Month: May 2019

Friday assorted links

The Baumol Effect

After looking at education and health care and doing a statistical analysis covering 139 industries, Helland and I conclude that a big factor in price increases over time in the rising price of skilled labor. Many industries use skilled labor, however, and even so prices decline so that cannot be a full explanation. Moreover, why is the price of skilled labor increasing? The Baumol effect answers both of these questions. In this post, I’ll explain the effect drawing from Why Are the Prices so D*mn High.

The Baumol effect is easy to explain but difficult to grasp. In 1826, when Beethoven’s String Quartet No. 14 was first played, it took four people 40 minutes to produce a performance. In 2010, it still took four people 40 minutes to produce a performance. Stated differently, in the nearly 200 years between 1826 and 2010, there was no growth in string quartet labor productivity. In 1826 it took 2.66 labor hours to produce one unit of output, and it took 2.66 labor hours to produce one unit of output in 2010.

Fortunately, most other sectors of the economy have experienced substantial growth in labor productivity since 1826. We can measure growth in labor productivity in the economy as a whole by looking at the growth in real wages. In 1826 the average hourly wage for a production worker was $1.14. In 2010 the average hourly wage for a production worker was $26.44, approximately 23 times higher in real (inflation-adjusted) terms. Growth in average labor productivity has a surprising implication: it makes the output of slow productivity-growth sectors (relatively) more expensive. In 1826, the average wage of $1.14 meant that the 2.66 hours needed to produce a performance of Beethoven’s String Quartet No. 14 had an opportunity cost of just $3.02. At a wage of $26.44, the 2.66 hours of labor in music production had an opportunity cost of $70.33. Thus, in 2010 it was 23 times (70.33/3.02) more expensive to produce a performance of Beethoven’s String Quartet No. 14 than in 1826. In other words, one had to give up more other goods and services to produce a music performance in 2010 than one did in 1826. Why? Simply because in 2010, society was better at producing other goods and services than in 1826.

The 23 times increase in the relative price of the string quartet is the driving force of Baumol’s cost disease. The focus on relative prices tells us that the cost disease is misnamed. The cost disease is not a disease but a blessing. To be sure, it would be better if productivity increased in all industries, but that is just to say that more is better. There is nothing negative about productivity growth, even if it is unbalanced.

In this post, I will discuss some implications of the fact that productivity is unbalanced. See the book for more discussion and speculation about why productivity growth is systematically unbalanced.

The Baumol effect reminds us that all prices are relative prices. An implication is that over time prices have very little connection to affordability. If the price of the same can of soup is higher at Wegmans than at Walmart we understand that soup is more affordable at Walmart. But if the price of the same can of soup is higher today than in the past it doesn’t imply that soup was more affordable in the past, even if we have done all the right corrections for inflation.

We can see this in the diagram at right. We have a two-good economy, Cars and Education. The production possibilities frontier shows all the combinations of Cars and Education that we can afford given our technology and resources at time 1 (PPF 1). Now suppose society chooses to consume the bundle of goods denoted by point (a). The relative price of Cars and Education is given by the slope of the PPF at that point. That price/slope tells us if we give up some education how many more cars can we get? In a market economy the price has to be given by the slope of the PPF because that is the only price at which people will willing consume the bundle of goods at point (a), i.e. it’s the equilibrium price.

Now at time 2, productivity has increased which means that with the same resources we can now have more of both goods. Productivity of Car production has increased more than that of Education production, however, so the curve shifts out more towards Cars than towards Education. Suppose society continues to consume Cars and Education in the same proportions, i.e. at point (b). The price of education must increase–and all that means is that if we give up a unit of education at point b we will get more cars than before which is the same as saying that if we want more education at point b we must give up more cars than before, i.e. the price has increased.

Notice, however, that although the price of education has increased, education is not less affordable. Indeed, at point (b) we are consuming more of both goods–broadly speaking this is exactly what has happened–namely, the price of education has increased and we now consume more of it than ever before.

When we recognize that all prices are relative prices the following simple yet deep facts follow:

- If productivity increases in some industries more than others then, ceteris paribus, some prices must increase.

- Over time, all real prices cannot fall.

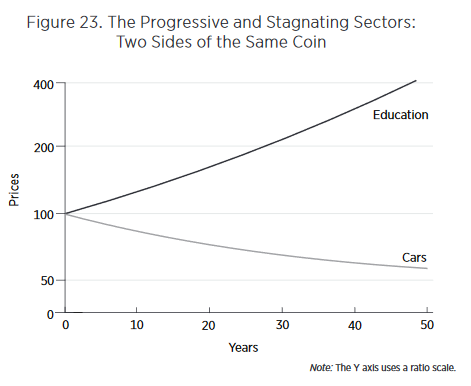

In Figure 22 the economy moves from point (a) to point (b). If we graph the same transition over time it will look something like Figure 23.

Looking at such graphs, our attention naturally is drawn to the rising cost of education. Why are costs rising so quickly? Entranced by such graphs, we may enter into a detailed analysis of the special factors of education—regulation, unionization, government purchases, insurance, international trade, and so forth—to try to explain the dramatic increase in costs. Yet the rising costs in the education sector are simply a reflection of increased productivity in the car sector. Thus, another deep lesson of the Baumol effect is that to understand why costs in the stagnant sector are rising, we must look away from the stagnating sector and toward the progressive sector.

Finally, there is one other addition to the Baumol effect which is not often recognized but worth drawing attention to. In Figure 22, I assumed that preferences were such that people wanted to consume the same ratio of goods over time so we moved from point (a) to point (b). But suppose that as we get wealthier we get tired of more cars and would like relatively more education so we move towards point (d). As we move from point (b) to point (d) we are taking resources away from car production, resources which were probably well-suited to making cars, and instead moving them towards education where they are probably less well suited. As a result as we move from point (b) to point (d) we are driving up the price of education as we try to turn auto workers into teachers. In this case, the Baumol effect gets magnified. We could alternatively move from point (b) to point (c) which would turn teachers into less productive auto workers thus driving down the price of education (i.e. increasing the price of cars). Thus, depending on preferences, the Baumol effect can be magnified or ameliorated.

As a society it appears that with greater wealth we have wanted to consume more of the goods like education and health care that have relatively slow productivity growth. Thus, preferences have magnified the Baumol effect.

Next week, I will wrap up the discussion by explaining some features of the data that the Baumol effect fits much better than do other theories.

Addendum: Other posts in this series.

Might Facebook boost wages?

In this paper, I estimate the causal effect of increased exposure to online social networks during college on future labor market outcomes.

Using quasi-random variation from Facebook’s entry to college campuses during its infancy, I exploit a natural experiment to determine the relationship between online social network access and future earnings.

I find a positive effect on wages from Facebook access during college. This positive effect is largest in magnitude for female students, and students from lower-middle class families.

I provide evidence that this positive effect from Facebook access comes through the channel of increased social ties to former classmates, which in turn leads to strengthened employment networks between college alumni.

My estimates imply that access to Facebook for 4 years of college causes a 2.7 percentile increase in a cohort’s average earnings, relative to the earnings of other individuals born in the same year. This translates to an average nominal wage increase of $3,000-$5,000 in 2014.

To be clear, some of that could be a wage distribution effect. Still, this paper points to the possibility of some very real networking and matching gains from the use of Facebook, and perhaps those gains do not favor traditional elites.

For the pointer I thank the excellent Kevin Lewis.

Alec Stapp on GDPR

Here is just one segment of an excellent piece:

Compliance costs are astronomical

- Prior to GDPR going into effect, it was estimated that total GDPR compliance costs for US firms with more than 500 employees “could reach $150 billion.” (Fortune)

- Another estimate from the same time said 75,000 Data Protection Officers would need to be hired for compliance. (IAPP)

- As of March 20, 2019, 1,129 US news sites are still unavailable in the EU due to GDPR. (Joseph O’Connor)

- Microsoft had 1,600 engineers working on compliance. (Microsoft)

- During a Senate hearing, Keith Enright, Google’s chief privacy officer, estimated that the company spent “hundreds of years of human time” to comply with the new privacy rules. (Quartz)

- However, French authorities ultimately decided Google’s compliance efforts were insufficient: “France fines Google nearly $57 million for first major violation of new European privacy regime” (The Washington Post)

- “About 220,000 name tags will be removed in Vienna by the end of [2018], the city’s housing authority said. Officials fear that they could otherwise be fined up to $23 million, or about $1,150 per name.” (The Washington Post)

And another part:

Unseen costs of foregone investment & research

- Startups: One study estimated that venture capital invested in EU startups fell by as much as 50 percent due to GDPR implementation. (NBER)

- Mergers and acquisitions: “55% of respondents said they had worked on deals that fell apart because of concerns about a target company’s data protection policies and compliance with GDPR” (WSJ)

- Scientific research: “[B]iomedical researchers fear that the EU’s new General Data Protection Regulation (GDPR) will make it harder to share information across borders or outside their original research context.” (POLITICO)

Do read the whole thing.

Thursday assorted links

The Tremendous Value of Increases in Life Expectancy

In this post I shall argue two things which together may confuse people. First, that life expectancy is so valuable that the money the US spends on healthcare relative to Europe could be well spent. Second that the extra spending is not in fact due to higher quality and does not explain rising prices over time.

What explains rising prices in some sectors of the economy? A common argument, at least from economists, is that there may be unmeasured improvements in quality. I don’t think that there have been marked improvements in quality in education so that argument doesn’t get off the ground (see my earlier post and the book for evidence). But health care quality has increased. Moreover, the value of life is so high that the improvements in quality could justify the cost increases. Here from Why Are The Prices So D*mn High is a back of the envelope calculation:

The United States spends about 5 percent more of GDP on health-care than do other developed countries. US GDP is almost $20 trillion, so 5 percent is approximately $1 trillion. The US population is 325 million, so the United States spends an extra $3,000 per person each year on healthcare. Is the expense worthwhile?

A value of a statistical life-year of around $200,000 is a mid-range, widely used estimate in the United States. Thus, if the extra US spending generated an extra $3,000 per $200,000 of a life-year, it would pay for itself. In other words, for the extra US spending to be worthwhile it must generate 3,000/200,000 × 365 = 5.45 extra days of statistical life, and, of course, it must do so every year. In recent years, life expectancy in the United States has increased by about 52 days a year. Thus, a little more than 10 percent of the increase in actual life expectancy must be a result of the extra US spending for that spending to be worthwhile. That hardly appears impossible. It’s also not impossible that the increase in life expectancy was not caused by the extra spending.

The bottom line is that the value of life is so high that US levels of spending could be worthwhile, but the high value of life and the difficulty of measuring the effectiveness of healthcare makes the question impossible to answer with certainty.

Nevertheless,I don’t think the increases in quality explain the increases in cost:

…even if the spending on healthcare is well justified by the improvements in life expectancy, it does not follow that the cause of higher spending is the improvement in life expectancy. As with education, many of the increases in life expectancy come from better knowledge, which does not necessarily cost more to use. It does not cost much more to treat an infection with antibiotics than with bloodletting; perhaps it costs less. We do use more technology in healthcare than in previous years—this includes computerized tomography (CT) scanners, magnetic resonance imaging (MRI) systems, and positron emission tomography (PET). Technology, however, is falling in price. At some point one would expect that decreases in the cost of existing technologies would overwhelm increases in costs owing to the introduction of new technologies. As with education, it would be peculiar if the only place in which technology raised costs was in healthcare (but see Joseph P. Newhouse for a strong argument that healthcare costs are driven by technology.)

Let’s put this argument more generally. Most increases in quality *over time* are similar to increases in productivity, i.e. A in A*f(K,L), an unpriced factor. Computers today are much higher quality than in the past. Indeed, so much so that today’s computers couldn’t be bought at any price not that long ago but we don’t pay more because what makes them higher quality is general knowledge.

In my view, most quality increases over time are due to improvements in knowledge. In other words, quality increases over time are much more about better recipes than better cooks. As a result, at a given point in time, higher quality is associated with higher prices but over time higher quality is more often associated with *lower* prices. Thus, in general, higher quality is not a good explanation for higher prices over time.

Tomorrow: The Baumol Effect.

Addendum: Other posts in this series.

The real losers from the U.S.-China trade war

The countries caught in the middle, as I argue in my latest Bloomberg column. Excerpt:

n this setting, many Pakistani businesspeople work with both China and the U.S. Now President Donald Trump is essentially telling them to choose sides. Will they do business with Huawei or not? Will they work to open up the Chinese economy or not? And so on.

If you’re Pakistan, on the actual matters under consideration, you will side with China. Pakistan is not going to ban Huawei or push China to open its markets to major U.S. tech companies. China will get its way on those issues, and win some very public victories in the Pakistani public arena. Pakistani leaders and businesspeople who sided with the U.S., or expressed strong American loyalties, will feel burned. Their side just lost a very big debate, centered on a conflict that did Pakistan no good in the first place and was at least in the proximate sense started by Trump.

In other words, the U.S. is making it harder for many foreigners to be on its side, even partially. Over time, it is limiting its own soft power in the countries caught between America and China — and soft power is the one area in which America still has (or is it, already, had?) a big advantage over China.

There is much more at the link, including coverage of Singapore and South Korea.

Venezuelan comovement now includes violent crime too

The feared street gangster El Negrito sleeps with a pistol under his pillow and says he’s lost track of his murder count. But despite his hardened demeanor, he’s quick to gripe about how Venezuela’s failing economy is cutting into his profits.

Firing a gun has become a luxury. Bullets are expensive at $1 each. And with less cash circulating on the street, he says robberies just don’t pay like they used to.

For the 24-year-old, that has all given way to a simple fact: Even for Venezuelan criminals it’s become harder to get by.

“If you empty your clip, you’re shooting off $15,” said El Negrito, who spoke to The Associated Press on the condition he be identified only by his street name and photographed wearing a hoodie and face mask to avoid attracting unwelcomed attention. “You lose your pistol or the police take it and you’re throwing away $800.”

In something of an unexpected silver lining to the country’s all-consuming economic crunch, experts say armed assaults and killings are plummeting in one of the world’s most violent nations. At the Venezuelan Observatory of Violence, a Caracas-based nonprofit group, researchers estimate homicides have plunged up to 20% over the last three years based on tallies from media clippings and sources at local morgues.

Officials of President Nicolás Maduro’s socialist administration have drawn criticism for not releasing robust crime statistics, but the government on Tuesday gave the AP figures showing a 39 percent drop in homicides over the same three-year period, with 10,598 killings in 2018. Officials also report a fall in kidnappings.

The decline has a direct link to the economic tailspin that has helped spark a political battle for control of the once-wealthy oil nation.

Here is more from Scott Smith, via the excellent Kevin Lewis.

Wednesday assorted links

1. The death of the Left in Indian politics?

2. Those new service sector jobs: icefall doctors.

3. Is the FDIC running “Operation Choke Point”?

4. Mobile phones lowered murder rates.

5. Is the start-up deficit mainly the result of demographics?

6. Mohamed El-Arian named head of Queens’ College, Cambridge.

Physician and Nurse Incomes Have Increased Tremendously

There has been a lot of ink spilled over the rising cost of health care and in Why Are the Prices So D*mn High? Helland and I do not cover every theory and cannot satisfy every objection. Our goal is more modest. We can say that one major factor in rising health care costs is the rising price of skilled labor.

There has been a lot of ink spilled over the rising cost of health care and in Why Are the Prices So D*mn High? Helland and I do not cover every theory and cannot satisfy every objection. Our goal is more modest. We can say that one major factor in rising health care costs is the rising price of skilled labor.

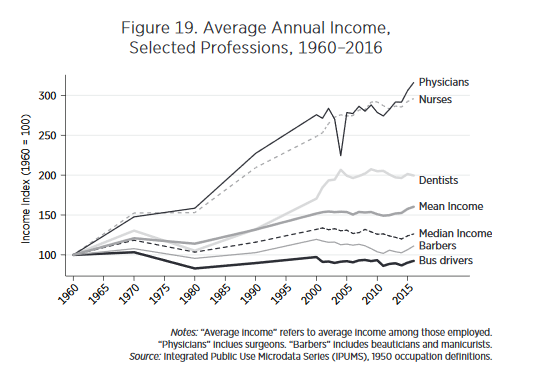

We argue that there is a direct, obvious, and measurable cause of higher costs in healthcare—namely, the price of skilled labor. No profession other than physicians has seen such large increases in incomes over the past 50 years. Figure 19 shows the real income of physicians from 1960 to 2016, indexed to 100 in 1960. Since 1960 the real income of physicians has increased by a factor of three. By comparison, barbers and bus drivers have seen essentially no increase in real incomes. Median incomes are up only modestly whereas mean incomes, which are pulled up by outliers, are up by only 50 percent.

Moreover, nurse incomes have risen in lock-step with those of physicians.

At the same time, we have hired more physicians and more nurses per capita. As Figure 20 shows since 1960 the number of physicians and the number of nurses has more than doubled.

With more physicians and more nurses each making more, it’s not surprising that the cost of medical care would increase.

Addendum: Other posts in this series.

*The Marginal Revolutionaries: How Austrian Economists Fought the War of Ideas*

That is the new and very interesting forthcoming book by Janek Wasserman, focusing on the history of the Austrian school of economics and due out in September. A few comments:

1. It is the best overall history of the Austrian school.

2. It is in some early places too wordy, though perhaps that is necessary for the uninitiated.

3. I don’t think actual “Austrian school members” will learn much economics from it, though it has plenty of useful historical detail, far more than any other comparable book. And much of it is interesting, not just: “Adolph Wagner and Albert Schaeffler taught in the Austrian capital in the 1860s and early 1870s, but quarrels with fellow incumbent Lorenz von Stein led to their departure.”

4. Even a full decade after its release in 1871, Menger’s Principles was not achieving much attention outside of Vienna.

5. The early Austrians favored progressive taxation and fairly standard Continental approaches to government spending.

6. The Austrian school of those earlier times was in danger of disappearing, as Boehm-Bawerk was working in government and the number of “Austrian students” was drying up, circa 1905.

7. The very first articles of Mises were empirical, and covered factory legislation, labor law, and welfare programs.

8. Wieser and some of the others lost status with the fall of the Dual Monarchy after WWI; Wieser for instance no longer had a House of Lords membership. Schumpeter and Mises responded to these changes by writing more for a broader public, often through newspapers (not blogs). Mises’s market-oriented views seemed to stem from this time.

9. Hayek in fact struggled in high school, though his grandfather had gone on Alpine hikes with Boehm-Bawerk.

10. The Lieder of the original Mises circle were patterned after the poems of Karl Kraus, and one of them mentioned spaghetti and risotto.

11. Much of this book is strong evidence for the “small group” theory of social change.

12. The patron institution for Hayek’s business cycle research of 1927 to 1931 was partly sponsored by the Rockefeller Foundation.

13. By the mid-1930s, Mises, Tinbergen, Koopmans, and Nurkse were all living in Geneva. There was a Vienna drinking song saying farewell to Mises.

14. I wonder how these guys would have looked as Emergent Ventures applicants. [“We’re going to run away from the Nazis and recreate anew our whole school of thought in America, with thick Austrian accents…and with a night school class at NYU to boot.”]

15. The Austrian school eventually was reborn in the United States, which accounts for many more chapters in this book, some of them concerned with the ties between the Austrian school and libertarianism. There are some outright errors of fact in this section of the book, sometimes involving matters I was involved with personally (and which are non-controversial, not a question of “taking sides”). I think also the latter parts of the book do not quite grasp the extensive influence of the Austrian school on America, extending up through the current day, and covering such diverse areas as regulatory policy and tech and crypto.

Nonetheless, recommended as an important contribution to the history of economic thought.

Gross Domestic Error

Pierre Lemieux at EconLib catches a surprising error from The Economist which wrote this week:

There was some head-scratching this week, as data showed Japan’s economy growing by 2.1% in the first quarter at an annualised rate, defying expectations of a slight contraction. Most of the growth was explained by a huge drop in imports. Because they fell at a faster rate than exports, gdp rose.

Nope. Imports do not influence Gross Domestic Product, at least not in the mechanical way suggested by The Economist. Here’s how Tyler and I explain it in Modern Principles:

It’s important to remember the Domestic in Gross Domestic Product. When we add C+I+G we are adding up all national spending but some of that spending was on imports, goods that were not produced domestically. So we subtract imports from national spending to get national spending on domestically produced goods, C+I+G – Imports.

…Here is a mistake to avoid. The national spending approach to calculating GDP requires a step where we subtract imports but that doesn’t mean that imports are bad for GDP! Let’s consider a simple economy where I, G, and Exports are all zero and C=$100 billion. Our only imports come from a container ship that once a year delivers $10 billion worth of iPhones. Thus when we calculate GDP we add up national spending and subtract $10 billion for the imports, $100-$10=$90 billion. But suppose that this year the container ship sinks before it reaches New York. So this year when we calculate GDP there are no imports to subtract. But GDP doesn’t change! Why not? Remember that part of the $100 billion of national spending was $10 billion spent on iPhones. So this year when we calculate GDP we will calculate $90 billion-$0=$90 billion. GDP doesn’t change and that shouldn’t be surprising since GDP is about domestic production and the sinking of the container ship doesn’t change domestic production.

We continue:

If we want to understand the role of imports (and exports) on GDP and national welfare. We have to go beyond accounting to think about economics. If we permanently stopped all the container ships from delivering iPhones, for example, then domestic producers would start producing more cellphones and that would add to GDP but producing more cellphones would require producing less of other goods. If we were buying cellphones from abroad because producing them abroad requires fewer resources then GDP would actually fall—this is the standard argument for trade that you learned in your microeconomics class. The standard answer could change, however, if there were lots of unemployed resources, an issue we will discuss in Chapter 32 and later chapters. The point we want to emphasize here is not whether trade is ultimately good or bad but rather that Y+C+I+G+NX is an accounting identity that can’t by itself answer this question.

The JPE is going monthly in 2020

Here is the announcement. Presumably they wish to claw back some of the quantity going to the ever-multiplying number of AEA journals and to thus avoid being an afterthought. Will the average quality of JPE article decline? I suppose by one definition it has to, but in such a rapidly specializing discipline, who will notice? Is it really so clear which pieces come close but don’t quite deserve to belong in the JPE? I for one could not pass this “blind taste test” in my role as a JPE reader, and I have been following the rag for decades.

As a polar experiment, what if they put out an issue every day, and in essence the top journals took all the published pieces? Then the notion of having a “top three” hit (or whatever) would dwindle and people actually would have to judge the work. A modest move in that direction should be just fine, said the daily blogger.

In the meantime, the leading lights of the profession — most of all in the earlier parts of their careers — should be prepared for that much more refereeing. Ay!

Tuesday assorted links

1. The technologies that are Canada: “Audible hockey puck could revolutionize the sport for blind players.” Note: “[It] sounds pretty much like a smoke detector,” Francois Beauregard, who helped come up with the idea for the puck prototype…”It is not made to be harmonious or pleasant.”

2. Was Leonardo da Vinci ADHD? (speculative)

3. Professional football is also much riskier for subsequent heart attacks.

4. Paul Keating, former Australian Prime Minister, on classical music.

5. Homeopathy in the French health care system, but much more than that too.

Chernobyl

Chernobyl, HBO’s taut 5-part mini-series, is excellent and it sticks close to the facts (although one female character played by Emily Watson is clearly made up). By all accounts, the series accurately represents life in the former Soviet Union and through a variety of means from color palette to casting and dialogue it does a remarkable job at capturing the political economy. One thing I learned (so far, it hasn’t all appeared yet) is that it could have been much, much worse but the Russians avoided the worst scenario with a combination of bravery, smarts and luck.

Chernobyl, HBO’s taut 5-part mini-series, is excellent and it sticks close to the facts (although one female character played by Emily Watson is clearly made up). By all accounts, the series accurately represents life in the former Soviet Union and through a variety of means from color palette to casting and dialogue it does a remarkable job at capturing the political economy. One thing I learned (so far, it hasn’t all appeared yet) is that it could have been much, much worse but the Russians avoided the worst scenario with a combination of bravery, smarts and luck.

The number of cancer deaths from Chernobyl appears to be quite low. The WHO estimated an additional 9,335 deaths with about half of those coming from workers and nearby residents and other half more distant impacts, other estimates are higher. More recent analysis, however, suggests that Chernobyl and its aftermath had relatively small but significant effects across a large number of people. Here are two recent papers:

Chernobyl’s Subclinical Legacy: Prenatal Exposure to Radioactive Fallout and School Outcomes in Sweden by Almond, Edlund and Palme.

Abstract: We use prenatal exposure to Chernobyl fallout in Sweden as a natural experiment inducing variation in cognitive ability. Students born in regions of Sweden with higher fallout performed worse in secondary school, in mathematics in particular. Damage is accentuated within families (i.e., siblings comparison) and among children born to parents with low education. In contrast, we detect no corresponding damage to health outcomes. To the extent that parents responded to the cognitive endowment, we infer that parental investments reinforced the initial Chernobyl damage. From a public health perspective, our findings suggest that cognitive ability is compromised at radiation doses currently considered harmless.

and The long-run consequences of Chernobyl: Evidence on subjective well-being, mental health and welfare by Danzer and Danzer.

Abstract: This paper assesses the long-run toll taken by a large-scale technological disaster on welfare, well-being and mental health. We estimate the causal effect of the 1986 Chernobyl catastrophe after 20 years by linking geographic variation in radioactive fallout to respondents of a nationally representative survey in Ukraine according to their place of residence in 1986. We exclude individuals who were exposed to high levels of radiation—about 4% of the population. Instead, we focus on the remaining majority of Ukrainians who received subclinical radiation doses; we find large and persistent psychological effects of this nuclear disaster. Affected individuals exhibit poorer subjective well-being, higher depression rates and lower subjective survival probabilities; they rely more on governmental transfers as source of subsistence. We estimate the aggregate annual welfare loss at 2–6% of Ukraine’s GDP highlighting previously ignored externalities of large-scale catastrophes.

Hat tip: Jennifer Doleac and Wojtek Kopczuk.