Month: May 2014

Why Vampires Live So Long

NYTimes: Two teams of scientists published studies on Sunday showing that blood from young mice reverses aging in old mice, rejuvenating their muscles and brains. As ghoulish as the research may sound, experts said that it could lead to treatments for disorders like Alzheimer’s disease and heart disease.

The key papers are here and here and here. Some of the papers are pointing to a specific protein but the last paper suggests that simple transfusions also work and that raises a number of issues of public policy. As Derek Lowe notes:

The key papers are here and here and here. Some of the papers are pointing to a specific protein but the last paper suggests that simple transfusions also work and that raises a number of issues of public policy. As Derek Lowe notes:

Since blood plasma is given uncounted thousands of times a day in every medical center in the country, this route should have a pretty easy time of it from the FDA. But I’d guess that Alkahest is still going to have to identify specific aging-related disease states for its trials, because aging, just by itself, has no regulatory framework for treatment, since it’s not considered a disease per se.

…You also have to wonder what something like this would do to the current model of blood donation and banking, if it turns out that plasma from an 18-year-old is worth a great deal more than plasma from a fifty-year-old. I hope that the folks at the Red Cross are keeping up with the literature.

A simple Bayesian updating on Ukraine

Putin didn’t carve off the eastern parts of the country, although he could have. I now infer he wishes to take the whole thing. There are sometimes reasons why you do not wish to stop and take the free lunch and create a focal line, namely that it can constrain you for the future. I don’t mean that Putin will conquer Ukraine by military force, but rather bit by bit he will harass the current government into losing legitimacy, until a strongly pro-Russian, pro-Putin government is running that country. By hook or by crook.

Parisian notes

By this point most of the Right Bank is mind-numbingly oppressive. I discovered the upper part of Marais, however, and fell in love with (parts of) Paris once again. Start on or near Rue Vertbois, explore the small streets, and end up in the food stores of Rue Bretagne, stopping many times along the way.

I’ve mostly seceded from the restaurant scene here, instead preferring to buy foodstuffs in the small shops. I just spent seven dollars for three (excellent) artichokes.

I know exactly how long an unrefrigerated crottin can stay good in a French hotel room.

Overall, what I am seeing more of is bagel shops and e-cigarette stores. The stand-alone fromagerie is increasingly difficult to find.

There is a separate art to ordering in Indian restaurants in Paris. Focus on the salmon and spinach, mostly unadorned.

For the first time ever I enjoyed gazing at the Mona Lisa.

Are athletes really getting better, faster, stronger?

A new TED talk by David Epstein says “not as much as you might think.”

From the transcript, here is one interesting excerpt:

…consider that Usain Bolt started by propelling himself out of blocks down a specially fabricated carpet designed to allow him to travel as fast as humanly possible. Jesse Owens, on the other hand, ran on cinders, the ash from burnt wood, and that soft surface stole far more energy from his legs as he ran. Rather than blocks, Jesse Owens had a gardening trowel that he had to use to dig holes in the cinders to start from.Biomechanical analysis of the speed of Owens’ joints shows that had been running on the same surface as Bolt, he wouldn’t have been 14 feet behind, he would have been within one stride.

This is interesting too:

In the early half of the 20th century, physical education instructors and coaches had the idea that the average body type was the best for all athletic endeavors: medium height, medium weight, no matter the sport.And this showed in athletes’ bodies. In the 1920s, the average elite high-jumper and average elite shot-putter were the same exact size. But as that idea started to fade away, as sports scientists and coaches realized that rather than the average body type, you want highly specialized bodies that fit into certain athletic niches, a form of artificial selection took place, a self-sorting for bodies that fit certain sports, and athletes’ bodies became more different from one another. Today, rather than the same size as the average elite high jumper, the average elite shot-putter is two and a half inches taller and 130 pounds heavier. And this happened throughout the sports world.

There is this contrast:

… if you know an American man between the ages of 20 and 40 who is at least seven feet tall, there’s a 17 percent chance he’s in the NBA right now…in sports where diminutive stature is an advantage, the small athletes got smaller. The average elite female gymnast shrunk from 5’3″ to 4’9″ on average over the last 30 years, all the better for their power-to-weight ratio and for spinning in the air.

I cannot say I am convinced, if only because I don’t recall too many NBA players from my boyhood looking like Charles Oakley. You can suggest that example more than fits the author’s hypothesis, but then I wonder which view he is arguing against. If you hold enough other things equal, of course performance has to be equal too.

For the pointer I thank Mitch Berkson.

Assorted Gary Becker links

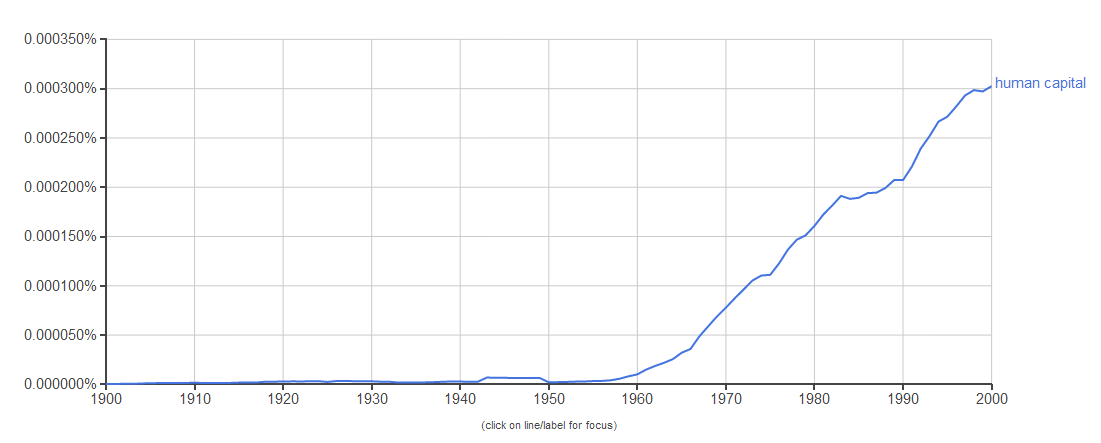

The Rise of Human Capital

No economist was more responsible for the appreciation, understanding and analysis of the fact that people invest in improving their productivity than was Gary Becker.

Some neglected Gary Becker open access pieces

Summarizing Becker’s contributions is like trying to summarize economics and it is not really possible. I believe he has the best “30th best” paper of any economist, living or dead.

Here are a few Becker articles which are not even his best known work:

1. “Irrational Behavior and Economic Theory.” Can the theorems of economics survive the assumption of irrational behavior? (hint: yes)

2. “Altruism, Egoism, and Genetic Fitness: Economics and Sociobiology.” The title says it all, from 1976.

3. “A Note on Restaurant Pricing and Other Examples of Social Influence on Price.” Why don’t successful restaurants just raise the prices for Saturday night seatings?

4. “The Quantity and Quality of Life and the Evolution of World Inequality” (with Philipson and Soares). The causes and importance of converging lifespans.

5. “Competition and Democracy.” From 1958, but most people still ignore this basic point about why government very often does not improve on market outcomes.

6. “The Challenge of Immigration: A Radical Solution.” Auction off the right to enter this country.

Assorted links

Gary Becker has passed away

Greg Mankiw offers the sad news. He was perhaps the greatest living economist.

Make three claims when trying to persuade

Suzanne B. Shu and Kurt A. Carlson have a paper (pdf) on this claim:

How many positive claims should be used to produce the most positive impression of a product or service? This article posits that in settings where consumers know that the message source has a persuasion motive, the optimal number of positive claims is three. More claims are better until the fourth claim, at which time consumers’ persuasion knowledge causes them to see all the claims with skepticism. The studies in this paper establish and explore this pattern, which is referred to as the charm of three. An initial experiment finds that impressions peak at three claims for sources with persuasion motives but not for sources without a persuasion motive. Experiment 2 finds that this occurs for attitudes and impressions, and that increases in skepticism after three claims explain the effect. Two final experiments examine the process by investigating how cognitive load and sequential claims impact the effect.

Here is a NYT summary of those results.

Rude salespeople make you buy fancy things

Here is a new result, although it is based on surveys rather than market data:

It’s no secret that salespeople at upscale shops can be a little snobbish, if not outright rude, the researchers note. Consumer complaints recently have pressured some luxury retailers to train their staffs to be more approachable; Louis Vuitton even went as far as decorating the entrance of its Beverly Hills store with a smiling cartoon apple in 2007. But if luxury retailers want to continue to rake in the dough, they actually should do the exact opposite, the study found. The ruder the salesperson the better.

In four online surveys, Ward and Dahl had participants imagine interactions with different types of salespeople under a bunch of different conditions. Variables included the imagined store’s level of luxury, the extent of the salesperson’s haughtiness, how well the salesperson represented the store’s brand, and how closely participants themselves related with the brand. The results:

- Rejection makes people want to buy luxury goods. A salesperson’s condescending attitude has little effect on consumers’ desire to buy more affordable brands like Gap and American Eagle, though.

- Rejection is stronger when salespeople convincingly embody brands in the way they act and dress. Sloppy salespeople aren’t as intimidating.

- People who really want to own a particular brand are even more influenced by rejection. Instead of switching their loyalties, customers just become more attached.

- Rejection works best in the short term. While great at pressuring people into buying something in the moment, dismissive staff may still alienate customers in the long run.

The results fall into a long line of research that demonstrates the extent to which rejection can jar our fragile self-conceptions.

The article is based on:

…a forthcoming study in theJournal of Consumer Research,Morgan Ward of Southern Methodist University and Darren Dahl of the Sauder School of Business…

The pointer is from Roman Hardgrave.

Department of Ho-Hum

Or should that read Department of Uh-Oh?:

Asteroids caused 26 nuclear-scale explosions in the Earth’s atmosphere between 2000 and 2013, a new report reveals.

Some were more powerful – in one case, dozens of times stronger – than the atom bomb blast that destroyed Hiroshima in 1945 with an energy yield equivalent to 16 kilotons of TNT.

Most occurred too high in the atmosphere to cause any serious damage on the ground. But the evidence was a sobering reminder of how vulnerable the Earth was to the threat from space, scientists said.

There is more here. You will find asteroid protection presented as the paradigmatic example of a public good in…um…my favorite Principles text.

Assorted links

1. Data on blockbuster movies.

2. Can China use its capital in a time of crisis?

3. My Piketty NYT column from July: “If you’d like to know where American political debates are headed, the data suggest a simple answer. The next major struggle — in economic terms at least — will be over whether taxes on personal wealth should rise — and by how much.” I believe this was the first coverage of Piketty in a major media outlet.

4. The prices of Qatari license plates.

5. First Bay area sex truck (what does this imply about living quarters?)

Cuba claims that plain tobacco packaging is anti-capitalist

Cuba has waded into the debate over plain tobacco packaging and has complained to the World Trade Organisation (WTO) over the UK’s plans.

According to a report in the Daily Telegraph, Cuba claimed that the law would be “anti-capitalist” and would threaten free trade. The Communist country added that plain packaging would lead to an increase in counterfeit cigarettes, leading to health risks to people smoking black market cigarettes.

Cuba’s letter to the WTO’s Committee to Technical Barriers on Trade concluded: “Cuba expresses great concern over the UK Parliament’s decision to move ahead with the process of implementation of plain packaging of tobacco products, without waiting for a settlement of the complaint against Australia before the WTO Dispute Settlement Body.”

That is not the silliest statement they have issued. There is more here, and for the pointer I thank R.

Stefan Homburg on Piketty

It is a useful overview (pdf, but better link here) of some of the major problems in the argument, here is one key passage:

Piketty’s erroneous claim is due to the implicit assumption that savings are never consumed, nor spent on charitable purposes or used to exert power over others. It is only under this outlandish premise that wealth grows at the rate r. If people use their savings later on, as they do in the Diamond model as well as in reality, the growth of wealth is independent of the return on capital. This holds all the more in the presence of taxes.

Piketty’s allegation that the relationship r>g implies a rising wealth-income ratio is not only logically flawed, however, but also rebutted by his own data: On p. 354, the author reports that the return on capital has consistently exceeded the world growth rate over the last 2,000 years. According to his “central contradiction of capitalism”, this would have implied steadily increasing wealth-income ratios. Yet, over the last two centuries or so, the period for which data are available, wealth-income ratios have remained relatively stable in countries like the United States or Canada. In countries such as Britain, France, or Germany, which were heavily affected by the wars, wealth-income ratios declined at the start of World War I and recovered after the end of World War II. The book’s references to these wars and the implied destruction of capital abound. They are intended to rescue the claim that r>g implies an ever rising wealth-income ratio. The United States and Canada as obvious counter-examples remain unmentioned in this context.

For the pointer I thank David Levey.