Month: February 2015

Did China really grow at seven-something percent last year?

The latest year-on-year data, from January, highlight the danger. The consumer price index dropped to 0.8%; the producer price index fell by 4.3%; exports contracted by 3.3%; imports were down by 19.9%; and growth of broad money (M2) slowed by 1.4%.

Moreover, the renminbi has come under downward pressure, owing partly to economic recovery in the United States, which has fueled capital outflows. Given huge declines in industrial profit growth (from 12.2% in 2013 to 3.3% last year) and in local-government revenues from land sales (which fell by 37% in 2014), there is considerable anxiety that today’s deflationary cycle could trigger corporate and local-government debt crises.

Just askin’…that is from Sheng and Xiao, there is more here.

Saturday assorted links

1. The fiasco that is the Nicaragua canal.

2. 15 year old makes 500k a year in the babysitting business.

4. Bryan Caplan’s totally conventional views. And Scott Sumner on those views, and whether Bryan is consistent in his views on love.

5. How the culture that is German views Yanis (video, unusual, not like Bryan’s conventional views. Or is it?).

That was quick…

Greece called into question on Saturday a major debt repayment it must make to the European Central Bank this summer, after acknowledging it faces problems in meeting its obligations to international creditors.

There is more here, most of all showing the Greeks have not obtained much leverage from the talks. They are in a deep liquidity squeeze, even post “agreement.” The Bundestag overwhelmingly approved last week’s “deal,” whereas the Greeks don’t even want to vote on it. So who won that round? The on-paper ability to be flexible with a primary surplus — that isn’t real any more — just isn’t worth very much right now.

Hong Kong fact and projection of the day

Hong Kong is a tough marriage market for women because of the city’s skewed gender ratio — 876 males for every 1,000 females, a gap predicted to worsen to 712 to 1,000 by 2041.

That is from Julie Zhu at the FT.

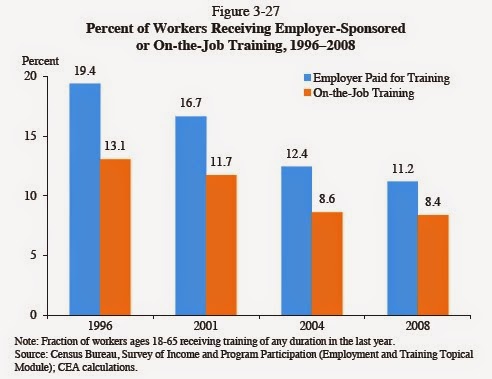

The decline in on-the-job training

That is from Timothy Taylor, who remains a model of excellence and lucidity.

How durable and valuable is the Draghi put?

Michael Pettis has an excellent short essay on this point, here is one (scary) excerpt:

A debt crisis must be resolved quickly because there is a self-reinforcing component within the process that can be extraordinarily harmful. High levels of sovereign debt create uncertainty about how the costs of resolving the debt will ultimately be assigned. This uncertainty causes growth to slow by adversely changing the behavior of a wide variety of stakeholders in the economy (as I will describe later). As the economy slows, contingent liabilities within the banking system rise, tax revenues decline and fiscal expenditures rise, all of which push up sovereign debt levels even further and increase both the cost of resolving the debt and the uncertainty about how the costs will be assigned. The consequence of this self-reinforcing deterioration in the sovereign balance sheet is, at first, a slow grinding away of the economy until the market reaches some point, after which the process accelerates and debt can spiral out of control.

Hat tip goes to the ever-excellent The Browser.

Assorted Friday links

1. How important is cutlery design anyway?

2. The Palestinian city without water.

3. Good further story on the machinations of LSU professor Johnny Matson, but Michelle Dawson should be getting more of the credit for this expose. It was her earlier stream of tweets which led to the uncovering of these rather dubious practices.

4. Should we remove investor-state dispute settlement from free trade agreements?

5. China wars against Tocqueville. And Putin’s teenage fan club. Full slideshow is here.

6. Meta-IRB.

7. Keith Hall, formerly of Mercatus and GMU, will be the new CBO director.

Price Ceilings

This week we released two new sections of our principles of economics class, price ceilings and trade. Most textbooks discuss how price ceilings create shortages and deadweight loss. Modern Principles delves much deeper to explain how price controls impede the operation of the price system creating economic discoordination and a misallocation of resources.

The introductory video is short but it covers a lot of economics.

Does using Facebook make you happier?

I’ve long suggested that those worried about inequality, envy, and relative deprivation should tax Facebook rather than the private fortune of Bill Gates. Most envy is local, and connected to people you know and whose lives you are in touch with. Along these lines, here is some recent research by Verduyn, et.al.:

Prior research indicates that Facebook usage predicts declines in subjective well-being over time. How does this come about? We examined this issue in 2 studies using experimental and field methods. In Study 1, cueing people in the laboratory to use Facebook passively (rather than actively) led to declines in affective well-being over time. Study 2 replicated these findings in the field using experience-sampling techniques. It also demonstrated how passive Facebook usage leads to declines in affective well-being: by increasing envy. Critically, the relationship between passive Facebook usage and changes in affective well-being remained significant when controlling for active Facebook use, non-Facebook online social network usage, and direct social interactions, highlighting the specificity of this result. These findings demonstrate that passive Facebook usage undermines affective well-being.

The pointer is from Robin Hanson on Twitter.

*Our Kids: The American Dream in Crisis*

That is the new Robert D. Putnam book and it focuses on the widening opportunity gap among America’s young. Much of the work is narrative and case studies, starting with Port Clinton, Ohio but not stopping there. Any Putnam book is an event, and this one is the natural sequel to Charles Murray’s Coming Apart. The writing and the underlying intelligence are of an extremely high quality.

One significant theme is that upward mobility results from a mingling of the upper and lower income classes, and such mingling is more scarce than in the immediate postwar era. You can think of it as case study evidence for the cross-sectional statistical regularities stressed by Chetty et.al. Contra Chetty, however, Putnam believes that declines in socioeconomic mobility will start to show up in the data as current generations age.

The book’s problem is finding a new note to strike. Putnam stresses this is a story of social forces rather than personal villains, but, for all the merits of his text, he identifies no new culprits or solutions. Inequality of opportunity seems to have more to do with parents than schools, but how to control parents? This book does not flirt with the so-called Neoreaction. Putnam favors increased access to contraception, professional coaching of poor parents, prison sentencing reform and more emphasis on rehabilitation, eliminating fees for school extracurricular activities, mentoring programs, and greater investment in vocational education; contra Krugman he gives a lot of evidence for skills mismatch (pp.232-233). More generally, he asks for federalist solutions and lots of experimentation. Maybe those are good paths to go, but the reader feels (once again) that matters will get worse before they get better. There is very little on either political economy or the evolution of technology.

Do read this book, but by the end Putnam himself seems to come away deflated from dealing with some of America’s toughest problems.

Assorted links

Psychology journal bans significance testing

This is perhaps the first real crack in the wall for the almost-universal use of the null hypothesis significance testing procedure (NHSTP). The journal, Basic and Applied Social Psychology (BASP), has banned the use of NHSTP and related statistical procedures from their journal. They previously had stated that use of these statistical methods was no longer required but can be optional included. Now they have proceeded to a full ban.

The type of analysis being banned is often called a frequentist analysis, and we have been highly critical in the pages of SBM of overreliance on such methods. This is the iconic p-value where <0.05 is generally considered to be statistically significant.

There is more here, with further interesting points in the piece, via Mark Thorson.

Smile! The Dentists Lose a Monopoly

Yesterday, the Supreme Court ruled (6:3) in North Carolina State Board of Dental Examiners v. FTC that the attempt of the state board of dental examiners to exclude nondentists from the practice of teeth whitening violated the Sherman antitrust act.

The opinion, written by Justice Kennedy, is especially lucid. Here, from Kennedy, are the key facts:

The opinion, written by Justice Kennedy, is especially lucid. Here, from Kennedy, are the key facts:

Starting in 2006, the Board issued at least 47 cease-and desist letters on its official letterhead to nondentist teeth whitening service providers and product manufacturers. Many of those letters directed the recipient to cease “all activity constituting the practice of dentistry”; warned that the unlicensed practice of dentistry is a crime; and strongly implied (or expressly stated) that teeth whitening constitutes “the practice of dentistry.” App. 13, 15. In early 2007, the Board persuaded the North Carolina Board of Cosmetic Art Examiners to warn cosmetologists against providing teeth whitening services. Later that year, the Board sent letters to mall operators, stating that kiosk teeth whiteners were violating the Dental Practice Act and advising that the malls consider expelling violators from their premises.

These actions had the intended result. Nondentists ceased offering teeth whitening services in North Carolina.

The FTC then brought suit, arguing that the action was anti-competitive. The case raises constitutional issues because the states are allowed to violate the federal antitrust acts, as will inevitably happen in the ordinary use of their powers. The question then became whether the NC State Dental Board was invested with enough state authority to overcome the antitrust provisions. On the one hand, the principles of federalism say leave the states alone. On the other (Kennedy quoting Justice Stevens in Hoover v. Ronwin):

“The risk that private regulation of market entry, prices, or output may be designed to confer monopoly profits on members of an industry at the expense of the consuming public has been the central concern of . . . our antitrust jurisprudence.”

In my view, the majority deftly navigated the tradeoff. The court said that North Carolina can, without question, decide that teeth whitening is the practice of dentistry but they have to do so more or less explicitly–they can’t simply put the fox in charge of the hen-house by deferring the decision to the dentists.

In other words, the court raised the cost of rent-seeking. If the dentists want to monopolize the practice of teeth whitening they will have to make that case to the legislature and not rely on the unilateral actions of a board composed almost entirely of dentists and created for entirely different purposes.

As Kennedy put it in language reminiscent of bootleggers and baptists:

Limits on state-action immunity are most essential when the State seeks to delegate its regulatory power to active market participants, for established ethical standards may blend with private anticompetitive motives in a way difficult even for market participants to discern. Dual allegiances are not always apparent to an actor. In consequence, active market participants cannot be allowed to regulate their own markets free from antitrust accountability.

Addendum: I, along with a number of other GMU scholars, was part of an Institute for Justice BRIEF OF AMICI CURIAE SCHOLARS OF PUBLIC CHOICE ECONOMICS IN SUPPORT OF RESPONDENT. Congratulations are due to the excellent team at IJ, as the brief seems to have been influential.

By the way, the dissenting opinion (Alito, Scalia, Thomas) appears to accept the logic of our brief to an even greater extent, so much so that they shrug their shoulders at the rent seeking as business as usual (I especially enjoyed the dig at the FTC as also being subject to regulatory capture). Thus, the dissenters focused entirely on the federalism question. I respect that approach but I think that as federalism stands today, the majority’s balancing approach is likely to lead to better policy.

Totally conventional views I hold about Hillary Clinton

I’ve been receiving numerous requests for more of my “totally conventional views,” and someone asked me about HRC. We’ve never covered her in the past, so why not? But by construction of this series, none of what follows is at all new and probably there won’t be any discussion in the comments. But with that in mind, I’ll offer up these points:

1. Women are judged far more by their looks than are men, and Hillary’s are not right for the presidency. She doesn’t seem composed enough, schoolmarmish enough a’ la Thatcher, and frankly many men, when they see her in their mind’s eye, imagine a voice saying “Look here, buster…!” Her hair is not properly ordered for the Executive Office, and I suspect many Americans want for their first female President to appear somewhat ageless. I am not suggesting any of this is fair or even an efficient form of Bayesian statistical discrimination, but it is a reality.

2. If not for factor #1, a healthy Hillary would be a shoo-in for demographic reasons, but as it stands her chances of winning are overrated.

3. A Clinton Presidency is the most likely of any, from the major candidates, to serve up significant and enduring market-oriented reforms. She could bring along enough Democrats to work with the Republicans, and reclaim a version of the old Clinton legacy. That said, her presidency also is more likely to effect change in the opposite direction as well, so the net expected value here is hard to calculate and still may be negative.

4. Given #1 and #2, and other gender-related factors, your opinion about Hillary, no matter what it may be, is less reliable than you think. That suggests you should think about her less rather than more (sorry people for this post, what did Wittgenstein say about that ladder?), because I don’t think you’re going to see much of a payoff from grabbing here at that third derivative.

5. The willingness of the Clinton Foundation to solicit donations from foreign governments and leaders is corrupt, and yet mostly receives a free pass, in spite of some recent coverage on corporate donations. I read recently they might stop soliciting donations “…if Hillary runs for President,” also known as “hurry up and give now!” Arguably we would be electing a political machine as President of the United States, even more than usual.

6. Democratic intellectuals and operatives are quite unexcited — or should I say “fervently and passionately unexcited” — about the prospect of a Hillary candidacy. The energy is already drained from the room, and they haven’t opened the door yet.

7. There is still the question of how the press, and the American people, might process any subsequent revelations about Bill’s “activities” since leaving the White House.

8. It will be hard to avoid giving the public “Hillary fatigue,” given how many years she has been in the public eye. This is another reason why I think her chances are overrated, plus she will have to be very careful to carry herself in the debates just the right way, see #1 and #2 again.

9. It is easier to transcend race than gender.

The wisdom that is Japanese

Funerals are being held for ROBOTIC dogs in Japan because owners believe they have souls…

It is a funeral like any other in Japan. Except that those being honoured are robot dogs, lined up on the altar, each wearing a tag to show where they came from and which family they belonged to.

The devices are ‘AIBOs’, the world’s first home-use entertainment robot equipped with Artificial Intelligence (AI) and capable of developing its own personality.

And don’t forget this:

The only source of genuine parts are ‘dead’ robots, who become donors for organ transplantation, but only once the proper respects have been paid.