Month: February 2019

Amazon winners and losers

WINNERS:

Virginia Governor Ralph Northam: He did a good job on the first Amazon deal for Virginia, and now can try to lure more of the company here. There is a new reason to keep him in office and also to start paying attention to a different issue.

Nashville and the Southeast more generally: That part of the country has fewer local NIMBY activists and is less likely to elect figures such as AOC. Texas too. Is it possible that I live in the sanest part of the country? Wouldn’t that be funny?

The Bay Area: NYC is no longer such a fierce competitor at the macro level, with the potential to become the new center of gravity for the tech world. The Bay Area can breathe a bit more easily now, at least as long as clustering remains the name of the game. Yet this one is double-edged, because it also means the Bay Area has less incentive to solve its rather pressing problems and dysfunctions.

Valentine’s Day: It will be used to announce more dramatic break-up events, and thus become all the more emotionally fraught, in both positive and negative directions.

Hoboken and Jersey City: They are nicer than Manhattan anyway and with better day-to-day food options, right? Right? Queens won’t be obviously outcompeting them as a home for a new, high-quality business site.

Regional development subsidies: It was awfully easy for Amazon to walk away from this “deal.” Expect to see higher subsidies and tighter deals in the future.

LOSERS:

Queens: Most of the residents wanted the project to come.

Amazon: The company will find it harder to access the top talent of New York City, and the top talent that is willing to live in New York City. Let’s hope this is a blessing in disguise, and a new path toward discovering hitherto untapped sources of talent.

New York City: Yes, Google is expanding in Chelsea but more and more NYC is becoming a city of finance and tourism and restaurants. Can a location have the Dutch disease and cost disease at the same time? Stay tuned to find out.

YIMBYs: One of the world’s most valuable, efficient, and also popular companies could not make stick a deal to expand and create tens of thousands of high-paying jobs and pay more taxes. What hope do the rest of us have?

Small teams vs. large teams in science

Here we analyse more than 65 million papers, patents and software products that span the period 1954–2014, and demonstrate that across this period smaller teams have tended to disrupt science and technology with new ideas and opportunities, whereas larger teams have tended to develop existing ones.

That is from a new Nature paper by Lingfei Wu, Dashun Wang, and James A. Evans. Here is the NYT write-up by Benedict Carey.

Thursday assorted links

2. Refugees in Denmark do much better in Copenhagen.

3. Carbon capture update (NYT, good piece).

4. Is Africa converting China?

5. “Royalties on 1983 Finance Classic ‘Trading Places’ Go Up for Bid.” “If it holds until the auction closes Wednesday, the current winning bid of $74,700 would obtain a producer’s share of the residuals generated by television rebroadcasts and streaming, worth $7,988 last year(…)”

AIs Quickly Learn to Collude

AI’s are better than humans at Chess and Go, why shouldn’t they also be better at the game of collusion? Calvano, Calzolari, Denicolò and Pastorello show that they are (here quoting a VOXEU summary by the authors):

[In Calvano et al. 2018a] we construct AI pricing agents and let them interact repeatedly in controlled environments that reproduce economists’ canonical model of collusion, i.e. a repeated pricing game with simultaneous moves and full price flexibility. Our findings suggest that in this framework even relatively simple pricing algorithms systematically learn to play sophisticated collusive strategies. The strategies mete out punishments that are proportional to the extent of the deviations and are finite in duration, with a gradual return to the pre-deviation prices.

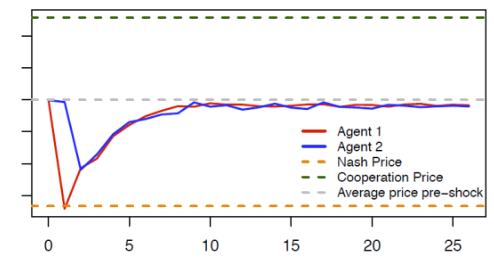

Figure 1 illustrates the punishment strategies that the algorithms autonomously learn to play. Starting from the (collusive) prices on which the algorithms have converged (the grey dotted line), we override one algorithm’s choice (the red line), forcing it to deviate downward to the competitive or Nash price (the orange dotted line) for one period. The other algorithm (the blue line) keeps playing as prescribed by the strategy it has learned. After this exogenous deviation in period , both algorithms regain control of the pricing.

Figure 1 Price responses to deviating price cut

Note: The blue and red lines show the price dynamic over time of two autonomous pricing algorithms (agents) when the red algorithm deviates from the collusive price in the first period.

The figure shows the price path in the subsequent periods. Clearly, the deviation is punished immediately (the blue line price drops immediately after the deviation of the red line), making the deviation unprofitable. However, the punishment is not as harsh as it could be (i.e. reversion to the competitive price), and it is only temporary; afterwards, the algorithms gradually return to their pre-deviation prices.

…The collusion that we find is typically partial – the algorithms do not converge to the monopoly price but a somewhat lower one. However, we show that the propensity to collude is stubborn – substantial collusion continues to prevail even when the active firms are three or four in number, when they are asymmetric, and when they operate in a stochastic environment. The experimental literature with human subjects, by contrast, has consistently found that they are practically unable to coordinate without explicit communication save in the simplest case, with two symmetric agents and no uncertainty.

What is most worrying is that the algorithms leave no trace of concerted action – they learn to collude purely by trial and error, with no prior knowledge of the environment in which they operate, without communicating with one another, and without being specifically designed or instructed to collude.

Tacit collusion isn’t actually illegal since it’s virtually impossible to prove, at least among humans. Tacit collusion by AIs is going to be much more common but perhaps also easier to prove if the antitrust authorities can demand access to the algorithms. No need to torture the data when you can torture the AIs. It’s going to be a strange world.

Hat tip: Ankur Delight.

Seven lessons about blackmail

That is the title of my latest Bloomberg column, here is the opening bit:

Every now and then, a few apparently random news events come together and influence how you see the world. My most recent lesson is that blackmail and blackmail risk are a lot more common than I had thought.

And:

…the main villains in these privacy losses are not the big internet companies. While it is murky exactly how the Bezos photos leaked, it seems to have involved old-fashioned spying and the interception of text messages (and possibly a renegade brother). Silicon Valley didn’t sell his data. As for Northam, the yearbook is from the pre-digital era, dug up in a school library. This information was not on the internet, though of course it did play a role in spreading it.

Third, billionaires can be pretty useful. As Bezos asked in his open letter on Medium: “If in my position I can’t stand up to this kind of extortion, how many people can?” In this case, both the billionaire and the medium of communication are the good guys.

Fourth, fears of a new era of blackmail based on Photoshopped images and so-called deep fakes (phony but convincing video) may be overblown, or at least premature. In the cases of both Bezos and Northam, the authenticity of the source material (text messages and photos) is not really being questioned, and both stories are receiving intense scrutiny. Rather, the debate is over the provenance and significance of the information.

There is much more at the link.

Wednesday assorted links

1. Something is on display here, I am just not sure exactly what. Is this an O-Ring model?

2. The five books that helped Craig Palsson fall in love with economics (video).

3.Ross Douthat on voter ID (NYT).

4. “Crystal Meth Is North Korea’s Trendiest Lunar New Year’s Gift.” (NYT)

5. Why tech companies hire so many economists.

6. Paul Krugman on Abba Lerner and functional finance and MMT (?). (NYT)

My Conversation with Jordan Peterson

Here is the transcript and audio, here is the summary:

Jordan Peterson joins Tyler to discuss collecting Soviet propaganda, why he’s so drawn to Jung, what the Exodus story can teach us about current events, his marriage and fame, what the Intellectual Dark Web gets wrong, immigration in America and Canada, his tendency towards depression, Tinder’s revolutionary nature, the lessons from The Lord of the Rings and Harry Potter, fixing universities, the skills needed to become a good educator, and much more.

Here is one bit:

COWEN: Your peers in the Intellectual Dark Web — the best of them — what is it they’re wrong about?

PETERSON: Oh, they’re wrong about all sorts of things. But at least they’re wrong in all sorts of interesting ways. I think Sam Harris, for example — I don’t think that he understands. I don’t think that he’s given sufficient credence to the role that religious thinking plays in human cognition.

I think that’s a huge mistake for someone who’s an evolutionary biologist because human religious thinking is a human universal. It’s built into our biology. It’s there for a reason. Although Sam is an evolutionary biologist, at least in principle, with regards to his thinking, he’s an Enlightenment rationalist when it comes to discussing the biology of religion, and that’s not acceptable.

It’s the wrong time frame. You don’t criticize religious thinking over a time frame of 200 years. You think about religious thinking over a time frame of 50,000 years, but probably over a far greater time span than that.

COWEN: So if that’s what Sam Harris doesn’t get —

PETERSON: Yeah.

COWEN: If we turn to senior management of large American companies, as a class of people — and I know it’s hard to generalize — but what do you see them as just not getting?

PETERSON: I would caution them not to underestimate the danger of their human resources departments.

Much more than just the usual, including a long segment at the end on Jordan’s plans for higher education, here is one bit from that:

Universities give people a chance to contend with the great thought of the past — that would be the educational element. To find mentors, to become disciplined, to work towards a single goal. And almost none of that has to do with content provision. Because you might think, how do you duplicate a university online? Well, you take lectures and you put them online, and you deliver multiple-choice questions. It’s like, yeah, but that’s one-fiftieth of what a university is doing.

So we’ve just scrapped that idea, and what we’re trying to do instead is to figure out, how can you teach people to write in a manner that’s scalable? That’s a big problem because teaching people to write is very, very difficult, and it’s very labor intensive and expensive. So that’s one problem we’d really like to crack. How can you teach people to speak? And can you do that in a scalable manner as well?

Definitely recommended, even if you feel you’ve already heard or read a lot of Jordan Peterson.

Women in Economics: Elinor Ostrom

Our first episode in the Women in Economics series is an introduction to Elinor Ostrom, the first woman to have won the Nobel Prize in Economics. Elinor Ostrom and Vincent Ostrom have long been a part of the intellectual foundations of “Masonomics”. Both the Ostroms were past presidents of the Public Choice Society, for example, as were Jim Buchanan, Gordon Tullock and Vernon Smith. The Mason Economics department was thrilled when Ostrom won the Nobel as there has been and continues to be fruitful interaction between public choice, experimental economics and institutional analysis.

At the Women in Economics website you can also find Ostrom’s Nobel Prize address, more on the tragedy of the commons, and other resources.

Especially valuable for in-depth research are Vlad Tarko’s biography of Elinor Ostrom and Paul Dragos Aligica and Peter Boettke’s introduction to The Bloomington School.

Life without the Export-Import Bank

In terms of total revenue, Boeing, the aerospace giant, had its best year ever in 2018, with worldwide sales of $101.1 billion.

Exports were particularly robust. Commercial jet deliveries to foreign airlines rose from 763 in 2017 to 806 last year. Overall, the company has a 5,900-order backlog for airplanes worth a staggering $412 billion, according to The Post last week…

For the past 3½ years, Ex-Im, as the trade-finance agency is known, has been essentially paralyzed, yet Boeing has gone from strength to strength…

In the end, Ex-Im survived, as a legal entity. Crucially, though, Senate Republican foes of the bank refused to confirm a quorum for the bank’s board; without a quorum, Ex-Im cannot approve loan transactions larger than $10 million.

As a result of this ploy, the bank has been unable to aid foreign sales of Boeing or other makers of big-ticket goods since June 2015.

And yet, in that time, Boeing has done awesomely well.

It’s not just Boeing that has survived or thrived during Ex-Im’s paralysis. Another company that received heavy Ex-Im support, construction-equipment-maker Caterpillar, achieved a record profit per share in 2018. Caterpillar’s outlook for 2019 is somewhat less rosy, due to broad economic factors such as the slowdown in China, but Ex-Im, or the lack thereof, hardly registers in analyst forecasts.

Here is more from Charles Lane.

What does a Twitter-driven politics look like?

That is the topic of my latest Bloomberg column, here is the final bit:

But what does this new, more intense celebrity culture mean for actual outcomes? The more power and influence that individual communicators wield over public opinion, the harder it will be for a sitting president to get things done. (The best option, see above, will be to make your case and engage your adversaries on social media.) The harder it will be for an aspirant party to put forward a coherent, predictable and actionable political program.

Finally, the issues that are easier to express on social media will become the more important ones. Technocratic dreams will fade, and fiery rhetoric and identity politics will rule the day. And if you think this is the political world we’re already living in, rest assured: It’s just barely gotten started.

Will insects go extinct?

No, probably not, no matter what you might have read or seen on Twitter. The underlying paper is “Worldwide decline of the entomofauna: A review of its drivers.” Here is a tweet thread by Alex Wild on the paper, here is one bit:

They make a great deal of local extinctions as a sort of proxy for global extinctions. That’s pretty dicey. I mean, bison are locally extinct here in my Austin neighborhood. But their numbers are recovering elsewhere.

They used 73 studies done on different taxa in different places. Those studies must represent tens of thousands of person-hours. Gargantuan. But the input studies weren’t designed for global assessment.

The paper itself has strong evidence on the severe pressure on butterflies and bees, and furthermore the general encroachment of humans on the natural environment probably is going to diminish species numbers and biodiversity, for insects too. At the same time, the remaining species will adapt and evolve to meet the new potential habitats, with many kinds of insects having an easier time adapting than say gorillas.

The paper has some quite non-dramatic sentences such as: “Studies on ant populations and trends are lacking except for a few invasive species.” And: “A single long-term study on grasshoppers and crickets is available…”

So I don’t quite see how the authors arrive at: “The conclusion is clear: unless we change our ways of producing food, insects as a whole will go down the path of extinction in a few decades.” Bryan Caplan, bet away!

Tuesday assorted links

Buy (or Rent) Coal! The Coasean Climate Change Policy

Since climate change and what to do about it are in the news it’s time to re-up an underrated idea, buy coal! Carbon taxes increase the price of carbon and induce economic and technological substitution towards lower-carbon sources of fuel in the countries that adopt them. As carbon-tax countries reduce fuel use, however, non carbon-tax countries see the price of their fuel decline. Thus, unless all countries join the tax-coalition, there is leakage. Supply-side policies are an alternative to demand supply policies. The United States, for example, could buy out and close coal mines, including giving the workers substantial retirement/reallocation bonuses, thus reducing the world supply of coal which is still the largest source of C02 emissions.

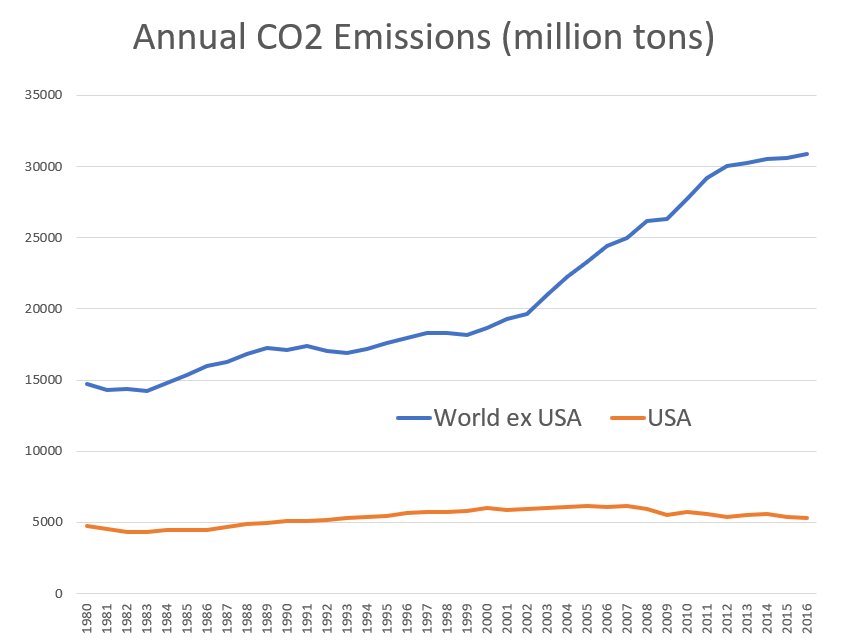

You can get rich by hitting an oil gusher, but coal is relatively expensive to mine and to transport. Thus, it’s relatively cheap to buy out coal mines because you aren’t buying the coal, you’re buying the right to leave the coal in the ground. Cutting the supply of coal raises its price which will increase the quantity supplied in other countries. Thus, there is the potential for supply leakage as well as demand leakage. It’s probably easier to use more coal when the price of coal falls (electricity, for example, can be generated in a variety of ways) than it is to mine more coal when the price rises. In other words, the elasticity of the demand for coal is greater than the elasticity of supply so supply leakage is probably less than demand leakage. Furthermore, supply leakage can be handled by buying out supply in the non-coalition countries. As Noah Smith pointed out with the graph at right (data) US CO2 emissions are actually falling while the rest of the world keeps rising (as they catch up in per-capita terms) so addressing the CO2 emissions problem requires bringing countries like China and India on board.

Coal use in China is very high and increasing. India has been canceling coal plants as solar becomes cheaper but coal is still by far the largest source of power in India. Thus, there is plenty of opportunity to buy out, high-cost coal mines in China and India.

It might seem odd to buy Chinese and Indian coal mines but we buy Chinese and Indian labor, why not a coal mine? Moreover, it’s important to understand that the policy is to buy only up to the point that it benefits both parties. Buying coal isn’t foreign aid, it’s a pollution reduction plan just like a carbon tax or R&D investment and because we can buy barely-profitable coal mines and avoid the problem of leakage this is a low-cost method to reduce CO2 emissions.

Collier and Venables worry that foreign voters won’t like foreign investors buying up coal mines, although foreign investment is hardly uncommon and foreigners do protect rainforests by buying the right to cut them down. In any case, Collier and Venables suggest a cap-extract and trade program. Under cap-extract there is a cap on global extractions of carbon (not use) but rights to extract can be traded. Since it’s more valuable to extract say oil than coal what this would mean is that payments would flow from mostly developed countries to developing countries which makes it clear that we are all in the boat together.

Even without a cap-extract and trade program, however, there are other factors that make buying coal attractive to people in selling countries, namely coal is killing them even putting aside the dangers of climate change.

NYTimes: Burning coal has the worst health impact of any source of air pollution in China and caused 366,000 premature deaths in 2013, Chinese and American researchers said on Thursday.

Coal is responsible for about 40 percent of the deadly fine particulate matter known as PM 2.5 in China’s atmosphere, according to a study the researchers released in Beijing.

India’s air quality is even worse than China’s and is responsible for some 1.2 million early deaths annually. A 25% cut in pollution in India could increase life-expectancy by 1.3 years and in some highly polluted cities such as Delhi by 2.8 years. Not all pollution comes from coal but a substantial amount does.

Buyers might worry that a foreign government will take their money and later renege on the deal. There are lots of ways to deal with this problem–turn the coal fields into a national park, for example, or develop them for housing. But let’s turn a problem into a solution. Instead of buying coal, we could rent it. In other words, buy the right to delay mining the coal for say 10 years. Given the rate of improvement in solar, many coal plants will be uneconomic in 10 years and given the rate of improvement in living standards and the consequent increased demand for clean air, many coal plants in India and China could well be unpolitical in 10 years. Thus, it is true that some solutions are naturally in the offing, but for exactly this reason some coal plants are going to be working extra hours in the next decade to squeeze out what profit they can while they still can. We can avoid this last push of CO2 into the atmosphere by buying up the right to extract and holding it for a decade.

A program to leave coal in the ground could easily pay for itself in lives saved and climate stabilized.

The policing culture that is China

Short-video app TikTok has a reputation for being beloved by young people the world over, but it’s also surprisingly popular with Chinese police officers.

In early January, China Police Network, a news portal run by the Ministry of Public Security, announced that 175 new TikTok channels had been created by police stations, SWAT teams, traffic police, and prisons in the month of December, bringing the country’s grand total to nearly 1,200 such accounts. That month, they churned out over 13,000 videos attracting a combined 4.8 billion views.

Since June of last year, China Police Network has kept a monthly tally of the most popular law enforcement accounts and videos on TikTok — or Douyin, as it’s known in China. While police in other countries have plugged into social media and cultivated fan followings on platforms like Instagram and Facebook, their Douyin-loving counterparts in China stand out in terms of scale and the wide range in both quality and content of their videos.

The January post mentions a comedic clip made by an account called Shishou Public Security that received over 800,000 likes. The video depicts a middle-aged woman tearfully describing her myriad contributions to the economic empowerment of women as mournful music plays in the background — before the camera flips to police officers unmasking her as the madame of a brothel.

The article also congratulates Siping Police Affairs for becoming the first police account in China to eclipse 10 million followers and praises the success of police hashtag campaigns such as #SayNoToDrunkDriving.

Since its launch in China in September 2016 and its expansion to international markets as TikTok a year later, Douyin boasts around 800 million downloads worldwide. The platform’s premise is simple: Users create and share 15-second videos, some of which wind up going viral. The police presence on Douyin has yielded a manic mix of content, from humdrum notices of arrests and other official business to reposts of pandas at play to original comic sketches with didactic denouements.

Sovereign Bonds since Waterloo — better than you had thought

This paper studies external sovereign bonds as an asset class. We compile a new database of 220,000 monthly prices of foreign-currency government bonds traded in London and New York between 1815 (the Battle of Waterloo) and 2016, covering 91 countries. Our main insight is that, as in equity markets, the returns on external sovereign bonds have been sufficiently high to compensate for risk. Real ex-post returns averaged 7% annually across two centuries, including default episodes, major wars, and global crises. This represents an excess return of around 4% above US or UK government bonds, which is comparable to stocks and outperforms corporate bonds. The observed returns are hard to reconcile with canonical theoretical models and with the degree of credit risk in this market, as measured by historical default and recovery rates. Based on our archive of more than 300 sovereign debt restructurings since 1815, we show that full repudiation is rare; the median haircut is below 50%.

That is from Josefin Meyer, Carmen M. Reinhart, and Christoph Trebesch in a new NBER working paper.