Month: August 2019

Estimating US Consumer Gains from Chinese Imports

>We estimate the size of US consumer gains from Chinese imports during 2004–2015. Using barcode-level price and expenditure data, we construct inflation rates under CES preferences, and use Chinese exports to Europe as an instrument. We find significant negative effects of Chinese imports on US prices. This effect is driven by both changes in the prices of existing goods and the entry of new goods, and it is similar across consumer groups by income or region. A simple benchmarking exercise suggests that Chinese imports led to a 0.19 percentage point annual reduction in the price index for consumer tradables.

That is from AER Insights by Liang Bai and Sebastian Stumpner. I would have expected a somewhat higher magnitude, and perhaps this in part explains why the trade war has been proceeding.

No man can be judge in his own case

Cash bail and bounty hunters can be an important and useful part of the criminal justice system. The practice in New Orleans, however, of funding court and judicial benefits with a tax on bail is obnoxious. In recent years, the tax on bail has funded 20-25% of the Judicial Expense Fund which is used to pay staff and office supplies, travel and other costs. The 5th U.S. Circuit Court of Appeal was right to affirm that this tax violates a defendant’s due process rights because it gives judges an incentive to require bail for their own benefit rather than to incentivize the defendant’s court appearance.

“No man can be judge in his own case.” Edward Coke, INSTITUTES OF THE LAWS OF ENGLAND, § 212, 141 (1628). That centuries-old maxim comes from Lord Coke’s ruling that a judge could not be paid with the fines he imposed. Dr. Bonham’s Case, 8 Co. Rep. 107a, 118a, 77 Eng. Rep. 638, 652 (C.P. 1610). Almost a century ago, the Supreme Court recognized that principle as part of the due process requirement of an impartial tribunal. Tumey v. Ohio, 273 U.S. 510, 523 (1927).

This case does not involve a judge who receives money based on the decisions he makes. But the magistrate in the Orleans Parish Criminal United States Court of Appeals District Court receives something almost as important: funding for various judicial expenses, most notably money to help pay for court reporters, judicial secretaries, and law clerks. What does this court funding depend on? The bail decisions the magistrate makes that determine whether a defendant obtains pretrial release. When a defendant has to buy a commercial surety bond, a portion of the bond’s value goes to a fund for judges’ expenses. So the more often the magistrate requires a secured money bond as a condition of release, the more money the court has to cover expenses. And the magistrate is a member of the committee that allocates those funds. Arrestees argue that the magistrate’s dual role—generator and administrator of court fees—creates a conflict of interest when the judge sets their bail. We [agree with the district court] that this dual role violates due process.

The plaintiffs also argued that judges must take into account a defendant’s ability to pay when setting bail. The appeals court didn’t rule on that issue but ironically judges who get a percent of the proceeds from bail do have an incentive to take into account ability to pay because only paid bail generates revenues. Eliminating the judge’s cut eliminates the incentive to think about ability to pay. Still, I support the decision. We should try for first best. The theory of second best leads only to madness and ruin.

*10% Less Democracy*

The author is Garett Jones and the subtitle is Why You Should Trust Elites a Little More and the Masses A Little Less, coming soon to a theater near you, early 2020.

If you believe in judicial independence, you do not believe in complete democracy.

If you do not think we should elect judges, sheriffs, and dog catchers, you do not believe in complete democracy.

If you believe in those European proportional representation systems, with post-election bargaining, you do not believe in complete democracy.

If you are a fan of the EU…etc.

Here is an excerpt from Garett’s excellent book:

Some cities in California appoint their treasurers and others elect their treasurers. Cities can have elections to decide whether the city treasurer should be appointed by the city government; the default is that they’re elected. Whalley checks to see which kinds of cities have lower borrowing costs: ones with appointed treasurers or elected ones. The interest rate paid on a city’s debt is a useful index of how well the city is running its finances…So Whalley’s overall question is this: Do cities with appointed treasurers pay lower interest rates on their debt?

…Over the period Whalley examined, 1992 to 2008, forty-three cities held referenda to ask whether they should switch to appointed treasurers. He’s therefore able to look at the before-and-after differences of these elections…

[there is] an even bigger benefit of appointed treasurers: seven-tenths of a percent lower interest rates every year. The average city has $30 million in debt, so that comes out to a savings of $210,000 per year.

Do I hear eleven percent anybody? Though twenty percent I do not wish to hazard, not at all.

You can pre-order the book here.

*The Enchantments of Mammon*

The author is Eugene McCarraher, and the subtitle of this Belknap Press book is How Capitalism Became the Religion of Modernity. Here is one excerpt:

The world does not need to be re-enchanted, because it was never disenchanted in the first place. Attending primarily to the history of the United States, I hope to demonstrate that capitalism has been, as Benjamin perceived, a religion of modernity, one that addresses the same hopes and anxieties formerly entrusted to traditional religion. But this does not mean only that capitalism has been and continues to be “beguiling” or “fetishized,” and that rigorous analysis will expose the phantoms as the projections they really are. These enchantments draw their power, not simply from our capacity for delusion., but from our deepest and truest desires — desires that are consonant and tragically out of touch with the dearest freshness of the universe. The world can never be disenchanted, not because our emotional or political or cultural needs compel us to find enchantments — though they do — but because the world itself, as Hopkins realized, is charged with the grandeur of God…

However significant theology is for this book, I have relied on a sizable body of historical literature on the symbolic universe of capitalism. Much of this work suggests that capitalist cultural authority cannot be fully understood without regard to the psychic, moral, and spiritual longings inscribed in the imagery of business culture.

I remain wedded to the traditional Weberian view that capitalism represents a discrete break away from such modes of thought, and I believe this perspective supported by the work of Joe Henrich and co-authors on WEIRD. Nonetheless, this is a book of note, and it has a clearly stated thesis on matters of direct relevance to what is explored on Marginal Revolution. Due out in November, pre-order at the link above.

Rent control doesn’t always lower rents

Using a 1994 law change, we exploit quasi-experimental variation in the assignment of rent control in San Francisco to study its impacts on tenants and landlords. Leveraging new data tracking individuals’ migration, we find rent control limits renters’ mobility by 20 percent and lowers displacement from San Francisco. Landlords treated by rent control reduce rental housing supplies by 15 percent by selling to owner-occupants and redeveloping buildings. Thus, while rent control prevents displacement of incumbent renters in the short run, the lost rental housing supply likely drove up market rents in the long run, ultimately undermining the goals of the law.

That is from a new AER piece by Rebecca Diamond, Tim McQuade and Franklin Qian.

Friday assorted links

How hard is it to limit airline carbon emissions?

As a result, many environmentalists are dismissive of biofuels as a long-term solution, particularly because a growing world population will need more food. To limit global warming to a 1.5C increase in temperature would require so much biofuel that it would take up to 7m square kilometres of arable land — roughly the size of Australia — to produce that much feedstock, according to a recent report from the UN Intergovernmental Panel on Climate Change.

“If you were to replace all today’s aviation fuel with biofuel, with first-generation biofuel, it would be at the expense of 2,100 calories per person per day for everyone on the planet,” says Prof Berners-Lee. “It would take almost all of humankind’s calorific requirements . . . So that is absolutely not a solution.”

How deregulatory is the Trump administration?

Here is an email from a loyal, anonymous MR reader:

Critics of the administration’s much-ballyhooed deregulatory efforts argue that there’s not really that much there; they contend the White House and agencies have been tinkering around the margins (and helping out special interest groups), but not really addressing regulation’s economic cost. They argue there’s been virtually nothing done to address the bloated corpus of 100 years of accumulated federal regulation, and there’s been no legislative action to change regulatory processes.

The administration’s defenders and their fiercest critics alike argue that Trump has taken a machete to the regulatory state. But aside from naming a few rule changes here or there, they don’t offer much concrete support for their claim.

What’s the steel man case that Trump has broken the back of the administrative state? Some hypothes

1. They haven’t made things worse. After eight years of an administration that was seen (fairly or not) as hostile to business, just taking the boot off the throat of entrepreneurs is a major step forward. Small-business optimism is at pre-crisis levels. The last two years have seen the fewest economically significant final rules promulgated since 1990. Beyond formal rules, the administration has ended the abuse of “dear colleague” letters, guidance documents, and sue-and-settle.

2. Related to #1, there’s been no new legislation along the lines of Sarbanes-Oxley or Dodd-Frank that will take as long as a decade to get regulations worked out. That takes a lot of the uncertainty out of the system.

3. Enforcement has been curtailed. The administrative state is a threat because its enforcement is so capricious and subject to questionable extralegal adjudication. The Trump administration has responded by simply not enforcing many regulations. EPA inspections are down by half; CFPB is asleep at the switch. Enforcement heads are basically emulating Ron Swanson, for the better.

4. The 14 uses of the Congressional Review Act in early 2017 should in fact count as highly deregulatory; it was of course more than had ever been done with this tool in the past. Okay, so the regs in question weren’t yet final or hadn’t been in effect for very long. That’s just playing a baselines game; the bottom line is tens of billions of dollars of costs were cut over what would have been.

5. The record-breaking number of appellate judges appointed by the president and confirmed by the Senate will shift the judiciary to be more skeptical of regulators’ self-aggrandized power. Justice Gorsuch is champing at the bit to eliminate Auer and Chevron deference; overruling these precedents would be game-changing.

6. There’s been more taking place than you think. No, there hasn’t been a huge shakeup of federal departments, but those kinds of things are mostly for show anyway; federal power remains more or less constant, responsibilities just get shifted around. Benefit-cost analyses and regulatory impact analyses done by most agencies are sloppy at best and mostly just a Soviet-style effort to justify what’s already been decided, so they don’t capture the magnitude of what’s happening.

What has happened? The president has appointed people who take regulatory analysis seriously and understand opportunity cost. Some of the deregulation has been in areas most sensitive to the costs of regulation, like labor and energy. ACA individual mandate? Gone. HUD is taking steps to push housing deregulation at the local level; this has gotten almost no attention.

7. There’s more that would have been done but for the “deep state.” It’s a matter of public choice economics, not AM radio conspiracies, that regulators may not be enthusiastic about deregulating. For instance, Trump’s much-trumpeted two-out-one-in executive order for federal regulations was largely kneecapped by OMB so that over 90% of new regulations are deemed exempt from the order. Given inherent resistance to change (again, for perfectly understandable reasons, this is not a conspiracy), it’s amazing that anything has been done at all!

Thursday assorted links

3. Kang Nara, defector from North Korea (YouTube, English subtitles). And WSJ coverage. I found both very interesting.

3. Richard Serra update (NYT).

4. 100 books to read on China.

5. Which California localities have the worst housing regulation? The worst is Atherton.

6. Harvard risk and environmental economist Marty Weitzman has passed away.

Marty Weitzman’s Noah’s Ark Problem

Marty Weitzman passed away suddenly yesterday. He was on many people’s shortlist for the Nobel. His work is marked by high-theory applied to practical problems. The theory is always worked out in great generality and is difficult even for most economists. Weitzman wanted to be understood by more than a handful of theorists, however, and so he also went to great lengths to look for special cases or revealing metaphors. Thus, the typical Weitzman paper has a dense middle section of math but an introduction and conclusion of sparkling prose that can be understood and appreciated by anyone for its insights.

The Noah’s Ark Problem illustrates the model and is my favorite Weitzman paper. It has great sentences like these:

Noah knows that a flood is coming. There are n existing species/libraries, indexed i = 1, 2,… , n. Using the same notation as before, the set of all n species/libraries is denoted S. An Ark is available to help save some species/libraries. In a world of unlimited resources, the entire set S might be saved. Unfortunately, Noah’s Ark has a limited capacity of B. In the Bible, B is given as 300 x 50 x 30 = 450,000 cubits. More generally, B stands for the total size of the budget available for biodiversity preservation.

…If species/library i is boarded on the Ark, and thereby afforded some protection, its survival probability is enhanced to Pi. Essentially, boarding on the Ark is a metaphor for investing in a conservation project, like habitat protection, that improves survivability of a particular species/library. A particularly grim version of the Noah’s Ark Problem would make the choice a matter of life or death, meaning that Pi= 0 and Pi= 1. This specification is perhaps closest to the old testament version, so I am taking literary license here by extending the metaphor to less stark alternatives.

Weitzman first shows that the solution to this problem has a surprising property:

The solution of the Noah’s Ark Problem is always “extreme” in the following sense…In an optimal policy, the entire budget is spent on a favored subset of species/libraries that is afforded maximal protection. The less favored complementary subset is sacrificed to a level of minimal protection in order to free up to the extreme all possible scarce budget dollars to go into protecting the favored few.

Weitzman offers a stark example. Suppose there are two species with probabilities of survival of .99 and .01. For the same cost, we can raise the probability of either surviving by .01. What should we do?

We should save the first species and let the other one take its chances. The intuition comes from thinking about the species or libraries as having some unique features but also sharing some genes or books. When you invest in the first species you are saving the unique genes associated with that species and you are also increasing the probability of saving the genes that are shared by the two species. But when you put your investment in the second species you are essentially only increasing the probability of saving the unique aspects of species 2 because the shared aspects are likely saved anyway. Thus, on the margin you get less by investing in species 2 than by investing in species 1 even though it seems like you are saving the species that is likely to be saved anyway.

The math establishing the result is complex and, of course, there are caveats such as linearity assumptions which might reverse the example in a particular case but the thrust of the result is always operating: Putting all your eggs in one basket is a good idea when it comes to saving species.

Weitzman gets the math details right, of course!, but he knows that Noah isn’t a math geek.

Noah is a practical outdoors man. He needs robustness and rugged performance “in the field.” As he stands at the door of the ark, Noah desires to use a simple priority ranking list from which he can check off one species at a time for boarding. Noah wishes to have a robust rule….Can we help Noah? Is the concept of an ordinal ranking system sensible? Can there exist such a simple myopic boarding rule, which correctly prioritizes each species independent of the budget size? And if so, what is the actual formula that determines Noah’s ranking list for achieving an optimal ark-full of species?

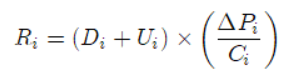

So working the problem further, Weitzman shows that there is a relatively simple rule which is optimal to second-order, namely:

Where R is an index of priority. Higher R gets you on the ark, lower R bars entrance. D is a measure of a species distinctiveness–this could be measured, for example, by the nearest common ancestor metric. U is a measure of the special utility of a species beyond its diversity (Pandas are cute, goats are useful etc.) C is the cost of a project to increase the probability of survival and Delta P is the increase in the probability of survival so Delta P/C is the cost of increasing the probability of survival per dollar. Put simply we should invest our dollars where they have the most survival probability per dollar multiplied by a factor taking into account diversity and utility.

The rule is simple and sensible and and it has been used occasionally. Much more could be done, however, to optimize dollars spent on conservation and Weitzman’s rule gives us the necessary practical guidance. RIP.

Has monetary policy lost its power?

No, says my latest Bloomberg column. Here is one of the opening bits:

The most striking fact about the current situation is that not one of the world’s major central banks has announced that it would like to see a higher rate of price inflation. Have you heard support for a 3% inflation rate lately from the heads of the European Central Bank, the Bank of Japan or the U.S. Federal Reserve? It is therefore no surprise that central banks don’t seem to matter much.

In essence, central banks would like to make marginal contributions to stimulating the economy, without incurring the political wrath from a higher rate of price increase. The powers they have lost are political, not economic.

On these and related questions, I am grateful to the writings of Scott Sumner over the years. And in sum:

In fact, when it comes to macroeconomics, the current malaise is not just political but also cultural: It is a paralysis of the spirit to achieve and excel. Conventional economic theory has not been proved wrong, at least not yet. There is just a fading willingness to apply it.

Boris Johnson’s suspension of Parliament

The betting markets have stayed in the 48-55 range for Brexit by year’s end, even after the suspension announcement. That to me does not sound like “hard Brexit hell or high water.”

I would sooner think that Boris Johnson wishes to see through a relabeled version of the Teresa May deal, perhaps with an extra concession from the EU tacked on. His dramatic precommitment raises the costs to the Tories of not supporting such a deal, and it also may induce slight additional EU concessions. The narrower time window forces the recalcitrants who would not sign the May deal to get their act together and fall into line, more or less now.

Uncertainty is high, but the smart money says the Parliamentary suspension is more of a stage play, and a move toward an actual deal, than a leap to authoritarian government.

That said, I still do not like either Brexit or the suspension.

Wednesday assorted links

My Conversation with Hollis Robbins

Here is the audio and video, here is part of the CWT summary:

Now a dean at Sonoma State University, Robbins joined Tyler to discuss 19th-century life and literature and more, including why the 1840s were a turning point in US history, Harriet Beecher Stowe’s Calvinism, whether 12 Years a Slave and Django Unchained are appropriate portraits of slavery, the best argument for reparations, how prepaid postage changed America, the second best Herman Melville book, why Ayn Rand and Margaret Mitchell are ignored by English departments, growing up the daughter of a tech entrepreneur, and why teachers should be like quarterbacks.

Here is one excerpt:

COWEN: You’ve written a good deal on the history of the postal service. How did the growth of the postal service change romance in America?

ROBBINS: Well, everybody could write a letter. [laughs] In 1844 — this was the other exciting thing that happened in the 1840s. Rowland Hill in England changed the postal service by inventing the idea of prepaid postage. Anybody could buy a stamp, and then you’d put the stamp on the letter and send the letter.

Prior to that, you had to go to the post office. You had to engage with the clerk. After the 1840s and after prepaid postage, you could just get your stamps, and anybody could send a letter. In fact, Frederick Douglass loved the idea of prepaid post for the ability for the enslaved to write and send letters. After that, people wrote letters to each other, letters home, letters to their lovers, letters to —

COWEN: When should you send a sealed letter? Because it’s also drawing attention to itself, right?

ROBBINS: Well, envelopes — it’s interesting that envelopes, sealed envelopes, came about 50 years after the post office became popular, so you didn’t really have self-sealing envelopes until the end of the 19th century.

COWEN: That was technology? Or people didn’t see the need for it?

ROBBINS: Technology, the idea of folding the envelope and then having it be gummed and self-sealing. There were a number of patents, but they kept breaking down. But technology finally resolved it at the end of the 19th century.

Prior to that, you would write in code. Also, paper was expensive, so you often wrote across the page horizontally and then turned it to the side and crossed the page, writing in the other direction. If somebody was really going to snoop on your letters, they had to work for it.

COWEN: On net, what were the social effects of the postal service?

ROBBINS: Well, communication. The post office and the need for the post office is in our Constitution.

COWEN: It was egalitarian? It was winner take all? It liberated women? It helped slaves? Or what?

ROBBINS: All those things.

COWEN: All those things.

ROBBINS: But yeah, de Tocqueville mentioned this in his great book in the 1830s that anybody — some farmer in Michigan — could be as informed as somebody in New York City.

And:

COWEN: Margaret Mitchell or Ayn Rand?

ROBBINS: Well, it’s interesting that two of the best-selling novelists of the 20th-century women are both equally ignored by English departments in universities. Margaret Mitchell and Gone with the Wind is paid attention to a little bit just because, as I said, it’s something that literature and film worked against, but not Ayn Rand at all.

And:

COWEN: What’s a paradigmatic example of a movie made better by a good soundtrack?

ROBBINS: The Pink Panther — Henry Mancini’s score. The movie is ridiculous, but Henry Mancini’s score — you’re going to be humming it now the rest of the day.

And:

COWEN: What is the Straussian reading of Babar the Elephant?

ROBBINS: When’s the last time you read it?

COWEN: Not long ago.

Recommended throughout.

Another day in the news

Dudley

Russian co-signed loans?

Suspension of British Parliament?

Planned Iranian drone attack on Israel?

What will it be tomorrow?