Category: Law

AI Physicians At Last

In 2004 (!) I wrote:

Many people complain that medicine is too impersonal. I think it is not impersonal enough. I have nothing against my physician (a local magazine says he is one of the best in the area) but I would prefer to be diagnosed by a computer. A typical physician spends most of the day playing twenty questions. Where does it hurt? Do you have a cough? How high is the patient’s blood pressure? But an expert system can play twenty questions better than most people. An expert system can use the best knowledge in the field, it can stay current with the journals, and it never forgets.

It took longer than it should have, but we are finally here. Today, most people already use AI to help diagnose and manage medical conditions, and now:

Utah is letting artificial intelligence — not a doctor — renew certain medical prescriptions. No human involved.

It’s a pilot program for routine renewals but a welcome start. The AMA, of course, is not pleased.

In a statement, Dr. John Whyte, CEO and executive vice president at the American Medical Association, said: “While AI has limitless opportunity to transform medicine for the better, without physician input it also poses serious risks to patients and physicians alike.”

One concern is misuse or abuse, including the possibility that people struggling with addiction could try to game automated systems to obtain drugs inappropriately. Another concern is missing subtle clinical red flags or drug interactions that a doctor would catch.

It’s amazing that anyone can say these things with a straight face. As far as I know, AI has never run a pill mill, unlike human physicians. And the AI

“missing subtle clinical red flags or drug interactions that a doctor would catch.” Is this a joke?

The downside of NAFTA?

We study how NAFTA changed the geography of violence in Mexico. We propose that this open border policy increased trafficking profits of Mexican cartels, resulting in violent competition among them. We test this hypothesis by comparing changes in drug-related homicides after NAFTA’s introduction in 1994 across municipalities with and without drug-trafficking routes. Routes are predicted least cost paths connecting municipalities with a recent history of detected drug trafficking with U.S. land ports of entry. On these routes, homicides increase by 2.1 per 100,000 inhabitants, which is equivalent to 26% of the pre-NAFTA mean. These results cannot be explained by changes in worker’s opportunity costs of using violence resulting from the trade shock.

That is from a new JDE paper by Eduardo Hidalgo, Erik Horning, and Pablo Selaya. Via the excellent Kevin Lewis.

Chairman Powell’s Statement

Whether an independent Fed is desirable is beside the point. The core issue is lawfare: the strategic use of legal processes to intimidate, constrain, and punish institutional actors for political ends. Lawfare is the hallmark of a failing state because it erodes not just political independence, but the capacity for independent judgment.

What sort of people will work at the whim of another? The inevitable result is toadies and ideological loyalists heading complex institutions, rather than people chosen for their knowledge and experience.

It is time to back off from Greenland

I do hope it falls eventually into U.S. hands, as I explain in my latest Free Press piece. But now is not the time and furthermore that should happen voluntarily, not coercively. Here is an excerpt:

The better approach is to let the Greenlanders choose independence on their own. They may be ready to do so. In a survey last year, 56 percent of Greenlanders favored independence from Denmark, with just 28 percent opposed. This should not be a tremendous surprise. The Danes have not always treated Greenland well; the legacy of Denmark taking away the children of Greenlanders 75 years ago still remains—and similar issues crop up to this day.

If and when Greenlanders do choose independence, the U.S. should, when conditions feel right, make a generous offer to Greenland. If they do not take the offer, we might try again later on, but we should not intimidate or coerce them. We should respect their right of independence throughout the process. That would increase the likelihood that the future partnership will be a cooperative and fruitful one.

The courtship could take 20 or 30 years, but I am pretty sure that eventually Greenlanders will see the benefits of a stronger U.S. affiliation.

I do not think that simply trying to “buy” Greenland is going to work. I am reminded of my own fieldwork, roughly 20 years ago, in a small Mexican village in the state of Guerrero. General Motors wanted to buy most of the land in and around the village, for the purpose of building a racetrack to test GM cars. It had a lot of money to offer, and at the time a family of seven in the village might have earned no more than $1,500 a year. But the negotiations never got very far. The villagers felt they were not being respected, they did not trust the terms of any deal, and they feared their ways of life would change irrevocably. The promise of better roads, schools, and doctors—in addition to whatever payments they might have negotiated—simply fell flat.

These are very important issues, so we need to get them right.

The Tyranny of the Complainers

Some years ago, Dourado and Russell pointed out a stunning fact about airport noise complaints: A very large number come from a single individual or household.

In 2015, for example, 6,852 of the 8,760 complaints submitted to Ronald Reagan Washington National Airport originated from one residence in the affluent Foxhall neighborhood of northwest Washington, DC. The residents of that particular house called Reagan National to express irritation about aircraft noise an average of almost 19 times per day during 2015.

Since then, total complaint volumes have exploded—but they are still coming from a tiny number of now apparently more “productive” individuals. In 2024, for example, one individual alone submitted 20,089 complaints, accounting for 25% of all complaints! Indeed, the total number of complainants was only 188 but they complained 79,918 times (an average of 425 per individual or more than one per day.)

What I learned recently is that it’s not just airport noise complaints. We see the same pattern in data from the US Department of Education’s Office for Civil Rights which enforces federal civil rights laws related to education funding. In 2023, for example, 5059 sexual discrimination complaints came from a single individual–from a total of 8151 complaints. Thus, one individual accounted for 68.5% of all sexual discrimination complaints in that year.

In the annual reports for 2022-2024 the OCR identifies what type of complaint the single-individual with multiple complaints was making, a sex discrimination complaint, while in previous years they just give data on the number of complaints from single individuals compared to the total of all types of complaints. I’ve collated this data in this graph which presents totals compared to multiple complaints from a single individual without regard to the type of complaint. Do note, that there are also single individuals filing hundreds of other types of complaints such as age discrimination complaints so the data from more recent years may actually be an underestimate.

In any case, it’s clear that a single individual often accounts for 10-30% of all complaints! These complaints have to be investigated so this single individual may be costing taxpayers millions. It’s as if a single individual were pulling a fire alarm thousands of times a year, mobilizing emergency services on demand, and never facing repercussions.

Does this strategy work? Probably. When complaints are summarized for Congress or reported in the media, are totals presented as-is, or adjusted for spam?

Increasingly, public institutions seem to exist to manage the obsessions of a tiny number of neurotic—and possibly malicious—complainers.

My excellent Conversation with Brendan Foody

Here is the audio, video, and transcript. Here is the episode summary:

At 22, Brendan Foody is both the youngest Conversations with Tyler guest ever and the youngest unicorn founder on record. His company Mercor hires the experts who train frontier AI models—from poets grading verse to economists building evaluation frameworks—and has become one of the fastest-growing startups in history.

Tyler and Brendan discuss why Mercor pays poets $150 an hour, why AI labs need rubrics more than raw text, whether we should enshrine the aesthetic standards of past eras rather than current ones, how quickly models are improving at economically valuable tasks, how long until AI can stump Cass Sunstein, the coming shift toward knowledge workers building RL environments instead of doing repetitive analysis, how to interview without falling for vibes, why nepotism might make a comeback as AI optimizes everyone’s cover letters, scaling the Thiel Fellowship 100,000X, what his 8th-grade donut empire taught him about driving out competition, the link between dyslexia and entrepreneurship, dining out and dating in San Francisco, Mercor’s next steps, and more.

And an excerpt:

COWEN: Now, I saw an ad online not too long ago from Mercor, and it said $150 an hour for a poet. Why would you pay a poet $150 an hour?

FOODY: That’s a phenomenal place to start. For background on what the company does — we hire all of the experts that teach the leading AI models. When one of the AI labs wants to teach their models how to be better at poetry, we’ll find some of the best poets in the world that can help to measure success via creating evals and examples of how the model should behave.

One of the reasons that we’re able to pay so well to attract the best talent is that when we have these phenomenal poets that teach the models how to do things once, they’re then able to apply those skills and that knowledge across billions of users, hence allowing us to pay $150 an hour for some of the best poets in the world.

COWEN: The poets grade the poetry of the models or they grade the writing? What is it they’re grading?

FOODY: It could be some combination depending on the project. An example might be similar to how a professor in English class would create a rubric to grade an essay or a poem that they might have for the students. We could have a poet that creates a rubric to grade how well is the model creating whatever poetry you would like, and a response that would be desirable to a given user.

COWEN: How do you know when you have a good poet, or a great poet?

FOODY: That’s so much of the challenge of it, especially with these very subjective domains in the liberal arts. So much of it is this question of taste, where you want some degree of consensus of different exceptional people believing that they’re each doing a good job, but you probably don’t want too much consensus because you also want to get all of these edge case scenarios of what are the models doing that might deviate a little bit from what the norm is.

COWEN: So, you want your poet graders to disagree with each other some amount.

FOODY: Some amount, exactly, but still a response that is conducive with what most users would want to see in their model responses.

COWEN: Are you ever tempted to ask the AI models, “How good are the poet graders?”

[laughter]

FOODY: We often are. We do a lot of this. It’s where we’ll have the humans create a rubric or some eval to measure success, and then have the models say their perspective. You actually can get a little bit of signal from that, especially if you have an expert — we have tens of thousands of people that are working on our platform at any given time. Oftentimes, there’ll be someone that is tired or not putting a lot of effort into their work, and the models are able to help us with catching that.

And:

COWEN: Let’s say it’s poetry. Let’s say you can get it for free, grab what you want from the known universe. What’s the data that’s going to make the models, working through your company, better at poetry?

FOODY: I think that it’s people that have phenomenal taste of what would users of the end products, users of these frontier models want to see. Someone that understands that when a prompt is given to the model, what is the type of response that people are going to be amazed with? How we define the characteristics of those responses is imperative.

Probably more than just poets that have spent a lot of time in school, we would want people that know how to write work that gets a lot of traction from readers, that gains broad popularity and interest, drives the impact, so to speak, in whatever dimension that we define it within poetry.

COWEN: But what’s the data you want concretely? Is it a tape of them sitting around a table, students come, bring their poems, the person says, “I like this one, here’s why, here’s why not.” Is it that tape or is it written reports? What’s the thing that would come in the mail when you get your wish?

FOODY: The best analog is a rubric. If you have some —

COWEN: A rubric for how to grade?

FOODY: A rubric for how to grade. If the poem evokes this idea that is inevitably going to come up in this prompt or is a characteristic of a really good response, we’ll reward the model a certain amount. If it says this thing, we’ll penalize the model. If it styles the response in this way, we’ll reward it. Those are the types of things, in many ways, very similar to the way that a professor might create a rubric to grade an essay or a poem.

Poetry is definitely a more difficult one because I feel like it’s very unbounded. With a lot of essays that you might grade from your students, it’s a relatively well-scoped prompt where you can probably create a rubric that’s easy to apply to all of them, versus I can only imagine in poetry classes how difficult it is to both create an accurate rubric as well as apply it. The people that are able to do that the best are certainly extremely valuable and exciting.

COWEN: To get all nerdy here, Immanuel Kant in his third critique, Critique of Judgment, said, in essence, taste is that which cannot be captured in a rubric. If the data you want is a rubric and taste is really important, maybe Kant was wrong, but how do I square that whole picture? Is it, by invoking taste, you’re being circular and wishing for a free lunch that comes from outside the model, in a sense?

FOODY: There are other kinds of data they could do if it can’t be captured in a rubric. Another kind is RLHF, where you could have the model generate two responses similar to what you might see in ChatGPT, and then have these people with a lot of taste choose which response they prefer, and do that many times until the model is able to understand their preferences. That could be one way of going about it as well.

Interesting throughout, and definitely recommended. Note the conversation was recorded in October (we have had a long queue), so a few parts of it sound slightly out of date. And here is Hollis Robbins on LLMs and poetry.

Yes, Western Europe will survive recent waves of migration

Over 1.2mn people came to the EU seeking protection in 2015, many displaced by worsening conflict in Syria. There were bitter political feuds in Brussels over asylum, border and relocation policies. January 2016 set a grim record for the number of migrants dying while attempting to cross the Mediterranean.

Now things have changed, as European Commission president Ursula von der Leyen made clear in December when she took the stage at a conference on migrant smuggling. After a major policy overhaul over the past two years, “Europe is managing migration responsibly,” she said. “The figures speak for themselves.”

Irregular arrivals of migrants to the EU recorded by its border agency Frontex dropped by 25 per cent in the 11 months to November 2024, and have been continuously declining since a recent peak of 380,000 arrivals registered in 2023.

New asylum applications have also decreased by around 26 per cent in the first nine months of last year, according to Eurostat data, as fewer Syrians are applying for protection since the fall of the authoritarian regime of Bashar al-Assad in late 2024.

Why Some US Indian Reservations Prosper While Others Struggle

Our colleague Thomas Stratmann writes about the political economy of Indian reservations in his excellent Substack Rules and Results.

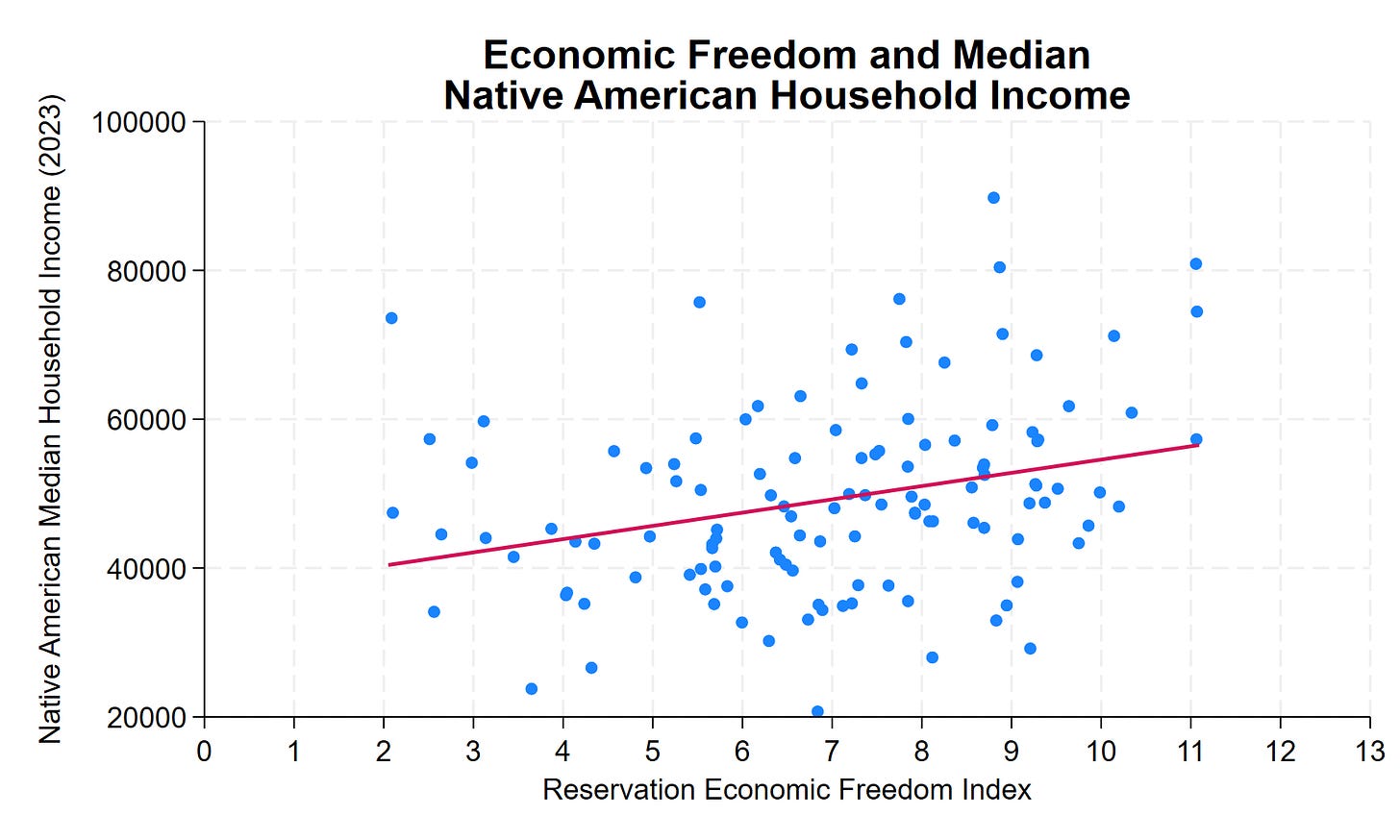

Across 123 tribal nations in the lower 48 states, median household income for Native American residents ranges from roughly $20,000 to over $130,000—a sixfold difference. Some reservations have household incomes comparable to middle-class America. Others face persistent poverty.

Why?

The common assumption: casino revenue. The data show otherwise. Gaming, natural resources, and location explain some variation. But they don’t explain most of it. What does? Institutional quality.

The Reservation Economic Freedom Index 2.0 measures how property rights, regulatory clarity, governance, and economic freedom vary across tribal nations. The correlation with prosperity is clear, consistent, and statistically significant. A 1-point improvement in REFI—on a 0-to-13 scale—correlates with approximately $1,800 higher median household income. A 10-point improvement? Nearly $18,000 more per household.

Many low-REFI features aren’t tribal choices—they’re federal impositions. Trust status prevents land from being used as collateral. Overlapping federal-state-tribal jurisdiction creates regulatory uncertainty. BIA approval requirements add months or years to routine transactions. Complex jurisdictional frameworks can deter investment when the rules governing business activity, dispute resolution, and enforcement remain unclear.

This is an important research program. In addition to potentially improving the lives of native Americans, the 123 tribal nations are a new and interesting dataset to study institutions.

See the post for more details amd discussion of causality. A longer paper is here.

Three that Made a Revolution

Another excellent post from Samir Varma, this time on the 1991 reforms in India that launched India’s second freedom movement:

Three men you’ve probably never heard of—P.V. Narasimha Rao, Manmohan Singh, Montek Singh Ahluwalia—may be the three most important people of the late 20th century.

Bold claim. Audacious, even. Let me defend it.

Here are the numbers. In 1991, over 45% of Indians lived below the poverty line—roughly 400 million people. By 2024, extreme poverty in India had fallen to under 3%.

That’s 400 to 500 million people lifted out of poverty.

The largest democratic poverty alleviation in human history.

….So there they stood.

The precipice was visible. A Hindu politician from a dusty village in Telangana who spoke 17 languages and wrote novels nobody wanted to read. A Sikh economist from a village that no longer existed, who took cold showers at Cambridge and kept dried fruits in his pockets. Another Sikh economist who’d been the youngest division chief in World Bank history and wrote a memo that would change a country.

Three men. All products of a civilization that absorbs contradictions—that somehow fits Hindus and Sikhs and Muslims and Christians and Jains and Buddhists and Parsis into one impossibly diverse democracy. A civilization where, as I’ve written before, any statement you make is true, AS IS its opposite.

India was bankrupt. The gold was gone. The Soviet model they’d followed for forty years was collapsing in real time. Every assumption that had guided Indian economic policy since independence was being revealed as catastrophically wrong.

The intelligentsia still believed in socialism. The party cadres still worshipped Nehru’s memory. The opposition would scream about selling out to foreign powers. The bureaucracy would resist losing its control. The protected industries would fight to keep their monopolies.

But the three men had something their opponents didn’t: a plan. The M Document—the years of thinking—the technocratic expertise accumulated across decades. They had political cover—Rao’s tactical genius, his willingness to let Singh take the heat while he worked the back channels. They had credibility—Singh’s Cambridge pedigree, Ahluwalia’s World Bank experience, Rao’s decades of political survival.

And they had something else: the crisis itself. The one thing that could break through forty years of socialist inertia. The emergency that made the previously impossible suddenly necessary.

Varma tells the story well. For the full history consult the indispensable The 1991 Project, full of documents, oral histories and interviews.

Hat tip: Naveen Nvn.

*38 Londres Street*

The author is Philippe Sands and the subtitle is

So recommended, and added to my own list. And yes I did buy another book by Philippe Sands, the acid test of whether I really liked something.

Bring Back the Privateers!

Senator Mike Lee has a new bill that encourages the President to authorize letters of marque and reprisal against drug cartels:

The President of the United States is authorized and requested to commission, under officially issued letters of marque and reprisal, so many of privately armed and equipped persons and entities as, in the judgment of the President, the service may require, with suitable instructions to the leaders thereof, to employ all means reasonably necessary to seize outside the geographic boundaries of the United States and its territories the person and property of any individual who the President determines is a member of a cartel, a member of a cartel-linked organization, or a conspirator associated with a cartel or a cartel-linked organization, who is responsible for an act of aggression against the United States.

SECURITY BONDS.—No letter of marque and reprisal shall be issued by the President without requiring the posting of a security bond in such amount as the President shall determine is sufficient to ensure that the letter be executed according to the terms and conditions thereof.

My paper on privateers explains how privateers were historically very successful. During the War of 1812, roughly 500 privateers operated alongside a tiny U.S. Navy. The market responded swiftly—privateers like the Comet were commissioned within days of war’s declaration and began capturing prizes within weeks. Sophisticated institutional design combined combined profit incentives with regulatory constraints:

- Security bonds ensured compliance with license terms

- Detailed instructions protected neutral vessels and required civilized conduct

- Prize courts adjudicated captures and distinguished privateers from pirates

- Share-based compensation created good incentives for crews

- Markets emerged where crew could sell shares forward (with limits to maintain work incentives)

Privateers cost the government essentially nothing compared to building and maintaining a navy. Private investors financed vessels , bore the risks, and operated on profit-seeking principles. Moreover, privateers unlike Navy vessels had incentives to capture enemy ships, particularly merchant ships, not just blow them and their occupants out of the water. Of course, capturing the drugs isn’t very useful but it’s quite possible to go after the money on the return journey–privateers as hackers–which is just as good.

Here is my paper on privateering, here is the time I went bounty hunting in Baltimore, here is work on the closely related issue of whistleblowing rewards and here is the excellent historian Mark Knopfler on privateering:

What should I ask Joanne Paul?

Yes I will be doing a Conversation with her. From the Google internet:

Joanne Paul is a writer, broadcaster, consultant, and Honorary Senior Lecturer in Intellectual History at the University of Sussex. A BBC/AHRC New Generation Thinker, her research focuses on the intellectual and cultural history of the Renaissance and Early Modern periods…

She has a new book out Thomas More: A Life.

Here is her home page. Here is Joanne on Twitter. She has many videos on the Tudor period, some with over one million views.

So what should I ask her?

Markets in everything?

If you don’t yet have a REAL ID, you can continue to fly, but it’s going to cost you. Beginning Feb. 1, 2026, the Transportation Security Administration (TSA) will start collecting a $45 fee from travelers using non-compliant forms of identification at airport security checkpoints.

The agency previously proposed a fee of $18 to cover the administrative and IT costs of ID verification for those traveling without a REAL ID or passport but increased the total to $45 in an announcement released earlier this month.

Here is the full story, via the excellent Samir Varma.

Is involuntary hospitalization working?

From Natalia Emanuel, Valentin Bolotnyy, and Pim Welle:

The involuntary hospitalization of people experiencing a mental health crisis is a widespread practice, as common in the US as incarceration in state and federal prisons and 2.4 times as common as death from cancer. The intent of involuntary hospitalization is to prevent individuals from harming themselves or others through incapacitation, stabilization and medical treatment over a short period of time. Does involuntary hospitalization achieve its goals? We leverage quasi-random assignment of the evaluating physician and administrative data from Allegheny County, Pennsylvania to estimate the causal effects of involuntary hospitalization on harm to self (proxied by death by suicide or overdose) and harm to others (proxied by violent crime charges). For individuals whom some physicians would hospitalize but others would not, we find that hospitalization nearly doubles the probability of being charged with a violent crime and more than doubles the probability of dying by suicide or overdose in the three months after evaluation. We provide evidence of housing and earnings disruptions as potential mechanisms. Our results suggest that on the margin, the system we study is not achieving the intended effects of the policy.

Here is the abstract online at the AEA site. I am looking forward to seeing more of this work.

Origins and persistence of the Mafia in the United States

This paper provides evidence of the institutional continuity between the “old world” Sicilian mafia and the mafia in America. We examine the migration to the United States of mafiosi expelled from Sicily in the 1920s following Fascist repression lead by Cesare Mori, the so-called “Iron Prefect”. Using historical US administrative records and FBI reports from decades later, we provide evidence that expelled mafiosi settled in pre-existing Sicilian immigrant enclaves, contributing to the rise of the American La Cosa Nostra (LCN). Our analysis reveals that a significant share of future mafia leaders in the US originated from neighborhoods that had hosted immigrant communities originating in the 32 Sicilian municipalities targeted by anti-mafia Fascist raids decades earlier. Future mafia activity is also disproportionately concentrated in these same neighborhoods. We then explore the socio-economic impact of organized crime on these communities. In the short term, we observe increased violence in adjacent neighborhoods, heightened incarceration rates, and redlining practices that restricted access to the formal financial sector. However, in the long run, these same neighborhoods exhibited higher levels of education, employment, and social mobility, challenging prevailing narratives about the purely detrimental effects of organized crime. Our findings contribute to debates on the persistence of criminal organizations and their broader economic and social consequences.

That is a new paper in the works by Zachary Porreca, Paolo Pinotti, and Masismo Anelli, here is the abstract online.