Category: Economics

AI, labor markets, and wages

There is a new and optimistic paper by Lukas Althoff and Hugo Reichardt:

Artificial intelligence is changing which tasks workers do and how they do them. Predicting its labor market consequences requires understanding how technical change affects workers’ productivity across tasks, how workers adapt by changing occupations and acquiring new skills, and how wages adjust in general equilibrium. We introduce a dynamic task-based model in which workers accumulate multidimensional skills that shape their comparative advantage and, in turn, their occupational choices. We then develop an estimation strategy that recovers (i) the mapping from skills to task-specific productivity, (ii) the law of motion for skill accumulation, and (iii) the determinants of occupational choice. We use the quantified model to study generative AI’s impact via augmentation, automation, and a third and new channel—simplification—which captures how technologies change the skills needed to perform tasks. Our key finding is that AI substantially reduces wage inequality while raising average wages by 21 percent. AI’s equalizing effect is fully driven by simplification, enabling workers across skill levels to compete for the same jobs. We show that the model’s predictions line up with recent labor market data.

Via Kris Gulati.

Profile of George Borjas and his influence

More recently, his research has found new attention and urgency in President Donald Trump’s second term: Borjas, 75, worked as a top economist on the Council of Economic Advisers, a post he stepped down from last week.

Borjas is an immigrant and refugee who escaped Cuba for the United States in 1962 and later obtained citizenship — a point of tension he has referenced in his writing.

“Not only do I have great sympathy for the immigrant’s desire to build a better life, I am also living proof that immigration policy can benefit some people enormously,” he wrote in a 2017 opinion piece for the New York Times. “But I am also an economist, and am very much aware of the many trade-offs involved. Inevitably, immigration does not improve everyone’s well-being.”

One of Borjas’s direct contributions to the Trump administration this past year was his extensive behind-the-scenes work on Trump’s overhaul of the H-1B visa system for highly skilled workers that added a $100,000 fee, according to three people familiar with his work and a White House official, who all spoke on the condition of anonymity because they weren’t authorized to share internal deliberations. Borjas had previously written about the “well-documented abuses” of that program over the years.

The White House official said Borjas was among many Trump administration members involved in redesigning the H-1B visa program and confirmed that Borjas provided intellectual support for other Trump immigration initiatives last year.

Here is more from The Washington Post.

Ken Opalo outlook on Africa 2026

(4) Keeping with the theme of growing during hard times and in difficult contexts, Nigeria is projected to grow by at least 4.3% in 2026, with consumer demand rising by over 7%.

Tinubu’s strong medicine may have nearly killed the patient, but after two painful years Nigerians seem poised to get relief from improving macro conditions. The Naira will remain stable (despite downward pressure on oil prices), with inflation projected to decline to under 14% — down from over 20% in 2025. Also, by now we can conclude that Dangote Refinery’s $20b bet on the Nigerian economy is a success. He appears to be winning the war against the entrenched interests that for decades fed at the trough of crude exports, imports of refined products, and fuel subsidies. The impact of the refinery will be felt in the further stabilization of fuel prices in 2026.

Nigeria’s reform momentum will slow down ahead of the 2027 elections. It’s not yet clear whether the reforms knocked the economy into a growth path, or if the projected growth is just recovery from the initial steep contraction after Tinubu took office.

(5) South Africa, too, will grow in 2026 despite tariff and political pressure from Washington. The GNU is holding; and Pretoria has weathered geopolitical storms (including the rift with Trump’s America) much better than I anticipated.

After years of stagnation, there is an emerging consensus that South Africa will see improvements in its growth rate over the next three years (averaging 1.7%). The reform momentum will continue, including in the power sector and entrenchment of the rule of law. Local elections later this year, including the big one in Johannesburg, will likely put further pressure on the ANC to improve service delivery and overall quality of policymaking.

The whole post is of interest, interesting throughout.

The Tyranny of the Complainers

Some years ago, Dourado and Russell pointed out a stunning fact about airport noise complaints: A very large number come from a single individual or household.

In 2015, for example, 6,852 of the 8,760 complaints submitted to Ronald Reagan Washington National Airport originated from one residence in the affluent Foxhall neighborhood of northwest Washington, DC. The residents of that particular house called Reagan National to express irritation about aircraft noise an average of almost 19 times per day during 2015.

Since then, total complaint volumes have exploded—but they are still coming from a tiny number of now apparently more “productive” individuals. In 2024, for example, one individual alone submitted 20,089 complaints, accounting for 25% of all complaints! Indeed, the total number of complainants was only 188 but they complained 79,918 times (an average of 425 per individual or more than one per day.)

What I learned recently is that it’s not just airport noise complaints. We see the same pattern in data from the US Department of Education’s Office for Civil Rights which enforces federal civil rights laws related to education funding. In 2023, for example, 5059 sexual discrimination complaints came from a single individual–from a total of 8151 complaints. Thus, one individual accounted for 68.5% of all sexual discrimination complaints in that year.

In the annual reports for 2022-2024 the OCR identifies what type of complaint the single-individual with multiple complaints was making, a sex discrimination complaint, while in previous years they just give data on the number of complaints from single individuals compared to the total of all types of complaints. I’ve collated this data in this graph which presents totals compared to multiple complaints from a single individual without regard to the type of complaint. Do note, that there are also single individuals filing hundreds of other types of complaints such as age discrimination complaints so the data from more recent years may actually be an underestimate.

In any case, it’s clear that a single individual often accounts for 10-30% of all complaints! These complaints have to be investigated so this single individual may be costing taxpayers millions. It’s as if a single individual were pulling a fire alarm thousands of times a year, mobilizing emergency services on demand, and never facing repercussions.

Does this strategy work? Probably. When complaints are summarized for Congress or reported in the media, are totals presented as-is, or adjusted for spam?

Increasingly, public institutions seem to exist to manage the obsessions of a tiny number of neurotic—and possibly malicious—complainers.

A final remark on AGI and taxation

I’ve noted repeatedly in the past that the notion of AGI, as it is batted around these days, is not so well-defined. But that said, just imagine that any meaningful version of AGI is going to contain the concept “a lot more stuff gets produced.”

So say AGI comes along, what does that mean for taxation? There have been all these recent debates, some of them surveyed here, on labor, capital, perfect substitutability, and so on. But surely the most important first order answer is: “With AGI, we don’t need to raise taxes!”

Because otherwise we do need to raise taxes, given the state of American indebtedness, even with significant cuts to the trajectory of spending.

So the AGI types should in fact be going further and calling for tax cuts. Even if you think AGI is going to do us all in someday — all the more reason to have more consumption now. Of course that will include tax cuts for the rich, since they pay such a large share of America’s tax burden. (Effective Altruists, are you listening?”)

The rest of us can be more circumspect, and say “let’s wait and see.”

The Venezuelan stock market

Venezuela’s stock market is now up +73% since President Maduro was captured. Since December 23rd, as President Trump ramped up pressure on Maduro’s government, Venezuela’s stock market is up +148%.

Here is the link and chart. And up seventeen percent in the last day, and now some more on top of that. Note the bolivar is down only a small amount since December 23.

I see the reality as such:

a) Immoral actions were taken, leading up to the removal of Maduro, and immoral measures are likely to continue, both from the United States and from various Venezuelan replacement governments.

b) Trump’s actions have been some mix of unlawful and unconstitutional, to what degree you can debate.

c) In expected value terms, the people of Venezuela are now much better off.

It can and should be debated how much a) and b) should be weighted against c). But to deny c), or even to fail to mention it, is, I think, quite delusional.

Effective Altruists, are you paying attention?

The US Leads the World in Robots (Once You Count Correctly)

If you search for data on robots you will quickly find data from the International Federation of Robotics which places South Korea in the lead with ~818 robots per 10,000 manufacturing workers, followed by China, Japan, Germany and finally at 10th place the US at ~304 robots per 10,000. The IFR, however, misses the most sophisticated, impressive and versatile robots, namely Teslas with FSD capability. Teslas see the world, navigate complex environments, move tons of metal at high speeds and must perform at very high levels of tolerance and safety. If you included Teslas as robots, as you should, the US leaps to the top.

Moreover, once you understand Teslas as robots, Optimus, Tesla’s humanoid robot division, stops being a quixotic Elon side-project and becomes the obvious continuation of Tesla’s core work.

Why Care About Debt-to-GDP?

Here is another piece for “contrarian Tuesday,” like it or not:

We construct an international panel data set comprising three distinct yet plausible measures of government indebtedness: the debt-to-GDP, the interest-to-GDP, and the debt-to-equity ratios. Our analysis reveals that these measures yield differing conclusions about recent trends in government indebtedness. While the debt-to-GDP ratio has reached historically high levels, the other two indicators show either no clear trend or a declining pattern over recent decades. We argue for the development of stronger theoretical foundations for the measures employed in the literature, suggesting that, without such grounding, assertions about debt (un)sustainability may be premature.

That is from a new NBER working paper by , it is worth repeating this basic idea. And here is my earlier podcast with Alex on similar themes.

The puzzle of Pakistan’s poverty?

Until 2009, India was poorer than Pakistan on a per capita basis. India truly became richer than Pakistan after 2009 and since then it hasn’t looked back. If trends continue for a decade, India will be more than twice as rich as Pakistan soon…

So why has India pulled ahead in GDP per capita? The reason is simple. Pakistan’s high fertility has driven population growth faster than India’s. In 1952 Pakistan had about one-tenth of India’s population; by 2025 it had grown to nearly one-seventh.

In other words, many of the added Pakistanis have not started working yet, but they are on the books to lower the per capita esstimate. There is much in this Rohit Shinde essay I disagree with, but it is a useful corrective to those who simply wish to sing “policy, policy, policy.” Putting aside its per capita lag, Pakistan has done a better job keeping up with India than you might think at first.

In any case, I am not predicting that trend will continue in the future, I do not think so. So someday this essay might look especially “off,” nonetheless it is worth a moment of ponder.

O-Ring Automation

We study automation when tasks are quality complements rather than separable. Production requires numerous tasks whose qualities multiply as in an O-ring technology. A worker allocates a fixed endowment of time across the tasks performed; machines can replace tasks with given quality, and time is allocated across the remaining manual tasks. This “focus” mechanism generates three results. First, task-by-task substitution logic is incomplete because automating one task changes the return to automating others. Second, automation decisions are discrete and can require bundled adoption even when automation quality improves smoothly. Third, labour income can rise under partial automation because automation scales the value of remaining bottleneck tasks. These results imply that widely-used exposure indices, which aggregate task-level automation risk using linear formulas, will overstate displacement when tasks are complements. The relevant object is not average task exposure but the structure of bottlenecks and how automation reshapes worker time around them.

That is from a new paper by Joshua S. Gans and Avi Goldfarb. Once again people, the share of labor is unlikely to collapse…

The wisdom of Garett Jones

Two cases for capital share going to zero in a strong AGI world: 1. Capital and labor are more like perfect complements than perfect substitutes, always will be as long as the economy is for humans, and so astronomical increases in capital shrink the capital share to zero.

Why capital share goes to zero in a strong AGI world: 2. Capital & labor are more like perfect substitutes than complements because AGI de facto replicates free humans. Astronomical increases in capital make capital so abundant it’s unpriced like air, so capital share is zero.

The link has a bit more. Of course this is a thought experiment and a reductio, not a prediction. (It seems people in the rationalist community systematically misunderstand how economists communicate? Maybe that is partly the fault of the economists, but they should not so dogmatically believe that the economists are wrong.) And here are very good comments from Basil Halperin.

The bottom line is that it is premature, to say the least, to expect that the share of labor falls to zero or near-zero.

Why Some US Indian Reservations Prosper While Others Struggle

Our colleague Thomas Stratmann writes about the political economy of Indian reservations in his excellent Substack Rules and Results.

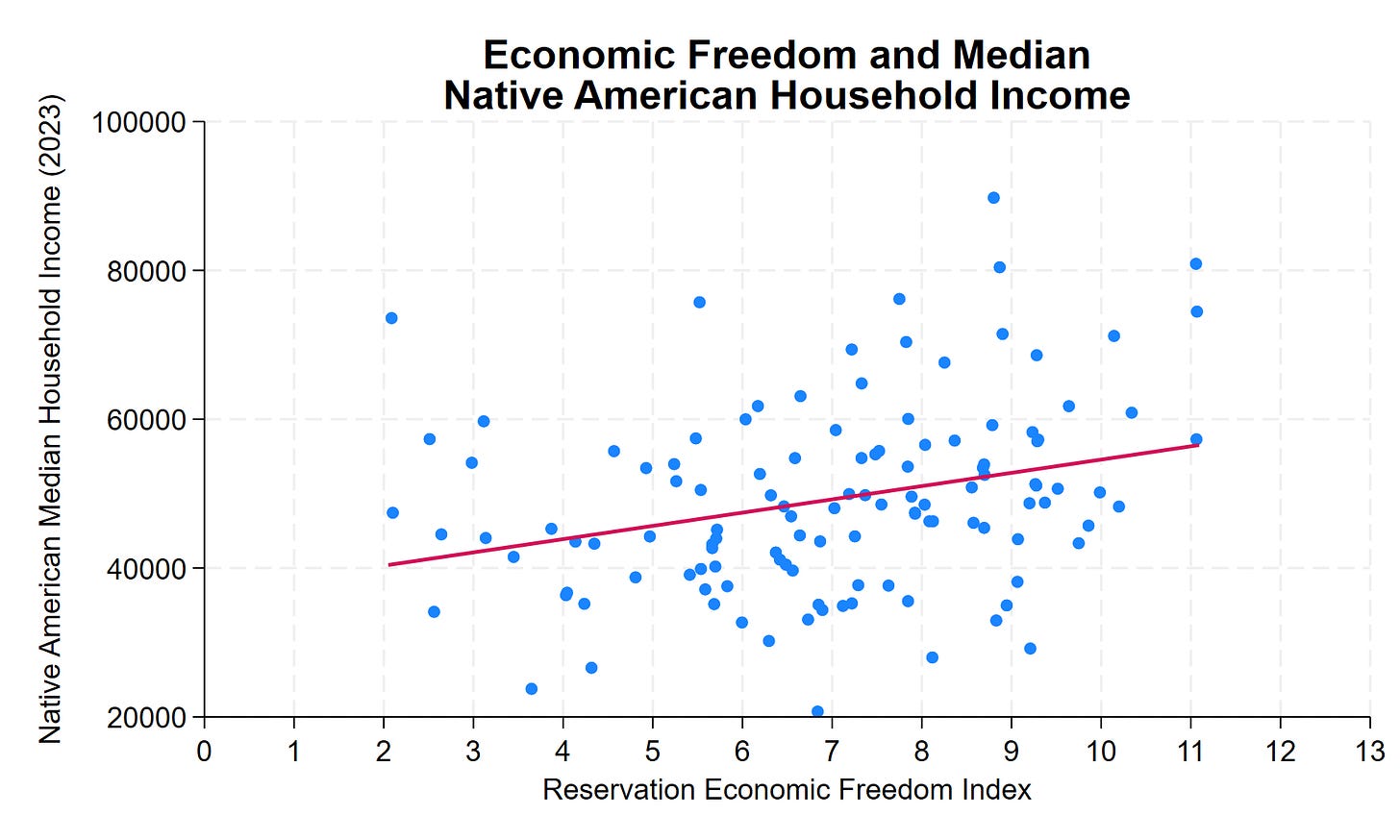

Across 123 tribal nations in the lower 48 states, median household income for Native American residents ranges from roughly $20,000 to over $130,000—a sixfold difference. Some reservations have household incomes comparable to middle-class America. Others face persistent poverty.

Why?

The common assumption: casino revenue. The data show otherwise. Gaming, natural resources, and location explain some variation. But they don’t explain most of it. What does? Institutional quality.

The Reservation Economic Freedom Index 2.0 measures how property rights, regulatory clarity, governance, and economic freedom vary across tribal nations. The correlation with prosperity is clear, consistent, and statistically significant. A 1-point improvement in REFI—on a 0-to-13 scale—correlates with approximately $1,800 higher median household income. A 10-point improvement? Nearly $18,000 more per household.

Many low-REFI features aren’t tribal choices—they’re federal impositions. Trust status prevents land from being used as collateral. Overlapping federal-state-tribal jurisdiction creates regulatory uncertainty. BIA approval requirements add months or years to routine transactions. Complex jurisdictional frameworks can deter investment when the rules governing business activity, dispute resolution, and enforcement remain unclear.

This is an important research program. In addition to potentially improving the lives of native Americans, the 123 tribal nations are a new and interesting dataset to study institutions.

See the post for more details amd discussion of causality. A longer paper is here.

AEA: Honoring Milton Friedman

Looks like a good AEA session on Sunday in Philly:

“Honoring Milton Friedman on his 50th Anniversary of Winning the Nobel Prize”

Mark Skousen: “My Friendly Fights with Milton Friedman”

Jeremy Siegel: “Milton Friedman’s contributions to financial markets and the influence of money on the business cycle.”

James K. Galbraith: “Milton Friedman’s Critique of Keynesian Economics and Fiscal Policy: A Response”

Michael Bordo: “The Future of Monetarism After Friedman: What Works, What Doesn’t.”

Judy Shelton: “Milton Friedman and Robert Mundell: Who Won the Nobel Money Duel?”

To be held Sunday Jan. 4, 8-10 am ET at the Philadelphia Marriott Hotel, Grand Ballroom Salon B.

Economic inequality does not equate to poor well-being or mental health

A meta-analysis of 168 studies covering more than 11 million people found no reliable link between economic inequality and well-being or mental health. In other words, living in a place that has large gaps between the rich and poor does not affect these outcomes, with implications for policy.

Here is the Nature link, this claim has been bad science all along.

One bad trend from 2025, diminution of the dollar’s safe haven status

It used to be that if you were worried about the future, you would move into dollars as the safe haven—in finance terms a countercyclical asset, which stays resilient when higher-risk assets fall. But if the United States’ own government and policies are unpredictable, and its economy is volatile, you will look for some other hedges instead. Chaos in the U.S., and particularly in the White House, is pushing investors to find alternatives to the dollar.

And so investment funds have been pouring into the precious metals, boosting their prices. While the current high price of silver reflects many factors, some of them technical and quite specific, the shift in risk attitudes has become pronounced over the last year.

The bottom line is that America is less of a safe haven than it used to be. When President Donald Trump announced his heavy tariff plan on “Liberation Day,” the dollar fell. That’s contrary to ordinary economic theory, which suggests that as Americans send fewer dollars abroad to buy imported goods, the dollar should rise. Traders, though, started to view the United States itself as a source of risk. It felt as if the right thing to do was to run away from the dollar. As a result, the dollar is down nearly 10 percent this year.

Here is more from me at The Free Press.