Free Trade with Free Nations

Alec Stapp points out that Canada is the only NATO country that has a free trade agreement with the United States. That’s quite remarkable if you think about it. NATO allies are bound by mutual defense commitments, support for military cooperation, and a dedication to democratic principles. Despite these shared commitments, the U.S. still enforces tariffs and quotas on our NATO allies including France, Germany, the UK, Denmark, Portugal, and Spain. This is like getting married and not having a joint checking account. If they are good enough partners to commit to their defense then surely NATO allies are good enough partners to commit to free trade?

Free trade enhances the economic strength of countries, thus free trade should be a strategic asset in self-defense. Let’s be rich and safe together.

There are many reasons to have free trade agreements with countries that we don’t have a defense pact with but free trade with free nations should be a minimum standard. It’s not just the United States, of course, NATO allies don’t all have free trade agreements with fellow NATO members. So how about a North-Atlantic Trade Organization? You could call it NATO for short.

Battery Arbitrage

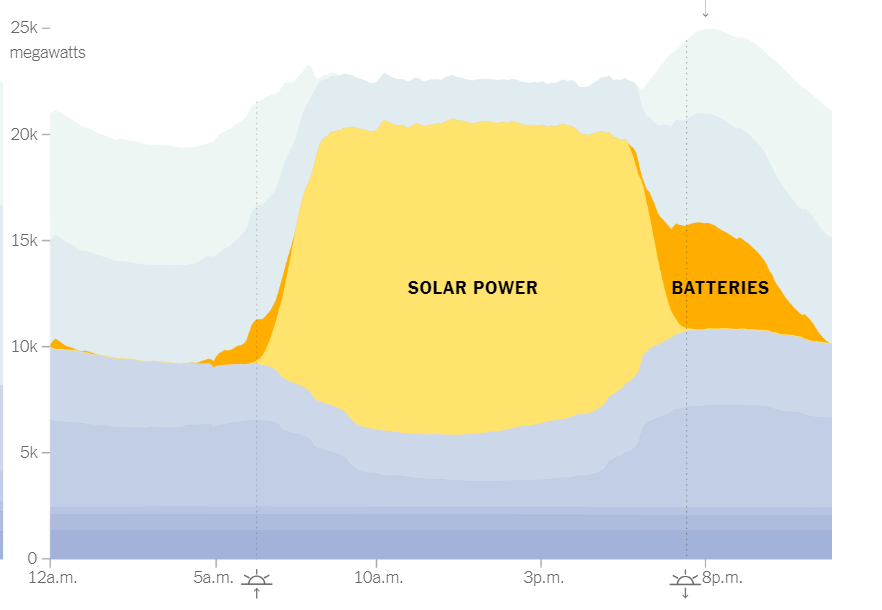

Solar is powering a large share of California’s energy needs during the day and batteries are now powering a significant share at night.

NYTimes: Since 2020, California has installed more giant batteries than anywhere in the world apart from China. They can soak up excess solar power during the day and store it for use when it gets dark.

Those batteries play a pivotal role in California’s electric grid, partially replacing fossil fuels in the evening. Between 7 p.m. and 10 p.m. on April 30, for example, batteries supplied more than one-fifth of California’s electricity and, for a few minutes, pumped out 7,046 megawatts of electricity, akin to the output from seven large nuclear reactors.

California’s electricity deregulation had a rocky start but notice that it is paying off today because what is happening is that prices are low at mid-day when the sun is shining and they rise in the evening. Power companies profit by using batteries to arbitrage these prices differences. Thus, power companies have been willing to make huge investments in battery technology.

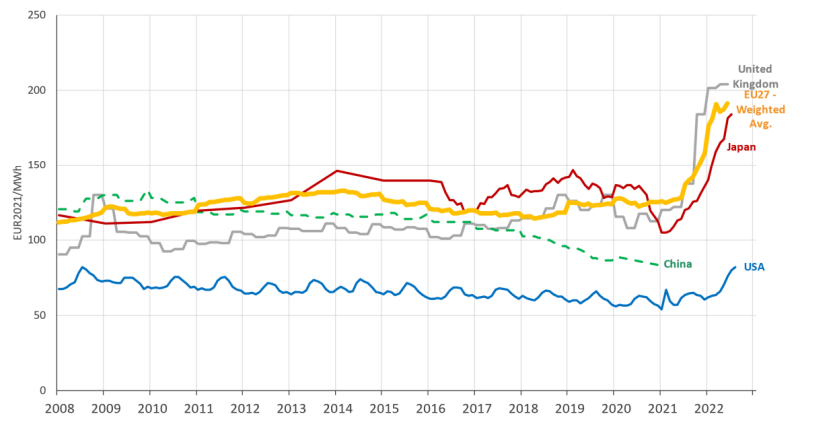

The US has Low Electricity Prices

The US has some of the lowest electricity prices in the world. Shown below are industrial retail electricity prices in EU27, USA, UK, China and Japan. Electricity is critical for AI compute, electric cars and more generally reducing carbon footprints. The US needs to build much more electricity infrastructure, by some estimates tripling or quadrupling production. That’s quite possible with deregulation and permitting reform. I am pleased to learn, moreover, that we are starting from a better base than I had imagined.

The Fiscal Impact of Low-Skill Immigration

Low-skill immigrants have low wages and thus don’t pay much in taxes but they do use some government services, especially education for their children. What’s the net fiscal impact? The National Academy of Sciences did a detailed scenario analysis looking at the impact over 75 years, thus including second and third generations. Overall the NAS concluded that the net fiscal impact of the average immigrant was positive. The impact was negative, however, for immigrants with just a high school education and even more so for immigrants with less than a high-school education.

Two recent papers qualify this conclusion. The NAS study estimated the direct fiscal effects of an immigrant–what do they pay in taxes and what do they take out in services? Immigration, however, has indirect effects on the native born population. In the The Case for Getting Rid of Borders I wrote:

The immigrant who mows the lawn of the nuclear physicist indirectly helps to unlock the secrets of the universe.

More prosaically, low-skill immigrants can complement higher-skilled native labor, increasing native productivity. Go to any fine restaurant in DC, for example, and you will typically see a native-born front of the house and a Mexican born back-of-the house. As Tyler quipped at lunch recently, all restaurants in the United States are Mexican restaurants only the type of food they are cooking changes. The opportunity to hire Mexican cooks increases the number of restaurants and the opportunities and wages of the native-born front of the house. Higher native wages mean higher taxes so there is a beneficial indirect fiscal effect of low-skill immigration.

A recent paper by Colas and Sachs, The Indirect Benefits of Low-Skilled Immigration finds that under plausible assumptions the indirect effects are large enough to make the net effects of immigration positive for almost all US immigrants.

My excellent colleague Michael Clemens makes another similar point about capital. When a profit-maximizing firm hires more labor it also hires more capital. Capital pays taxes. Thus, immigration raises the taxes paid by capital and when you add that indirect effect to the calculation it also shows that the net fiscal impacts of low-skilled immigration are plausibly positive.

The fiscal benefits of low-skilled immigration aren’t a big reason to support low-skill immigration but the new literature on the indirect effects should take one worry off the table.

As a takeaway, it’s important to recognize that the fiscal benefits arise because low-skilled immigrants are gainfully employed. The U.S. excels at integrating people into the workforce. We need to keep this in mind when thinking about labor policy including minimum wages, occupational licensing, E-Verify, access to banking, education, and driver’s licenses and so forth. We could easily turn fiscal benefits into fiscal costs by making it more difficult to employ immigrants (and workers more generally). Employing immigrants benefits both them and native citizens. America’s open markets play a pivotal role in this success. Let’s keep it going.

Interview with Cliff Winston

An excellent interview of economist Cliff Winston with Joe Lonsdale covering occupational licensing, barriers to entry in the US markets, the failure to test antitrust actions and more.

False Necessity is the Mother of Dumb Invention

Recently, I have seen two innovations in retail, AI cashiers and human cashiers but working remotely from another country such as the Philippines and making much lower wages than domestic workers (examples are below). I fear that the AI cashiers will outcompete the Philippine cashiers leading to the worst of all worlds, AIs doing low-productivity work. In an excellent piece, People Over Robots, Lant Pritchett nails the problem:

Barriers to migration encourage a terrible misdirection of resources. In the world’s most productive economies, the capital and energies of business leaders (not to mention the time and talents of highly educated scientists and engineers) get sucked into developing technology that will minimize the use of one of the most abundant resources on the planet: labor. Raw labor power is the most important (and often the only) asset low-income people around the world have. The drive to make machines that perform roles that could easily be fulfilled by people not only wastes money but helps keep the poorest poor.

The knock on immigration has always been “we wanted workers, we got people instead.” But, with remote workers, we can get workers without people! Even Steve Sailer might approve.

At the same time, the use of AI for cashiers illustrates Acemoglu’s complaint about “so-so automation,” automation that displaces labor but with low productivity impact. AI cashiers are fine but how big can the gains be when you are replacing $3 an hour human labor?

It seems likely that at least one of these innovations will become common. Unfortunately, I suspect that US workers will object more to $3 an hour remote workers taking “their jobs” than to AI. As a result, we will get AI cashiers and labor displacement of both US and foreign workers. Doesn’t seem ideal. It’s not obvious how to direct technology to higher productivity tasks and tasks complementary to human labor but at the very least we shouldn’t artificially raise the price of labor to make AI profitable.

As Pritchett notes this is hardly the first time that cuffing labor leads to the creation of unnecessary technology.

In the middle of the twentieth century, the United States allowed the seasonal migration of agricultural guest workers from Mexico under the rubric of the Bracero Program. The government eventually slowed the program and finally stopped it entirely in 1964. Researchers compared the patterns of employment and production between those states that lost Bracero workers and those that never had them. They found that eliminating these workers did not increase the employment of native workers in the agricultural sector at all. Instead, farmers responded to the newly created scarcity of workers by relying more on machines and technological advances; for instance, they shifted to planting genetically modified products that could be harvested by machines, such as tomatoes with thicker skins, and away from crops such as asparagus and strawberries, for which options for mechanized harvesting were limited.

Necessity may be the mother of invention, but false necessity is the mother of dumb inventions.

Wendy’s AI.

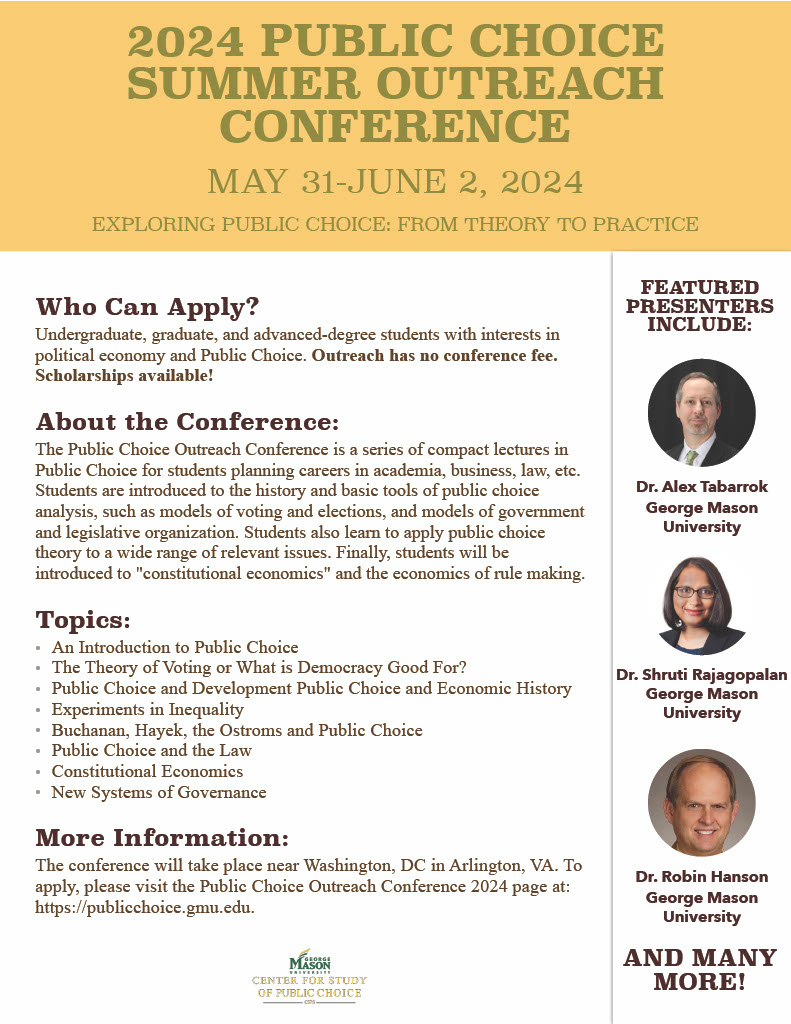

Public Choice Outreach!

There are just a few spots left for the Public Choice Outreach Conference! This is a great opportunity to hear from excellent speakers including Garett Jones, Peter Boettke, Johanna Mollerstrom and more! The conference is a crash course in public choice. It’s entirely free. Indeed scholarships are available! More details in the poster. Please pass around. Applications are here!

The Prisoner’s Dilemma of Non-Competes

I agree with Tyler, that the FTC ban on non-competes is overly broad and not tailored to fields where the drawbacks outweigh the benefits. Additionally, the FTC’s authority to enact this rule, rather than Congress, is questionable.

Nevertheless, I don’t think banning non-competes is without merit. The reason is not the standard Twitter-econ view that non-competes are bad for workers. Indeed, some non-competes, so-called “gardening leave”, pay the worker during the non-compete period. Sounds pretty good! More generally, non-competes are just one item in the wage bargain like hours, health and pension benefits. As a result, the FTC is quite wrong to think that banning non-competes will raise wages–the most immediate effect will be to reduce wages. Indeed, more workers will be willing to work at lower wages precisely to the extent that non-competes were a burden. Can’t have it both ways. Instead of being bad for workers, my skepticism about non-competes is that they are bad for industry.

The problem with non-competes is that every firm wants non-competes on the workers it fires but no firm wants non-competes on the workers it hires. However, firms only control the terms on which they hire workers so it’s possible for each firm acting in its self-interest to create a situation which is in the interests of none. Or, to put it differently, firms may approve of the decision to ban non-competes because it’s a package deal, firms can’t restrict their own former employees but they gain the ability to recruit freely from competitors.

More generally, worker mobility often carries externalities. As I wrote earlier, ideas are in heads and if you don’t move the heads, often the ideas don’t move either. The innovation that results from mobility is a public good. Non-competes are a type of intellectual property, call it intellect property. Once again, firms want to lock up their intellectual property but they also want to use ideas from other firms. Firms only control the former decision not the latter so IP in general has a prisoner’s dilemma issue which is one reason IP in the US is too strong (see the Tabarrok Curve) and non-competes are part of that package. Ultimately, if the innovation effects are important, wages could rise but those effects would be for more or less all workers not specifically for those with non-competes.

Governments aren’t good at the fine details of optimizing IP so perhaps a heavy-handed approach is the best we can expect. Non-competes also aren’t a huge issue for most firms, even firms that use them, so given the above I am willing to give the experiment a try.

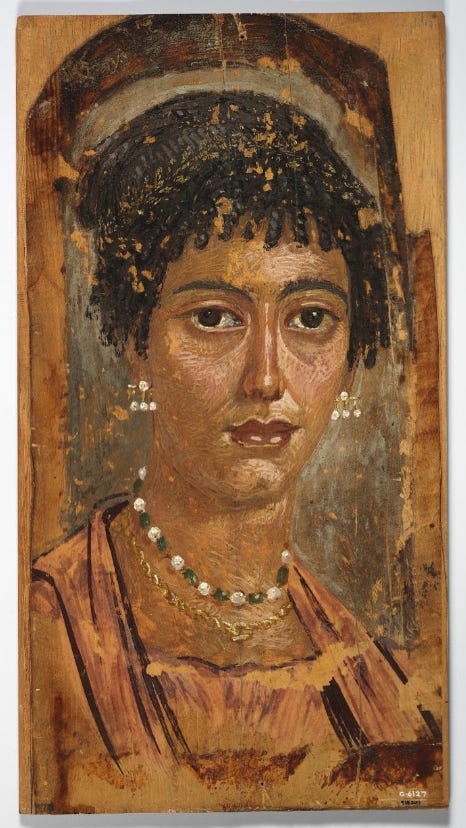

Four Thousand Years of Egyptian Women Pictured

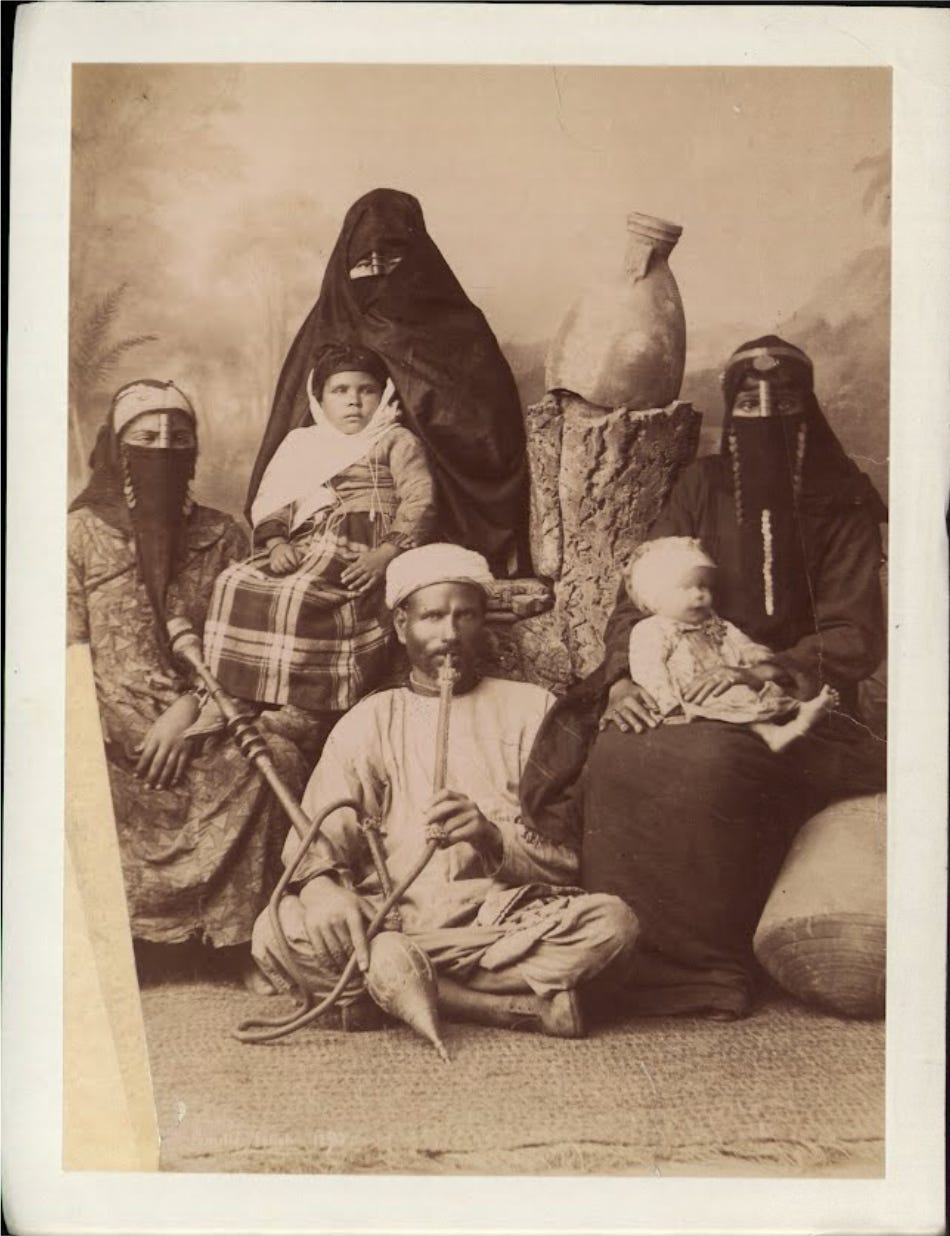

In an excellent, deep-dive Alice Evans looks at patriarchy in Egypt using pictures drawn from four thousand years of history. Here are three examples.

In an excellent, deep-dive Alice Evans looks at patriarchy in Egypt using pictures drawn from four thousand years of history. Here are three examples.

A wealthy woman, shown at right circa 116 CE. Unveiled, immodest, looking out at the world. A person to be reckoned with.

After the Arab conquests, pictures of people in general disappear, and there are no books written by women. With the dawn of photography in the 19th century we see (at left) what was probably typical, veiled women, and very few women on the street.

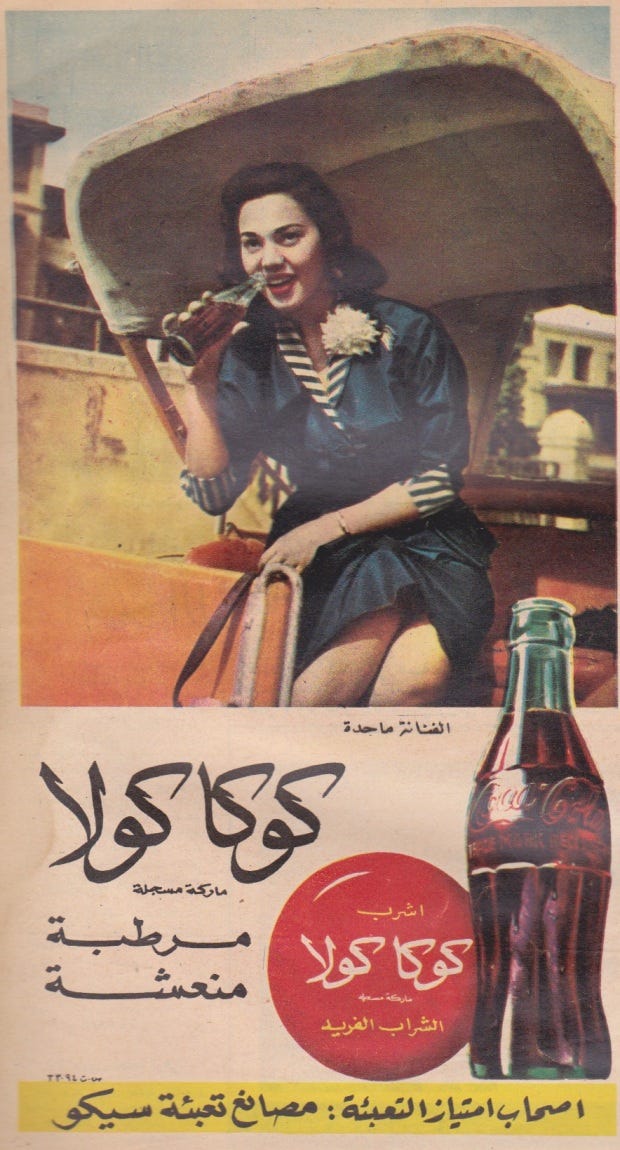

In the 1950s and 1970s we see a remarkable revitalization and liberalization noted most evidently in advertisements (advertisers being careful not to offend). Note the bare legs and the fact that many advertisements are directed at women (below)

This period culminates in a remarkable video unearthed by Evans of Nasser in 1958 openly laughing at the idea that women should or could be required to veil in public. Worth watching.

In the 1980s, however, it all ends.

Egyptians who came of age in the 1950s and ‘60s experienced national independence, social mobility and new economic opportunities. By the 1980s, economic progress was grinding down. Egypt’s purchasing power was plummeting. Middle class families could no longer afford basic goods, nor could the state provide.

As observed by Galal Amin,

“When the economy started to slacken in the early 1980s, accompanied by the fall in oil prices and the resulting decline in work opportunities in the Gulf, many of the aspirations built up in the 1970s were suddenly seen to be unrealistic and intense feelings of frustration followed”.

‘Western modernisation’ became discredited by economic stagnation and defeat by Israel. In Egypt, clerics equated modernity with a rejection of Islam and declared the economic and military failures of the state to be punishments for aping the West. Islamic preachers called on men to restore order and piety (i.e., female seclusion). Frustrated graduates, struggling to find white collar work, found solace in religion, whilst many ordinary people turned to the Muslim Brotherhood for social services and righteous purpose.

That’s just a brief look at a much longer and fascinating post.

Tying the Knot

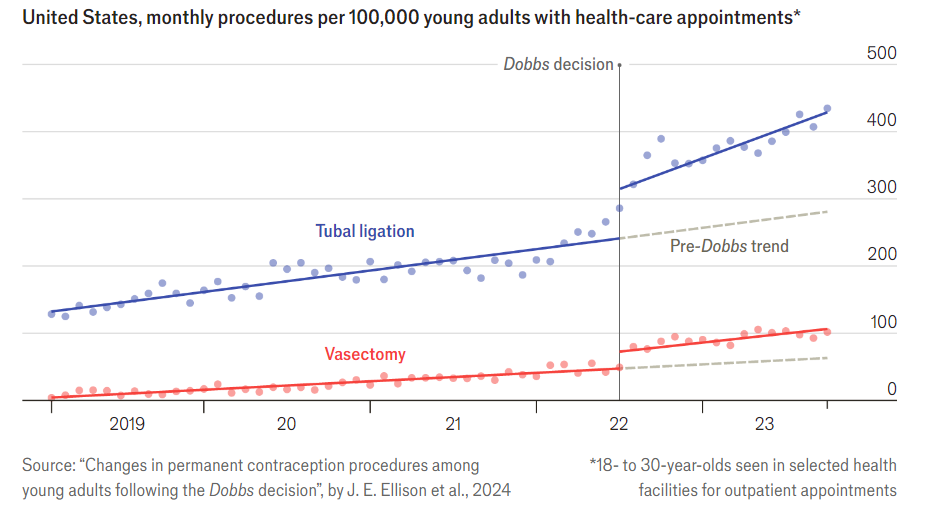

Dobbs, of course, was the Supreme Court decision saying that the constitution does not provide a right to abortion, thus leading to restrictions on abortion in many states. The pictures is from The Economist, the original paper is here.

Why a Housing Shortage Exists Despite More Houses Per Person

When I post about the skyrocketing price of housing and the need to build, commentators (include some of the most astute commentators on MR), will sometimes object by pointing to the increasing and historically high number of houses per capita. They question how this aligns with rising prices and wave vaguely towards factors like monopoly pricing, hedge funds, Airbnb, vacancies and so forth, implying that more construction isn’t the solution. The real explanation for rising prices amid greater homes per capita is actually quite simple, fewer kids. Kevin Erdmann has an excellent post on this going through the numbers in detail. I will illustrate with a stylized example.

Suppose we have 100 homes and 100 families, each with 2 parents and 2 kids. Thus, there are 100 homes, 400 people and 0.25 homes per capita. Now the kids grow up, get married, and want homes of their own but they have fewer kids of their own, none for simplicity. Imagine that supply increases substantially, say to 150 homes. The number of homes per capita goes up to 150/400 (.375), an all time high! Supply-side skeptics are right about the numbers, wrong about the meaning. The reality is that the demand for homes has increased to 200 but supply has increased to just 150 leading to soaring prices.

Now what do we do about this? One response is to blame people’s choices–immigrants are buying all the houses, hedge funds are buying all the houses, tourists are renting all the houses, everyone should want less and conserve more! Going down this path will tear the country apart. The other response is the American way, in the words of Bryan Caplan’s excellent new book, build, baby, build!

Here’s Kevin:

We are already 15 years into a cultural and economic battle that is so important, it turned the direction of adults per house upward for, likely, the first time since the start of the industrial revolution. Fifteen years in, by that measure, we have reversed economic progress by nearly 40 years. There is so much ground we have to make up. And, also, the reactionary position will have to continue to dig deeper and get worse – rounding up immigrants, blaming the homeless, stoking fear and distrust of financial institutions. I’m sorry if I’m sounding too shrill. It all happens in slow motion around us, so we adapt to the new normal. But the tent encampments in all the urban parks are a long way from what should be considered normal. We are already deeply into a cultural battle. And you can see that it is a cultural battle, because it is difficult to simply establish a plurality of support to admit obvious things.

If this continues, it will destroy the fabric of mutual trust that has managed to miraculously hold this country together for 250 years. The challenge is to open the eyes of enough victims of these policy choices that 50%+1 of the country can address it on the empirical level rather than the aesthetic level, and to stop this devolution before it gets worse.

Hat tip: Naveen.

Why is the Biden Administration Against Fee Transparency in Education?

President Biden has made a big deal of simplifying fees:

The FTC is proposing a rule that…would ban businesses from charging hidden and misleading fees and require them to show the full price up front. The rule would also require companies disclose up front whether fees are refundable. This would mean no more surprise resort fees at check out or unexpected service fees to buy a live event ticket.

Like everyone, I dislike these kinds of fees, although I don’t think they are a good subject for legislation. But I would certainly not prevent firms from offering a simple, up-front fee. And yet that is exactly what the Biden administration is doing in higher education.

So called Inclusive Access programs let colleges package textbooks with tuition and other fees. Students get one bill and access to textbooks on the first day of college. It’s convenient, no more hunting for textbooks or sticker shock. In addition, inclusive access programs give colleges bargaining power when negotiating prices.

Strangely, the Biden administration’s Department of Education wants to ban colleges from offering inclusive access programs. Thus, the Dept. of Education is arguing that simplified pricing is bad for consumers at the same time as the FTC is arguing that simplified pricing is good for consumers. What makes this contradiction even more baffling is that Inclusive Access was a program promoted in 2015 by the Obama-Biden Administration!

Proponents of the ban argue that letting students negotiate their own purchases lets them better tailor the outcome. Maybe, but that’s the same argument for letting airlines unbundle seat choice and baggage allowances. Hard to have it both ways. Pricing is complex.

Tyler and I are textbook authors so you might wonder where our interests lie. I actually have no idea. It’s complicated. I suspect inclusive access leads to a more winner-take-all market on textbooks. Modern Principles is a winner, thus on those grounds I would favor. More generally, however, I would get the FTC and the Dept. of Education out of pricing decisions and let colleges and firms negotiate. Pricing decisions are more complicated and contextual than simplified bans or regulations.

The Adderall Shortage: DEA versus FDA in a Regulatory War

A record number of drugs are in shortage across the United States. In any particular case, it’s difficult to trace out the exact causes of the shortage but health care is the US’s most highly regulated, socialist industry and shortages are endemic under socialism so the pattern fits. The shortage of Adderall and other ADHD medications is a case in point. Adderall is a Schedule II controlled substance which means that in addition to the FDA and other health agencies the production of Adderall is also regulated, monitored and controlled by the U.S. Drug Enforcement Administration (DEA).

The DEA aims to “combat criminal drug networks that bring harm, violence, overdoses, and poisonings to the United States.” Its homepage displays stories of record drug seizures, pictures of “most wanted” criminal fugitives, and heroic armed agents conducting drug raids. With this culture, do you think the DEA is the right agency to ensure that Americans are also well supplied with legally prescribed amphetamines?

The DEA aims to “combat criminal drug networks that bring harm, violence, overdoses, and poisonings to the United States.” Its homepage displays stories of record drug seizures, pictures of “most wanted” criminal fugitives, and heroic armed agents conducting drug raids. With this culture, do you think the DEA is the right agency to ensure that Americans are also well supplied with legally prescribed amphetamines?

Indeed, there is a large factory in the United States capable of producing 600 million doses of Adderall annually that has been shut down by the DEA for over a year because of trivial paperwork violations. The New York Magazine article on the DEA created shortage has to be read to be believed.

Inside Ascent’s 320,000-square-foot factory in Central Islip, a labyrinth of sterile white hallways connects 105 manufacturing rooms, some of them containing large, intricate machines capable of producing 400,000 tablets per hour. In one of these rooms, Ascent’s founder and CEO — Sudhakar Vidiyala, Meghana’s father — points to a hulking unit that he says is worth $1.5 million. It’s used to produce time-release Concerta tablets with three colored layers, each dispensing the drug’s active ingredient at a different point in the tablet’s journey through the body. “About 25 percent of the generic market would pass through this machine,” he says. “But we didn’t make a single pill in 2023.”

… the company has acknowledged that it committed infractions. For example, orders struck from 222s must be crossed out with a line and the word cancel written next to them. Investigators found two instances in which Ascent employees had drawn the line but failed to write the word.

The causes of the DEA’s crackdown appears to be precisely the contradiction in its dueling missions. Ascent also produces opioids and the DEA crackdown was part of what it calls Operation Bottleneck, a series of raids on a variety of companies to demand that they account for every pill produced.

The causes of the DEA’s crackdown appears to be precisely the contradiction in its dueling missions. Ascent also produces opioids and the DEA crackdown was part of what it calls Operation Bottleneck, a series of raids on a variety of companies to demand that they account for every pill produced.

To be sure, the opioid epidemic is a problem but the big, multi-national plants are not responsible for fentanyl on the streets and even in the early years the opioid epidemic was a prescription problem (with some theft from pharmacies) not a factory theft problem (see figure at left). Maybe you think Adderall is overprescribed. Could be but the DEA is supposed to be enforcing laws not making drug policy. The one thing one can say for certain is that Operation Bottleneck has surely been a success in creating shortages of Adderall.

The DEA’s contradictory role in both combating the illegal drug trade and regulating the supply of legal, prescription drugs is highlighted by the fact that at the same as the DEA was raiding and shutting down Ascent, the FDA was pleading with them to increase production!

For Ascent, one of the more frustrating parts of being told by the government to stop making Adderall is that other parts of the government have pleaded with the company to make more. The company says that on multiple occasions, officials from the FDA asked it to increase production in response to the shortage, and that Ron Wyden, the Democratic senator from Oregon, also pressed Ascent for help. They received responses similar to those the company gave the stressed-out callers looking for pills: Ascent didn’t have any information. Instead, the company directed them to the DEA.

The Culture that is Germany

FT: When it launched its fully automated stores four years ago, Germany’s regional supermarket chain Tegut billed the experiment as a window into the future of shopping. But the Fulda-based retailer has since been embroiled in a legal fight over a centuries-old principle enshrined in the German constitution: Sunday rest. Be they robotic or staffed by humans, most shops in Germany are not allowed to open on the last day of the week — and courts have upheld that ban.

You are probably thinking this is a Baptists and Bootleggers story but actually it’s a Baptists, Catholics and Bootleggers story.

Both the Protestant and Catholic Churches have formed an unusual alliance with Germany’s powerful unions to defend the status quo for years, and spearheaded the campaign against the Sunday opening of automated stores. In March, the alliance encouraged pastors to criticise the shops in their weekly sermons.

No word yet on whether the 8-hour day or bathroom breaks will also apply to robots. You will note that MR has posted on Sundays for over 20 years.

Pay For Performance Increases Performance (Water Runs Downhill)

In my 2011 book, Launching the Innovation Renaissance, I wrote:

At times, teacher pay in the United States seems more like something from Soviet-era Russia than 21st-century America. Wages for teachers are low, egalitarian and not based on performance. We pay physical education teachers about the same as math teachers despite the fact that math teachers have greater opportunities elsewhere in the economy. As a result, we have lots of excellent physical education teachers but not nearly enough excellent math teachers. The teachers unions oppose even the most modest proposals to add measures of teacher quality to selection and pay decisions.

As I wrote, however, Wisconsin passed Act 10, a bill that discontinued collective bargaining over teachers’ salary schedules. Act 10 took power away from the labor unions and gave districts full autonomy to negotiate salaries with individual teachers. In a paper that just won the Best Paper published in AEJ: Policy in the last three years, Barbara Biasi studies the effect of Act 10 on salaries, effort and student achievement.

Compensation of most US public school teachers is rigid and solely based on seniority. This paper studies the effects of a reform that gave school districts in Wisconsin full autonomy to redesign teacher pay schemes. Following the reform some districts switched to flexible compensation. Using the expiration of preexisting collective bargaining agreements as a source of exogenous variation in the timing of changes in pay, I show that the introduction of flexible pay raised salaries of high-quality teachers, increased teacher quality (due to the arrival of high-quality teachers from other districts and increased effort), and improved student achievement.

We still have a long way to go but COVID, homeschooling and universal voucher programs have put a huge dent in the power of the teacher’s unions. There is now a chance to bring teacher pay into the American model. Moreover, such a model is pro-teacher! Not every district in Wisconsin grasped the opportunity to reform teacher pay but those districts that did raised pay considerably. Appleton district, for example, instituted pay for performance, Oshkosh did not. Prior to the Act salaries were about the same in the two districts:

After the expiration of the CBAs, the same teacher could earn up to $68,000 in Appleton, and only between $39,000 and $43,000 in Oshkosh.

Thus, pay for performance is a win-win policy. Paying the best teachers more is good for teachers and great for students who see increases in achievement which pay off many years later in higher wages.

Hat tip: Josh Goodman on twitter who will surely agree about the negative effect of egalitarian pay on the relative quality of math teachers.