Assorted links

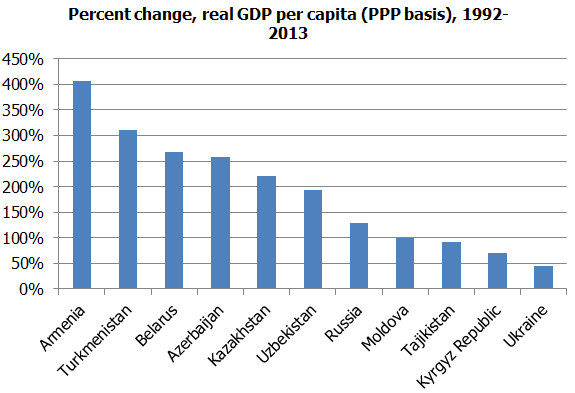

Economic growth in Ukraine, a recent history

From C.W. at Free Exchange, there is more here.

Robert Ashley has passed away at age 83

The great Robert Ashley, one of the musical geniuses of the last forty years, has passed away. He is one of the few who did something truly new in music. Here is NPR on Ashley. Here is the opera Perfect Lives, perhaps his greatest contribution. Here are parts of that opera on YouTube. Here is Ashley on Wikipedia.

Sadly, Sherwin Nuland has passed away too. His How We Die: Reflections of Life’s Final Chapter is one of my favorite books, recommended to all.

The new Paul Ryan report on poverty and safety net programs

I read much of the document last night, here are a few comments:

1. The so-called “war on poverty” has gone better than most of this document would appear to suggest, although this ends up being acknowledged in the appendix on poverty measures.

2. High implicit marginal tax rates are a problem for poor families, but they receive too much attention in this report. Those same high implicit rates never stopped higher earners, who at some point were (often) much poorer themselves. Furthermore, without some assumption of dysfunctional behavior, high implicit marginal tax rates will hurt society but should not hurt lower earners per se.

3. There is an implicit ranking of programs as good or bad. If a program is ranked as bad, there is a cataloging of its cost, but this is not compared to potential benefits, even granting that net cost is positive.

4. Two things that work to cure poverty are immigration and cash transfers. These points should be stressed more. More generally, not much of an analytical framework is imposed on the material. And the discussion of barriers to advancement is extremely thin. Collapsing families surely constitute an important issue, but reading the discussion of that topic yields precious little knowledge, not even “false knowledge.”

5. Reading through the long list — the too-long list I would say– of programs, one really does get the feeling that a lot of them ought to be replaced by cash grants or pro-employment cash incentives, such as EITC. But what else should we be doing differently? If one insists that the point of the document is simply to list extant programs, so be it. But what is the point of that exercise? Why not introduce some material on the causes of dysfunctional health care, educational, and rental sectors?

Overall this needed to be a lot better than it was. The document has almost no vision, only a marginal command of the scholarly literature, and it is a good example of how the conservative movement is still allowing the poverty issue to defeat it and tie it up in knots.

There are further criticisms here, not all of them convincing. Paul Krugman had a few posts on the document too.

I am tonight doing an event on poverty with Neera Tanden, Steve Pearlstein, and Reihan Salam, and a few others on the Arlington campus of GMU.

The most human-like computer poem?

Try this:

Long years have passed.

I think of goodbye.

Locked tight in the night

I think of passion;

Drawn to for blue, the night

During the page

My shattered pieces of life

watching the joy

shattered pieces of love

My shattered pieces of love

gone stale.

Here is (supposedly) the most computer-like human poem, “Cut Opinions,” by Deanna Ferguson:

cut opinions tear tasteful

hungers huge ground swell

partisan have-not thought

green opinions hidden slide

hub from sprung in

weather yah

bold erect tender

perfect term transparent till

I two minute topless formed

A necessarily sorry sloppy strands

hot opinions oh like an apple

a lie, a liar kick back

filial oh well hybrid opinions happen

not stopped

Here are related rankings and explanation (sort of). Was this poem written by a human or a computer? I have no idea.

Should we extend EITC to childless workers?

Jason Furmans says yes, here is one bit:

Looking back at the history of poverty and the tax code in the last several decades reveals some important lessons for expanding opportunity and combating poverty going forward, including the value of having a pro-work, pro-family tax code. The most important new prospect in this area is expanding such an approach for households without children, a proposal that President Obama included in his 2015 budget, and an idea that is also being advanced across the political spectrum, from Senator Marco Rubio to Bush Administration economist Glenn Hubbard to Isabel Sawhill at the Brookings Institution.

It becomes more analytical after that. Here are some further basic facts about EITC extension. Here is a 2009 study (pdf).

Assorted links

Do economic sanctions work?

There is talk that the United States will, within days, apply some kind of sanctions to Russia. For some analysis, shall we not turn to the work of Daniel Drezner? Here is his piece (pdf) on cooperation and multilateral sanctions:

Intuitively, the link between international cooperation and sanctions success seems obvious. Empirically, however, the results are rather surprising. Repeated statistical tests show either no link or a negative link between cooperation and sanctions success. At least four studies conclude that successful episodes of economic coercion exhibit the least levels of coercion among the sanctioning states. No statistical test has shown a significant positive correlation between policy success and international cooperation among the sanctioning states.

This Drezner piece (pdf) indicates that applied sanctions don’t usually work, but the threat of sanctions can be effective. Here is Dan on “smart sanctions,” (pdf) which are not in general effective. Here is Dan’s book The Sanctions Paradox. Here is Dan on Twitter. I hereby request a new article from Dan on sanctions, as they might be applied to Russia. Here is a short BBC piece on the possible economic impact of sanctions today.

Here is a 2013 paper (pdf) which tests the Drezner sanctions model on the territories of the former Soviet Union. Here is a piece on how zombie studies are gaining ground.

Money, Status, and the Ovulatory Cycle (politically incorrect paper of the month)

That is a new research paper by Kristina M. Durante, Vladas Griskevicius, Stephanie M. Cantú , and Jeffry A. Simpson, and the abstract is here:

Each month, millions of women experience an ovulatory cycle that regulates fertility. Previous consumer research has found that this cycle influences women’s clothing and food preferences. The authors propose that the ovulatory cycle actually has a much broader effect on women’s economic behavior. Drawing on theory in evolutionary psychology, the authors hypothesize that the week-long period near ovulation should boost women’s desire for relative status, which should alter their economic decisions. Findings from three studies show that women near ovulation seek positional goods to improve their social standing. Additional findings reveal that ovulation leads women to pursue positional goods when doing so improves relative standing compared with other women but not compared with men. When playing the dictator game, for example, ovulating women gave smaller offers to a female partner but not to a male partner. Overall, women’s monthly hormonal fluctuations seem to have a substantial effect on consumer behavior by systematically altering their positional concerns, a finding that has important implications for marketers, consumers, and researchers.

Here is some popular coverage of the piece. For the pointer I thank C.

Megan McArdle dialogue at AEI

You will find the video here, the dialogue is with me and Tim Carney.

The underlying question behind the book is when the general possibility of error helps you learn and when it leads you off the precipice, never to return. As I understand Megan’s argument, additional error-making propensity has positive individual and social returns at the margin, which means we should offer implicit or sometimes explicit subsidies to experimentation. That means a liberal bankruptcy law, relatively easy divorce, and a focus of subsidies on areas with high fixed costs. In other words, the National Science Foundation should worry more about labs and less about individual researchers.

As I had predicted, this is proving to be a breakout book for Megan. You can buy her book here. There is more on the book here.

Recommended reading

Anatol Lieven, Ukraine and Russia: A Fraternal Rivalry. And here is a short essay of his on Ukraine today.

Orlando Figes, A Crimean War.

Vassily Aksyonov, The Island of Crimea, discussed here: “Written in 1979, Vassily Aksyonov’s “The Island of Crimea” imagines an alternative history (abetted by alternative geography—the Crimea is a peninsula) wherein the Russian civil war ends with the tsarist forces able to hold onto this southern scrap of the old empire. “

What I worry about

LATimes: A 30,000-year-old giant virus has been revived from the frozen Siberian tundra, sparking concern that increased mining and oil drilling in rapidly warming northern latitudes could disturb dormant microbial life that could one day prove harmful to man.

The original research is here. Have a nice day.

*Getting a Ph.D. in Economics*

That is a new and highly useful book by Stuart J. Hillmon, here is one bit from it:

Truthfully, majoring in economics is not really all that helpful for your admissions prospects. This is true for two reasons. First, knowing who does well in undergraduate economics is not terribly helpful in identifying who will be a good academic economist. Unlike other fields such as chemistry or physics, what happens in undergraduate courses bears little relation to what happens in graduate courses. For this reason, the committee cannot predict how well you will do as an academic economist based on your doing well in your undergraduate econ courses. Consequently, they don’t give too much weight to your stellar performance in the usual undergraduate classes.

For this book, I would have asked for greater length, more discussion of government and private sector careers, and more discussion of non-orthodox paths through academic economics, or for that matter seeking employment at a teaching school or attending a Ph.D. program below the top tier. You will note “Stuart J. Hillmon is the pseudonym for an academic economist who graduated from a top five doctoral program in economics and currently teaches courses in policy and economics.” The book is structured accordingly and perhaps that will frighten some of you away. If everyone were like Hillmon, I would not myself today be an economist.

Still, this is a good place to start if you are considering whether to get a Ph.D. in economics.

Assorted links

How much does credibility matter in foreign affairs?

Under one view, credibility is like a chain. If the United States does not keep one of its public promises, the credibility of the chain falls apart. In essence observers are using the behavior of the American government to draw inferences about its true underlying type. A single act of breaking a promise or failing to honor a commitment would show we really cannot be trusted, or that we are weak and craven, and so that characterization of our true type would be applied more generally to all or most of our commitments.

Under a second view, we don’t have that much credibility in the first place. To be sure, we can be trusted to do what is in our self-interest. But there is not much underlying uncertainty about our true type. So we can promise Ruritania the moon, and fail to deliver it, and still the world thinks we would defend Canada if we had to, simply because such a course of action makes sense for us. In this setting, our violation of a single promise changes estimates of our true scope of concern, but it does not much change anyone’s estimate of the true type of the American government.

Insofar as you believe in the first view, our inability/unwillingness to honor our commitment to the territorial integrity of Ukraine is a disaster. Insofar as you hold the second view, our other commitments remain mostly credible.

For the most part, I see the second view as more relevant to understanding U.S. foreign policy than the first. We’ve broken promises and commitments for centuries, and yet still we have some underlying credibility. Remember those helicopters evacuating Saigon rooftops in 1975?

Still, when it comes to Taiwan, or those Japanese islands, or other Pacific islands, I think the first view plays a role. That is, I think the world does not know our true type. How much are we willing to risk conflict to limit Chinese influence in the Pacific? Whatever you think should be the case, what is the case is not clear, perhaps not clear even to our policymakers themselves. (In contrast there are plenty of data on the parameters of American preferences toward Middle East and Israel-linked outcomes, and our willingness to incur costs to alter those outcomes.)

That is another way of thinking about why the Ukraine crisis is scary for the Pacific. It is one reason why the Nikkei was down 2.5% shortly after market opening Monday morning (Asia time) and ended up 1.3% down for the day. The Chinese stock market did just fine.