Wednesday assorted links

1. Can we inherit our way into higher fertility? Maybe not.

2. Paul Romer offers you tech support.

4. All sorts of new cancer drugs and treatments are in the works (FT), p.s. supply is elastic.

5. Can New Hampshire keep just one area code? (WSJ)

6. Murder as measuring rate (speculative).

7. More on the French post-election.

9. “Go long Waterloo youngsters.” (it’s happening)

Prescriptive versus Performance Codes

A great piece in the NYTimes on the history and future of factory produced buildings:

But the most remarkable difference between the United States and Sweden is regulatory. Building codes in the U.S. try to make buildings safe by prescribing exactly what materials must be used and how (a prescriptive code). In Sweden, the government does this by setting goals and letting builders come up with a way to achieve them (a performance code).

So, for instance, U.S. building codes dictate the thickness of drywall that must be used for fire resistance, how many layers are needed and how many nails are required to attach it. In Sweden, the code requires that a wall must resist burning for two hours, say, and lets engineers and manufacturers figure out how to accomplish that. The regulator’s job is to check the engineer’s work.

The result of both is fire resistance and structural safety, but in the United States, each residential building needs to be granted a permit. During construction, work often halts for inspectors to make periodic visual inspections. That contributes to a stop-and-go pace that frustrates pretty much everybody except lenders, who get interest on financing. Sweden’s codes require more work on the front end when builders have to demonstrate that their methods are up to snuff, but factory processes that comply with the performance code can be certified. This encourages innovative solutions and results in less waste.

As an example of how a performance code leads to innovation:

..Before Sweden adopted its performance-based code in 1995, wood buildings had been limited to two stories; almost overnight, wooden buildings could be as tall as engineers could prove safe.

Addendum: See the comments for useful argument that the US code is more performance based than the NYTimes article suggests. What would be very useful is to hear from someone with experience in both systems.

Was the Great Stagnation originally a problem of human capital?

That is the topic of my latest Bloomberg column. Here is one key part of the argument:

There are numerous theories as to why [the Great Stagnation started in the early 1970s]: oil price shocks, more stringent government regulations, an increased emphasis on environmental protection over economic growth, and the collapse of the Bretton Woods international monetary order. In my 2011 book The Great Stagnation, I blame the disappearance of the low-hanging fruit that resulted from powerful machines and plentiful fossil fuels.

Some of those likely are factors. Now an economist, Nicholas Reynolds of the University of Essex, claims to have found a new villain in this economic story: a negative shock to the quality of human capital in America.

Americans born after 1947 and before the mid-1960s — the first of whom were just entering their prime working years in 1971 — did not see economic gains comparable to those of their predecessors. But the problems of this cohort are more far-reaching. They had more problems as young children, and they did worse in school in the 1960s, accounting for the educational declines of that era, such as lower test scores and higher dropout rates.

Birthweights also declined in the 1980s, a sign that the post-1947 cohort was less healthy, most of all when it comes to maternal health. You might think that development is due to intervening economic factors. But the post-1947 world is still wealthier than what came before, so it is not obvious why an economic slowdown, but not absolute decline, should have created such significant health problems.

It’s not just that Americans born after 1955 stopped getting taller, whereas Europeans didn’t. There are deeper problems, such as the alarming rise in the midlife mortality rate since 1999. These “deaths of despair” may also be a legacy from this 1947 break in Americans’ quality of health.

I am not sure that is all true, but if so it is very important and would constitute a significant revision in our understanding of 20th century economic history. And what happened in the late 1940s? There it gets tricky:

The obvious question is what exactly happened in about 1947 to put the US on this less constructive path. There is no obvious smoking gun, but the cohort decline seems to start in adolescence, prior to entering labor markets. So perhaps it is something in the structure of American society, or in US public health practices, rather than stemming from traditional macroeconomic factors.

One possible cause is an increase in postwar automobile usage, and thus higher levels of lead exposure, given the lead additives in gasoline at the time. There is no direct evidence for this claim, but lead has been shown to have significant negative impacts on human development, and some researchers blame it for the later higher US crime rates.

Still, it is not obvious why lead should lead to such a sharp break in the data. And if lead is the main culprit, then there should be major improvements forthcoming, as lead additives were fully banned from American gasoline in 1996, with a phase-out starting in the 1970s.

A second possibility is that the baby boom generation was so large that there was a decline in quality of care given to each child.

Very much worth a ponder, and then some.

From Reed and Logchies

Introduction. Your analysis produces a statistically insignificant estimate. Is it because the effect is negligibly different from zero? Or because your research design does not have sufficient power to achieve statistical significance? Alternatively, you read that “The median statistical power [in empirical economics] is 18%, or less” (Ioannidis et al., 2017) and you wonder if the article you are reading also has low statistical power. By the end of this blog, you will be able to easily answer both questions. Without doing any programming.

An Online App. In this post, we show how to calculate statistical power post-estimation for those who are not familiar with R. To do that, we have created a Shiny App that does all the necessarily calculating for the researcher (CLICK HERE).

Here is the link and the full story.

Tuesday assorted links

1. Something, something, French politics, I don’t understand either the equilibrium or the procedure. Does anybody?

2. Kevin Sherwin is an amazing guitarist, and yet no one has heard of him.

3. Bioy Casares on Borges, translated into English, at least in part, you can now pre-order. One of the great Spanish-language books, hitherto unavailable in English.

4. What happened to the gay rights movement in the Caribbean?

5. 48% of NYC riders do not pay the bus fare (NYT).

6. Tech regulation and the logic of obfuscation.

7. Henry Oliver podcast with Hollis Robbins.

8. Good FT piece on how the Midwest, and American economy, needs more migrants.

Rawls Killed Marx

I found this Joseph Heath post very informative. In essence, Marx was about exploitation but when no theory of exploitation without gaping holes could be developed, the analytical Marxists shifted to egalitarianism ala Rawls.

Back when I was an undergraduate, during the final years of the cold war, by far the most exciting thing going on in political philosophy was the powerful resurgence of Marxism in the English-speaking world. Most of this work was being done under the banner of “analytical Marxism” (aka “no-bullshit Marxism”), following the publication of Gerald Cohen’s Karl Marx’s Theory of History: A Defence (and his subsequent elevation to the Chichele Professorship in Social and Political Philosophy at Oxford). Meanwhile in Germany, Jürgen Habermas’s incredibly compact Legitimationsprobleme im Spätkapitalismus promised to reinvigorate Marx’s analysis of capitalist crises in the language of contemporary systems theory. It was an exciting time to be a young radical. One could say, without exaggeration, that many of the smartest and most important people working in political philosophy were Marxists of some description.

So what happened to all this ferment and excitement, all of the high-powered theory being done under the banner of Western Marxism? It’s the damndest thing, but all of those smart, important Marxists and neo-Marxists, doing all that high-powered work, became liberals. Every single one of the theorists at the core of the analytic Marxism movement – not just Cohen, but Philippe van Parijs, John Roemer, Allen Buchanan, and Jon Elster – as well as inheritors of the Frankfurt School like Habermas, wound up embracing some variant of the view that came to be known as “liberal egalitarianism.” Of course, this was not a capitulation to the old-fashioned “classical liberalism” of the 19th century, it was rather a defection to the style of modern liberalism that found its canonical expression in the work of John Rawls.

If one felt like putting the point polemically, one might say that the “no-bullshit” Marxists, after having removed all of the bullshit from Marxism, discovered that there was nothing left but liberalism.

That’s the opening. Read the whole thing.

Why massive deregulation is very difficult

That is the topic of my latest Bloomberg column, just to clarify context for the newbies I think more than half of all current regulations are a net negative. Anywhere, here are some of the problems:

Consider the relatively straightforward idea, popular in some Republican circles, of firing large numbers of federal bureaucrats. There would be immediate objections, not only from the employees themselves but also from US businesses.

Businesses need to make plans, and they frequently consult with regulatory agencies as to what might be permissible. The Food and Drug Administration needs to approve new drug offerings. The Federal Aviation Administration needs to approve new airline routes. The Federal Communications Commission needs to approve new versions of mobile phones. The Federal Trade Commission and Department of Justice need to give green lights for significant mergers. The Federal Deposit Insurance Corp. needs to approve plans for winding down failed banks. And so on.

If those and other agencies were stripped of their staffs, a lot of US businesses would be paralyzed. You might argue that this fact is itself proof that there is too much regulation, but the fact remains. Shutting down a large chunk of the federal regulatory apparatus would make it harder, not easier, for the private sector. Furthermore, regulation would give way to litigation, and the judiciary is not obviously more efficient than the bureaucracy.

And this:

The basic paradox is this: Government regulations are embedded in a large, unwieldy and complex set of institutions. Dismantling it, or paring it back significantly, would require a lot of state capacity — that is, state competence. Yet deregulators are suspicious of greater state capacity, as it carries the potential for more state regulatory action. Think of it this way: If someone told a libertarian-leaning government efficiency expert that, in order to pare back the state, it first must be granted more power, he would probably run away screaming.

Recommended, the piece has numerous good points of interest.

Obama’s space legacy?

Bucking his central planning instincts, Obama embraced a surprisingly laissez-faire approach to space flight that angered political allies and opponents alike.

In doing so, however, he tapped a reservoir of ingenuity and innovation that has ushered in a new age of space flight and exploration…

In her forthcoming book Bureaucrats and Billionaires, former NASA deputy administrator Lori Garver and reporter Michael Sheetz trace the origins of NASA’s commercial crew program, a revolutionary human spaceflight program that joins private aerospace manufacturers such SpaceX and Boeing with NASA’s astronauts.

Garver writes that this hybrid allows space flight “at a fraction of the cost of previous government owned and operated systems.” A decade ago, however, the program faced opposition seemingly from every side.

The saga began early in 2010 when President Obama announced his intention to abort NASA’s Constellation program—NASA’s crew spaceflight program—correctly pointing out it was “over budget, behind schedule, and lacking in innovation.”

The decision angered almost everyone. As Garver and Sheetz write, the program was “extremely popular with Congress, and the contractors who were benefiting from the tax dollars coming their way.” An impressive array of stakeholders from aerospace companies, trade associations, and astronauts to lobbyists, Congressional delegations, and NASA pushed back.

The resistance was immense.

NASA chief Charles Bolden, while choking back tears, compared the decision to “a death in the family.” Pulitzer Prize winning columnist Charles Krauthammer ominously noted the move would give the Russians “a monopoly on rides into space.” Congressman Pete Olson (R-Texas) called the decision “a crippling blow to America’s human spaceflight program.”

Few commentators seemed to even notice the $6 billion in spending over five years to support commercially built spacecraft to launch NASA’s astronauts into outer space…

By pulling the plug on Constellation, Obama had unleashed the power of markets and competition. While many associate competition with dog-eat-dog and survival of the fittest tropes, competition is a healthy and productive force.

Here is the full story, by John Miltimore at FEE (!). Via Matt Yglesias.

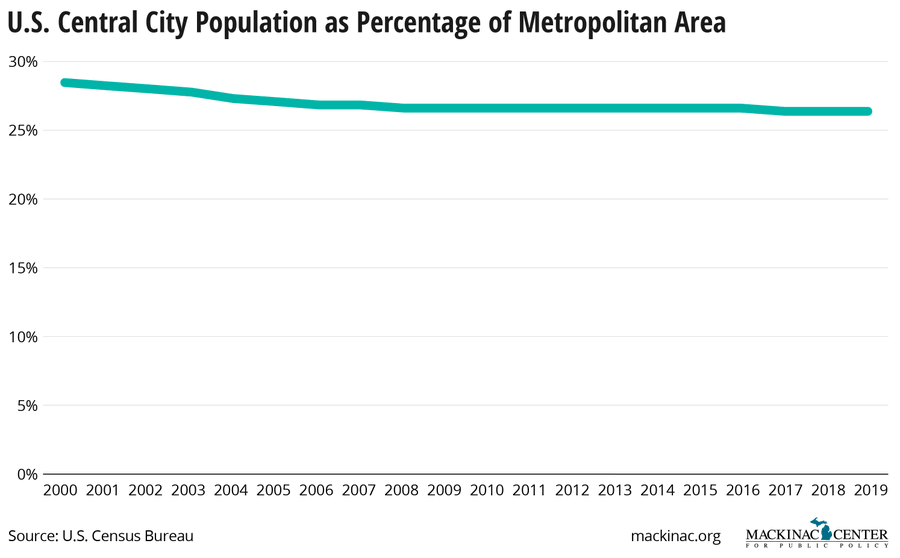

U.S: central city population as a % of metropolitan area

Via James Hohman.

What should I ask Musa al-Gharbi?

Yes, I will be doing a Conversation with him.

Musa al-Gharbi is a sociologist and assistant professor in the School of Communication and Journalism at Stony Brook University. He is a columnist for The Guardian and his writing has also appeared in the New York Times, the Washington Post, and The Atlantic, among other publications.

I am a big fan of his forthcoming book We Have Never Been Woke, which I have blurbed. Here is Musa’s home page, do read his bio. Here is Musa on Twitter.

So what should I ask?

Monday assorted links

1. This DVD/Blu-Ray of Korngold’s Die Tote Stadt is one of the best performances I have seen, ever.

2. Houston is turning its back on bicycles.

3. Ethiopia vs. Somalia? (NYT) And Juleanna Glover on where Republican donations go (NYT).

6. The importance of mobility for hunter-gatherers. “They remain mobile so they can participate in large and complex societies.”

Jim Crow and Black Economic Progress After Slavery

This paper studies the long-run effects of slavery and restrictive Jim Crow institutions on Black Americans’ economic outcomes. We track individual-level census records of each Black family from 1850 to 1940, and extend our analysis to neighborhood-level outcomes in 2000 and surname-based outcomes in 2023. We show that Black families whose ancestors were enslaved until the Civil War have considerably lower education, income, and wealth than Black families whose ancestors were free before the Civil War. The disparities between the two groups have persisted substantially because most families enslaved until the Civil War lived in states with strict Jim Crow regimes after slavery ended. In a regression discontinuity design based on ancestors’ enslavement locations, we show that Jim Crow institutions sharply reduced Black families’ economic progress in the long run.

That paper, by Lukas Althoff and Hugh Reichardt, will be coming out in the QJE, was it Florian Ederer who mentioned this on Twitter?

Why do the servers always want to take our cutlery and plates and glasses away?

I have noticed repeatedly, over the course of many restaurant visits, that my servers want to take away my plates, my glasses, my cutlery, and indeed almost anything else — before I really want to give it up.

The ratio of “they want to take it away too soon” to “they take it away too late” seems to me at least five to one.

Those who know me would not describe me as a lingerer over meals, or a very slow eater. So I do not view this phenomenon as merely my peculiarity, rather the servers often want to take my things away before I am done with them.

In many restaurants the servers seem to put more energy into keeping your table clean than in taking your order promptly in the first place.

How should we model this behavior?

One possibility is that the servers know they will be busier yet later on, so they want to get some of the work out of the way now. Surely that holds in many cases, but still I observe this “server grabbing behavior” in a wide variety of circumstances, including in near-empty restaurants.

Could it be that the restaurant managers give these instructions, hoping it will induce the diners to order further dishes and spend more money?

Another possibility is that the servers feel the need to signal that they are always busy, rather than standing around and looking idle. I can imagine that hypothesis having some truth, but it doesn’t explain the entirety of what I observe.

The most plausible general explanation is that the restaurant managers favor a more rapid turnover of tables than the customers do, and regular plate- and glass-clearing helps to achieve that end. It also creates another “point of contact,” giving the customer the opportunity to ask for the check. Still, you might think ex ante competition to attract diners would moderate this practice more than it does.

I have asked both current and former servers why there is so much emphasis on place-clearing, and usually I receive circular answers, such as “We want to make sure your plates and glasses are cleared away when you are done with them.”

So what is the best way of thinking about this practice?

Sunday assorted links

1. Crafting AI-complementary skills.

2. Rhino vs. elephant. And they work for less than minimum wage.

3. Some evidence that wage disclosure leads to wage suppression.

4. Lotte Lenya singing Weill’s Alabama Song.

5. High-tech ice packs for the summer heat (WSJ).

7. Chicago School of Economics canon. And for Austrian economics.

Claude Reviews You!

I asked Claude to read my post, Go for the Gold! on using inequality in the NFL and NBA to get a different perspective on income inequality. I then asked Claude, “Which are the best comments showing they understood the op-ed and responded in a productive and reasonable way either critically or positively?” And following that “Which are the least informed, least useful comments?” Here are Claude’s answers for the best comments and the original comments (no indent on Claude):

Jack of all disciplines (2024-08-19 09:26:51):

The NFL is a clever analogy, but were this not such a small part of the economy we’d surely have fights over value creation, opportunity, and fairness even if we could measure performance in other careers as well as we can in professional athletics. Genes matter a lot for economic outcomes, for example. Is this fair or unfair? We’d be fighting a lot about that question even if we could provide every reasonable opportunity for everyone to increase their human capital to their full potential and could measure one’s contribution to society perfectly.

This comment acknowledges the NFL analogy as clever while pointing out its limitations. It expands on the discussion by noting that genetics play a large role in economic outcomes beyond just athletics, raising thoughtful questions about fairness and opportunity that go beyond the original analogy.

Marginalist Cormac (2024-08-19 11:42:54):

The point that most of the comments here are unwilling to accept is a undeniable fact of reality:

Every equal society known to man in practice has been way, way poorer than the more unequal societies. Across the board: poorer economically, socially, with more poverty, more resentment, less freedom, less access to health and leisure, less optimistic and less dynamic.

Voila!

While brief, this comment shows understanding of the op-ed’s broader implications. It productively shifts the discussion to empirical outcomes, noting the historical correlation between inequality and overall societal prosperity. This adds a valuable perspective to consider alongside the ethical arguments presented in the original piece.

Saturn (2024-08-19 08:10:08):

The analogy makes me think that Alex is now sympathetic to strong government, unions and price controls/salary caps. Go Kamala!

This comment, while brief, cleverly turns the op-ed’s argument on its head in a thought-provoking way. By suggesting that the NFL analogy actually supports “strong government, unions and price controls/salary caps,” the commenter highlights potential inconsistencies in using the NFL as a model for free-market economics. This response shows a keen understanding of the op-ed’s premise and critically engages with it in a witty and insightful manner.

Alex again: Here are Claude’s answers for the worst comments. In this case I do not include the original comment but I checked and Claude is correct. EdR is usually much better!

It’s much easier to agree on the worst than the best comments. I would have no problem letting Claude delete the worst comments.

- Skeptical American (2024-08-19 08:37:25): This comment attacks Bernie Sanders personally rather than engaging with the content of the op-ed. It uses inflammatory language and makes accusations without providing evidence or constructive criticism. This type of comment doesn’t contribute to a reasoned debate about inequality.

- EdR (2024-08-19 14:26:49): This comment veers off-topic to make personal attacks against Kamala Harris, including unsubstantiated claims about her personal life. It doesn’t address the arguments in the op-ed and instead engages in inflammatory rhetoric that doesn’t contribute to a productive discussion about inequality.

Hat tip: Robin Hanson who suggested the experiment.