Jony Ive and Patrick Collison

The new Pope

Has taken a class in real analysis.

Globalization did not hollow out the U.S. middle class

From Noah Smith:

Trade deficits are an even smaller amount of GDP. U.S. imports of manufactured goods minus exports are equal to about 4% of GDP per year. Our trade deficit with China is about 1% of GDP.

In terms of imported components, America manufactures most of what it uses in production. China’s exports to the U.S. are actually more likely to be intermediate goods rather than the consumer goods we see on the shelves of Wal-Mart — another thing the typical narrative misses. But even so, China makes only about 3.5% of the intermediate goods that American manufacturers need

…trade deficits and manufacturing aren’t as tightly linked as most people seem to think. France has become steadily less manufacturing-intensive since 1960, despite the fact that it historically had very balanced trade, and even ran big trade surpluses in the 90s and 00s. Meanwhile, out of all the countries on the chart, Japan has done the best job of preserving its manufacturing share since 2010, despite running a trade deficit over that time period.

Excellent throughout, do read the whole thing.

Thursday assorted links

This is Vindication???

Joe Nocera has a strange piece in the Free Press arguing that the “godfathers of protectionism” have been vindicated. It begins with a story about how Dani Rodrik couldn’t get a famous economist to endorse his book Has Globalization Gone Too Far? because doing so would arm the barbarians. Well give that reluctant economist a Nobel! because they were obviously correct. Tyler made the same point in his debate with Rodrik. Rodrik had no answer.

The piece is strange because there is little to no connection with any data; just assertion, vibe, and non-sequitur. Most bizarrely but hardly alone was this bit:

In the 1980s, Prestowitz was an official in Ronald Reagan’s Commerce Department, back when Japan, not China, was the trading partner the U.S. most feared. Japanese autos, televisions, washing machines, and all sorts of consumer electronics were flooding into the U.S., forcing American auto makers to close factories and even putting U.S. companies like Zenith out of business. Yet Japan was using tariffs and other less obvious trade barriers to prevent U.S. companies from exporting many of their products to Japan. It was protecting certain key industries from foreign competition.

This was not how the rules of free trade were supposed to work. Prying that market open, forcing Japan to play by the same rules as the U.S., was Prestowitz’s job.

He found it deeply frustrating. “Every time we completed a trade negotiation,” Prestowitz told me, “some economist would turn out a model to show that the deal was going to create X number of American jobs and would reduce the trade deficit by Y. And it never happened.”

Even more galling, he said, “The conventional response among economists was that it didn’t matter.” After all, even if Japan was keeping U.S. products out of its market, America still benefited from low-cost imports. Prestowitz has a vivid memory of a conversation he once had with Herbert Stein, President Richard Nixon’s former chief economist. “The Japanese will sell us cars,” Stein told him with a shrug, “and we’ll sell them poetry.”

Prestowitz also remembers the abuse he took for his views. “I was a Japan-basher, a protectionist, and so on,” he said. Paul Krugman, who was not yet a New York Times columnist but was already an influential economist, called Prestowitz “an intellectual snake-oil salesman” in a book he wrote called Pop Internationalism. The book, published in 1997, consisted of a half-dozen essays, each of which brutally attacked one or another of the handful of people who dared to say that globalization was less than perfect. (He described then-Labor Secretary Robert Reich as “not a serious thinker,” and Lester Thurow, the best-selling author and Massachusetts Institute of Technology economist, as “silly.”)

When I asked Prestowitz recently if he felt vindicated, he admitted that he did, but added that “I also feel a sense of loss that it took us so long to face reality and at such cost.”

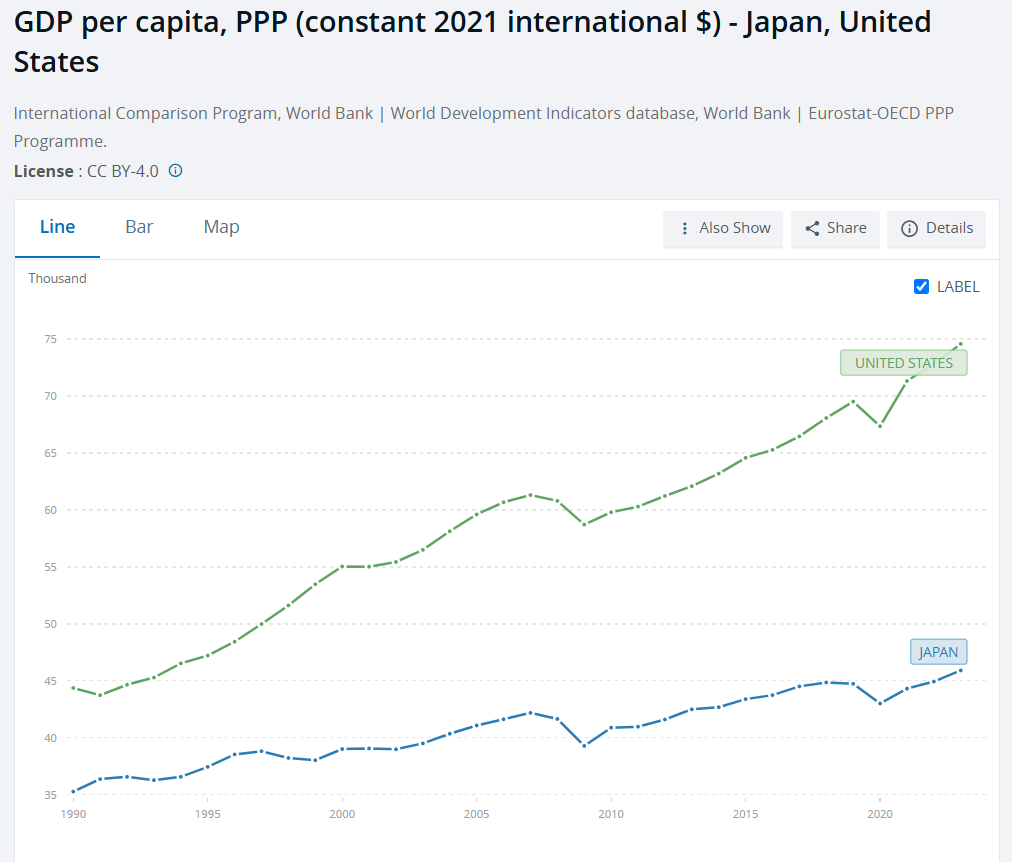

Well here is data on GDP per capita in real terms in Japan and the United States since 1990. This is vindication???!

Or how about this:

No one anymore, on the left or the right, denies that globalization has fractured the U.S., both economically and socially. It has hollowed out once-prosperous regions like the furniture-making areas of North Carolina and the auto manufacturing towns of the Midwest.

Well the far left and the far right agree that America has become fractured and hollowed out, the Bernie Sanders-Donald Trump horseshoe. But both are wrong. For the rest of us in the happy middle, consider this–Hickory, North Carolina, once known as the furniture capital of the United States, did face some hard times. But in 2023 Travel and Leisure magazine named Hickory the most beautiful and affordable place to live in the United States! Writing:

Located in the foothills of the Blue Ridge Mountains, Hickory is a family-friendly destination known for its ample hiking trails and Southern charm. Currently ranked as the cheapest place to live in the U.S., Hickory has a median home price of $161,000. This affordable neighbor to the east of Asheville and north of Charlotte is popular with retirees, but it’s also becoming more attractive to young families; a steady stream of residents has been flocking here for its newfound fame as a technological hub for Google and Apple.

Doesn’t sound hollowed out to me.

The godfathers of protectionism haven’t been vindicated—but if they want to claim credit for President Trump’s tariff binge they’re welcome to it.

Addendum: Hat tip to Scott Lincicome on Hickory and do read Jeremy Horpedahl for details on the distribution of wages. Did you know, for example, that median weekly earnings for full time workers who graduated high school but are without a college degree are at an all time high? Switched earlier current for constant $2021 dollars in graph.

Avoiding pharma dependence on China

Research-intensive pharmaceutical companies have also warned that low prices paid by European health systems are driving new drug discovery efforts to the US and China.

China. Here is the FT source, with plenty of interesting additional information. It is a common charge that libertarians or classical liberals had no suggested remedy for the growing U.S. dependence on China in biomedical supply chains. But of course we did. Many of us have been saying, for many years, that Europe should be paying much higher prices for pharma contracts. That in turn would have allowed more pharma production to have remained with our European allies, to our benefit and theirs. We also have been wanting to make it much easier to build and maintain pharma factories in the United States. Here is o3 on all the legal and regulatory obstacles to building pharma plants in the United States.

As a good rule of thumb, when someone says “group X never has dealt with problem Y,” usually it is wrong. (One possible remedy here is to do an o3 search.) A corollary principle is when someone says “Tyler Cowen never has dealt with problem Y” that usually is wrong too.

My excellent Conversation with Jack Clark

This was great fun and I learned a lot, here is the audio, video, and transcript. Here is part of the episode summary:

Jack and Tyler explore which parts of the economy AGI will affect last, where AI will encounter the strongest legal obstacles, the prospect of AI teddy bears, what AI means for the economics of journalism, how competitive the LLM sector will become, why he’s relatively bearish on AI-fueled economic growth, how AI will change American cities, what we’ll do with abundant compute, how the law should handle autonomous AI agents, whether we’re entering the age of manager nerds, AI consciousness, when we’ll be able to speak directly to dolphins, AI and national sovereignty, how the UK and Singapore might position themselves as AI hubs, what Clark hopes to learn next, and much more.

An excerpt:

COWEN: Say 10 years out, what’s your best estimate of the economic growth rate in the United States?

CLARK: The economic growth rate now is on the order of 1 percent to 2 percent.

COWEN: There’s a chance at the moment, we’re entering a recession, but at average, 2.2 percent, so let’s say it’s 2.2.

CLARK: I think my bear case on all of this is 3 percent, and my bull case is something like 5 percent. I think that you probably hear higher numbers from lots of other people.

COWEN: 20 and 30, I hear all the time. To me, it’s absurd.

CLARK: The reason that my numbers are more conservative is, I think that we will enter into a world where there will be an incredibly fast-moving, high-growth part of the economy, but it is a relatively small part of the economy. It may be growing its share over time, but it’s growing from a small base. Then there are large parts of the economy, like healthcare or other things, which are naturally slow-moving, and may be slow in adoption of this.

I think that the things that would make me wrong are if AI systems could meaningfully unlock productive capacity in the physical world at a really surprisingly high compounding growth rate, automating and building factories and things like this.

Even then, I’m skeptical because every time the AI community has tried to cross the chasm from the digital world to the real world, they’ve run into 10,000 problems that they thought were paper cuts but, in sum, add up to you losing all the blood in your body. I think we’ve seen this with self-driving cars, where very, very promising growth rate, and then an incredibly grinding slow pace at getting it to scale.

I just read a paper two days ago about trying to train human-like hands on industrial robots. Using reinforcement learning doesn’t work. The best they had was a 60 percent success rate. If I have my baby, and I give her a robot butler that has a 60 percent accuracy rate at holding things, including the baby, I’m not buying the butler. Or my wife is incredibly unhappy that I bought it and makes me send it back.

As a community, we tend to underestimate that. I may be proved to be an unrealistic pessimist here. I think that’s what many of my colleagues would say, but I think we overestimate the ease with which we get into a physical world.

COWEN: As I said in print, my best estimate is, we get half a percentage point of growth a year. Five percent would be my upper bound. What’s your scenario where there’s no growth improvement? If it’s not yours, say there’s a smart person somewhere in Anthropic — you don’t agree with them, but what would they say?

Interesting throughout, definitely recommended.

Wednesday assorted links

1. Interview with Galen Strawson, including about panpsychism.

2. Botched Dublin pipe bomb drone attack, neighborly feud edition. Solve for the equilibrium.

3. Claims that spicy food is good for you.

4. Unparalleled misalignments. Amazing what people will spend time on.

5. Why didn’t tariffs help the dollar?

6. Reforming naval shipbuilding.

7. The cardinals are watching Conclave to learn things.

Betting markets in everything

Polymarket, on the chances of a nuclear weapon being used in 2025. Currently at 17. Here is further analysis from o3.

China missing facts of the day

Not long ago, anyone could comb through a wide range of official data from China. Then it started to disappear.

Land sales measures, foreign investment data and unemployment indicators have gone dark in recent years. Data on cremations and a business confidence index have been cut off. Even official soy sauce production reports are gone.

In all, Chinese officials have stopped publishing hundreds of data points once used by researchers and investors, according to a Wall Street Journal analysis.

In most cases, Chinese authorities haven’t given any reason for ending or withholding data. But the missing numbers have come as the world’s second biggest economy has stumbled under the weight of excessive debt, a crumbling real-estate market and other troubles—spurring heavy-handed efforts by authorities to control the narrative.

Here is more from the WSJ, “model this.” Via B.

UK estimate of the day

A majority of Britons may now consider themselves neurodivergent, meaning they have a condition such as autism, dyslexia or dyspraxia, according to a leading psychologist.

Francesca Happé, professor of cognitive neuroscience at the Institute of Psychiatry, Psychology and Neuroscience at King’s College London, said reduced stigma around these conditions had led more people both to seek medical diagnoses and to self-diagnose.

She said: “There’s a lot more tolerance, which is good — particularly among my children’s generation, who are late teens and early adults, where people are very happy to say ‘I’m dyslexic’, ‘I’m ADHD [attention deficit hyperactivity disorder]’.”

Here is more from the (gated) Times of London. Via Glenn.

Are recent cohorts in worse health?

From the abstract:

Our sample is individuals in the Health and Retirement Study who are aged 51 to 54 at baseline and are followed for up to two decades. We find that limitations in most domains have increased for younger cohorts, especially pain and cognitive impairment. People are more impaired in their 50s, where such impairment used to occur in one’s 60s. However, this appears to be a speeding up of impairment more than a long-term increase. Among people in their late 60s, health for later cohorts is similar to health for earlier cohorts. To evaluate the implications of these trends, we simulate the work capacity of adults just before reaching age 65 based on the health status of people at this age and the relationship between health and the labor force outcomes of younger people. Overall health among those age 62 to 64 remains high, despite impairment striking at younger ages. However, among people without high school degrees, less than half are predicted to have the capacity to work full time by age 62 to 64, and over a quarter are predicted to be receiving SSDI.

That is from a new NBER working paper by David M. Cutler, Ellen Meara, and Susan Stewart.

Tuesday assorted links

1. Writing an economics paper using LLMs entirely. Sort of.

2. The most beautiful words in the English language? The o3 list is better.

3. The macroeconomics of tariffs and retaliation. The real news here is the claim that, in the absence of foreign retaliation, the tariffs will make America better off. Typically I am skeptical of such conclusions, due to the importance of more dynamic factors, including those of public choice, but in any case I expect that finding will be underreported.

4. China’s One Child Policy lowered fertility more than we used to think.

5. Daniel Muñoz on Coleman Hughes and the norm of colorblindness. A very good piece.

Has Clothing Declined in Quality?

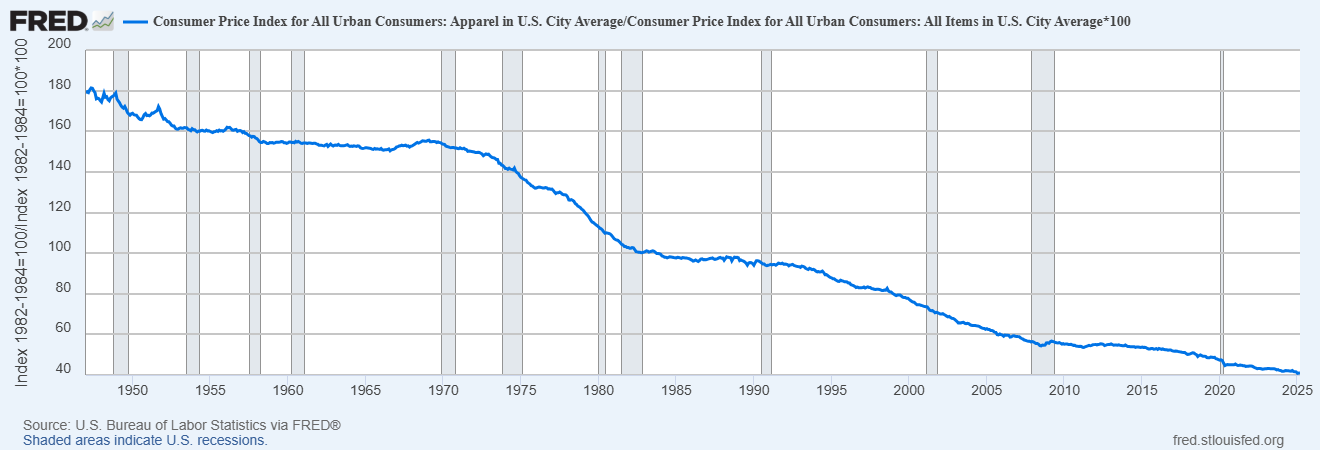

The Office of the U.S. Trade Representative (USTR) recently tweeted that they wanted to bring back apparel manufacturing to the United States. Why would anyone want more jobs with long hours and low pay, whether historically in the US or currently in places like Bangladesh? Thanks in part to international trade, the real price of clothing has fallen dramatically (see figure below). Clothing expenditure dropped from 9-10% of household budgets in the 1960s (down from 14% in 1900) to about 3% today.

Apparently, however, not everyone agrees. While some responses to my tweet revealed misunderstandings of basic economics, one interesting counter-claim emerged–the low price of imported clothing has been a false bargain, the argument goes, because the quality of clothing has fallen.

The idea that clothing has fallen in quality is very common (although it’s worth noting that this complaint was also made more than 50 years ago, suggesting a nostalgia bias, like the fact that the kids today are always going to hell). But are there reliable statistics documenting a decline in quality? In some cases, there are! For example, jeans from the 1960s-80s, for example, were often 13–16 oz denim, compared to 9–11 oz today. According to some sources, the average garment life is down modestly. The statistical evidence is not great but the anecdotes are widespread and I shall accept them. Most sources date the decline in quality to the fast fashion trend which took off in the 1990s and that provides a clue to what is really going on.

Fast fashion, led by firms like Zara, is a business model that focuses on rapidly transforming street style and runway trends into mass-produced, low-cost clothing—sometimes from runway to store within weeks. The model is not about timeless style but about synchronized consumption: aligning production with ephemeral cultural signals, i.e. to be fashionable, which is to say to be on trend, au-courant and of the moment.

It doesn’t make sense to criticize fast fashion for lacking durability—by design, it isn’t meant to last. Making it durable would actually be wasteful. The product isn’t just clothing; it’s fashionable clothing. And in that sense, quality has improved: fast fashion is better than ever at delivering what’s current. Critics who lament declining quality miss the point—it’s fun to buy new clothes and if consumers want to buy new clothes it doesn’t make sense to produce long lasting clothes. People do own many more pieces of clothing today than in the past but the flow is the fun.

So my argument is that the decline in “quality” clothing has little to do with the shift to importing but instead is consumer-driven and better understood as an increase in the quality of fashion. Testing my theory isn’t hard. Consider clothing where function, not just fashion, is paramount: performance sportswear and Personal Protective Equipment (PPE).

There has been a massive and obvious improvement in functional clothing. The latest GoreTex jackets, for example, are more than five times as water resistant (28 000 mm hydrostatic head) compared to the best waxed cotton technology of the past (~5 000 mm) and they are breathable (!) and lighter. Or consider PolarTec winter jackets, originally developed for the military these jackets have the incredible property of releasing heat when you are active but holding it in when you are inactive. (In the past, mountain climbers and workers in extreme environments had to strip on or off layers to prevent over-heating or freezing while exerting effort or resting.) Amazing new super shoes can actually help runners to run faster! Now that is high quality. Personal protective equipment has also increased in quality dramatically. Industrial workers and intense sports enthusiasts can now wear impact resistant gloves which use non-Newtonian polymers that stiffen on impact to reduce hand injuries.

Moreover, it’s not just functional clothing that has increased in quality. For those willing to look, there is in fact plenty of high-quality clothing readily available. From Iron Heart, for example, you can buy jeans made with 21oz selvedge indigo denim produced in Japan. Pair with a high-quality Ralph Lauren shirt, a Mackinaw Wool Cruiser Jacket and a nice pair of Alden boots. Experts like the excellent Derek Guy regularly highlight such high-quality options. Of course, when Derek Guy discusses clothes like this people complain about the price and accuse him of being an elitist snob. Sigh. Tradeoffs are everywhere.

Moreover, it’s not just functional clothing that has increased in quality. For those willing to look, there is in fact plenty of high-quality clothing readily available. From Iron Heart, for example, you can buy jeans made with 21oz selvedge indigo denim produced in Japan. Pair with a high-quality Ralph Lauren shirt, a Mackinaw Wool Cruiser Jacket and a nice pair of Alden boots. Experts like the excellent Derek Guy regularly highlight such high-quality options. Of course, when Derek Guy discusses clothes like this people complain about the price and accuse him of being an elitist snob. Sigh. Tradeoffs are everywhere.

Critics long for a past when goods were cheap, high quality, and Made in America—but that era never really existed. Clothing in the past was more expensive and often low quality. To the extent that some products in the past were of higher quality–heavier fabric jeans, for example–that was often because the producers of the time couldn’t produce it less expensively. Technology and trade have increased variety along many dimensions, including quality. As with fast fashion, lower quality on some dimensions can often produce a superior product. And, of course, it should be obvious but it needs saying: products made abroad can be just as good—or better—than those made domestically. Where something is made tells you little about how well it’s made.

The bottom line is that international trade has brought us more options and if today’s household were to redirect the historical 9 – 10 % share of income to clothing, it could absolutely buy garments that are heavier, better-constructed, and longer-lived than the typical mid-century mass-market clothing.

Tabarrok on the Movie Tariff

The Hollywood Reporter has a good piece on Trump’s proposed movie tariffs:

Even if such a tariff were legal — and there is some debate about whether Trump has the authority to impose such levies — industry experts are baffled as to how, in practice, a “movie tariff” would work.

“What exactly does he want to put a tariff on: A film’s production budget, the level of foreign tax incentive, its ticket receipts in the U.S.?” asks David Garrett of international film sales group Mister Smith Entertainment.

Details, as so often with Trump, are vague. What precisely constitutes a “foreign” production is unclear. Does a production need to be majority shot outside America — Warner Bros’ A Minecraft Movie, say, which filmed in New Zealand and Canada, or Paramount’s Gladiator II, shot in Morocco, Malta and the U.K. — to qualify as “foreign” under the tariffs, or is it enough to have some foreign locations? Marvel Studios’ Thunderbolts*, for example, had some location shooting in Malaysia but did the bulk of its production in the U.S, in Atlanta, New York and Utah.

…“The only certainty right now is uncertainty,” notes Martin Moszkowicz, a producer for German mini-major Constantin, whose credits including Monster Hunter and Resident Evil: The Final Chapter. “That’s not good for business.”

A movie producer is quoted on the bottom line:

“Consistent with everything Trump does and says, this is an erratic, ill conceived and poorly considered action,” says Nicholas Tabarrok of Darius Films, a production house with offices in Los Angeles and Toronto. “It will adversely affect everyone. U.S. studios, distributors, and filmmakers will suffer as much as international ones. Trump just doesn’t seem to understand that international trade is good for both parties and tariffs not only penalize international companies but also raise prices for U.S. based companies and consumers. This is an ‘everyone loses, no one gains’ policy.”