Category: Data Source

The high rate of employment for Mexicans in New York

In a time of widespread joblessness, Mexicans in New York have proved unusually adept at finding and keeping work. Of the city’s 10 largest immigrant groups, they have the highest rate of employment and are more likely to hold a job than New York’s native-born population, according to an analysis of the most recently available census data. They are even employed at a greater rate than Mexicans nationwide.

And as they have filled the city’s restaurant kitchens and building sites, they have acquired a reputation for an extraordinary work ethic.

There is more here. There are interesting implications for whether current unemployment is all about demand and whether marginal productivities justify the expected costs of hiring (some groups of) non-Mexicans:

One reason Mexicans have found work in such numbers, experts say, is that many are illegal immigrants, and less likely to report workplace abuses to the authorities for fear of deportation.

“Illegal immigrants are very convenient,” said Demetrios Papademetriou, president of the Migration Policy Institute, a nonpartisan research group in Washington. “Employers are quite interested in employing people who are willing to work and to overlook some labor laws.”

…Across the country, immigrants in general are more likely to be employed than the American-born. They tend to be more willing to move in pursuit of jobs and to take any job they can find, especially if they lack access to unemployment benefits.

New data on income inequality and finance

They confirm the central role of finance and in a piece I am writing for another outlet, I summarized some of the results as follows:

…for 2004, nonfinancial executives of publicly traded companies account for less than six percent of the top 0.01% income bracket. In that same year, the top twenty-five hedge fund managers combined appear to have earned more than all of the CEOs from the entire S&P 500. The number of Wall Street investors earning over $100 million a year was nine times higher than the public company executives earning that amount.

That is based on material from the Kaplan and Rauh paper in The Review of Financial Studies, 2010 (the final version is gated for many of you). I had blogged an earlier version of this paper (which was itself excellent), but the final revision has additional numbers of interest, plus a much richer discussion.

On-line "pre-publication" is wonderful, but let's not neglect the improvements in the subsequent drafts brought in part by…on-line pre-publication.

The Canterbury earthquake

The NZX 50 Index of stocks climbed in Wellington, led by building-related companies. Insurers fell. New Zealand’s dollar rose to 72.41 U.S. cents from 72.07 cents in New York on Sept. 3. The nation’s bonds declined, pushing 10-year yields to their highest in more than a month.

Here is more. The costs of repair are estimated at about two percent of gdp. Milk supply from New Zealand has not been disrupted.

Sentences to ponder, dubious distinctions edition

…as unemployment has skyrocketed in the U.S., we’ve overtaken the French in GDP per hour worked. We’re also ahead of Norway, an oil-and-gas-rich country that has a higher level of GDP per capita (PPP) than we do.

That is from Reihan, the link is here.

The Small Schools Myth

Did Bill Gates waste a billion dollars because he failed to understand the formula for the standard deviation of the mean? Howard Wainer makes the case in the entertaining Picturing the Uncertain World (first chapter with the Gates story free here). The Gates Foundation certainly spent a lot of money, along with many others, pushing for smaller schools. A lot of the push came because people jumped to the wrong conclusion when they discovered that the smallest schools were consistently among the best performing schools.

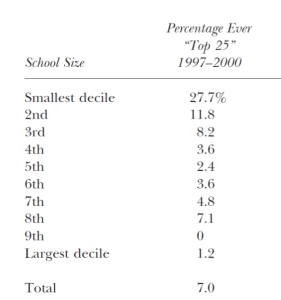

The chart at left, for example, shows by size the percentage of schools in North Carolina which were ever ranked in the top 25 of schools for performance. Notice that nearly 30% of the smallest decile (10%) of schools were in the top 25 at some point during 1997-2000 but only 1.2% of the schools in the largest decile ever made the top 25.

The chart at left, for example, shows by size the percentage of schools in North Carolina which were ever ranked in the top 25 of schools for performance. Notice that nearly 30% of the smallest decile (10%) of schools were in the top 25 at some point during 1997-2000 but only 1.2% of the schools in the largest decile ever made the top 25.

Seeing this data many people concluded that small schools were better and so they began to push to build smaller schools and break up larger schools. Can you see the problem?

The problem is that because small schools don’t have a lot of students, scores are much more variable. If for random reasons a few geniuses happen to enroll in a small school scores jump up for that year and if a few extra dullards enroll the next year scores fall.

Thus, for purely random reasons we would expect small schools to be among the best performing schools in any given year. Of course we would also expect small schools to be among the worst performing schools in any given year! And in fact, once we look at all the data, this is exactly what we see. The figure below shows changes in fourth grade math scores against school size. Note that small schools have more variable scores but there is no evidence at all that scores on average decrease with school size.

States like North Carolina which reward schools for big performance gains without correcting for size end up rewarding small schools for random reasons. Worst yet, the focus on small schools may actually be counter-productive because large schools do have important advantages such as being able to offer more advanced classes and better facilities.

All of this was laid out in 2002 in a wonderful paper I teach my students every year, Thomas Kane and Douglas Staiger’s The Promise and Pitfalls of Using Imprecise School Accountability Measures.

All of this was laid out in 2002 in a wonderful paper I teach my students every year, Thomas Kane and Douglas Staiger’s The Promise and Pitfalls of Using Imprecise School Accountability Measures.

In recent years Bill Gates and the Gates Foundation have acknowledged that their earlier emphasis on small schools was misplaced. Perhaps not coincidentally the Foundation recently hired Thomas Kane to be deputy director of its education programs.

Ignoring variance and how it relates to group size is a simple but common error. As Wainer notes, building on a discussion in Gelman and Nolan, counties with low cancer rates tend to be rural counties in the south, mid-west and west. Is it the clean country air or some other factor peculiar to rural counties which accounts for this fact? Probably not. The counties with the highest cancer rates also tend to be rural counties in the south, mid-west and west! Once again, small size and random variation appear to be the main culprit.

Herbert Hoover fact of the day

…real government purchases actually rose by 11.0% between 1929 and 1932, with federal government purchases alone growing 18.1% between 1929 and 1932.

Here is more, mostly on Germany. Here is my earlier post on automatic stabilizers. For the pointer I thank Yancey Ward.

How to interpret Germany, again

Here is one recent Paul Krugman post on Germany, here is another. Excerpt from the first:

Via Mark Thoma, Dean Baker points out that real government consumption of goods and services – that’s government buying things, as opposed to cutting taxes or handing out checks – has risen more in “austerity” Germany than in the United States.

In the second post:

Germany’s austerity policies have not yet begun – up to this point they’ve actually been quite Keynesian.

I would frame this debate with a few points:

1. Kindred put it well: "No one is saying Germany is an economic miracle. Some people, like Tyler Cowen, are saying that Germany's experience doesn't track very well with standard economic models and this fact needs to be acknowledged by those who loudly proffer policy advice…No one (that I've seen) is saying that Germany's turn-around is due to austerity." The good analyses of Germany credit the real economy and restructuring — the supply side — with credible fiscal policy as only one part of a broader story, while recognizing Germany already had higher government spending, high previous use of debt, and better automatic stabilizers.

2. The German recovery has been export-driven, which also suggests the role of domestic fiscal policy is secondary.

3. If Germany is so Keynesian, why did Krugman write in June: "And it’s also important to send a message to the Germans: we are not going to let them export the consequences of their obsession with austerity. Nicely, nicely isn’t working. Time to get tough."

It's fair enough for Krugman to simply admit he was wrong. But then he should…admit he was wrong (and also ponder what such an admission means for "get tough" trade policies). Maybe Krugman has a story about how he was talking only about their pending austerity, and approving of their current policies but simply failing to mention that at the time, but it's hard to get that impression from reading his corpus of 2010 writings on Germany.

4. Talk of exports as zero-sum has been dwindling. German imports have risen to new highs and it is also apparent that the Germany economy is a positive-sum locomotive for most other countries. And a lot of the German exports contribute to the productive capacity of other nations.

5. For well over a year, and also in earlier research, Krugman has repeatedly argued that AD-expanding policies work only if they are accompanied by a credible commitment to continue them in the future. Germany has exactly the opposite of such a commitment, indeed they have a fairly credible commitment to near-balance the budget by 2016. By Krugman's logic a) the German use of stimulus shouldn't work, and b) we shouldn't measure the German AD stance by checking current policies only and therefore we should not judge their overall fiscal policy as very expansionary. His current remarks on Germany leave aside this intertemporal perspective.

6. Across countries, the size of ramp-up stimulus doesn't seem to matter for recovery.

Why were the measured productivity gains so high in 2009?

You'll find the BLS statistics here, with a broader list of tables here. For the "Business Sector, output per hour," 2008 shows an overall growth rate of 1.1 percent.

The quarters of 2009 yield 6.1, 7.2, 8.3, and 3.5 percent growth rates.

The quarters of 2010 show 3.5 and 1.1 percent growth rates.

Total hours worked are falling through 2008 and falling at more than five percent by the third quarter of 2008.

In other words, there was a lot of "productivity growth" precisely when workers were being laid off, and not so much before or after. I interpret the "high productivity innovation" as the decision to lay the workers off, and the selection of workers, not the sudden advent and withdrawal of some new high productivity technology.

Further sentences to ponder, or my Arnold Kling imitation

I am aware that not everyone is happy with Rasmussen polls, still I think this result is striking, especially the difference in perspectives:

63% of the Political Class think the government has the consent of the governed, but only six percent (6%) of those with Mainstream views agree.

Seventy-one percent (71%) of all voters now view the federal government as a special interest group, and 70% believe that the government and big business typically work together in ways that hurt consumers and investors.

The link is here, with further information, and I thank Roger Congleton for the pointer.

Pakistan fact of the day

To put matters in their depressing context, the number of children who perish daily from water-related diseases is several times higher than the rate at which people perished in last week's devastating floods.

There is more here. The article, which is interesting throughout, focuses on the multiple problems in Pakistani water policy.

LA Times Ranks Teachers

The LA Times investigative report on teacher quality is groundbreaking. The teacher’s union has already started a boycott but, as the shock recedes, I think this is going to be emulated throughout the country. It should have been done decades ago.

The Times obtained seven years of math and English test scores from the Los Angeles Unified School District and used the information to estimate the effectiveness of L.A. teachers – something the district could do but has not.

The Times used a statistical approach known as value-added analysis, which rates teachers based on their students’ progress on standardized tests from year to year. Each student’s performance is compared with his or her own in past years, which largely controls for outside influences often blamed for academic failure: poverty, prior learning and other factors….

In coming months, The Times will publish a series of articles and a database analyzing individual teachers’ effectiveness in the nation’s second-largest school district – the first time, experts say, such information has been made public anywhere in the country.

Not much data is available yet but what is astounding is that the LA Times will release information on individual teachers. The graphic below, for example, is not an illustration it is real information on the real teachers named. To understand the importance of these differences note that:

After a single year with teachers who ranked in the top 10% in effectiveness, students scored an average of 17 percentile points higher in English and 25 points higher in math than students whose teachers ranked in the bottom 10%. Students often backslid significantly in the classrooms of ineffective teachers, and thousands of students in the study had two or more ineffective teachers in a row.

With better information there is a possibility that teachers will improve. Simply knowing that other teachers do better will encourage the lower performing teachers to ask why and to emulate best practices.

Unfortunately, we have little idea how to train good teachers. The best we may be able to do is to throw a bunch of people into the classroom and measure what happens but for that strategy to work it needs to be followed up with firings. Indeed, one recent study (see here for another explanation) found that the optimal system–given our current knowledge and the importance of teacher effects–is to hire a lot of teachers on probation and then fire 80% after two years, yes 80%.

I don’t blame the unions for being up in arms and I feel for the teachers, for some of them this is going to be a shock and an embarrassment. We cannot simultaneously claim, however, that teachers are vitally important for the future of our children and also that their effectiveness should not be measured. As systems like this become more common students will benefit enormously and so will teachers.

Moreover, I see this as a turning point. Once parents have this kind of information who will allow their child to be in a class with a teacher in the bottom ranks of effectiveness? And if LA can do it why not Chicago and Fairfax?

Many people said that information technology would revolutionize teaching but few had this in mind.

Addendum: Details on methods here.

Parking fact of the day

Several studies have found that cruising for curb parking generates about 30 percent of the traffic in central business districts. In a recent survey conducted by Bruce Schaller in the SoHo district in Manhattan, 28 percent of drivers interviewed while they were stopped at traffic lights said they were searching for curb parking. A similar study conducted by Transportation Alternatives in the Park Slope neighborhood in Brooklyn found that 45 percent of drivers were cruising.

…What causes this astonishing waste? As is often the case, the prices are wrong. A national study of downtown parking found that the average price of curb parking is only 20 percent that of parking in a garage, giving drivers a strong incentive to cruise.

Here is more, from Donald Shoup.

Australia fact of the day

Which country's stock market has been the best performer in the world — not just over the past year or decade, but over the last 110 years?

It's Australia, which stands above all others in its combination of higher returns and lower volatility.

While they speak our language, and we have some common origins, they have hitched their wagon to the dynamic growth of Asia. And it's paid off, as Australia has had the best performing stock market in the world from 1900 to 2009.

Australia posted 7.5% after-inflation returns per year during that time, with a standard deviation of 18.2%, according to a study from Credit Suisse. Those returns are the highest and the volatility the second lowest of the 19 major markets the researchers studied.

During that time, U.S. stocks made a 6.2% return, with a standard deviation of 20.4%. That means investors would have made more money in Australian stocks with less volatility than in the U.S. or any other major market over that long stretch.

The full story is here and hat tip goes to Ann Jessica Lien on Twitter.

Question: does this mean that Australia is really good, economically speaking, or simply not thought very much of by others?

CAPTCHA Economics

CAPTCHA (Completely Automated Public Turing test to tell Computers and Humans Apart) are the distorted text puzzles that are designed to keep spammers out of websites. Although some AI systems have been developed to solve CAPTCHAs the market has discovered that it is cheaper to farm out the problems to workers in developing countries.

Here is an amazingly detailed investigation from researchers at UC San Deigo of the market for solving CAPTCHAs.

Bottom line:

- Prices run about $1 per thousand CAPTCHAs solved, depending on the time of

day and demand.

- The median response time to solve a CAPTCHA is 14

seconds and accuracy runs about 90%.

- “[T]he

business of solving CAPTCHAs,…is a well developed, highly-competitive industry with the capacity to solve on the order of a million CAPTCHAs per

day.”

Hat tip: Mim’s Bits.

Wichita fact of the day

It is, in percentage terms, the most export-oriented city in the United States.

According to a study published late last month by the Brookings Institution, a Washington think-tank, nearly 28 per cent of the city’s gross metropolitan product is sold abroad. That makes it the most export-oriented in the country, just ahead of Portland, Oregon – noted for its computer and electronics companies – and San Jose in California’s Silicon Valley.

Can you say "small aircraft"?