Category: Current Affairs

Elasticities and incidence

President Trump’s budget proposes a significant rethink of federal rental assistance programs, consolidating a number of them — and cutting them by more than $26 billion — next fiscal year. Many experts previously told The New York Times that this could result in low-income Americans losing access to federal housing benefits.

Here is more from the NYT. If you are a YIMBY type, odds are you should favor this, since some of the subsidy gain likely would end up captured by landlords.

Major reforms at the NSF

The National Science Foundation (NSF), already battered by White House directives and staff reductions, is plunging into deeper turmoil. According to sources who requested anonymity for fear of retribution, staff were told today that the agency’s 37 divisions—across all eight NSF directorates—are being abolished and the number of programs within those divisions will be drastically reduced. The current directors and deputy directors will lose their titles and might be reassigned to other positions at the agency or elsewhere in the federal government.

The consolidation appears to be driven in part by President Donald Trump’s proposal to cut the agency’s $9 billion budget by 55% for the 2026 fiscal year that begins on 1 October. NSF’s decision to abolish its divisions could also be part of a larger restructuring of the agency’s grantmaking process that involves adding a new layer of review. NSF watchers fear that a smaller, restructured agency could be more vulnerable to pressure from the White House to fund research that suits its ideological bent.

As soon as this evening, NSF is also expected to send layoff notices to an unspecified number of its 1700-member staff. The remaining staff and programs will be assigned to one of the eight smaller directorates. Staff will receive a memo on Friday “with details to be finalized by the end of the fiscal year,” sources tell Science. The agency is also expected to issue another round of notices tomorrow terminating grants that have already been awarded, sources say. In the past 3 weeks, the agency has pulled the plug on almost 1400 grants worth more than $1 billion.

Here is more information, this story is still developing…

Solve for the electoral energy equilibrium

I know many Democrats have been heartened by recent electoral wins by the Labor Party in Australia and the Liberal Party in Canada, both boosted by anti-Trump sentiment.

But Labor prime minister Anthony Albanese views Australia as an energy-producing country, and while they have taken measures to boost renewables deployment and electric cars, they’re not seeking to curb coal mining or exports. Similarly, Mark Carney went to Alberta to proclaim his desire to make Canada an “energy superpower” that would “recognize that we are home to an abundance of conventional — that means oil and gas — conventional and clean energy resources.” I think that part where he went off script and clarified that by conventional he meant oil and gas is important. The prepared text was sort of doing dog whistle moderation, but he wanted people to hear his message clearly: that, while his strongest interest is in facilitating clean energy deployment, he intends to keep selling the world oil and gas as long as oil and gas are useful.

Everybody knows you’re not winning in Colorado, New Mexico, Pennsylvania, Ohio, Texas, or Alaska on a message of shutting down fossil fuels. But if you’re not winning those states, you don’t have a majority. Instead of the national party adopting a message that’s toxic in those states and then recruiting candidates who try to distance themselves from it, the solution is for the national party to adopt the same kind of messages that work for the center-left in Canada and Australia and Norway.

That is from (partially gated) Matt Yglesias.

Is classical liberalism for losers?

That is the topic of my latest column for The Free Press. Excerpt, starting with the point that the New Right has an obsession with seizing political power:

There are two essential problems with yelling “Rule!”

The first is that your side will not win every election. It’s a reliable assumption that, on average, “the other side,” whoever that may be, is going to win half of the time.

If you build up executive power, or state power more generally, in the service of your ends, the chances are pretty high that those same powers someday will be used against you. Democrats are enraged at Trump’s use of executive orders and executive power more broadly, but that did not begin with Trump. Consider how Barack Obama seized the power to provide legal status to illegal immigrants, or how Joe Biden sought to extinguish all those student loans, without buy-in from Congress. The point is that Trump stepped into a system that had already been transformed, and he is now using it to his own ends.

Or to take another example: Many Democrats hate DOGE, but in fact it is a repurposed version of a 2014 President Obama creation, namely the United States Digital Service, which initially was designed to improve the IT capabilities of the federal government. Ask yourself which Trump initiatives someday will be repurposed in an analogous fashion.

If your fundamental beliefs are in individual liberty, responsibility, and toleration, the escalation of state power, across competing administrations, is unlikely to prove your friend over time.

The second problem is that rule by the political right is not necessarily better than rule by the political left, even if you have basic right-leaning sympathies, as I do on a large number of issues, especially in the economic realm. But even on economics, the Trump administration is bringing depredations, such as the very high proposed tariff rates, that we would not have seen under a typical Democratic administration. Circa May 2025, I feel less economically free than I did under the Biden administration.

Such problems are all the more true when a given side wins a series of successive political victories.

Power corrupts; the right is not immune to that truism. For instance, the Republican Party typically has been a vehicle for fiscal conservatives, at least on paper and in rhetoric. Yet under the Republican trifectas of both George W. Bush and the first Trump administration, both spending and debt rose dramatically. When you get to be the one spending the money, it is hard to exercise restraint.

I go on to argue that classical liberalism in fact does win a series of periodic transformative victories, even though at many historical moments it is relatively dormant in influence. It is the way to be a real winner.

Definitely recommended, of real importance.

The new Pope

Has taken a class in real analysis.

This is Vindication???

Joe Nocera has a strange piece in the Free Press arguing that the “godfathers of protectionism” have been vindicated. It begins with a story about how Dani Rodrik couldn’t get a famous economist to endorse his book Has Globalization Gone Too Far? because doing so would arm the barbarians. Well give that reluctant economist a Nobel! because they were obviously correct. Tyler made the same point in his debate with Rodrik. Rodrik had no answer.

The piece is strange because there is little to no connection with any data; just assertion, vibe, and non-sequitur. Most bizarrely but hardly alone was this bit:

In the 1980s, Prestowitz was an official in Ronald Reagan’s Commerce Department, back when Japan, not China, was the trading partner the U.S. most feared. Japanese autos, televisions, washing machines, and all sorts of consumer electronics were flooding into the U.S., forcing American auto makers to close factories and even putting U.S. companies like Zenith out of business. Yet Japan was using tariffs and other less obvious trade barriers to prevent U.S. companies from exporting many of their products to Japan. It was protecting certain key industries from foreign competition.

This was not how the rules of free trade were supposed to work. Prying that market open, forcing Japan to play by the same rules as the U.S., was Prestowitz’s job.

He found it deeply frustrating. “Every time we completed a trade negotiation,” Prestowitz told me, “some economist would turn out a model to show that the deal was going to create X number of American jobs and would reduce the trade deficit by Y. And it never happened.”

Even more galling, he said, “The conventional response among economists was that it didn’t matter.” After all, even if Japan was keeping U.S. products out of its market, America still benefited from low-cost imports. Prestowitz has a vivid memory of a conversation he once had with Herbert Stein, President Richard Nixon’s former chief economist. “The Japanese will sell us cars,” Stein told him with a shrug, “and we’ll sell them poetry.”

Prestowitz also remembers the abuse he took for his views. “I was a Japan-basher, a protectionist, and so on,” he said. Paul Krugman, who was not yet a New York Times columnist but was already an influential economist, called Prestowitz “an intellectual snake-oil salesman” in a book he wrote called Pop Internationalism. The book, published in 1997, consisted of a half-dozen essays, each of which brutally attacked one or another of the handful of people who dared to say that globalization was less than perfect. (He described then-Labor Secretary Robert Reich as “not a serious thinker,” and Lester Thurow, the best-selling author and Massachusetts Institute of Technology economist, as “silly.”)

When I asked Prestowitz recently if he felt vindicated, he admitted that he did, but added that “I also feel a sense of loss that it took us so long to face reality and at such cost.”

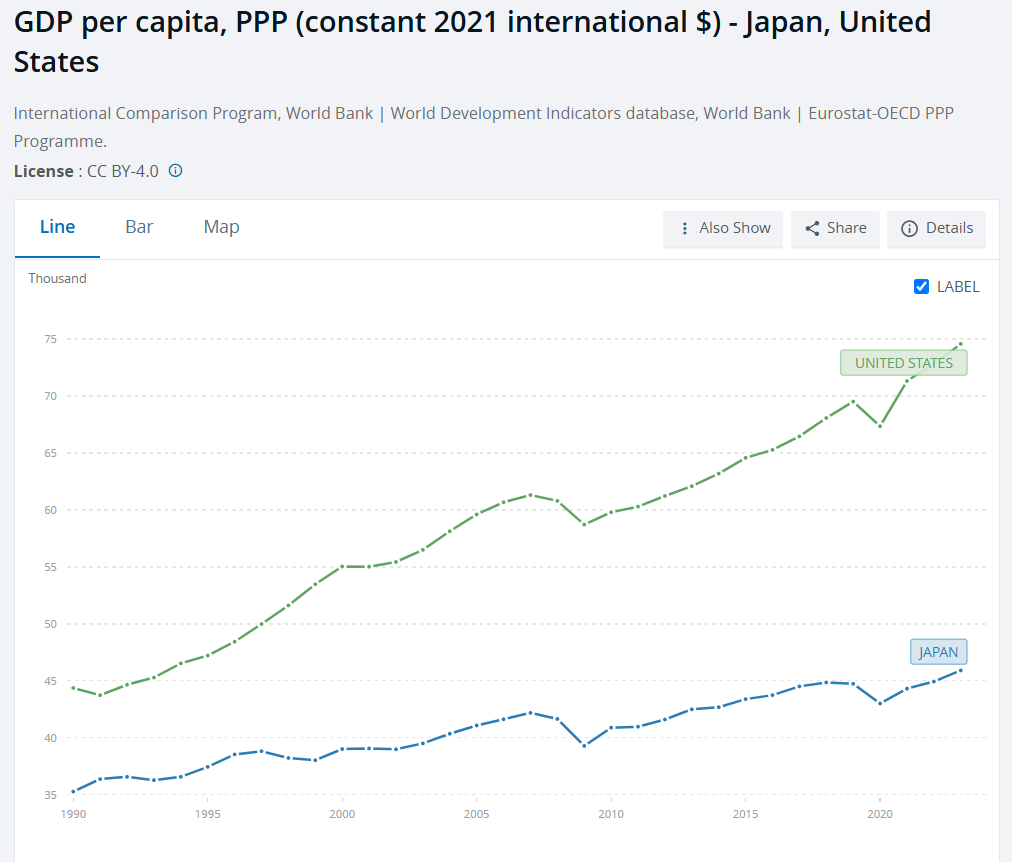

Well here is data on GDP per capita in real terms in Japan and the United States since 1990. This is vindication???!

Or how about this:

No one anymore, on the left or the right, denies that globalization has fractured the U.S., both economically and socially. It has hollowed out once-prosperous regions like the furniture-making areas of North Carolina and the auto manufacturing towns of the Midwest.

Well the far left and the far right agree that America has become fractured and hollowed out, the Bernie Sanders-Donald Trump horseshoe. But both are wrong. For the rest of us in the happy middle, consider this–Hickory, North Carolina, once known as the furniture capital of the United States, did face some hard times. But in 2023 Travel and Leisure magazine named Hickory the most beautiful and affordable place to live in the United States! Writing:

Located in the foothills of the Blue Ridge Mountains, Hickory is a family-friendly destination known for its ample hiking trails and Southern charm. Currently ranked as the cheapest place to live in the U.S., Hickory has a median home price of $161,000. This affordable neighbor to the east of Asheville and north of Charlotte is popular with retirees, but it’s also becoming more attractive to young families; a steady stream of residents has been flocking here for its newfound fame as a technological hub for Google and Apple.

Doesn’t sound hollowed out to me.

The godfathers of protectionism haven’t been vindicated—but if they want to claim credit for President Trump’s tariff binge they’re welcome to it.

Addendum: Hat tip to Scott Lincicome on Hickory and do read Jeremy Horpedahl for details on the distribution of wages. Did you know, for example, that median weekly earnings for full time workers who graduated high school but are without a college degree are at an all time high? Switched earlier current for constant $2021 dollars in graph.

My excellent Conversation with Jack Clark

This was great fun and I learned a lot, here is the audio, video, and transcript. Here is part of the episode summary:

Jack and Tyler explore which parts of the economy AGI will affect last, where AI will encounter the strongest legal obstacles, the prospect of AI teddy bears, what AI means for the economics of journalism, how competitive the LLM sector will become, why he’s relatively bearish on AI-fueled economic growth, how AI will change American cities, what we’ll do with abundant compute, how the law should handle autonomous AI agents, whether we’re entering the age of manager nerds, AI consciousness, when we’ll be able to speak directly to dolphins, AI and national sovereignty, how the UK and Singapore might position themselves as AI hubs, what Clark hopes to learn next, and much more.

An excerpt:

COWEN: Say 10 years out, what’s your best estimate of the economic growth rate in the United States?

CLARK: The economic growth rate now is on the order of 1 percent to 2 percent.

COWEN: There’s a chance at the moment, we’re entering a recession, but at average, 2.2 percent, so let’s say it’s 2.2.

CLARK: I think my bear case on all of this is 3 percent, and my bull case is something like 5 percent. I think that you probably hear higher numbers from lots of other people.

COWEN: 20 and 30, I hear all the time. To me, it’s absurd.

CLARK: The reason that my numbers are more conservative is, I think that we will enter into a world where there will be an incredibly fast-moving, high-growth part of the economy, but it is a relatively small part of the economy. It may be growing its share over time, but it’s growing from a small base. Then there are large parts of the economy, like healthcare or other things, which are naturally slow-moving, and may be slow in adoption of this.

I think that the things that would make me wrong are if AI systems could meaningfully unlock productive capacity in the physical world at a really surprisingly high compounding growth rate, automating and building factories and things like this.

Even then, I’m skeptical because every time the AI community has tried to cross the chasm from the digital world to the real world, they’ve run into 10,000 problems that they thought were paper cuts but, in sum, add up to you losing all the blood in your body. I think we’ve seen this with self-driving cars, where very, very promising growth rate, and then an incredibly grinding slow pace at getting it to scale.

I just read a paper two days ago about trying to train human-like hands on industrial robots. Using reinforcement learning doesn’t work. The best they had was a 60 percent success rate. If I have my baby, and I give her a robot butler that has a 60 percent accuracy rate at holding things, including the baby, I’m not buying the butler. Or my wife is incredibly unhappy that I bought it and makes me send it back.

As a community, we tend to underestimate that. I may be proved to be an unrealistic pessimist here. I think that’s what many of my colleagues would say, but I think we overestimate the ease with which we get into a physical world.

COWEN: As I said in print, my best estimate is, we get half a percentage point of growth a year. Five percent would be my upper bound. What’s your scenario where there’s no growth improvement? If it’s not yours, say there’s a smart person somewhere in Anthropic — you don’t agree with them, but what would they say?

Interesting throughout, definitely recommended.

Betting markets in everything

Polymarket, on the chances of a nuclear weapon being used in 2025. Currently at 17. Here is further analysis from o3.

China missing facts of the day

Not long ago, anyone could comb through a wide range of official data from China. Then it started to disappear.

Land sales measures, foreign investment data and unemployment indicators have gone dark in recent years. Data on cremations and a business confidence index have been cut off. Even official soy sauce production reports are gone.

In all, Chinese officials have stopped publishing hundreds of data points once used by researchers and investors, according to a Wall Street Journal analysis.

In most cases, Chinese authorities haven’t given any reason for ending or withholding data. But the missing numbers have come as the world’s second biggest economy has stumbled under the weight of excessive debt, a crumbling real-estate market and other troubles—spurring heavy-handed efforts by authorities to control the narrative.

Here is more from the WSJ, “model this.” Via B.

Tabarrok on the Movie Tariff

The Hollywood Reporter has a good piece on Trump’s proposed movie tariffs:

Even if such a tariff were legal — and there is some debate about whether Trump has the authority to impose such levies — industry experts are baffled as to how, in practice, a “movie tariff” would work.

“What exactly does he want to put a tariff on: A film’s production budget, the level of foreign tax incentive, its ticket receipts in the U.S.?” asks David Garrett of international film sales group Mister Smith Entertainment.

Details, as so often with Trump, are vague. What precisely constitutes a “foreign” production is unclear. Does a production need to be majority shot outside America — Warner Bros’ A Minecraft Movie, say, which filmed in New Zealand and Canada, or Paramount’s Gladiator II, shot in Morocco, Malta and the U.K. — to qualify as “foreign” under the tariffs, or is it enough to have some foreign locations? Marvel Studios’ Thunderbolts*, for example, had some location shooting in Malaysia but did the bulk of its production in the U.S, in Atlanta, New York and Utah.

…“The only certainty right now is uncertainty,” notes Martin Moszkowicz, a producer for German mini-major Constantin, whose credits including Monster Hunter and Resident Evil: The Final Chapter. “That’s not good for business.”

A movie producer is quoted on the bottom line:

“Consistent with everything Trump does and says, this is an erratic, ill conceived and poorly considered action,” says Nicholas Tabarrok of Darius Films, a production house with offices in Los Angeles and Toronto. “It will adversely affect everyone. U.S. studios, distributors, and filmmakers will suffer as much as international ones. Trump just doesn’t seem to understand that international trade is good for both parties and tariffs not only penalize international companies but also raise prices for U.S. based companies and consumers. This is an ‘everyone loses, no one gains’ policy.”

Lady Liberty of the Pacific

Instead of re-opening Alcatraz as super-max prison we should build a statue to America. I suggest “Lady Liberty of the Pacific”. The spirit of Columbia ala John Gast’s American Progress carrying a welcoming beacon-lamp in her raised right hand and a coiled fibre-optic cable in her left representing Bay Area technology.

Trump proposes 100% tariff on movies shot outside the United States

Here is one link. Of course the proposal is not easy to understand. If it is a Jason Bourne movie, do they add up the number of scenes shot abroad and consider those as a percentage of the entire movie? Does one scene shot abroad invoke the entire tariff? o3 guesstimates that about half of major Hollywood releases are shot abroad to a significant degree, with many more having particular scenes shot abroad.

Imagine the new Amazon release: “James Bond in Seattle.” And it actually would be Seattle — do they have baccarat there?

Furthermore, virtually all foreign films are shot abroad rather than in the U.S. The incidence in this case is interesting. Assuming the movie would have been made anyway, most of the tax burden falls on the producer, not the American consumer, because the marginal cost of sending the extra units of the film to America is low. Nonetheless lower American revenue will force those films onto lower budgets. Possibly Canadian and also English movies will suffer the most, because they are most likely to have the U.S. as their dominant market.

Of course the U.S: is by far the world’s number one exporter of movies, so we are vulnerable to retaliation on this issue, to say the least.

Not De Minimis

Commerce Secretary Howard Lutnick:

Ending the “de minimis loophole” is a big deal. This rule allowed foreign companies to avoid paying tariffs on small shipments, giving them an unfair advantage over American small businesses. To small businesses across the country: we have your back.

The Value of De Minimis Imports by Fajgelbaum and Khandelwal:

A U.S. consumer can import $800 worth of goods per day free of tariffs and administrative fees. Fueled by rising direct-to-consumer trade, these “de minimis” shipments have exploded in recent years, yet are not recorded in Census trade data. Who benefits from this type of trade, and what are the policy implications? We analyze international shipment data, including de minimis shipments, from three global carriers and U.S. Customs and Border Protection. Lower-income zip codes are more likely to import de minimis shipments, particularly from China, which suggests that the tariff and administrative fee incidence in direct-to-consumer trade disproportionately benefits the poor. Theoretically, imposing tariffs above a threshold leads to terms-of-trade gains through bunching, even in a setting with complete pass-through of linear tariffs. Empirically, bunching pins down the demand elasticity for direct shipments. Eliminating §321 would reduce aggregate welfare by $10.9-$13.0 billion and disproportionately hurt lower-income and minority consumers.

In other words, eliminating the de minimis rule is a significant tax on poorer Americans.

Frankly, it’s also a pain in the ass to have your international shipments delayed at broker (who often charges you exorbitant rates, more than the customs tax) and then have to go down to the customs office to pay the stupid tax. Yes, I am speaking from experience.

Driverless trucks on their way?

Aurora Innovation, Inc. (NASDAQ: AUR) has successfully launched its commercial self-driving trucking service in Texas. Following the closure of its safety case, Aurora began regular driverless customer deliveries between Dallas and Houston this week. To date, the Aurora Driver has completed over 1,200 miles without a driver. The milestone makes Aurora the first company to operate a commercial self-driving service with heavy-duty trucks on public roads. Aurora plans to expand its driverless service to El Paso, Texas and Phoenix, Arizona by the end of 2025.

Here is the story, via Joe Brenton.

Has international travel to the U.S. really collapsed?

But despite some ominous signs, a close look at the data shows that travel to the United States is largely holding up — at least so far.

Nearly as many foreign travelers have arrived at American airports this year than during the same period last year, according to an analysis by The New York Times of entry data collected from every international airport in the country.

International arrivals did drop more than 10 percent in March compared with last year, but this was largely because Easter fell unusually late this year, pushing back a popular travel window for European tourists. More recent figures from April show that travel over the holiday looked similar to previous years.

Here is more from the NYT. The main major difference is for Canadians, who are indeed more skittish, and their ticket sales are down 21 percent.