Month: November 2016

Make baseball fun again

Gregory Howard of MIT is on the job market this year, and I was intrigued by one of his papers in process (not yet available):

Make Baseball Fun Again (with Vivek Bhattacharya)

Abstract: Using Pitch F/X data covering over 6 million pitches, we document that pitchers are averse to throwing fastballs. Controlling for the state space of a baseball game, including balls, strikes, outs, inning, run differential, and pitcher/batter fixed effects, we find the pitching team is more likely to win the game when throwing a fastball. This is inconsistent with a mixed-strategy equilibrium where the pitcher’s utility is winning the game. We document that fastballs are riskier, leading to more outs, but also to more extra-base hits. We outline a possible incentive problem between the team and the pitcher, who has preferences over remaining in the game, similar to career concerns (Holmstrom 1998), leading the pitcher to be risk-averse. As suggestive evidence, we show that these effects are more prevalent later in the game, and that rookie pitchers, who have less leverage over pitch choice, do not exhibit this tendency.

If you are wondering, Greg’s job market paper (also at the above link) is on how local labor migration creates an “accelerator” for labor demand by boosting the demand for housing — a locally-produced good — in that area.

Does lifetime experience influence FOMC votes?

There is a new paper by Malmandier, Nagel, and Yan (pdf) on that question, it seems the answer is yes, here is the abstract:

We show that personal lifetime experiences of inflation significantly affect the hawkish or dovish leanings of central bankers. We link experience-based inflation expectations to the desired level of nominal interest rates using a forward-looking formulation of the Taylor rule. Using data of the FOMC voting history from March 1951 to January 2014, we estimate that a one standard-deviation increase in experience-based forecasts increases the unconditional probability of a hawkish dissent by about one third, and decreases the unconditional probability of a dovish dissent also by about one third. FOMC members also use significantly a more hawkish tone in their speeches if they have experienced high inflation in their lives so far. Aggregating over all FOMC members present at a meeting, we establish a significantly positive relationship between their average inflation experience and the Fed Funds Rate target decided at the meeting. Finally, inflation experiences have a strong direct impact on FOMC members’ inflation forecasts as reported in their semiannual Monetary Policy Reports to Congress, suggesting that experiences affect beliefs. Our findings imply that even professionals are affected by their lifetime experiences of macroeconomic outcomes and shed new light on the importance of FOMC appointments.

This is from their conclusion:

This evidence adds to a growing literature on the role of ‘experience effects’, a term first coined by Malmendier and Nagel (2011) in the context of stock-market investment. What is still debated is whether such influences are weaker among more highly educated decision-makers or even experts. Our results here suggest that this is not necessarily the case.

I would expect such effects to be stronger for the better-educated and the experts. We are more a prisoner of our prisms, just as we are more likely to have strong prisms in the first place.

Saturday assorted links

1. Medical hand-washing is addictive, and persists once monitoring is removed, an important result. That is by Reshmaan Hussam, currently a job market candidate at MIT. Here is her YouTube talk on the same topic. This is probably going to be one of the best and most important job market papers of the year.

2. The audacious plan to bring back supersonic flight.

3. Can scientists publish their best work at any age? This seems counterintuitive to me, but it is always worth examining that which challenges our prior beliefs.

4. Does the “bike desk” improve cognitive performance?

6. “Rogoff predicts that future cash registers will include scanners that log purchases with plastic bills, blending elements of digital and physical currencies.” Link here, that is a Jeremy Bentham idea, basically.

What else is happening

Turkey continues a major crackdown against the Kurds.

This week at least 239 people drowned trying to cross the Mediterranean.

Huawei will begin marketing its smart phone in the United States this January.

Journalists will try to tell you that Carlsen vs. Karjakin will be close. Other journalists will try to tell you that someone other than Golden State or Cleveland will win the next NBA title. Other journalists will try to tell you…

“U.S. military hackers have penetrated Russia’s electric grid, telecommunications networks and the Kremlin’s command systems, making them vulnerable to attack by secret American cyber weapons should the U.S. deem it necessary”…link here.

TaterGrams: New Alberta company lets you mail personalized potatoes.

Just keep Mexico, South Korea, and Estonia in mind, and I’m sure you’ll do the right thing.

*Meetings with Remarkable Manuscripts*

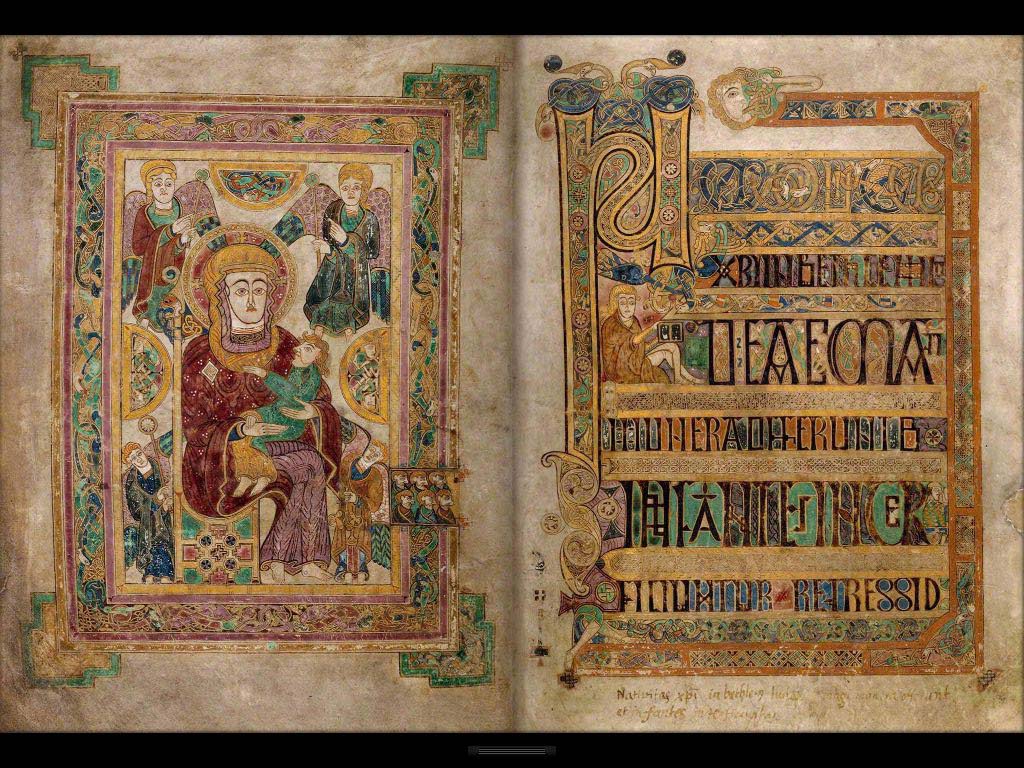

That is the new book by Christopher de Hamel, and it is one of the very best non-fiction books this year, in fact so far it might rank #1. It is twelve chapters, each one about an individual medieval manuscript, the best-known of those being the Book of Kells. The integration of text and the visuals is of the highest order of quality. Most of all, the book brings each manuscript to life, relating its creators and creation, the surrounding historical context, its subsequent preservation and fame, and how that history has embodied varying attitudes toward copying and preservation. No less illuminating is the anthropological treatment of how each manuscript is currently guarded and displayed, the author’s travel history in getting there, and a more general “philosophical without the philosophy” introspection on what these objects are really supposed to mean to us.

This book is not in every way light reading, and it does assume some (very broad) background in medieval history, but it brings a whole topic to light, and instructs, in a way that few other works do.

Here is just one short excerpt:

My initial inquiry as to whether I might see the manuscript of the Aratea in the Universiteitsbibliotheek in Leiden was met with the reply that this would hardly be necessary, since there is a high-class published facsimile from 1989 and the complete book is in any case digitized and freely available on-line. It was a response entirely within the theme of copying. If you had applied to the palace librarians of Aachen in the early ninth century to see the late-antique Terence, they would almost certainly have assured you that you would be better off with their nice new copy by their scribe Hrodgarius.

Hamel worked for a long time in the book department at Sotheby’s and then in a library at Cambridge University. He is a bit of a fuddy-duddy (he thinks the bustle of NYC is extreme, for instance), but nonetheless has produced a lovely and complete work that virtually every author should envy. I am ordering his other books too, mostly on the history of books.

Here is a Guardian review, John Banville in the FT raves about it, and here is The Paris Review. I believe I ordered it on Amazon.uk, all five-star reviews by the way. Here is the U.S. Amazon listing, with access to used copies, I am not sure when the American edition comes out.

Friday assorted links

1. Rachael Meager has new and very high quality evidence on microcredit; it’s good but not great and sometimes possibly zero effect in the aggregate. She is a job market candidate at MIT.

2. “Neiman Marcus Is Selling Frozen Collard Greens For $66 Plus Shipping.”

3. Watch a drone hack a room of smart light bulbs from outside the window.

4. “Proponents of the gondola argue that it is far cheaper and quicker to build than a Metro station.” When it comes to transportation, there is definitely a great stagnation. ““Just think of it as a Georgetown Metro station,” Sternlieb said.” Building the system, by the way, would take considerably longer than fighting and winning WWII.

5. Do Nanodegrees (TM!) have a future?

6. I’ve been waiting for someone to call a piece “White Riot,” now it has been done. The piece has too much posturing, and pandering/moralizing, but on the factual side it has a variety of worthwhile and interesting points.

The political economy of inflation

That is the topic of my latest Bloomberg column, here is one bit:

Just think how the U.S. has changed. Compared to earlier decades, economic growth and wage growth have slowed, the population has aged, average job tenure is longer and Americans are much less likely to move across the country for a new job. Furthermore, more Americans have ensconced themselves service-sector jobs, where they’re sheltered by formal tenure or strong networks of allies at work. We are more set in our ways, and that means people with jobs feel more threatened by inflation.

In the rarefied world of economic theory, higher inflation would translate into higher nominal wages fairly quickly, keeping the real, inflation-adjusted wage constant. But that doesn’t happen automatically, because employers will only pay their workers more if they fear those workers will leave or rebel. With lower levels of labor-market and geographic mobility, and with more two-income families, it’s harder for many workers to threaten to quit than before.

The net result is that inflation would leave many workers with permanently lower wages, as in essence the central bank would be giving them a wage cut that their own employers probably would not have dared.

Do read the whole thing.

How does bad weather influence elections?

It does, and there is a new theory of how, from Erik P. Duhaime and Taylor A. Moulton. Here is the abstract:

While political experts have long claimed that bad weather lowers voter turnout, the impact of weather on U.S. election outcomes remains unclear. The most rigorous work to date found that precipitation benefits Republicans and suggested that Florida rains influenced the outcome of the 2000 presidential election, but a more recent analysis finding that precipitation only lowers turnout in uncompetitive election states calls this claim into question. Here, we reanalyze the 1972-2000 U.S. presidential elections with a focus on supporters of non-major party candidates, an oft-overlooked contingency. We propose that bad weather affects election outcomes not through its effect on turnout—as has long been assumed—but rather, through its psychological effect on swing voters. Specifically, we find evidence that bad weather increases regret aversion among supporters of non-major party candidates in competitive elections, leading some to instead vote for their preferred two-party candidate.

In other words, rain on Tuesday could swing some Gary Johnson voters to Trump.

Here is a page for Duhaime, and here is the home page of Moulton. Both are from MIT’s Sloan School, and Duhaime is on the job market next year (I am not sure about Moulton).

Voting Paradoxes

Here’s an excellent video on voting paradoxes from the San Francisco Exploratorium and here is my older post on Arrow’s Impossibility Theorem.

VotingParadoxes from Paul stepahin on Vimeo.

How to choose and assess the movies you are watching

Greg Adamo, a loyal MR reader, writes me with a query:

I have two related questions sparked by your review of American Honey.

First, do you have any tips on judging movies? I make a lot of mistakes. I dismiss a number of very good movies after seeing them the first time. If I happen to watch them a second time – or even a third – I come to see a lot of virtues that I missed originally. I thought Pulp Fiction and the Big Lebowski were quite overrated the first time I saw them. 20 years later, having seen them both several times, my view has changed greatly. These are only two examples – there are dozens more. How can I avoid this problem?

Second, what is the correct time period for appreciating a movie? We have an annual award system (the Oscars). Like me, it also makes a lot of mistakes. Misfires like Crash or Shakespeare in Love – the don’t hold up to other winners. How Green Was My Valley beat Citizen Kane. Hitchcock never won an Oscar. It’s not just me that goofs up – it’s everyone.

I can’t help but think time is a factor. Suppose the Oscars were like the Baseball hall-of-fame and had a five-year waiting period. Would that improve the selection? Is there a market-failure in the movie-critic journalism business that pushes reviews out so near to the release date?

This is an area in which overconfidence and bias abound. I wonder if I’m better off disregarding individual movie reviews in favor of aggregated data – i.e. rotten tomatoes.

Those are some very good questions, I will offer some general observations in response:

1. If the movie was shot for the big screen, you must see it on the big screen. Otherwise your response is not to be trusted.

2. Try not to discriminate by genre or topic, for instance “I don’t like war movies,” “I don’t like romantic comedies,” and so on. You’ll miss out on the very best of that genre or topic this way, and those are very likely very good indeed. (NB: In your spare time, you can debate whether there is a horror movies exception to the principle.)

3. In my view, the bad Oscar picks were evident right away. A five year wait will only elevate some other set of mediocre movies instead. Movie awards are designed to generate publicity for the industry, not to reward merit. Ignore them.

4. I use movie criticism in the following way: I read just enough to decide if I want to see the movie, and then no more. I also try to forget what I have read. But before a second viewing of a film, I try to read as much as possible about it.

5. On net, I find the best reviews are in Variety magazine, as they are written for movie professionals. And the market for reviews is largely efficient. That is, if you read six smart critics on a movie — usually just two or three in fact — you will have a good idea of the quality of the movie. But you must put aside movies that are politically correct or culturally iconic, as they tend to be overrated. Brokeback Mountain and The Graduate will make plenty of “best of” lists, and they are both interesting and extremely important for both cinematic and cultural reasons. Still, I would not say either is a great movie, though they have some wonderful scenes and themes.

6. Hardly anyone watches enough foreign movies, that means you too. Or you might not watch enough outside your favored cinematic area, such as French, Bollywood, etc. There is a switching cost due to different cinematic “languages,” but most of your additional rewards at the margin probably lie in this direction. Furthermore, the very best foreign movies are so excellent it is easy to find out which they are.

7. I still think Pulp Fiction and The Big Lebowski, while good, are overrated. Don’t always assume your second reaction is the correct one. In addition, a lot of movies are made to be seen only once, so don’t hold that against them. For instance, I am not sure I need to see the opening sequence of Private Ryan again, but I am very glad I saw it once. It made seeing the whole movie worthwhile, but since most of the rest is ordinary, albeit serviceable, seeing it again would be excruciating.

8. It is a mistake to smugly assume that television has surpassed movies. The best movies (mostly foreign) are better than the best TV, even today.

What tips can you all offer?

Thursday assorted links

1. Are airline legacy mergers anti-competitive?

2. What happened to the Gary Johnson campaign?

3. Are chains the future of global food?

4. Evidence for Amihai Glazer’s theory of expressive voting, namely that you vote against the supporters of the other candidate.

The New Monetary Economics, Zimbabwe style

Debit card machines are proliferating in Zimbabwe’s cities — not only in churches but also in supermarkets, betting parlors, nightclubs, parking areas and every other business happy to accept paper cash but unable to dispense it. If there are no card-reading machines around, many shoppers now text payments on their cellphones.

A kind of Gresham’s Law is operating:

But Zimbabwe is hurtling toward a plastic future for a simple reason: It is running out of cash, specifically the American dollars it adopted in 2009 before abandoning its own troubled currency. Anxious about their nation’s political and economic troubles, many Zimbabweans have been hoarding dollars or taking them out of the country. Banks have slashed daily withdrawal limits. A.T.M.s now sit empty.

Here is more from Jeffrey Moyo and Norimitsu Onishi at the NYT. In the countryside, barter is returning and the article is interesting throughout.

The FDA is Also Slow at Hiring

One of the reason’s the FDA is too slow to approve new drugs is that as a branch of the Federal government they are tied to slow and inefficient hiring rules.

The Food and Drug Administration has more than 700 job vacancies in its division that approves new drugs, and top officials say the agency is struggling to hire and retain staff because pharmaceutical companies lure them away.

“They can pay them roughly twice as much as we can,” Janet Woodcock, who directs the FDA’s Center for Drug Evaluation and Research (CDER), said at a rare-diseases summit recently in Arlington, Va.

High-value, potentially life-saving drugs are being delayed because the FDA is constrained from paying market rates. Absurd. Moreover, it’s not just about the wage rate.

[Janet] Woodcock [Director of FDA’s Center for Drug Evaluation and Research] wrote in December that staffing was a priority in 2016 because the center had “more than 600 staff vacancies.” At the Arlington event, she called the federal hiring system “challenging,” adding that prospective candidates often take other jobs while waiting for the FDA to make an offer.

“We move rather slowly — like a snail might be a better analogy,” agreed Peter Marks, director of the FDA’s Center for Biologics Evaluation and Research. “A young person with a family can’t wait four months for us to get through some of the federal hiring process. So if they have something else that’s more . . . expedient, they will take that.”

Sadly, slow and bureaucratic describes not just the hiring process but the drug approval process. The only difference is that patients don’t have an option to take the expedient alternative.

Why the British parliamentary vote may matter

No, I don’t see them voting down Brexit, any more than Republican Senators ever were going to endorse Hillary Clinton, even though many of them are rooting for her. The more likely scenario out of Brexit is simply that Parliament stalls, demanding that Theresa May give them “the right Brexit.” Of course there is no such thing, wrong Brexit is wrong Brexit, if only because EU-27 cannot agree on very much. But with enough stalling, eventually another national election will be held and of course Brexit would be a major issue, probably the major issue. That in essence would serve as a second referendum, and if anti-Brexit candidates did well enough, parliamentarians would have cover to go against the previous expression of the public will.

I give that path out of Brexit p = 0.2, with another p = 0.1 for “somehow Brexit just doesn’t happen.”

Here is commentary from Joshua Tucker. And from Jolyom Maugham.

Addendum: The final word on Brexit rights may be held by…the European Court of Justice.

China fact of the day

Chinese cities are less densely populated than many people think:

While China is a very populous country, density in Chinese cities is typically much lower than major American metropolitan areas. For example, the first tier cities have population density varying from 1,000 to 2,000 people per square kilometer in 2010, whereas New York City has density of 10,000 people per square kilometer and the top 100 American MSAs all have density above 4,000 people per square kilometer.

That is from Glaeser, Huang, Ma, and Shleifer “A Real Estate Boom With Chinese Characteristics,” an interesting and useful paper. They argue that current Chinese real estate prices might prove sustainable, but there is a basic dilemma that cannot be avoided:

…that path may create significant social costs. Construction employment would plummet. Millions of Chinese may lose the apparent productivity advantages associated with living in Chinese cities (Chauvin et al. 2016). Local governments would lose the financial autonomy from land sales and taxes that has been their institutional basis. The alternative for the Chinese government is to accommodate high levels of construction and housing supply. As we showed, this will lead to very low or negative expected returns to investment in housing. The welfare of potential new buyers will rise, but current owners will suffer losses.

Recommended reading.