The Decline of Manufacturing

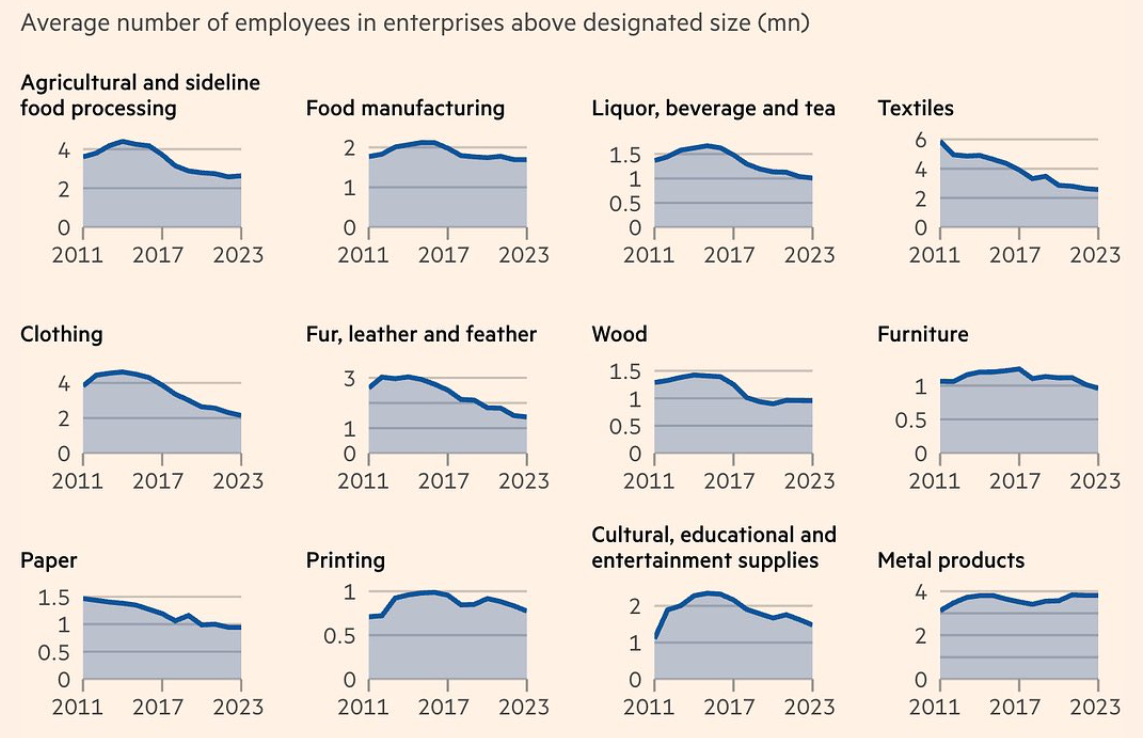

Look at the incredible decline of manufacturing across a wide variety of industries in the figure below. Nearly 7.5 million jobs lost, just since 2011. Devastated communities. Factories shuttered. Millions of older, lower-skilled workers out of work. A rise in inequality. Jobs going overseas.

“The future is bleak and hopeless if we continue like this,” said one worker.

…“This eventually leads to serious social problems, such as higher rates of unemployment and increased crime and social unrest. Nations with socially polarised work forces also suffer from political instability.”

And now for the rest of the story (non-paywalled or go to the comments.)

Will American soft power triumph through AI?

That is the theme of my latest Free Press column, here is one bit from it:

…for all the differences across the models, they are remarkably similar. That’s because they all have souls rooted in the ideals of Western civilization. They reflect Western notions of rationality, discourse, and objectivity—even if they sometimes fall short in achieving those ends. Their understanding of “what counts as winning an argument” or “what counts as a tough question to answer” stems from the long Western traditions, starting with ancient Greece and the Judeo-Christian heritage. They will put on a Buddhist persona if you request that, but that, too, is a Western approach to thinking about religion and ideology as an item on a menu.

These universal properties of the models are no accident, as they are primarily trained on Western outputs, whether from the internet or from the books they have digested. Furthermore, the leading models are created by Bay Area labor and rooted in American corporate practices, even if the workers come from around the world. They are expected to do things the American way.

The bottom line is that the smartest entities in the world—the top AI programs—will not just be Western but likely even American in their intellectual and ideological orientations for some while to come. (That probably means the rest of the world will end up a bit more “woke” as well, for better or worse.)

One of the biggest soft power victories in all of world history occurred over the last few years, and hardly anyone has noticed.

You might think the Chinese AI models are fundamentally different, but they are not. They too “think like Westerners.” That’s no surprise because it is highly likely that the top Chinese model, DeepSeek, was distilled from OpenAI models and also is based on data largely taken from Western sources. DeepSeek’s incredible innovation was to make the model much cheaper in terms of required compute, but the Chinese did not build their own model from scratch. And DeepSeek has the same basic broad ideological orientation as the American models, again putting aside issues related to Chinese politics. Unless an issue is framed in explicitly anti–Chinese Communist Party (CCP) terms, as a Taiwan query might be, it still thinks like an American.

Manus is another top Chinese AI model, but it is believed the makers built it upon Claude, an AI model from the American company Anthropic.

And this:

The geopolitics of all this have yet to play out. But already the most intelligent entities in the world are thinking, and evaluating options, like Westerners and Americans. Censoring them on a few issues related directly to Chinese politics will not change that basic reality.

In other words, the entire Chinese service sector, over time, may be built upon Western modes of thought and Western ideology. That includes the Chinese government and of course, the CCP itself. The point is that, over time, everyone’s thoughts and decisions and mental frameworks will be nudged in Western and American directions.

These are underrated points of import.

Harvard says no

Harvard University said on Monday that it had rejected policy changes requested by the Trump administration, becoming the first university to directly refuse to comply with the administration’s demands and setting up a showdown between the federal government and the nation’s wealthiest university.

Other universities have pushed back against the Trump administration’s interference in higher education. But Harvard’s response, which essentially called the Trump administration’s demands illegal, marked a major shift in tone for the nation’s most influential school, which has been criticized in recent weeks for capitulating to Trump administration pressure…

Some of the actions that the Trump administration demanded of Harvard were:

Conducting plagiarism checks on all current and prospective faculty members.

Sharing all its hiring data with the Trump administration, and subjecting itself to audits of its hiring while “reforms are being implemented,” at least through 2028.

Providing all admissions data to the federal government, including information on both rejected and admitted applicants, sorted by race, national origin, grade-point average and performance on standardized tests.

Immediately shutting down any programming related to diversity, equity and inclusion.

Overhauling academic programs that the Trump administration says have “egregious records on antisemitism,” including placing certain departments and programs under an external audit. The list includes the Divinity School, the Graduate School of Education, the School of Public Health and the Medical School, among many others.

Here is more from Vimal Patel at the NYT.

What should I ask John Arnold?

Yes, I will be doing a Conversation with him. John might be the smartest person I know about the energy sector and also about philanthropy. Here is the opening of his Wikipedia entry:

John Douglas Arnold (born 1974) is an American philanthropist, former Enron executive, and founder of Arnold Ventures LLC, formerly the Laura and John Arnold Foundation. In 2007, Arnold became the youngest billionaire in the U.S. His firm, Centaurus Advisors, LLC, was a Houston-based hedge fund specializing in trading energy products that closed in 2012. He now focuses on philanthropy through Arnold Ventures LLC. Arnold is a board member of Breakthrough Energy Ventures and since February 2024, is a member of the board of directors of Meta.

So what should I ask him?

Monday assorted links

1. ADHD diagnosis is a mess (NYT).

2. John Cochrane on tariffs, savings, and investment.

3. More on low productivity growth in construction.

4. Ken Rogoff is now on Substack.

5. DolphinGemma: How Google AI is helping decode dolphin communication.

6. Russian birth rates hit new low.

7. Out of date (a lot will be happening this week), but a new paper on ChatGPT as an economics tutor.

The roots of gun violence

An estimated 80 percent [of U.S: gun shootings] seem to instead be crimes of passion — including rage. They’re arguments that could be defused but aren’t, then end in tragedy because someone has a gun. Most violent crimes are the result of human behavior gone temporarily haywire, not premeditated acts for financial benefit.

That is from the new and interesting Unforgiving Places: The Unexpected Origins of American Gun Violence, by Jens Ludwig.

How to do regulatory reform (from my email)

“Philip Howard here. I enjoyed your discussion with Jen Pahlka. Here are a few notes:

1. This current system needs disrupting, but I fear DOGEs indiscriminate cuts are making the status quo look good. Here’s Peter Drucker, criticizing Gore’s reinventing got: “patching. It always fails. The next step is to rush into downsizing. Management picks up a meat-ax and lays about indiscriminately. …amputation before diagnosis.” (from Management, revised ed).

2. Most of the newcomers to the realization that govt is paralyzed (Ezra Klein, Dunkelman etc) think that the red tape jungle can be pruned, or organized with better feedback loops (Pahlka). This is falling into Gore’s pit. There’s a fatal defect: the operating system is designed around legal compliance–instead of human authority to make tradeoff judgments. Law should be a framework setting the boundaries of authority, not a checklist. That’s why some reforms I championed (page limits, time limits) haven’t worked; there’s always another legal tripwire. I describe what a new framework should look like in this recent essay. https://manhattan.institute/article/escape-from-quicksand-a-new-framework-for-modernizing-america

3. Public unions: Democracy loses its link to voters–quite literally–if elected executives lack managerial authority. The main tools of management– accountability, resource allocation, and daily direction–have been either removed by union controls or are subject to union veto. Government is more like a scrum than a purposeful organization. There’s a core constitutional principle –private nondelegation–that prevents elected officials from ceding their governing responsibility to private groups. Stone v Mississippi: “The power of governing is a trust…, no part of which can be granted away.” That’s the basis of the constitutional challenge we’re organizing. The Trump admin could transform state and local govt by invoking this principle.

Fwiw, I see these points– authority to make tradeoff judgments, authority to manage— as microeconomic necessities, not policy positions. Nothing can work sensibly until people are free to make things work. We’re organizing a forum at Columbia Law School, The Day After Doge, on the morning of April 23. Here’s the lineup. https://www.commongood.org/the-day-after-doge. Let me know if you’d like to weigh in.”

Muere Mario Vargas Llosa, RIP

Here is one article in Spanish, my favorite novel by him is War of the End of the World. Aunt Julia and the Scripwriter is a wonderful introduction, and there are many other fine works.

Sunday assorted links

1. 2013 paper on the economics of a “sudden stop” in lending to the United States. Not what I think is going on now, but fyi.

2. Richer Swedes are getting healthier more quickly.

3. Incredible AI thread from Steve Jurvetson.

4. Lottery arbitrage? (WSJ)

5. What does a House of Representatives member do all day?

6. Haiti turns to weaponized drones to fight the gangs.

7. Branko.

I never knew Joseph Smith ran for President

Eventually, Smith declared himself a candidate for the White House. His proposed platform was an awkward conglomeration of popular, though incongruent, principles including restoring the national bank, cutting Congress members’ salaries, annexing Texas, and instituting the gradual abolition of slavery. Hundreds of Mormon men, including Brigham Young, swarmed the nation campaigning for their prophet to become president.

That is from the new and excellent Benjamin E. Park, American Zion: A New History of Mormonism. An excellent book, good enough to make the year’s best non-fiction list.

I also learned recently (from Utah, not from this book) that early Mormons would drink alcohol and “Brigham Young even operated a commercial distillery east of Salt Lake City, and his southern‐Utah “Dixie Wine Mission” (1860s‑80s) was organized to supply sacramental, medicinal, and commercial wine for the territory.” By the time Prohibition rolled around, however, Mormons were close to completely “dry.”

Markets expand to fill empty spaces

How does a start-up founder hire a software engineer or a tech worker find a date in 2025? They could share a job posting on LinkedIn, log on to a dating app — or leave a handwritten note in a Waymo.

“Looking to hire senior software engineers to work on AI/music project,” said the note, a retro touch in a futuristic setting, with the company’s website and Angelini’s email scrawled below. That same day, another Waymo rider snapped a photo of the note and posted it on the social media platform X, where it has been reshared nearly 200 times, received more than 4,000 likes and more than 300,000 views…

A few days later, another handwritten ad found in a Waymo was shared on X from a single man looking for a date. The bachelor described himself as a 26-year-old who works in tech but “doesn’t make it my whole personality” and left a phone number for interested parties to text. The post has gotten more than 200 replies.

Problems in Treasury markets (from my email)

Max writes to me:

“Hope you’re doing well. And the craziness in the world hasn’t been affecting you too much. I know I’ve written to you about cash-treasury basis a couple of times over the years. The situation has unfortunately become somewhat more acute and has started to get wider media attention.

There are some good accounts of the issue in the media, by Matt Levine for example But, there are a few things being missed even in high quality media accounts:

- The issue is now a global one, which has not been the case historically. German bunds now trade at a negative swap spread (the yield on cash bonds is higher than on similar tenor swaps). This is a fairly recent development. It suggests the problem has shifted from being primarily a shortage of USD cash (though that is still true to a significant degree), to a global oversupply of longer dated bonds.

- A crunch in repo funding does not seem to be primarily responsible here. Balance sheet efficient methods of intermediating repo (sponsored repo) are more available now than they have been in the past. And they haven’t solved the problem.

- Permitting bond basis to fluctuate is quite pernicious. It meaningfully reduces the negative correlation between long bonds and risk assets. Meaningully reducing the attractiveness of holding them in a portfolio and increasing funding costs.

- At this point, global government debt outstanding is so large basis is so high that failing to correct this issue has a meaningful budget impact. Not only in the US, but across the Western world.

I think there is a straightforward solution: The Fed has clear cut authority to trade Treasury forwards during open market operations. Which would alleviate the pressure on dealer balance sheets, relieve market dysfunction, and help restore basis to more natural levels. And do so without relying on emergency authorities.”

Saturday assorted links

1. New Knausgaard novel coming.

2. Unsecured penguin caused helicopter crash in South Africa.

3. Why does pre-training work?

4. Opinion polling from Poland.

5. Survey measures of the natural rate of interest. Thread is here.

6. Cass Sunstein reports on the social neuroticism of the Right. And Balaji is correct.

7. The conservative legal case against the tariffs (New Yorker).

*Postcard from Earth*

If you are willing to pay $250 or so, you can watch it in The Sphere. From Wikipedia:

Postcard from Earth is a 2023 film directed by Darren Aronofsky, starring Brandon Santana and Zaya Ribeiro. Created specifically to be screened at Sphere in the Las Vegas Valley on the venue’s 160,000 square-foot video screen, the film was shot in an 18K resolution with the Big Sky camera system. The 4D film features 270 degrees of viewing experience, climate control, haptic capabilities for the venue’s seating, and scents to create an immersive environment that tells the story of life on Earth. The film is one of two entertainment features to inaugurate the Sphere, along with U2‘s concert residency.

For visuals, and “integration with its venue,” I give the film an A++. For script a D? (Not having read Julian Simon is the least of it.) For soundtrack C minus? So it is hardly the Gesamtkunstwerk you might have been hoping for. But it was worth the money, though barely.

Parallels between our current time and 17th century England

That is the topic of my recent essay for The Free Press. Excerpt:

Ideologically, the English 17th century was weird above all else.

Millenarianism blossomed, and the occult and witchcraft became stronger obsessions. This was an age of religious and economic upheaval; King James I even wrote a book partly about witches called Daemonologie. The greater spread of pamphlets and books meant that witch accusations circulated more widely and more rapidly, and so the 1604 Witchcraft Act applied harsher punishments to supposed witches.

People were more likely to fear imminent transformation, and new groups sprouted up with names such as “Fifth Monarchy Men,” devoted to the idea that a new reign of Christ would usher in the end of the world. Protestantism splintered, giving rise to Puritanism and numerous sects, many of them extreme.

Meanwhile, Roger Williams brought ideas of free speech and freedom of conscience to America, founding what later became the state of Rhode Island. The development of economics as a science with an understanding of markets (credit Nicholas Barbon and Dudley North) dates from that time, as do the first libertarians, namely the Levellers, a liberty-oriented group from the time of the English Civil War.

All of these developments were supported by the falling price of printing, giving rise to an extensive use of pamphlets and broadsheets to communicate and debate ideas, often in London coffeehouses. Johannes Gutenberg had built the printing press for Europe much earlier, in the middle of the 15th century—but 17th-century England was the time and place when a commercial middle class could start to afford buying printed works.

I explore the parallels with today at the link, recommended.