The Acemoglu arguments against high-skilled immigration

Here is Daron Acemoglu’s Project Syndicate piece, mostly critical on high-skilled immigration.

Here is the first argument from Acemoglu:

…one would expect corporate America’s growing need for skilled STEM workers to translate into advocacy for, and investments in, STEM education. But an overreliance on the H-1B program may have broken this link and made American elites indifferent to the widely recognized failures of the US education system. Put differently, the problem may not be a cultural veneration of mediocrity, as Ramaswamy argued, but rather neglect on the part of business leaders, intellectual elites, and politicians.

o1 responds. Here is Acemoglu’s second argument:

Even as H-1B workers boost innovation, their presence may affect the direction innovation takes. My own work shows (theoretically and empirically) that when the supply of skilled labor increases, technology choices start favoring such workers. Over the last several decades, businesses have increasingly adopted technologies that favor high-skill workers and automate tasks previously performed by lower-skill workers. While this trend may have been driven by other factors, too, the availability of affordable high-skill workers for the tech industry plausibly contributed to it.

The third argument about brain drain has enough qualifications and admissions that it isn’t really a criticism. In any case my colleague Michael Clemens, among others, has shown that the brain drain argument applies mainly to very small countries. But if you wish, run it through AI yourself.

If all I knew were this “exchange,” I would conclude that o1 and o1 pro were better economists — much better — than one of our most recent Nobel Laureates, and also the top cited economist of his generation. Noah Smith also is critical.

Via Mike Doherty.

The Greenland debates

I would say we have not yet figured out what is the best U.S. policy toward Greenland, nor have we figured out best stances for either Greenland or Denmark. I am struck however by the low quality of the debate, and I mean on the anti-U.S. side most of all. This is just one clip, but I am hearing very much the same in a number of other interchanges, most of all from Europeans. There is a lot of EU pearl-clutching, and throwing around of adjectives like “colonialist” or “imperialist.” Or trying to buy Greenland is somehow analogized to Putin not trying to buy Ukraine. Or the word “offensive” is deployed as if that were an argument, or the person tries to switch the discussion into an attack on Trump and his rhetoric.

C’mon, people!

De facto, you are all creating the impression that Greenland really would be better off under some other arrangement. Why not put forward a constructive plan for improving Greenland? It would be better yet to cite a current plan under consideration (is there one?). “We at the EU, by following this plan, will give Greenland a better economic and security future than can the United States.” If the plan is decent, Greenland will wish to break off the talks with America it desires. (To be clear, I do not think they desire incorporation. This FT piece strikes me as the best so far on the debates.)

Or if you must stick to the negative, put forward some concrete arguments for how greater U.S. involvement in Greenland would be bad for global security, bad for economic growth, bad for the U.S., or…something. “Your EU allies won’t like it,” or “Trump’s behavior is unacceptable” isn’t enough and furthermore the first of those is question-begging.

It is time to rise to the occasion.

p.s. I still am glad we bought the Danish West Indies in 1917. Nor do I hear many Danes, or island natives, complain about this.

My podcast with Andrew Xu

I had fun, and Andrew writes:

In this episode, I got a chance to talk with Tyler about quite a few of those topics: the extent of his libertarian ideology, why he’s less pessimistic about social media, what movies have influenced him, etc.

Here is the Spotify link.

Sunday assorted links

1. Cracks in the silence about Havana Syndrome (Atlantic).

2. “As Rainer Zitelmann, a noted historian of the Third Reich, has pointed out, the AfD has long since abandoned its former economic liberalism for a Right-wing form of anti-capitalism. Its rhetoric is often indistinguishable from that of the far-Left Die Linke, or the Left populist Bündnis Sahra Wagenknecht.” (Brendan Simms in the Telegraph)

3. “Australia appoints first rabbit tsar to combat invasive species.” (FT)

4. o1 pro answers a question about intra-profile social welfare theory, a’la Kevin Roberts. Wake up, people! I start it off with the Harberger tax model, but perhaps that is too easy to still be impressive these days?

5. University of Chicago economics professor Casey Mulligan appointed Chief Counsel for Advocacy at the U.S. Small Business Administration.

6. The law and economics of a fire disaster. And Schoenberg archive destroyed by the fire.

Facts about U.S. employment

First, the labor market is no longer polarizing— employment in low- and middle-paid occupations has declined, while highly paid employment has grown. Second, employment growth has stalled in low-paid service jobs. Third, the share of employment in STEM jobs has increased by more than 50 percent since 2010, fueled by growth in software and computer-related occupations. Fourth, retail sales employment has declined by 25 percent in the last decade, likely because of technological improvements in online retail.

That is from a recent NBER working paper by David J. Deming, Christopher Ong, and Lawrence M. Summers.

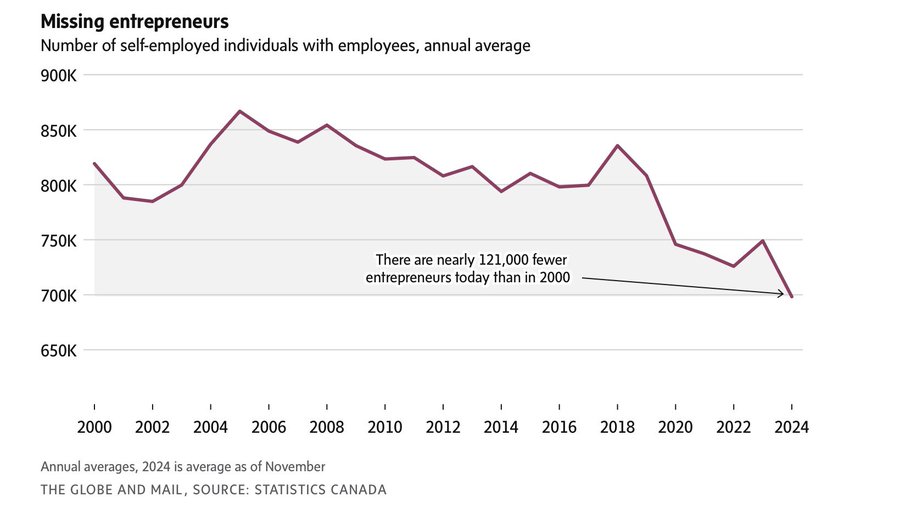

Canada’s missing entrepreneurs

Companies in Argentina (from my email)

From Krzysztof Tyszka-Drozdowski:

Every weekend, I try to go through interesting articles about Argentina. Here’s something from La Nación that surprised me: it discusses the relatively weak standing of Argentine companies internationally. (https://www.lanacion.com.ar/opinion/las-empresas-argentinas-ante-un-cambio-de-perfil-nid11012025/):

– only 3 of the top 50 largest Latin American companies are Argentine (22 are Brazilian, 14 Mexican, and 8 Chilean). Moreover, only 7 of the top 100 largest Latin American companies are Argentine.

– there are just about $50 billion invested by Argentine companies abroad; compared to $300 billion from Brazil, $215 billion from Mexico, $140 billion from Chile, and $75 billion from Colombia.

Argentina still has a long way to go!

>By the way, what would be your answer to the question: why is Argentina not Australia? I’m currently reading the book ‘Por qué Argentina no fue Australia’ by Gerchunoff and Fajgelbaum, which discusses this topic.

*The Brutalist* (no real spoilers)

As I kept watching, I was thinking “well, this is pretty good but it isn’t great.” But by the time the final scene rolled around, I was convinced. A few points:

1. The Hungarian wife is the best character.

2. The title “The Brutalist” does not refer solely to the architect.

3. The industrial landscapes and shots of an earlier America are excellent.

4. The movie never felt too long, and that is at 3.5 hours.

5. It is an explicitly pro-Israel movie, and that angle I was not expecting at all.

6. The movie does make an actual case for brutalism in architecture. Note the architect and main character starts off as a modernist, not a brutalist.

7. Do pay attention to how this movie “rewrites” Casablanca.

Recommended, for some.

My podcast with Reason

With Liz Wolfe and Zach Weissmueller:

The link here contains the YouTube video, text description, and links to audio versions at reason.com: https://reason.com/podcast/2025/01/10/tyler-cowen-why-do-we-refuse-to-learn-from-history/

Youtube page for embedding is here: https://www.youtube.com/watch?v=p-Kpyg2mFU8

Lots of about libertarianism and state capacity libertarianism, and The Great Forgetting, food at the end…interesting throughout!

Economics in the Age of Algorithms

Great talk from Sendhil Mullainathan. He discusses how machine learning differs from causal inference, how ML can be used to develop new and strikingly original hypotheses, why economists are necessary for the design of recommendation systems and algorithms. Deep but accessible. Provides a very important roadmap for how humans and AI can work together on science.

Saturday assorted links

1. A report on “killing with applause.”

3. Turkish chef recreates 8,600 year old Neolithic bread.

4. Boomerasking (not about Boomers, btw).

5. Peter Thiel publishes the word “struldbrugg” in the FT.

6. Who paid U.S. taxes in 1929?

7. Africa books of 2024, and forthcoming in 2025.

Lunar spectrum markets in everything?

Private companies are staking claims to radio spectrum on the Moon with the aim of exploiting an emerging lunar economy, Financial Times research has found. More than 50 applications have been filed with the International Telecommunication Union since 2010 to use spectrum, the invisible highway of electromagnetic waves that enable all wireless technology, on or from the Moon.

Last year the number of commercial filings to the global co-ordinating body for lunar spectrum outstripped those from space agencies and governments for the first time, according to FT research. The filings cover satellite systems as well as missions to land on the lunar surface.

“We will look back and see this as an important inflection point,” said Katherine Gizinski, chief executive of spectrum consultancy River Advisers, which has filed for lunar spectrum for three satellite systems on behalf of other companies since 2021.

Here is more from Oliver Hawkins and Peggy Hollinger at the FT.

Noah Smith on L.A: fire lessons

The best piece I have seen so far, here is one bit:

Basically, the lessons I take away from the horrific L.A. fires are:

- The insurance industry as we know it is in big trouble.

- Climate change is making wildfires worse, but there’s not much we can do about that right now.

- Forest management needs to get a lot more proactive, but is being blocked by regulation.

- Wildfire preparedness is just a lot more important than it used to be.

And this:

Patrick Brown of the Breakthrough Institute estimates that in order to achieve the maximum economic benefit from wildfire suppression, California should be doing almost 4 times as much controlled burning as it currently aims to do, and almost 8 times as much as it’s currently doing. The gains over the last few years are welcome, but also woefully insufficient to the task.

Here is the entire essay. And this guy has a background in fires and forest management, a good piece.

Friday assorted links

1. Perhaps people do not view love as zero-sum.

2. The growing strategic significance of Greenland.

3. Changing building materials to improve carbon outcomes?

4. “The Danish West Indies—comprising the islands of St. Thomas, St. John, and St. Croix—were sold by Denmark to the United States in 1917. After decades of on-and-off negotiations between the two countries, the U.S. and Denmark signed the Treaty of the Danish West Indies on August 4, 1916, and the formal transfer took place on March 31, 1917. The purchase price was $25 million in gold.” (o1)

5. Brian Albrecht on fire insurance and price controls. Excellent and important thread, for instance: “Over the last 5 years, CA ranks 50th in speed of rate approvals. The avg delay is 236 days for homeowners and 226 days for auto insurance.”

6. China building solar power in space?

7. Zvi reviews the AI segments of my podcast with Dwarkesh. Note in his remarks there is a confusion between government consumption and government spending. p.s. Zvi says he is long the market and is doing well — good! I’ll just repeat my periodic observation that there is nothing — literally nothing — in either the peer-reviewed literature or in market prices — to support the doomster position.

Congestion Tolls versus Congestion Pricing

New York’s new congestion fee appears to be reducing commuting times on key routes (see Tyler and this thread from Michael Ostrovsky). The toll only has two rates, however, on-peak (5 AM to 9 PM on weekdays and 9 AM to 9 PM on weekends) $9 and off-peak ($2.50). I like the way Vitalik Buterin explained a key weakness:

I wish the tolls were dynamic. Price uncertainty is better than time uncertainty (paying $10 more today is fine if you pay $10 less tomorrow, but you can’t compensate being 30 min late for a flight or meeting by being 30 min early to the next one).

Exactly right. Tyler and I make the same point about price controls (ceilings) in Modern Principles. A price ceiling substitutes a time price for a money price. But this isn’t a neutral tradeoff—money prices benefit sellers, while time prices are pure waste (see this video for a fun illustration).

Here in Northern Virginia the toll on I-66 to Washington is dynamic and on-average varies by more than a factor of 6 during peak hours. Everyone complains about congestion pricing when it is first introduced but people get used to it quickly. Albeit in VA we still have the option of paying no-toll which perhaps eases the transition.