Mexico political challenge of the day

When Mexicans arrive at voting booths next year to elect their judges for the first time, they face a unique and daunting task.

In the capital Mexico City, voters will have to choose judges for more than 150 positions, including on the Supreme Court, from a list of 1,000 candidates that most people have never heard of. For each of the 150 posts, space will be allotted for voters to write out individually the names of up to 10 preferred candidates.

Without makeshift solutions such as dividing up the judges into subdistricts, it could take 45 minutes just to fill in the ballot papers, one analyst estimated. Even with such fixes, voters will still have to choose from many dozens of unfamiliar names.

“It’s impossible,” said Jaime Olaiz-González, a constitutional theory professor at Mexico’s Universidad Panamericana. “In no country, not even the most backward, have they proposed a system like this.” The vote will be the culmination of a drive by the country’s leftwing nationalist president, Andrés Manuel López Obrador, to radically overhaul a branch of the state that has frequently angered him by blocking his plans.

Here is more from Christine Murray from the FT. Garett Jones…telephone!

Tuesday assorted links

2. Who is the greatest British novelist of all time? You get to vote, too.

3. How far can Irvine (CA) go?

4. How and why drug traffickers are infiltrating Costa Rica (NYT).

5. Mr. Beast YouTube hiring and production guide.

6. Chinese do Mun vs. Ricardo, on trade, violent cartoon.

7. Recycled paper and cardboard possibly are bad for the chemical content that leeches away from them?

China estimate and debate of the day

A major sign of Chinese economic malaise: In 2018, 51,302 new startups were founded in China. Last year, that number dropped to 1,202.

Here is one link, leading to others. Here is an attempt to talk down the relevance of those numbers. I would mention that initially there were far too many Chinese start-ups, in part because of government largesse, and so this change is not as bad as it sounds. Nonetheless it is bad.

How to persuade to YIMBY?

Recent research finds that most people want lower housing prices but, contrary to expert consensus, do not believe that more supply would lower prices. This study tests the effects of four informational interventions on Americans’ beliefs about housing markets and associated policy preferences and political actions (writing to state lawmakers). Several of the interventions significantly and positively affected economic understanding and support for land-use liberalization, with standardized effect sizes of 0.15 − 0.3. The most impactful treatment—an educational video from an advocacy group—had effects 2-3 times larger than typical economics-information or political-messaging treatments. Learning about housing markets increased support for development among homeowners as much as renters, contrary to the “homevoter hypothesis.” The treatments did not significantly affect the probability of writing to lawmakers, but an off-plan analysis suggests that the advocacy video increased the number of messages asking for more market-rate housing.

Here is more from Christopher S. Elmendorf, Clayton Nall, and Stan Oklobdzija. Here is the video.

The Economic Consequences of the French Wealth Tax

By Eric Pichet, here is the abstract:

Despite attempts to ‘unwind’ the Impôt de Solidarité sur la Fortune (‘Solidarity Wealth Tax,’ the French wealth tax) during the last legislature (2002-2007), ISF yields had soared by 2006, jumping from €2.5 billion in 2002 to €3.6 billion. Analysis of the economic consequences of this ISF wealth tax has raised the following conclusions: Tax collection costs remain low (around 1.6% of proceeds); Not raising the threshold in line with inflation between 1998 and 2004 created windfall revenues for the French State of €400 million in FY 2004 alone; ISF fraud mainly involving an under-assessment of property assets has stabilised over time at around 28% of total revenues, equivalent; (had the legal framework remained unchanged) to a shortfall for the State of €700 million in 2004; Capital flight since the ISF wealth tax’s creation in 1988 amounts to ca. €200 billion; The ISF causes an annual fiscal shortfall of €7 billion, or about twice what it yields; The ISF wealth tax has probably reduced GDP growth by 0.2% per annum, or around 3.5 billion (roughly the same as it yields); In an open world, the ISF wealth tax impoverishes France, shifting the tax burden from wealthy taxpayers leaving the country onto other taxpayers.

Via Fredrik. I would describe this work as a very loose estimate, nonetheless pointing in the proper direction.

State capacity and economic development

I do not in general trust such methods, but the conclusions are not unwelcome to me:

I provide new empirical estimates of the effect of state capacity on economic development across countries over the period 1960–2022. Specifically, I construct a comprehensive state capacity index based on six different dimensions of effective state institutions available in the Varieties of Democracy (V-Dem) dataset. Then, I estimate heterogeneous parameter models under a common factor framework. My empirical strategy explicitly allows the growth effect of state capacity to differ across countries and accounts for unobserved common factors. My preferred estimates indicate that a one-standard-deviation increase in my V-Dem-based state capacity index predicts a rise in income per person by roughly 6%–7%. The magnitude of such impact equates to less than half of that implied by conventional estimates obtained under highly restrictive assumptions of slope homogeneity and cross-sectional independence. Furthermore, I provide partial evidence suggesting that worldwide heterogeneity in the economic importance of state capacity is deeply rooted in prehistorically determined population diversity, state history, long-term relatedness between countries, and interpersonal trust.

That is from a new paper by Trung V. Vu, via the excellent Kevin Lewis. I am never sure if such results show anything more than “most good things come together at the macro level.”

Monday assorted links

1. Markets in church real estate. You can expect their business to grow.

2. Not Quite Past. For instance, make your own Delftware using AI. Here is further information.

3. Smart goose deterrent system.

4. Tracking SEC inquiries using geolocation data.

5. Metformin investigations (speculative).

6. Does alcohol regulation boost the populist Right?

7. China vs. the Philippines update (NYT).

India and the US

Good op-ed from Arthur Herman and Aparna Pande:

[H]ow America approaches its relations with India — the world’s largest democracy, its most populous nation and very soon its third-largest economy — may determine the balance of global power for the 21st century…As the U.S. looks for a strong strategic partner to contain China’s current hegemonic ambitions, India stands out as the one country whose economic might, military potential and political values can decisively shift the balance of power toward the U.S. and other democracies around the world.

Over 17 percent of the world’s population lives in India. India is poised to become the world’s third-largest economy by 2030 (its GDP stands at $3.94 trillion and is expected to hit $10 trillion by 2035). Its economic growth has stayed around 7 percent per year for the last decade, and it promises to remain robust in the future.

…As for cultural affinities with the U.S. and the West, it’s important to remember that India is the largest English-speaking nation in the world. It’s a vocal supporter of the global norms and multilateral trade institutions such as GATT and the WTO, which sustain a liberal global order.

…For the partnership to really deepen, however, there are important steps both sides must take.

First, India needs to open up its still relatively closed economy, a legacy from its socialist past. It needs to undertake the next generation of market reforms, bolster manufacturing, continue to build up its infrastructure and invest even more in its human capital. India also needs to increase its defense spending from the current 1.6 percent to 2.5 to 3 percent, and diversify its suppliers to include more important ones from Western countries, including the U.S.

Second, the U.S. would benefit from American companies treating the Indian market as their alternative to China in the civilian manufacturing, high-tech and defense-industrial spheres. We also need to respect the fact that as a post-colonial country with a world-class economy, and one with a 5,000-year-old civilization, India will always see itself as a global power, not as a junior American ally, with strategic interests separate from — albeit largely aligned with — those of the U.S.

The emergence of India as a global power will permanently alter the dynamic of competition between the U.S. and China. A president who can correctly guide a closer strategic partnership between India and America will not only counterbalance China’s global ambitions and economic and military might, but could trigger a new era of growth and prosperity for both countries — indeed, for all three.

Dean Ball on AI and prediction markets

What if an LLM read all my writing, listened to all my podcast appearances, and perhaps even to some of my private or semi-private conversations, and then placed hundreds of micro-bets for me, updating them as my own thinking evolved? What if LLMs did this for everyone who cares about AI, or any other topic? The income I would gain or lose needn’t be significant. If the bets were small, it could be a modest income stream, similar to what most artists get from streaming royalties, or what many mid-sized X accounts receive in revenue sharing. That way, any losses would not be the end of the world for most people. The real value would be the knowledge society could construct.

What if the debate over the capabilities trajectory of AI, for example, was also operationalized in 1000s of prediction markets, thickly traded in micro-bets made on behalf of millions?

And what if other LLMs also surveyed the broader media environment and placed their own bets? If you think of my writing and thinking (or yours) as a kind of one-man intellectual hedge fund, these latter groups would be something like funds of funds.

What if we could simulate financial markets for every question about the future that concerns us? And what if it cost next to nothing to do? What if, after the work of setting it up was complete, all this just carried on each day, in a way that few humans had to devote much time to maintaining or thinking about?

Here is the full piece.

Are “anchor babies” underrated?

Did you worry about the 2020 fall in U.S. fertility? Well, ponder this:

Birth rates in Canada and the USA declined sharply in March 2020 and deviated from historical trends. This decline was absent in similarly developed European countries. We argue that the selective decline was driven by incoming individuals, who would have travelled from abroad and given birth in Canada and the USA, had there been no travel restrictions during the COVID-19 pandemic. Furthermore, by leveraging data from periods before and during the COVID-19 travel restrictions, we quantified the extent of births by incoming individuals. In an interrupted time series analysis, the expected number of such births in Canada was 970 per month (95% CI: 710-1,200), which is 3.2% of all births in the country. The corresponding estimate for the USA was 6,700 per month (95% CI: 3,400-10,000), which is 2.2% of all births. A secondary difference-in-differences analysis gave similar estimates at 2.8% and 3.4% for Canada and the USA, respectively. Our study reveals the extent of births by recent international arrivals, which hitherto has been unknown and infeasible to study.

That is from a new paper by Amit N. Sawant and Mats J. Stensrud, via the excellent Kevin Lewis.

Sunday assorted links

1. A new mode of national defense for Europe?

2. AI creating a ten-minute podcast on how to practice thinking. Some good advice in there!

3. Robert Moses, The Power Broker, finally coming to eBook September 16.

4. John Stossel on election prediction markets.

5. Why is fiction no longer interested in financial complexity (FT).

USA fact of the day

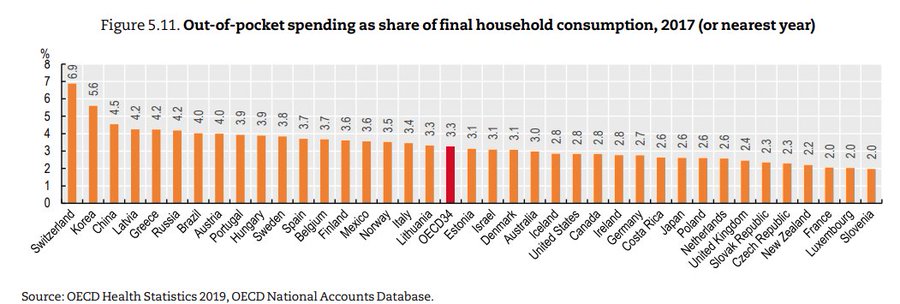

Surprised to learn that the US is below the OECD average for out of pocket health care spending as a fraction of per capita consumption, with virtually the same % as Canada.

That is Jason Abaluck, via the wisdom of Garett Jones.

What is Haitian food like in the United States?

As late as the 1990s, food in Haiti probably was the best in the Caribbean, and it certainly was regarded as such. There were fancy French-Caribbean fusion restaurants in Petitionville with amazing seafood, and there was high quality street and diner-level food in Port-au-Prince. Lambi (conch) was consistently the best I ever have had, and the dish with rice cooked in the juice of those special mushrooms was outstanding — Djon Djon they call it. A simple breakfast with eggs and “combi hash” could be memorable. Griot (with sour oranges) was another option, and once I had the best (small) turkey I ate in my life, “dinde,” as it was called from the French. The food was indeed a reason to visit Haiti, at least if you had outside dollars to spend.

As for poorer Haitians, and there are many of them, eating dirt cookies [bonbon tè], mixed with a bit of fat and salt, is indeed a thing.

Haitian food in the United States can be decent, but it is far inferior. The conch is never truly fresh. The servings are far too carbohydrate heavy, with lots of plantains and rice. The stews can be decent, but there isn’t much variety of flavors. It is worth eating such Haitian food once or twice a year, partly for nostalgia value, but it is not really something I crave. I can recommend the sociology you observe in those restaurants, including their reactions to you.

Maybe Brooklyn is best for Haitian food in this country? Some of the North Miami venues are skimpy on the infrastructure side, and not that many Haitians seem to live in Los Angeles. Maryland has a few decent places, and a few times I had tasty Haitian snacks served at late night Haitian concerts there. Possibly in Florida, but not in Little Haiti, would be another option, as I’ve had good Haitian food in both Tampa and Orlando.

Addendum: The Chris Rufo bounty (supply is elastic!) did yield a video of some Africans barbecuing a cat, or is it rather a chicken?, but so far nothing of the Haitians.

Saturday assorted links

1. Is there a rationale for natural monopoly regulation in AI services?

2. Three mistakes in the moral mathematics of existential risk. I don’t agree with everything in there, but quite an interesting piece, forthcoming in Ethics by David Thorstad.

3. Claims about o1.

4. Good article about Haitians settling in Alabama.

5. The Zvi on a bunch of things, including AI superforecasting and recent claims.

Civil War

I knew Civil War (now streaming on HBO/Max) was going to be good when just a minute or so in you see an explosion in the distance and only later do you hear the sound wave. [Mild spoilers may follow.] Shortly after, we meet war journalist Lee (Kirsten Dunst in a standout performance). I thought, “She looks like Lee Miller,” and seconds later, the name is dropped. In the next shot, Lee is in a bathtub—a clear sign you’re in the hands of a master. It is not without import that Lee Miller photographed Dachau or a little less obviously that she was a pioneer of the surreal. Both will reappear in Civil War.

I knew Civil War (now streaming on HBO/Max) was going to be good when just a minute or so in you see an explosion in the distance and only later do you hear the sound wave. [Mild spoilers may follow.] Shortly after, we meet war journalist Lee (Kirsten Dunst in a standout performance). I thought, “She looks like Lee Miller,” and seconds later, the name is dropped. In the next shot, Lee is in a bathtub—a clear sign you’re in the hands of a master. It is not without import that Lee Miller photographed Dachau or a little less obviously that she was a pioneer of the surreal. Both will reappear in Civil War.

In a scene where the journalists need to buy gas, they offer $300. The armed attendant scoffs, “$300 will get you a ham sandwich.” “$300 Canadian,” comes the reply, telling you everything you need to know about the state of the economy.

Civil War was written and directed by Alex Garland, who also made Annihilation, Ex Machina, and the underrated Dredd (the 2012 reboot not the Stallone movie). Many viewers expected Civil War to serve some lectures about red state/blue state politics, but it doesn’t. Tyler makes astute comments about the hidden politics (and reviews the movie here).

My interest was more on how the film portrays war—war is hell but it’s also fucking amazing. The photojournalists at the heart of the story justify their actions as serving a higher purpose, but in reality, they have become addicted to the adrenaline. Civil War shares themes with Nightcrawler. The journalists also share more than they think with the sick fucks who also love war because it gives them a chance to torture and kill.

A great scene at the climax incarnates the “when one dies, another is born” trope. The lead character starts to feel and gain a moral code, only to be killed for it, while the apprentice simultaneously sheds hers, emerging as a new, amoral hero. And it’s all caught on film. Karma is a bitch. The transition isn’t surprising given the logic of the setup but it is handled with originality and grace.

Recommended, given the obvious strictures about violence and serious themes.