When does greater inequality lead to greater redistribution?

Henry Farrell reports:

Noam Lupu and Jonas Pontussen (PDF) have a piece on the relationship between inequality and distribution in the new American Political Science Review. There is a lot of debate about whether the level of economic inequality in society leads to greater or lesser distribution – what Lupu and Pontussen suggest is that the structure of inequality (that is – the more particular relationships between different segments in the income distribution, rather than some summary index) is more important. More particularly they argue that if one tries to hold racial and ethnic cleavages constant, the key factor determining redistribution is the income gap between middle income voters and lower income voters. Where this gap is low, middle class people feel some degree of solidarity with the poor and exhibit what Lupu and Pontussen describe as “parochial altruism.” That is, they are more likely to support income redistribution because they feel that the poor are in some sense, ‘like them.’ When the gap is high, middle class people will have a much weaker sense of solidarity with the poor, and hence be less supportive of redistribution. Lupu and Pontussen suggest that the US is an outlier, with weaker solidarity than the structure of US inequality would suggest. They argue that the explanation for this is straightforward – “it is clearly attributable to the high-concentration of racial-ethnic minorities in the bottom of the income distribution.” More bluntly put – middle class Americans feel less solidarity with the very poor because the very poor are more likely to be black.

China barter market regret of the day

According to Thursday’s Shanghai Daily, a 17-year-old student in Huaishan City, China, gave up his right kidney to get his hands on Apple’s hottest-selling product.

That’s the iPad2, and for the pointer I thank Thomas Acox.

Questions that are rarely asked

To Oded Galor:

As the father of unified growth theory, what does it mean to have a single theory that accounts for the entire growth process since the dawn of civilization?

The answer and full interview is here, concerning Galor’s new book Unified Growth Theory. Here is an earlier interview with Oded Galor.

Assorted links

George Selgin and Kurt Schuler are now blogging

www.freebanking.org. Hat tip goes to Niklas.

Should it be illegal to park facing the wrong way?

Jeff writes:

Economic theory suggests that penalties should be attached to behaviors that are correlated with crime and not necessarily to criminal behavior itself. For example, price fixing may be impossible to detect, but conspiracy to fix prices may be much easier. It makes sense to make cheap talk a crime even though the talk itself causes no harm.

When you car is parked facing the wrong way its a sure sign that A) you previously committed the crime of driving the wrong way and B) you will soon do it again.

Is this another of his elaborate jests? The web suggests that Texas has begun to enforce this law only recently, to shore up Medicaid, but the resulting policy uncertainty adds to our current output gap. It also violates Keynesian strictures not to raise taxes during a recession. Up until now, of course, there has been strong net mobility into the state of Texas, so was the previous lack of enforcement so bad?

The practice of parking the wrong [sic] way is at least as safe as turning across lanes of oncoming traffic.

One fear is that traffic will slam into your parked car if your rear reflectors are not facing the proper way. Yet if everyone parks facing the wrong way, does not this risk diminish and indeed a benefit can be seen? And is not a car, if parked for long enough, infinitely dangerous in any case? And are not wrong way parkers the most likely to hurry in and out of a spot quickly, thereby lowering stationary collision probabilities? Or is the argument that a parked car safer is in any case safer than a moving car, and that wrong way parking allows more cars to park more readily, thereby lowering the average velocity of automobiles? In any case, the Peltzmann effect suggests that wrong way parking, and the concomitant dangers, will discourage drunk driving, thereby saving lives. Furthermore the relevant alternative to “wrong way parking” is usually an extremely reckless, immediate, illegal U-turn.

I once “parked the wrong way” in Falls Church City. The policeman told me he could not give me a ticket, since he had not seen me do it, but that there was no way I could leave the space legally. (I so enjoy a dare.) Here in Virginia, or at least in Falls Church City, the rule of law reigns; the policeman recognized the car might have been there forever, or might have been parked by a computer (that’s illegal too, but let him try to prove the computer did it), or might have materialized there through quantum effects. A game of waiting ensued.

All Watched Over By Machines of Loving Grace

All Watched Over By Machines of Loving Grace, is a hallucinatory BBC documentary that hyperwarps across continents and through time to draw shadowy connections between Ayn Rand, Silicon Valley, the “rise of the machines”, anarchism, the financial crisis and the Monica Lewinsky scandal. (Need, I add and much more!?) Incongruous images and a surreal soundtrack give it a Lynchian feel. Not your usual documentary. Evaluated as a whole, it’s madness but delicious madness. Here is the first episode.

http://youtu.be/Uz2j3BhL47c

FYI, especially interesting in the first episode is Loren Carpenter’s Pong experiment. You can read more about that here.

The “New Monetary Economics” is alive and well

The standard view is that Fischer Black, Bob Hall, Neil Wallace, and Eugene Fama wrote a few creative papers on monetary theory in the 1980s (for Black the 70s), but that the embedded monetary scenarios were “too weird” and the line of research did not prove fruitful. Even in “free banking” circles the “New Monetary Economics,” as it was called for a while (NME), wasn’t always taken very seriously. If you’re looking for a definition of the NME, I would say it is the study of unusual monetary arrangements involving either explicit prices for monetary media of exchange (i.e., separating money’s medium of exchange function from its medium of account function), and/or paying interest on currency or bank reserves held at the Fed. Most fundamentally, the NME suggests we can make progress in macroeconomics by deconstructing the concept of money into its constituent parts.

Although the term has fallen out of use, in the last three to four years the NME has made a big comeback, albeit not under that name:

1. It was a core NME point that if the nature or quality of a money is somehow in doubt, it is important to have that money priced. Yet there is no market price for “a euro in an Irish bank” vs. “a euro in a German bank” and that is a fundamental problem with the euro, namely that the price is fixed at one. The market is wanting that price to reemerge, namely the market wants some additional monetary separation. The NME explains pretty clearly why parts of the eurozone are not working and probably cannot work. Economists interested in the NME were generally skeptical of the eurozone from the beginning, as they saw multiple monies as ways of containing and limiting macroeconomic risk.

2. Scott Sumner has made a big splash with his idea to “target the forecast of nominal gdp.” You can think of Scott as proposing what is currently a missing prediction market. The deeper way of understanding Scott’s proposal is to see money as missing a price and wanting to create a new way of pricing money, namely in terms of nominal gdp forecasts. Until money has the correct price, we won’t know the correct quantity of money or the correct time path for monetary policy. Scott of course was one of the early contributors to the NME literature and he and I once had a published exchange on related matters, way back when (Garrison and White are here).

3. We are now paying interest on reserves. Is Fischer Black’s claim true that, under these circumstances, the central bank cannot control the price level and the price level will be whatever people want it to be? Optimistic expectations will lead to lots of borrowing and rising prices, while pessimistic forecasts will lead to lower levels of borrowing and weaker inflationary pressures. I’m not so sure of this claim, but at the very least a) it is worth thinking about, b) it now gets debated a lot, and c) it really matters.

4. NME theorists frequently argued that a gold standard provides insufficient hedging opportunities; in an era where gold prices have risen very rapidly and steeply this seems prescient. A gold standard never was a desirable monetary option, as it would have brought a very radical and very nasty deflation.

The part of the NME which has held up least well in this claim that “mutual fund banking” can limit or prevent bank runs. The runs on money market funds, during the financial crisis, seemed to show that flex-price “equity banking” is not in fact an underexploited source of macroeconomic and financial stability. The market resists flex-price for these accounts even when it would appear it should embrace it. That’s only one data point, but it seems to me a somewhat damning one.

My very first (co-authored) book was on the NME, circa 1994. The NME is most interesting when monetary institutions are in an abnormal state, but now “abnormal” is “the new normal.” The NME is less interesting in explaining, say, the macroeconomics of 1963.

Does this technique reliably increase your fluid intelligence?

I am passing this along without endorsing it (travel prevents me from going through the research):

The n-back task involves presenting a series of visual and/or auditory cues to a subject and asking the subject to respond if that cue has occurred, to start with, one time back. If the subject scores well, the number of times back is increased each round. The task can be done with dual auditory and visual cues, or with just one or the other.

A few years ago, Jonides and his colleagues Martin Buschkuehl, Susanne Jaeggi, and Walter Perrig demonstrated that dual n-back training increased performance on tests of fluid intelligence. But the current work extends that finding in several ways.

“These new studies demonstrate that the more training people have on the dual n-back task, the greater the improvement in fluid intelligence,” Jonides said. “It’s actually a dose-response effect. And we also demonstrate that the much simpler single n-back training using spatial cues has the same positive effect.”

In the so-called real world, who actually gets this kind of training?:

According to Jonides, the n-back task taps into a crucial brain function known as working memory—the ability to maintain information in an active, easily retrieved state, especially under conditions of distraction or interference. Working memory goes beyond mere storage to include processing information.

For the pointer I thank MR commentator JamieNYC.

Assorted links

What is the evidence on whether cell phones can cause cancer?

The World Health Organization is publicizing this idea (pdf), but to me the evidence still does not look very strong at all. Chat away. Hat tip goes to Mocost on Twitter.

Long Term Trends in Homicide Rates

Here is a graph of American homicide rates, the earlier results should be taken with a grain of salt of course, but the trend is clear. N.B. These rates are per 100,000.

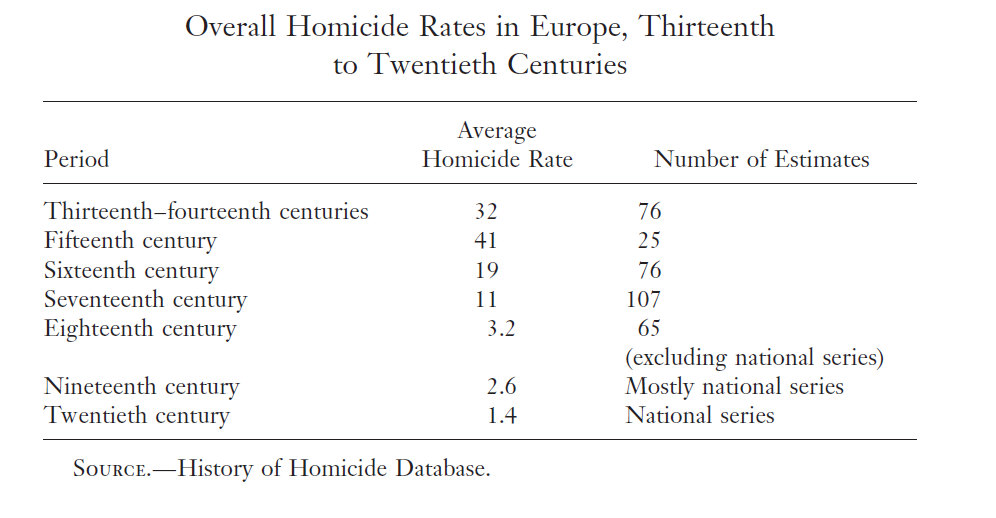

The American data is consistent with European data. Here is Table 2 from Manuel Eisner’s Long-Term Historical Trends in Violent Crime. Do note that some correction should be made for the fact that violence is less lethal when people are healthier and medical care is more effective.

The bottom line is that there has been a big and welcome decrease in homicide rates in Europe and America over the past several centuries. To put these numbers in perspective, however, note that the homicide rate in New Orleans today is 52 per 100,000 and in Detroit it’s 40 per 100,000 so even with a lower average there is lots of variation. Brazil today is around 22 per 100,000 not too far from America in the 19th century. The homicide rate in El Salvador is 71 per 100,000, in Jamaica (!) 60 per 100,000 and in Honduras 67 per 100,000 — all higher than fifteenth century Europe. Thus, the past was a more violent place but not so violent as to be unknown to the present.

Hat tip: Tim Harford.

The culture that is Taco Bell (cheap chalupas edition)

This article is superb throughout, here is one excerpt:

Every Taco Bell, McDonald’s (MCD), Wendy’s (WEN), and Burger King is a little factory, with a manager who oversees three dozen workers, devises schedules and shifts, keeps track of inventory and the supply chain, supervises an assembly line churning out a quality-controlled, high-volume product, and takes in revenue of $1 million to $3 million a year, all with customers who show up at the front end of the factory at all hours of the day to buy the product. Taco Bell Chief Executive Officer Greg Creed, a veteran of the detergents and personal products division of Unilever (UL), puts it this way: “I think at Unilever, we had five factories. Well, at Taco Bell today I’ve got 6,000 factories, many of them running 24 hours a day.”

…When I take my place on the line and start to prepare burritos, tacos, and chalupas—they won’t let me near a Crunchwrap Supreme—it is immediately clear that this has been engineered to make the process as simple as possible. The real challenge is the wrapping. Taco Bell once had 13 different wrappers for its products. That has been cut to six by labeling the corners of each wrapper differently. The paper, designed to slide off a stack in single sheets, has to be angled with the name of the item being made at the upper corner. The tortilla is placed in the middle of the paper and the item assembled from there until you fold the whole thing up in the wrapping expediting area next to the grill. “We had so many wrappers before, half a dozen stickers; it was all costing us seconds,” says Harkins. In repeated attempts, I never get the proper item name into the proper place. And my burritos just do not hold together.

With me on the line are Carmen Franco, 60, and Ricardo Alvarez, 36. The best Food Champions can prepare about 100 burritos, tacos, chalupas, and gorditas in less than half an hour, and they have the 78-item menu memorized. Franco and Alvarez are a precise and frighteningly fast team. Ten orders at a time are displayed on a screen above the line, five drive-thrus and five walk-ins. Franco is a blur of motion as she slips out wrapping paper and tortillas, stirs, scoops, and taps, then slides the items down the line while looking up at the screen. The top Food Champions have an ability to scan through the next five orders and identify those that require more preparation steps, such as Grilled Stuffed Burritos and Crunchwrap Supremes, and set those up before returning to simpler tacos and burritos. When Alvarez is bogged down, Franco slips around him and slides Crunchwrap Supremes into their boxes. For this adroit time management and manual dexterity, Taco Bell starts its workers at $8.50 an hour, $1.25 more than minimum wage.

Glasgow markets in everything

A parking fine in Glasgow is £30 if paid promptly, £60 otherwise. Our entrepreneurs have other ideas. They’ll sell you a used parking ticket with a specific time on it for a tenner, which you can send to the council to “prove” that you were wrongly fined.

Here is more, pointer via Greg and also Yahel. The intro to the story is this:

If you park your car or walk through the Osborne St car park near my flat, you are quickly approached by one or more rough looking types asking if there is any time left on your parking ticket. They’re rude and slightly threatening, so most people give up their used ticket. If it’s valid for any significant amount of time (ie. you’ve paid for the whole day or a several hour stretch and there is time remaining) they will stand by the ticket machine and sell your ticket on to the next punter. They’re not the type of people you say no to so they no doubt do a roaring trade.

But that’s not all. If you protest that your parking ticket is about to expire and is therefore useless they’ll demand it anyway. Why? This is where it gets interesting.

When the parking inspectors come past the thugs keep a keen eye on which cars they catch. On a driver returning to their car and discovering that they’ve been fined the thugs move in.