Thursday assorted links

2. John Cochrane on causal identification.

3. What are the density trends in major cities around the world?

4. “You Can Now Invest In A Hedge Fund Dedicated To Hermès Bags.”

5. What does it mean for an experiment to be beautiful?

8. New Yorker fact checkers confirm that AI song really did hit #1 on the C&W charts.

9. Here is the 5.1 Thinking model on different kinds of humor in Woody Allen movies, and then a follow-up question on the influence of Bergman. Impressive, as is the model more generally.

Waymo

Waymo now does highways in the Bay area.

Expanding our service territory in the Bay Area and introducing freeways is built on real-world performance and millions of miles logged on freeways, skillfully handling highway dynamics with our employees and guests in Phoenix, San Francisco, and Los Angeles. This experience, reinforced by comprehensive testing as well as extensive operational preparation, supports the delivery of a safe and reliable service.

The future is happening fast.

My Conversation with the excellent Donald S. Lopez Jr.

Here is the audio, video, and transcript. Here is part of the episode summary:

Tyler and Donald discuss the Buddha’s 32 bodily marks, whether he died of dysentery, what sets the limits of the Buddha’s omniscience, the theological puzzle of sacred power in an atheistic religion, Buddhism’s elaborate system of hells and hungry ghosts, how 19th-century European atheists invented the “peaceful” Buddhism we know today, whether the axial age theory holds up, what happened to the Buddha’s son Rahula, Buddhism’s global decline, the evidently effective succession process for Dalai Lamas, how a guy from New Jersey created the Tibetan Book of the Dead, what makes Zen Buddhism theologically unique, why Thailand is the wealthiest Buddhist country, where to go on a three-week Buddhist pilgrimage, how Donald became a scholar of Buddhism after abandoning his plans to study Shakespeare, his dream of translating Buddhist stories into new dramatic forms, and more.

Excerpt:

COWEN: Fire is a central theme in Buddhism, right?

LOPEZ: Well, there are hot hells, and there are also cold hells. Fire comes up, really, in the idea of nirvana. Where we see the fire, I think most importantly, philosophically, is the idea of where did the Buddha go when he died? He was not reborn again. They say it’s really just like a flame going out, that is, the flame ends. Where did the fire go? Nowhere, that is, the wood that was producing the flame is all burned up, and you just end. Nirvana is not a place. It’s a state of extinction or what the Buddhists call cessation.

COWEN: What role does blood sacrifice play in Buddhism?

LOPEZ: Well, it’s not supposed to perform any role. There’s no blood sacrifice in Buddhism.

COWEN: No blood sacrifice. How about wrathful deities?

LOPEZ: Wrathful deities — there’re a lot, yes.

COWEN: Then we’re back to supernatural. Again, this gets to my central confusion. It’s atheistic, but there’s some other set of principles in the universe that generate wrathful deities, right?

LOPEZ: Wrathful deities are beings who were humans in one lifetime, animals in another, and born as wrathful deities in another lifetime. Everyone is in the cycle of rebirth. We’ve all been wrathful deities in the past. We’ll be wrathful deities in the future unless we get out soon. It’s this universe of strange beings, all taking turns, shape-shifting from one lifetime to the next, and it goes on forever until we find the way out.

COWEN: Are they like ghosts at all — the wrathful deities?

LOPEZ: There’s a whole separate category of ghosts. The ghosts are often called — if we look at the Chinese translation — hungry ghosts. The ghosts are beings who suffer from hunger and thirst. They are depicted as having distended bellies. They have these horrible sufferings that when they drink water, it turns into molten lead. They’ll eat solid food — it turns into an arrow or a spear. Constantly seeking food, constantly being frustrated, and they appear a lot in Buddhist text. One of the jobs of Buddhist monks and nuns is to feed the hungry ghosts.

COWEN: Is it a fundamental misconception to think of Buddhism as a peaceful religion?

And:

COWEN: …If one goes to Borobudur in Java — spectacular, one of the most amazing places to see in the world.

LOPEZ: Absolutely.

COWEN: We read that it was abandoned. It wasn’t even converted into a tourist site or a place where you would sell things. Why would you just toss away so much capital structure?

LOPEZ: I think it just got overgrown by the jungle. I think that people were not going there. There were no Buddhist pilgrims coming. The populace converted to Islam mostly, and it just fell into decline, just to be revived in the 19th, 20th century.

COWEN: Turn it into a candy store or something! It just seems capital maintenance occurs across other margins. The best-looking building you have — one of the best-looking in the world — is forgotten. Don’t you find that paradoxical?

Definitely recommended, interesting throughout and I learned a great deal doing the prep. One of my favorite episodes of this year. And I am happy to recommend all of Donald’s books on Buddhism.

Prediction markets in everything? Tariff refund edition

Oppenheimer changed its terms from offers earlier this year. The firm said it would consider bids starting at 20 percent per refund claim pertaining to “reciprocal” or IEEPA tariffs and 10 percent for tariffs tied to fentanyl.

Gabriel Rodriguez, the president and co-founder of A Customs Brokerage, in Doral, Fla., and a recipient of several emails from Oppenheimer, said he believed Oppenheimer was offering to pay the equivalent of 80 cents on the dollar per claim.

Here is more from the NYT, via Amy.

Lô Borges, RIP

Here is the obituary, via John.

Wednesday assorted links

1. Marginal product. And more.

2. On Richard II.

3. Brief comments on stablecoins.

4. Decorating with information density (NYT).

5. Susan Athey and Fiona Scott Morton on the economics of AI. They actually have something new to say.

UCSD Faculty Sound Alarm on Declining Student Skills

The UC San Diego Senate Report on Admissions documents a sharp decline in students’ math and reading skills—a warning that has been sounded before, but this time it’s coming from within the building.

At our campus, the picture is truly troubling. Between 2020 and 2025, the number of freshmen whose math placement exam results indicate they do not meet middle school standards grew nearly thirtyfold, despite almost all of these students having taken beyond the minimum UCOP required math curriculum, and many with high grades. In the 2025 incoming class, this group constitutes roughly one-eighth of our entire entering cohort. A similarly large share of students must take additional writing courses to reach the level expected of high school graduates, though this is a figure that has not varied much over the same time span.

Moreover, weaknesses in math and language tend to be more related in recent years. In 2024, two out of five students with severe deficiencies in math also required remedial writing instruction. Conversely, one in four students with inadequate writing skills also needed additional math preparation.

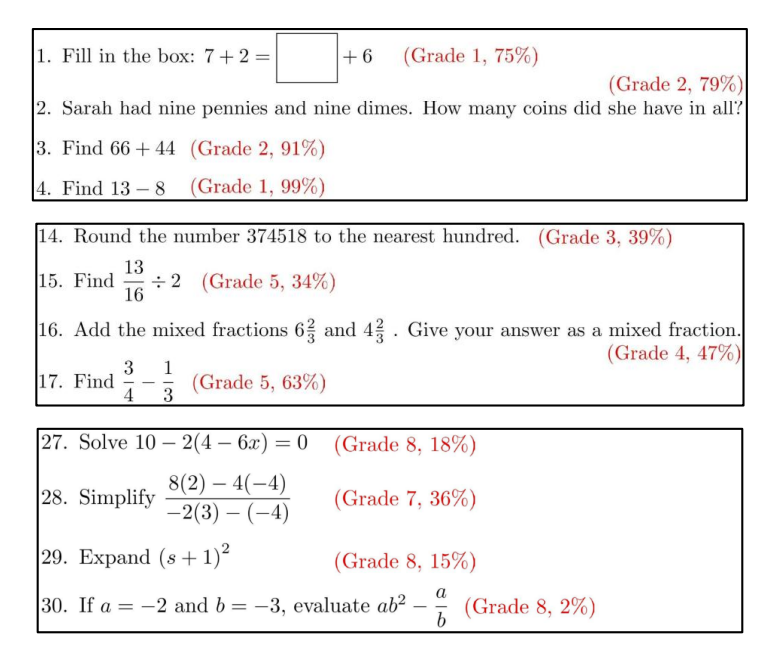

The math department created a remedial course, only to be so stunned by how little the students knew that the class had to be redesigned to cover material normally taught in grades 1 through 8.

Alarmingly, the instructors running the 2023-2024 Math 2 courses observed a marked change in the skill gaps compared to prior years. While Math 2 was designed in 2016 to remediate missing high school math knowledge, now most students had knowledge gaps that went back much further, to middle and even elementary school. To address the large number of underprepared students, the Mathematics Department redesigned Math 2 for Fall 2024 to focus entirely on elementary and middle school Common Core math subjects (grades 1-8), and introduced a new course, Math 3B, so as to cover missing high-school common core math subjects (Algebra I, Geometry, Algebra II or Math I, II, III; grades 9-11).

In Fall 2024, the numbers of students placing into Math 2 and 3B surged further, with over 900 students in the combined Math 2 and 3B population, representing an alarming 12.5% of the incoming first-year class (compared to under 1% of the first-year students testing into these courses prior to 2021)

(The figure gives some examples of remedial class material and the percentage of remedial students getting the answers correct.)

The report attributes the decline to several factors: the pandemic, the elimination of standardized testing—which has forced UCSD to rely on increasingly inflated and therefore useless high school grades—and political pressure from state lawmakers to admit more “low-income students and students from underrepresented minority groups.”

…This situation goes to the heart of the present conundrum: in order to holistically admit a diverse and representative class, we need to admit students who may be at a higher risk of not succeeding (e.g. with lower retention rates, higher DFW rates, and longer time-to-degree).

The report exposes a hard truth: expanding access without preserving standards risks the very idea of a higher education. Can the cultivation of excellence survive an egalitarian world?

Solve for the NIMBY equilibrium?

We are just beginning to think these issues through:

The government’s plan to use artificial intelligence to accelerate planning for new homes may be about to hit an unexpected roadblock: AI-powered nimbyism.

A new service called Objector is offering “policy-backed objections in minutes” to people who are upset about planning applications near their homes.

It uses generative AI to scan planning applications and check for grounds for objection, ranking these as “high”, “medium” or “low” impact. It then automatically creates objection letters, AI-written speeches to deliver to the planning committees, and even AI-generated videos to “influence councillors”.

Kent residents Hannah and Paul George designed the system after estimating they spent hundreds of hours attempting to navigate the planning process when they opposed plans to convert a building near their home into a mosque.

Here is the full story. Via Aaron K.

Mexico estimates of the day

Ms Sheinbaum’s government says Mexico’s murder rate has come down by 32% in the year since she took office. Analysis by The Economist confirms that the rate has fallen, though by a significantly smaller margin, 14%. Counting homicides alone misses an important part of the picture, namely the thousands of people who disappear in Mexico every year, many of whom are killed and buried in unmarked graves. A broader view of deadly crime that includes manslaughter, femicide and two-thirds of disappearances (the data for disappearances is imperfect), shows a more modest decline of 6% (see chart). Still, Mexico is on track for about 24,300 murders this year, horribly high, but well below the recent annual average of slightly over 30,000. Ms Sheinbaum is the first Mexican leader in years to push violent crime in the right direction.

Here is more from The Economist.

Tuesday assorted links

2. Road network of the Roman empire.

3. NIMBYs will pay to keep low income people away. Job market paper from Helena Pedrotti of NYU.

4. Kennedy Center update (NYT). And the Washington National Opera might leave the Kennedy Center.

5. Decoupling dollar and Treasury privilege.

6. In a mock trial, the AIs acquit a teen who was ruled guilty by the judge.

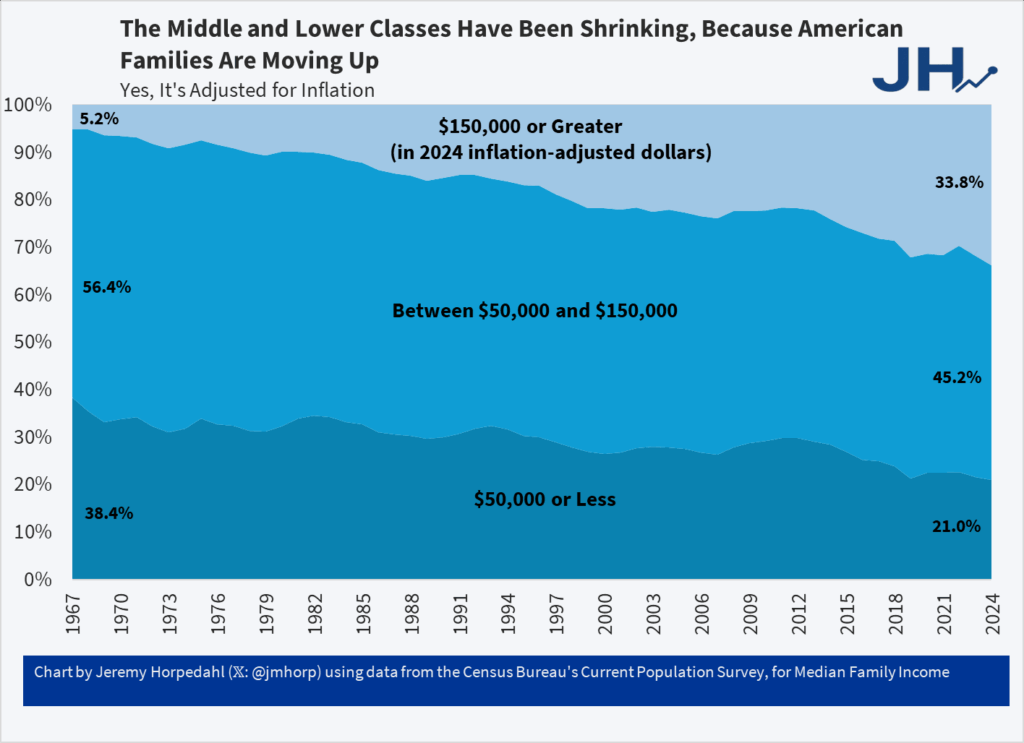

One-Third of US Families Earn Over $150,000

It’s astonishing that the richest country in world history could convince itself that it was plundered by immigrants and trade. Truly astonishing.

From Jeremy Horpedahl who notes:

This is from the latest Census release of CPS ASEC data, updated through 2024 (see Table F-23 at this link).

In 1967, only 5 percent of US families earned over $150,000 (inflation adjusted).

And even though it says so in the chart and in the text let me say it again, this is inflation adjusted and so yes it’s real and no the fact that housing has gone up in price doesn’t negate this, it’s built in. We would have done even better had NIMBYs not reduced the supply of housing.

See also Asness and Strain.

Addendum: Note it isn’t the rise of dual-earner households which haven’t increased for over 30 years.

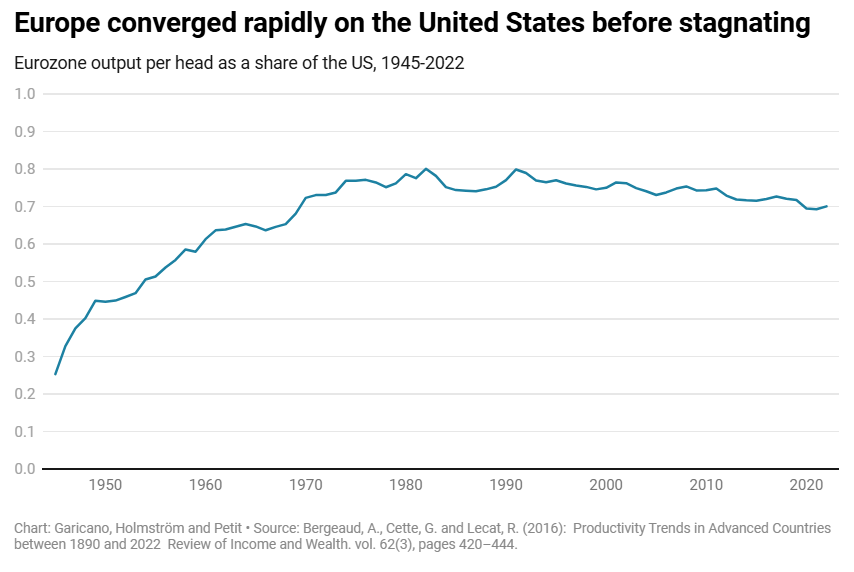

European Stagnation

Excellent piece by Luis Garicano, Bengt Holmström & Nicolas Petit.

The continent faces two options. By the middle of this century, it could follow the path of Argentina: its enormous prosperity a distant memory; its welfare states bankrupt and its pensions unpayable; its politics stuck between extremes that mortgage the future to save themselves in the present; and its brightest gone for opportunities elsewhere. In fact, it would have an even worse hand than Argentina, as it has enemies keen to carve it up by force and a population that would be older than Argentina’s is today.

Or it could return to the dynamics of the trente glorieuses. Rather than aspire to be a museum-cum-retirement home, happy to leave the technological frontier to other countries, Europe could be the engine of a new industrial revolution. Europe was at the cutting edge of innovation in the lifetime of most Europeans alive today. It could again be a continent of builders, traders and inventors who seek opportunity in the world’s second largest market.

The European Union does not need a new treaty or powers. It just needs a single-minded focus on one goal: economic prosperity.

I’ve quoted the call to arms but there is much more substantive and deep analysis. Naturally, I approve of this theme “If a product is safe enough to be sold in Lisbon, it should be safe enough for Berlin.” Not the usual fare, read the whole thing.

Old school workplace feminization

We investigate whether consequential decisions made by judges are impacted by the gender composition of these judges’ peer group. Using the universe of decisions on juvenile defendants in each courthouse in a Southern state over 15 years, we estimate two-way fixed effects models leveraging random assignment of cases to judges and variations in judge peer composition generated by judicial turnover. The results show that an increase in the proportion of female peers in the courthouse causes a rise in individual judges’ propensity to incarcerate, and an increase in prison time. This effect is driven by the behavior of female judges. We examine the sensitivity of our findings to heterogeneous-robust difference-in-differences estimators for continuous and nonabsorbing treatments.

Here is the full article by Ozkan Eren and Naci Mocan, tekl.

*Marked by Time*

The author is Robert J, Sampson, and the subtitle is How Social Change has Transformed Crime and the Life Trajectories of Young Americans, from Harvard University Press. Excerpt:

…[for part of Chicago]..the chance of being arrested in life among people born in the mid-1980s is more than double that of those born just a decade later, in the mid-1990s. This large arrest inequality does not arise from early-life individual, family, or local neighborhood characteristics. It arises from the larger and highly divergent socio-historical contexts in which the children grew through adolescence into adulthood.

The particular story focuses on guns, death, and lead exposure, though I wonder whether the in-sample implied elasticities are validated out of sample. Nonetheless an interesting book.

Monday assorted links

2. “Risk of myocarditis is higher after Covid infection than after vaccine.” For young people, yup.

3. Claims about Tokyo’s train system. Princeton job market paper.

4. Matt Y. on the game theory of some of the Democrats conceding. And thoughts from Sam Stein.

5. Japanese buzzwords of the year?

6. Only five countries have no Swiss citizens living there. It seems it would be more efficient for that number to be higher?

7. The #1 country song is AI-generated?

8. Efforts toward genetically-engineered babies (WSJ). And the “fertility awareness” movement (NYT).