (the Consumer Price Index for Urban Wage Earners) for the third quarter to the third quarter of the previous year and, if needed, adjusts benefits upward to compensate for inflation. There happen to have been three years during Obama’s presidency — 2009, 2010, and 2015 — when the mathematically correct cost-of-living adjustment would have been negative. What actually happens in this case is that seniors get zero cost-of-living adjustment, which means that, in real terms, benefits ratcheted upward.

Then during the Biden administration, Congress ended up passing the Social Security Fairness Act, which increased Social Security benefits for a disproportionately affluent set of retirees with access to other pensions with very little fanfare. This happened via a hugely bipartisan vote, so even organizations that were critical of the idea when it was first proposed were mostly silent as it actually happened. Then during the 2024 presidential campaign, Donald Trump proposed “no tax on Social Security,” which is really just a way of making Social Security benefits mildly more generous for high-income seniors.

That is from Matt Yglesias. It would be amazing if we got away with all of this!

Chairman Powell’s Statement

Whether an independent Fed is desirable is beside the point. The core issue is lawfare: the strategic use of legal processes to intimidate, constrain, and punish institutional actors for political ends. Lawfare is the hallmark of a failing state because it erodes not just political independence, but the capacity for independent judgment.

What sort of people will work at the whim of another? The inevitable result is toadies and ideological loyalists heading complex institutions, rather than people chosen for their knowledge and experience.

What should I ask Joe Studwell?

He has a new and excellent book coming out, namely How Africa Works: Success and Failure on the World’s Last Developmental Frontier, which I consumed eagerly. You probably know his earlier book How Asia Works. So what should I ask him?

For additional context, here is the opening of his home page (no Wikipedia page?):

Hello. I am an author, journalist, public speaker and occasional university teacher. I am based much of the time in Cambridge. In the 2000s I restored and lived in a home in a still unspoiled area of central Italy (the photo at the top of the page is a view from the house).

So what should I ask him?

It is time to back off from Greenland

I do hope it falls eventually into U.S. hands, as I explain in my latest Free Press piece. But now is not the time and furthermore that should happen voluntarily, not coercively. Here is an excerpt:

The better approach is to let the Greenlanders choose independence on their own. They may be ready to do so. In a survey last year, 56 percent of Greenlanders favored independence from Denmark, with just 28 percent opposed. This should not be a tremendous surprise. The Danes have not always treated Greenland well; the legacy of Denmark taking away the children of Greenlanders 75 years ago still remains—and similar issues crop up to this day.

If and when Greenlanders do choose independence, the U.S. should, when conditions feel right, make a generous offer to Greenland. If they do not take the offer, we might try again later on, but we should not intimidate or coerce them. We should respect their right of independence throughout the process. That would increase the likelihood that the future partnership will be a cooperative and fruitful one.

The courtship could take 20 or 30 years, but I am pretty sure that eventually Greenlanders will see the benefits of a stronger U.S. affiliation.

I do not think that simply trying to “buy” Greenland is going to work. I am reminded of my own fieldwork, roughly 20 years ago, in a small Mexican village in the state of Guerrero. General Motors wanted to buy most of the land in and around the village, for the purpose of building a racetrack to test GM cars. It had a lot of money to offer, and at the time a family of seven in the village might have earned no more than $1,500 a year. But the negotiations never got very far. The villagers felt they were not being respected, they did not trust the terms of any deal, and they feared their ways of life would change irrevocably. The promise of better roads, schools, and doctors—in addition to whatever payments they might have negotiated—simply fell flat.

These are very important issues, so we need to get them right.

U.S. interventions in the New World, with leader removal

I can think of a few. I am not thinking of ongoing struggles, such as the funding of opposition to the Sandinistas, rather I wish to focus on cases where the key leaders actually were removed. After all, we know that is the case in Venezuela today. Maybe these efforts were rights violations, or unconstitutional, and yes that matters. But how did they fare in utilitarian terms?

Puerto Rico: 1898, a big success.

Mexican-American War: Removed Mexican leaders from what today is the American Southwest. Big utilitarian success, including for the many Mexicans who live there now.

Chile, and the coup against Allende: A utilitarian success, Chile is one of the wealthiest places in Latin America and a stable democracy today.

Grenada: Under Reagan, better than Marxism, not a huge success, but certainly an improvement.

Panama, under the first Bush, or for that matter much earlier to get the Canal built: Both times a big success.

Haiti, under Clinton, and also 1915-1934: Unclear what the counterfactuals should be, still this case has to be considered a terrible failure.

Cuba, 1906-1909: Unclear? Nor do I know enough to assess the counterfactual.

Dominican Republic, 1961-1954, starting with Trujillo. A success, as today the DR is one of the wealthiest countries in Latin America. But the positive developments took a long time.

I do not know enough about the U.S. occupation of the DR 1916-1924 to judge that instance. But not an obvious success?

Can we count the American Revolution itself? The Civil War? Both I would say were successes.

We played partial but perhaps non-decisive roles in regime changes in Ecuador 1963 and Brazil 1964, in any case I consider those results to be unclear. Maybe Nicaragua 1909-1933 counts here as well.

So the utilitarian in you, at least, should be happy about Venezuela, whether or not you should be happy on net.

You should note two things. First, the Latin interventions on the whole have gone much better than the Middle East interventions. Perhaps that is because the region has stronger ties to democracy, and also is closer to the United States, both geographically and culturally. Second, looking only at the successes, often they took a long time and/or were not exactly the exact kinds of successes the intervenors may have sought.

Absher, Grier, and Grier consider CIA activism in Latin America and find poor results. I think much of that is springing from cases where we failed to remove the actual leaders, such as Nicaragua and Cuba. Simply funding a conflict does seem to yield poor returns.

Why Some US Indian Reservations Prosper While Others Struggle

Our colleague Thomas Stratmann writes about the political economy of Indian reservations in his excellent Substack Rules and Results.

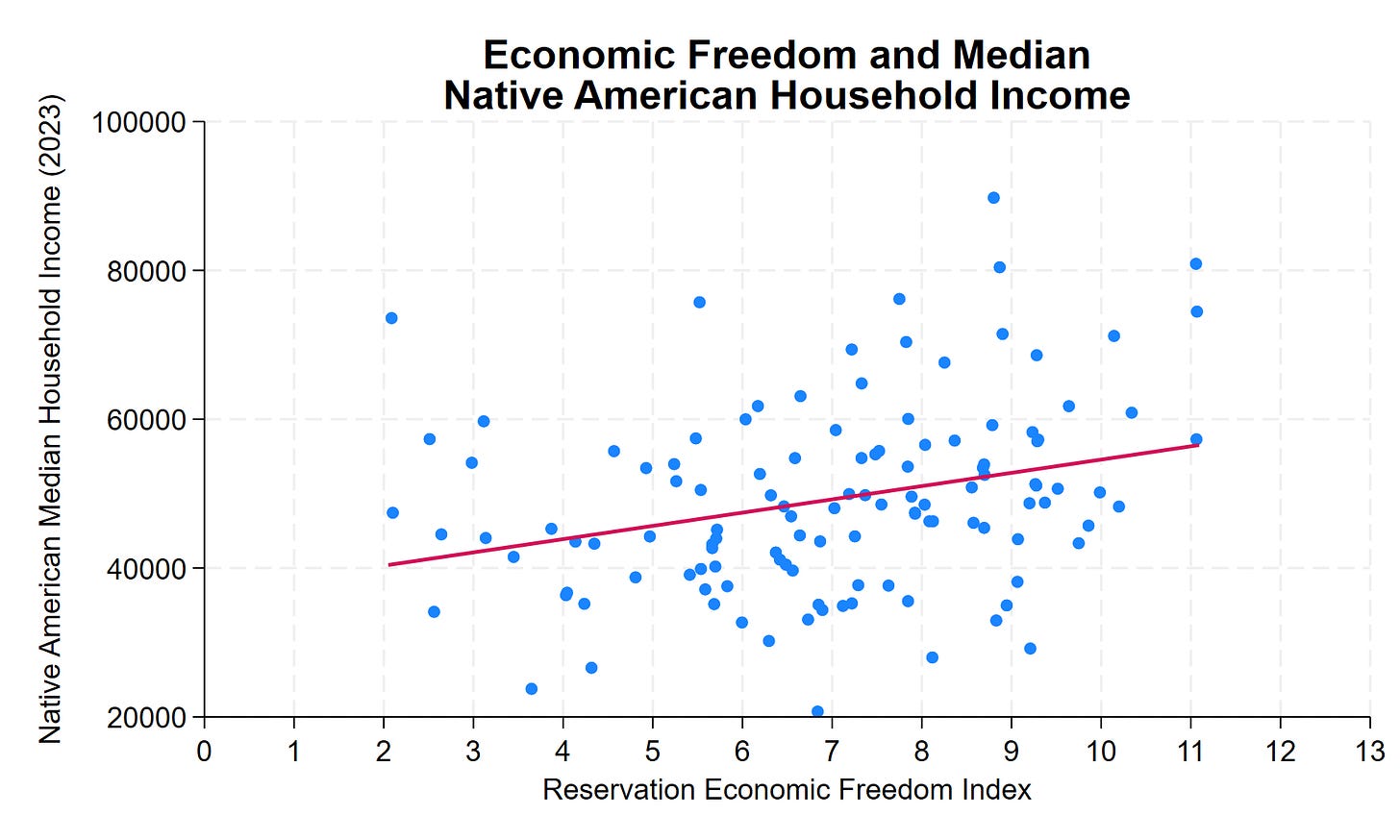

Across 123 tribal nations in the lower 48 states, median household income for Native American residents ranges from roughly $20,000 to over $130,000—a sixfold difference. Some reservations have household incomes comparable to middle-class America. Others face persistent poverty.

Why?

The common assumption: casino revenue. The data show otherwise. Gaming, natural resources, and location explain some variation. But they don’t explain most of it. What does? Institutional quality.

The Reservation Economic Freedom Index 2.0 measures how property rights, regulatory clarity, governance, and economic freedom vary across tribal nations. The correlation with prosperity is clear, consistent, and statistically significant. A 1-point improvement in REFI—on a 0-to-13 scale—correlates with approximately $1,800 higher median household income. A 10-point improvement? Nearly $18,000 more per household.

Many low-REFI features aren’t tribal choices—they’re federal impositions. Trust status prevents land from being used as collateral. Overlapping federal-state-tribal jurisdiction creates regulatory uncertainty. BIA approval requirements add months or years to routine transactions. Complex jurisdictional frameworks can deter investment when the rules governing business activity, dispute resolution, and enforcement remain unclear.

This is an important research program. In addition to potentially improving the lives of native Americans, the 123 tribal nations are a new and interesting dataset to study institutions.

See the post for more details amd discussion of causality. A longer paper is here.

California facts of the day

At Berkeley, as recently as 2015, white male hires were 52.7 percent of new tenure-track faculty; in 2023, they were 21.5 percent. UC Irvine has hired 64 tenure-track assistant professors in the humanities and social sciences since 2020. Just three (4.7 percent) are white men. Of the 59 Assistant Professors in Arts, Humanities and Social Science appointed at UC Santa Cruz between 2020-2024, only two were white men (3 percent).

Here is the essay by Jacob Savage that everyone is talking about.

What should I ask Joanne Paul?

Yes I will be doing a Conversation with her. From the Google internet:

Joanne Paul is a writer, broadcaster, consultant, and Honorary Senior Lecturer in Intellectual History at the University of Sussex. A BBC/AHRC New Generation Thinker, her research focuses on the intellectual and cultural history of the Renaissance and Early Modern periods…

She has a new book out Thomas More: A Life.

Here is her home page. Here is Joanne on Twitter. She has many videos on the Tudor period, some with over one million views.

So what should I ask her?

Art as Data in Political History

From Valentine Figuroa of MIT:

Ongoing advances in machine learning are expanding opportunities to analyze large-scale visual data. In historical political economy, paintings from museums and private collections represent an untapped source of information. Before computational methods can be applied, however, it is essential to establish a framework for assessing what information paintings encode and under what assumptions it can be interpreted. This article develops such a framework, drawing on the enduring concerns of the traditional humanities. I describe three applications using a database of 25,000 European paintings from 1000CE to the First World War. Each application targets a distinct type of information conveyed in paintings (depicted content, communicative intent, and incidental information) and a cultural transformation of the early-modern period. The first revisits the notion of a European “civilizing process”—the internalization of stricter norms of behavior that occurred in tandem with the growth of state power—by examining whether paintings of meals show increasingly complex etiquette. The second analyzes portraits to study how political elites shaped their public image, highlighting a long-term shift from chivalric to more rational-bureaucratic representations of men. The third documents a long-term process of secularization, measured by the share of religious paintings, which began prior to the Reformation and accelerated afterward.

Here is the link, via the excellent Kevin Lewis.

Building a cohesive Indonesia

Building a cohesive nation-state amid deep ethnic, linguistic, and religious diversity is a central challenge for many governments. This paper examines the process of nation building, drawing lessons from the remarkable experience of Indonesia over the past century. I discuss conceptual perspectives on nation building and review Indonesia’s historical nation-building trajectory. I then synthesize insights from four studies exploring distinct policy interventions in Indonesia—population resettlement, administrative unit proliferation, land reform, and mass schooling—to understand their effects on social cohesion and national integration. Together, these cases underscore the promise and pitfalls of nation-building efforts in diverse societies, offering guidance for future research and policymaking to support these endeavors in Indonesia and beyond.

That is from a new NBER working paper by Samuel Bazzi. As I have noted in the past, Indonesia remains a remarkably understudied and also undervisited country (Bali aside), so efforts in this direction should be appreciated.

Origins and persistence of the Mafia in the United States

This paper provides evidence of the institutional continuity between the “old world” Sicilian mafia and the mafia in America. We examine the migration to the United States of mafiosi expelled from Sicily in the 1920s following Fascist repression lead by Cesare Mori, the so-called “Iron Prefect”. Using historical US administrative records and FBI reports from decades later, we provide evidence that expelled mafiosi settled in pre-existing Sicilian immigrant enclaves, contributing to the rise of the American La Cosa Nostra (LCN). Our analysis reveals that a significant share of future mafia leaders in the US originated from neighborhoods that had hosted immigrant communities originating in the 32 Sicilian municipalities targeted by anti-mafia Fascist raids decades earlier. Future mafia activity is also disproportionately concentrated in these same neighborhoods. We then explore the socio-economic impact of organized crime on these communities. In the short term, we observe increased violence in adjacent neighborhoods, heightened incarceration rates, and redlining practices that restricted access to the formal financial sector. However, in the long run, these same neighborhoods exhibited higher levels of education, employment, and social mobility, challenging prevailing narratives about the purely detrimental effects of organized crime. Our findings contribute to debates on the persistence of criminal organizations and their broader economic and social consequences.

That is a new paper in the works by Zachary Porreca, Paolo Pinotti, and Masismo Anelli, here is the abstract online.