Category: Law

The MR Podcast: Our Favorite Models, Session 3: Compensating Differentials and Selective Incentives

On The Marginal Revolution Podcast this week, Tyler and I discuss compensating differentials and Olsonian selective incentives. Here’s one bit:

If you think about the gender wage gap, it’s sometimes said that women earn—it varies—80 cents for every dollar that a man earns. That doesn’t control for anything. Once you control for education and skill and so forth, this gets smaller. Then you also have to control for these quite difficult, elusive sometimes, job amenities. Claudia Goldin, for example, has pointed out that men are much more willing to take jobs requiring inflexible hours.

COWEN: And longer hours, too.

TABARROK: Longer hours and inflexible hours, where your hours are less under your control. That’s what I mean by inflexible. For example, in one study of train and bus drivers, the train and bus drivers are paid equally by gender. There’s no differences whatsoever in what they’re paid on an hourly basis. It turns out that the male drivers, their wages, their returns are much higher because they take a lot more overtime. They take 83% more overtime than their female colleagues. They’re much more likely to accept an overtime shift, which pays time and a half. The male workers also take fewer unpaid hours off. The male salaries on a yearly basis end up being higher, even though males and females are paid equally.

Now, you can roll this back and say that’s because of the unfair demands on women of childcare or something like that, but it’s not a market discrimination. It’s not market discrimination. It’s a compensating differential. Males earn more because they’re more willing to take the inflexible overtime hours and so forth.

One of the most interesting ones is that Uber drivers, male drivers earn a little bit more. Now, obviously, there’s no gender difference whatsoever in how the drivers are paid. It just turns out that male drivers just drive a little bit faster.

COWEN: I’ve noticed this, by the way, when I take Ubers.

TABARROK: On an annual basis, they make about 7% more. Now, again, it’s not entirely obvious that this is even better for the male drivers. Maybe they’re taking a little bit more risk. Maybe they’re a little bit more likely to get into an accident as well.

….COWEN: …Someone gets the short end of the stick. Not only women, but maybe women on average would be more likely to suffer.

TABARROK: I’m not sure it’s the short end of the stick, though I agree with increasing returns, that the people who work longer hours will also earn higher salaries and maybe have plush offices and so forth. Let me put it this way. One of the things which I think the feminism story sometimes gets a little bit wrong is to actually underestimate the value that women get, and that men can get as well, of childcare, of looking after kids, of spending more time at home, or spending more time doing childcare. That can be extremely valuable. At the end of life, who writes on their tombstone, “I wish I could have worked more”?

COWEN: You’re looking at one.

TABARROK: Present company excepted.

Here’s the episode. Subscribe now to take a small step toward a much better world: Apple Podcasts | Spotify | YouTube.

Public housing and economic opportunity

This paper studies the long-term neighborhood effects of the American public housing program, one of the largest and most controversial American urban policies of the 20th century. I construct a new national dataset tracking the locations, completion dates, and characteristics of over 1 million public housing units built between 1935 and 1973, which I link to neighborhood-level data from 1930 to2010. Ifirstshowthatpublichousingprojects were systematically targeted towards initially poorer, more populated neighborhoods with higher Black population shares, reflecting the program’s slum clearance goals and racialized site selection politics. Using a stacked matched difference-in-differences approach, I estimate causal effects of public housing construction on neighborhood change by comparing treated neighborhoods to matched control areas within the same county based on pre-treatment characteristics that predict placement. Public housing neighborhoods experienced large, persistent increases in Black population and population shares and substantial declines in median incomes and rents. Geographic spillovers to nearby neighborhoods were limited: median incomes declined modestly, but demographic composition remained relatively stable on average. I find evidence consistent with neighborhood tipping dynamics: neighborhoods with initial Black shares in a plausible tipping range experienced substantial white population outflows in response to public housing construction. Linking to modern mobility data, I show that children from low-income families who grew up in public housing neighborhoods experienced significantly lower rates of upward mobility. These f indings demonstrate that, despite intentions of slum clearance and neighborhood revitalization, public housing reinforced existing patterns of economic and racial segregation and reduced long-run economic opportunity, although effects were largely confined to project neighborhoods themselves.

That is from a new paper by Beau Bressler at UC Davis. Beau is on the job market this year, here is his home page.

My Conversation with the excellent Jonny Steinberg

Here is the audio, video, and transcript. Here is the episode summary:

Tyler considers Winnie and Nelson: Portrait of a Marriage one of the best books of the last decade, and its author Jonny Steinberg one of the most underrated writers and thinkers—in North America, at least. Steinberg’s particular genius lies in getting uncomfortably close to difficult truths through immersive research—spending 350 hours in police ride-alongs, years studying prison gangs and their century-old oral histories, following a Somali refugee’s journey across East Africa—and then rendering what he finds with a novelist’s emotional insight.

Tyler and Jonny discuss why South African police only feel comfortable responding to domestic violence calls, how to fix policing, the ghettoization of crime, how prison gangs regulate behavior through century-old rituals, how apartheid led to mass incarceration and how it manifested in prisons, why Nelson Mandela never really knew his wife Winnie and the many masks they each wore, what went wrong with the ANC, why the judiciary maintained its independence but not its quality, whether Tyler should buy land in Durban, the art scene in Johannesburg, how COVID gave statism a new lease on life, why the best South African novels may still be ahead, his forthcoming biography of Cecil Rhodes, why English families weren’t foolish to move to Rhodesia in the 1920s, where to take an ideal two-week trip around South Africa, and more.

Excerpt:

COWEN: My favorite book of yours again is Winnie and Nelson, which has won a number of awards. A few questions about that. So, they’re this very charismatic couple. Obviously, they become world-historical famous. For how long were they even together as a pair?

STEINBERG: Very, very briefly. They met in early 1957. They married in ’58. By 1960, Mandela was no longer living at home. He was underground. He was on the run. By 1962, he was in prison. So, they were really only living together under the same roof for two years.

COWEN: And how well do you feel they knew each other?

STEINBERG: Well, that’s an interesting question because Nelson Mandela was very, very in love with his wife, very besotted with his wife. He was 38, she was 20 when they met. She was beautiful. He was a notorious philanderer. He was married with three children when they met. He really was besotted with her. I don’t think that he ever truly came to know her. And when he was in prison, you can see it in his letters. It’s quite remarkable to watch. She more and more becomes the center of meaning in his life, his sense of foundation, his sense of self as everything else is falling away.

And he begins to love her more and more, and even to coronate her more and more so that she doesn’t forget him. His letters grow more romantic, more intense, more emotional. But the person he’s so deeply in love with is really a fiction. She’s living a life on the outside. And you see this very troubling line between fantasy and reality. A man becoming deeply, deeply involved with a woman who is more and more a figment of his imagination.

COWEN: Do you think you learned anything about marriage more generally from writing this book?

STEINBERG: [laughs] One of the sets of documents that I came across in writing the book were the transcripts of their meetings in the last 10 years of his imprisonment. The authorities bugged all of his meetings. They knew they were being bugged, but nonetheless, they were very, very candid with each other. And you very unusually see a marriage in real time and what people are saying to each other. And when I read those lines, 10 different marriages that I know passed through my head: the bickering, the lying, the nasty things that people do to one another, the cruelties. It all seemed very familiar.

COWEN: How is it you think she managed his career from a distance, so to speak?

STEINBERG: Well, she was a really interesting woman. She arrived in Johannesburg, 20 years old in the 1950s, where there was no reason to expect a woman to want a place in public life, particularly not in the prime of public life. And she was absolutely convinced that there was no position she should not occupy because she was a woman. She wanted a place in politics; she wanted to exercise power. But she understood intuitively that in that time and place, the way to do that was through a man. And she went after the most powerful rising political activists available.

I don’t think it was quite as cynical as that. She loved him, but she absolutely wanted to exercise power, and that was a way to do it. Once she became Mrs. Mandela, I think she had an enormously aristocratic sense of politics and of entitlement and legitimacy. She understood herself to be South Africa’s leader by virtue of being married to him, and understood his and her reputations as her projects to endeavor to keep going. And she did so brilliantly. She was unbelievably savvy. She understood the power of image like nobody else did, and at times saved them both from oblivion.

COWEN: This is maybe a delicate question, but from a number of things I read, including your book, I get the impression that Winnie’s just flat out a bad person…

Interesting throughout, this is one of my favorite CWT episodes, noting it does have a South Africa focus.

Informative jury disagreement

The article introduces a counterintuitive argument, contending that jury disagreement on the defendant’s guilt-a nonunanimous conviction-may well provide a more informative signal, compared to consensus. Because stronger consensus implies higher likelihood of herding, it is shown that beyond some threshold, further accumulation of votes to convict would carry negligible epistemic contribution, barely enhancing the posterior probability of guilt. On the other hand, while dissenting votes provide a direct signal of innocence, they indicate that herding has not been involved in the decision-making process, hence increase the epistemic contribution of any vote generated by said processincluding votes to convict-and may thus offer an indirect signal of guilt, potentially increasing the posterior. This unravels the informational value of dissent and the possible disadvantageousness of consensus.

That is from a new paper by Roy Baharad, via the excellent Kevin Lewis.

Privatizing Law Enforcement: The Economics of Whistleblowing

The False Claims Act lets whistleblowers sue private firms on behalf of the federal government. In exchange for uncovering fraud and bringing the case, whistleblowers can receive up to 30% of any recovered funds. My work on bounty hunters made me appreciate the idea of private incentives in the service of public goals but a recent paper by Jetson Leder-Luis quantifies the value of the False Claims Act.

Leder-Luis looks at Medicare fraud. Because the government depends heavily on medical providers to accurately report the services they deliver, Medicare is vulnerable to misbilling. It helps, therefore, to have an insider willing to spill the beans. Moreover, the amounts involved are very large giving whistleblowers strong incentives. One notable case, for example, involved manipulating cost reports in order to receive extra payments for “outliers,” unusually expensive patients.

On November 4, 2002, Tenet Healthcare, a large investor-owned hospital company, was sued under the False Claims Act for manipulating its cost reports in order to illicitly receive additional outlier payments. This lawsuit was settled in June 2006, with Tenet paying $788 million to resolve these allegations without admission of guilt.

The savings from the defendants alone were significant but Leder-Luis looks for the deterrent effect—the reduction in fraud beyond the firms directly penalized. He finds that after the Tenet case, outlier payments fell sharply relative to comparable categories, even at hospitals that were never sued.

Tenet settled the outlier case for $788 million, but outlier payments were around $500 million per month at the time of the lawsuit and declined by more than half following litigation. This indicates that outlier payment manipulation was widespread… for controls, I consider the other broad types of payments made by Medicare that are of comparable scale, including durable medical equipment, home health care, hospice care, nursing care, and disproportionate share payments for hospitals that serve many low-income patients.

…the five-year discounted deterrence measurement for the outlier payments computed is $17.46 billion, which is roughly nineten times the total settlement value of the outlier whistleblowing lawsuits of $923 million.

[Overall]…I analyze four case studies for which whistleblowers recovered $1.9 billion in federal funds. I estimate that these lawsuits generated $18.9 billion in specific deterrence effects. In contrast, public costs for all lawsuits filed in 2018 amounted to less than $108.5 million, and total whistleblower payouts for all cases since 1986 have totaled $4.29 billion. Just the few large whistleblowing cases I analyze have more than paid for the public costs of the entire whistleblowing program over its life span, indicating a very high return on investment to the FCA.

As an aside, Leder-Luis uses synthetic control but allows the controls to come from different time periods. I’m less enthused by the method because it introduces another free parameter but given the large gains at small cost from the False Claims Act, I don’t doubt the conclusion:

The results of this analysis suggest that privatization is a highly effective way to combat fraud. Whistleblowing and private enforcement have strong deterrence effects and relatively low costs, overcoming the limited incentives for government-conducted antifraud enforcement. A major benefit of the False Claims Act is not just the information provided by the whistleblower but also the profit motive it provides for whistleblowers to root out fraud.

What should I ask Dan Wang?

Yes, I will be doing a podcast with him. Dan first became famous on the internet with his excellent Christmas letters. More recently, Dan is the author of the NYT bestselling book Breakneck: China’s Quest to Engineer the Future.

Here is Dan Wang on Wikipedia, here is Dan on Twitter. I have known him for some while. So what should I ask him?

The median voter model, or the Becker pressure group model?

Or perhaps a game-theoretic model between the President and the Supreme Court? From the WSJ:

President Trump in recent weeks has exempted dozens of products from his so-called reciprocal tariffs and offered to carve out hundreds more goods from farm products to airplane parts when countries strike trade deals with the U.S.

The offer to exempt more products from tariffs reflects a growing sentiment among administration officials that the U.S. should lower levies on goods that it doesn’t domestically produce, say people familiar with administration planning. That notion “has been emerging over time” within the administration, said Everett Eissenstat, deputy director of the National Economic Council in Trump’s first term. “There is definitely that recognition.”

The move comes ahead of a Supreme Court hearing in early November on the reciprocal tariffs—a case that could force the administration to pay back many of the levies if it loses in court. The White House, Commerce Department and U.S. Trade Representative’s office didn’t respond to requests for comment.

I suppose that is good news, but of course it can introduce more cross-product and cross-nation distortions as well.

The Economic Geography of American Slavery

What would the antebellum American economy have looked like without slavery? Using new micro-data on the U.S. economy in 1860, we document that where free and enslaved workers live and how much they earn correlates strongly—but differently—with geographic proxies for agricultural productivity, disease, and ease of slave escape. To explain these patterns, we build a quantitative spatial model of slavery, where slaveholders coerce enslaved workers into supplying more labor, capture the proceeds of their labor, and assign them to sectors and occupations that maximize owner profits rather than worker welfare. Combining theory and data, we then quantify how dismantling the institution of slavery affected the spatial economy. We find that the economic impacts of emancipation are substantial, generating welfare gains for the enslaved of roughly 1,200%, while reducing welfare of free workers by 0.7% and eliminating slaveholder profit. Aggregate GDP rises by 9.1%, with a contraction in agricultural productivity counteracted by an expansion in manufacturing and services driven by an exodus of formerly enslaved workers out of agriculture and into the U.S. North.

That is from a new NBER working paper by

AI and the First Amendment

The more that outputs come from generative AI, the more the “free speech” treatment of AIs will matter, as I argue in my latest column for The Free Press. Here is one excerpt, quite separate from some of my other points:

Another problem is that many current bills, including one already passed in California, require online platforms to disclose which of their content is AI-generated, in the interest of transparency. That mandate has some good features, and in the short run it may be necessary to ease people’s fears about AI. But I am nervous about its longer-run implications.

Let’s say that most content evolves to be jointly produced by humans and AI, and not always in a way where all the lines are clear (GPT-5 did proofread this column, to look for stylistic errors, and check for possible improvements). Does all joint work have to be reported as such? If not, does a single human tweak to AI-generated material mean that no reporting is required?

And if joint work does have to be reported as joint, won’t that level of requirement inevitably soon apply to all output? Who will determine if users accurately report their role in the production of output? And do they have to keep records about this for years? The easier it becomes for individual users to use AI to edit output, the less it will suffice to impose a single, supposedly unambiguous reporting mandate on the AI provider.

I am not comfortable with the notion that the government has the legal right to probe the origin of a work that comes out under your name. In addition to their impracticality, such laws could become yet another vehicle for targeting writers, visual artists, and musicians whom the government opposes. For example, if a president doesn’t like a particular singer, he can ask her to prove that she has properly reported all AI contributions to her recordings.

I suspect this topic will not prove popular with many people. If you dislike free speech, you may oppose the new speech opportunities opened up by AIs (just build a bot and put it out there to blog, it does not have to be traceable to you). If you do like free speech, you will be uncomfortable with the much lower marginal cost of producing “license,” resulting from AI systems. Was the First Amendment really built to handle such technologies?

In my view free speech remains the best constitutional policy, but I do not expect AI systems to make it more popular as a concept. It is thus all the more important that we fight for free speech rights heading into the immediate future.

China understands negative emotional contagion

China’s censors are moving to stamp out more than just political dissent online. Now, they are targeting the public mood itself — punishing bloggers and influencers whose weary posts are resonating widely in a country where optimism is fraying.

The authorities have punished two bloggers who advocated for a life of less work and less pressure; an influencer who said that it made financial sense not to marry and have children; and a commentator known for bluntly observing that China still lags behind Western countries in terms of quality of life.

These supposed cynics and skeptics, two of whom had tens of millions of followers, have had their accounts suspended or banned in recent weeks as China’s internet regulator conducts a new cleanup of Chinese social media. The two-month campaign, launched by the Cyberspace Administration of China in late September, is aimed at purging content that incites “excessively pessimistic sentiment” and panic or promotes defeatist ideas such as “hard work is useless,” according to a notice from the agency.

Here is more from Lily Kuo from the NYT. If you are spreading negative emotional contagion, there is a very good chance that, no matter what you are saying, that you are part of the problem. A more fundamental division these days than Left vs. Right.

Claims about polygyny

The title of this piece is “High rates of polygyny do not lock large proportions of men out of the marriage market.” I believe further investigation is warranted before drawing such conclusions, but here is the abstract:

Social scientists often assume that when men can marry multiple wives (polygyny), many other men will be unable to marry. Versions of this assumption feature prominently in theories of civil war, the evolution of monogamy, and the incel movement. Using census data from 30 countries across Africa, Asia, and Oceania, as well as data from the historical United States, we find no clear evidence that polygyny is associated with higher proportions of unmarried men in society. Instead, high-polygyny populations often have marriage markets skewed in favor of men, and actually, men in high-polygyny populations usually marry more than men in low-polygyny ones. These findings challenge entrenched assumptions and inform debates on marriage systems, societal stability, and human rights.

That is from a recent paper by Hampton Gaddy, Rebecca Sear, and Laura Fortunato. At the very least, you hear the contrary story so often, and without firm documentation, that it is worth shaking the debate here a little bit.

Why we should not auction off all H1-B visas

I am fine with auctioning off some of them, but it should not be the dominant allocation mechanism. The visas work best when they support young talents who are unproven and perhaps liquidity constrained. Sundar Pichai was not a big star when he received his H1-B.

How about the business paying? Well, that is hard for a lot of start-ups. McKinsey, the employer who got Sundar his visa, might have coughed up the 100k, but Sundar did not stay there very long, only about two years. Which is what you might expect from the most talented, upwardly mobile candidates. That will discourage even well-capitalized businesses from making these investments, or they might try to lock in their new hires more than is currently the case.

So a pure auction mechanism probably is not optimal here, even though again it is fine to auction off some of the slots.

AI and the FDA

Dean Ball has an excellent survey of the AI landscape and policy that includes this:

The speed of drug development will increase within a few years, and we will see headlines along the lines of “10 New Computationally Validated Drugs Discovered by One Company This Week,” probably toward the last quarter of the decade. But no American will feel those benefits, because the Food and Drug Administration’s approval backlog will be at record highs. A prominent, Silicon Valley-based pharmaceutical startup will threaten to move to a friendlier jurisdiction such as the United Arab Emirates, and they may in fact do it.

Eventually, I expect the FDA and other regulators to do something to break the logjam. It is likely to perceived as reckless by many, including virtually everyone in the opposite party of whomever holds the White House at the time it happens. What medicines you consume could take on a techno-political valence.

Agreed—but the nearer-term upside is repurposing. Once a drug has been FDA approved for one use, physicians can prescribe it for any use. New uses for old drugs are often discovered, so the off-label market is large. The key advantage of off-label prescribing is speed: a new use can be described in the medical literature and physicians can start applying that knowledge immediately, without the cost and delay of new FDA trials. When the RECOVERY trial provided evidence that an already-approved drug, dexamethasone, was effective against some stages of COVID, for example, physicians started prescribing it within hours. If dexamethasone had had to go through new FDA-efficacy trials a million people would likely have died in the interim. With thousands of already approved drugs there is a significant opportunity for AI to discover new uses for old drugs. Remember, every side-effect is potentially a main effect for a different condition.

On Ball’s main point, I agree: there is considerable room for AI-discovered drugs, and this will strain the current FDA system. The challenge is threefold.

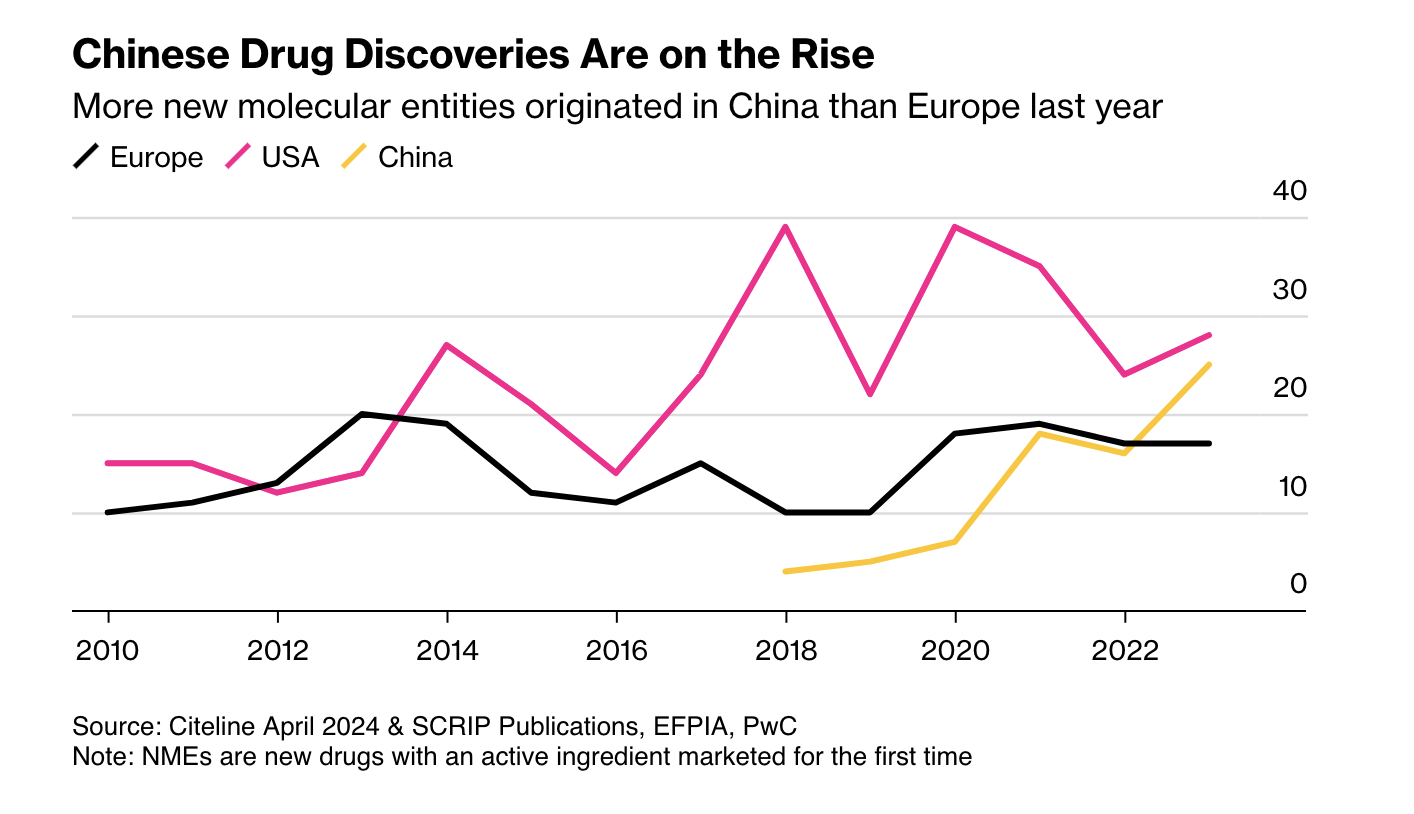

First, as Ball notes, more candidate drugs at lower cost means other regulators may become competitive with the FDA. China is the obvious case: it is now large and wealthy enough to be an independent market, and its regulators have streamlined approvals and improved clinical trials. More new drugs now emerge from China than from Europe.

Second, AI pushes us toward rational drug design. RCTs were a major advance, but they are in some sense primitive. Once a mechanic has diagnosed a problem, the mechanic doesn’t run a RCT to determine the solution. The mechanic fixes the problem! As our knowledge of the body grows, medicine should look more like car repair: precise, targeted, and not reliant on averages.

Closely related is the rise of personalized medicine. As I wrote in A New FDA for the Age of Personalized, Molecular Medicine:

Each patient is a unique, dynamic system and at the molecular level diseases are heterogeneous even when symptoms are not. In just the last few years we have expanded breast cancer into first four and now ten different types of cancer and the subdivision is likely to continue as knowledge expands. Match heterogeneous patients against heterogeneous diseases and the result is a high dimension system that cannot be well navigated with expensive, randomized controlled trials. As a result, the FDA ends up throwing out many drugs that could do good.

RCTs tell us about average treatment effects, but the more we treat patients as unique, the less relevant those averages become.

AI holds a lot of promise for more effective, better targeted drugs but the full promise will only be unlocked if the FDA also adapts.

Michael Clemens on H1-B visas

From 1990 to 2010, rising numbers of H-1B holders caused 30–50 percent of all productivity growth in the US economy. This means that the jobs and wages of most Americans depend in some measure on these workers.

The specialized workers who enter on this visa fuel high-tech, high-growth sectors of the 21st century economy with skills like computer programming, engineering, medicine, basic science, and financial analysis. Growth in those sectors sparks demand for construction, food services, child care, and a constellation of other goods and services. That creates employment opportunities for native workers in all sectors and at all levels of education.

This is not from a textbook narrative or a computer model. It is what happened in the real world following past, large changes in H-1B visa restrictions. For example, Congress tripled the annual limit on H-1B visas after 1998, then slashed it by 56 percent after 2004. That produced large, sudden shocks to the number of these workers in some US cities relative to others. Economists traced what happened to various economic indicators in the most-affected cities versus the least-affected but otherwise similar cities. The best research exhaustively ruled out other, confounding forces.

That’s how we know that workers on H-1B visas cause dynamism and opportunity for natives. They cause more patenting of new inventions, ideas that create new products and even new industries. They cause entrepreneurs to found more (and more successful) high-growth startup firms. The resulting productivity growth causes more higher-paying jobs for native workers, both with and without a college education, across all sectors. American firms able to hire more H-1B workers grow more, generating far more jobs inside and outside the firm than the foreign workers take.

An important, rigorous new study found the firms that win a government lottery allowing them to hire H-1B workers produce 27 percent more than otherwise-identical firms that don’t win, employing more immigrants but no fewer US natives—thus expanding the economy outside their own walls. So, when an influx of H-1B workers raised a US city’s share of foreign tech workers by 1 percentage point during 1990–2010, that caused7 percent to 8 percent higher wages for college-educated workers and 3 percent to 4 percent higher wages for workers without any college education.

Here is the full piece.

H1-B visa fees and the academic job market

Assume the courts do not strike this down (perhaps they will?).

Will foreigners still be hired at the entry level with an extra 100k surcharge? I would think not,as university budgets are tight these days. I presume there is some way to turn them down legally, without courting discrimination lawsuits?

What if you ask them to accept a lower starting wage? A different deal in some other manner, such as no summer money or a higher teaching load? Is that legal? Will schools have the stomach to even try? I would guess not. Is there a way to amortize the 100k over five or six years? What if the new hire leaves the institution in year three of the deal?

In economics at least, a pretty high percentage of the graduate students at top institutions do not have green cards or citizenships.

So how exactly is this going to work? There are not so many jobs in Europe, not enough to absorb those students even if they wish to work there. Will many drop out right now? And if the flow of graduate students is not replenished, given that entry into the US job market is now tougher, how many graduate programs will close up?

Will Chinese universities suddenly hire a lot more quality talent?

Here is some related discussion on Twitter.

As they say, solve for the equilibrium…