Category: Data Source

International PPP for faculty salaries

Not exactly what I would have thought:

Canada comes out on top for those newly entering the academic profession, average salaries among all professors and those at the senior levels. In terms of average faculty salaries based on purchasing power, the United States ranks fifth, behind not only its northern neighbor, but also Italy, South Africa and India.

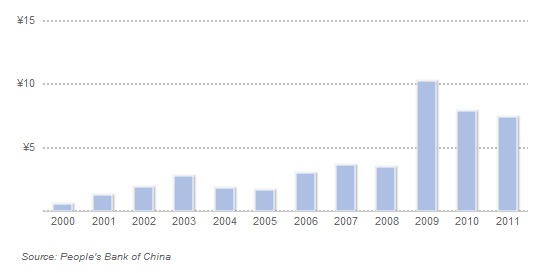

Bank lending in China

With caveats about the data, yes, but still this is striking:

That is from Christopher Balding’s Asia/China blog, the post is here. It is entitled “Why I am Concerned About the Chinese Economy in One Picture.” If you would prefer the words:

From 2008 to 2009 new local currency loans rose from 3.48 trillion rmb to 10.32 trillion according to the PBOC for an annualized increase of nearly 300%.

I do not know if those who praised the Chinese in 2009 for their aggressive stimulus program are having second thoughts, or fearing that the stimulus simply postponed — and intensified — a much-needed adjustment.

Italy Fact of the Day

- Italian labor unions represent more retirees than workers.

From a good piece on reforming Italian labor law in the NYTimes.

Addendum: Some commentators are asking whether this is surprising. Answer: Italy has far more retired union members than any other European country. Circa 2003-2004 (when 48% percent of Italian union members were retired) in France and Germany just 20% of union members were retired, in the UK 10%, in Spain 4.5%. Oddly, I could not find a source for the US, although some unions like the UAW clearly have more retirees than members my guess is that the overall number is quite low and certainly well below the Italian rate.

Facts about Italy

Industrial output in January was five per cent down on a year earlier, while a study by Intesa Sanpaolo, a bank, shows that national consumption of food, drink and tobacco fell in 2011 to levels last seen 30 years ago.

And:

John Elkann, chairman of Fiat, expects Italians to buy fewer cars this year than they did in 1985. Registration of new Fiat group cars in Europe fell 16.7 per cent in February from a year earlier.

And:

Whereas electricity producers were fretting four years ago that Italy lacked generating capacity, one senior utility executive told the Financial Times he feared that industrial consumption would never return to the then levels.

Analysts warn the worst is yet to come. This month Italians will feel the first impact of Mr Monti’s revenue-raising measures when they start paying higher regional income tax. In June reintroduction of a tax on first homes and higher rates on second homes come into force, to be followed in October by a further rise in value added tax.

The article is here.

Pop Bonds

Pay on Performance Bonds incentivize private-sector creativity in the performance of public goals. One of the first Pop bonds (also called social improvement or social impact bonds, SIBs) was pioneered by the British government and the UK group Social Finance. The UK Pop bond is designed to reduce prisoner re-conviction rates. Social Finance raised about $8 million from investors to fund a variety of programs for released prisoners, helping them to find work, stay off alcohol and drugs, reintegrate with society and so forth. The programs are managed by a group of non-profits. The UK government has agreed to pay the investors a return but only if reconviction rates are 7.5% less than those of a control group. If reconviction rates fall below the target level, the investors will earn a good rate of return, 7.5-13%, depending on how far rates fall below the control, but they could also lose everything if rates do not fall. The Pop bond issued in 2010 and appears to be going well although no (potential) bond payments are scheduled until 2014.

A Pop bond puts little risk on governments, who pay nothing if the program does not work but who save money if the program does work. With less at risk government should be willing to experiment more and try new approaches to problems. By contracting out, the government also eliminates a public bureaucracy resistant to change. Most importantly, a Pop bond encourages creativity and innovation in social programs. Investors in a Pop bond have an incentive to monitor the groups implementing the programs and to ensure that they choose the very best, most cost-effective programs. The better the program works, the more the investors earn. If Pop bonds expand it may even pay investors to undertake their own experiments to see how best to maximize their returns.

For Pop bonds to work it is critical that outcomes be measured and marked to an appropriate, randomized, control group. If not carefully monitored, the private sector will also excel at innovative and creative gaming at the public expense (see the comments for some suggestions).

More Pop bonds are being planned in the UK and the idea is also catching on in the United States. The Department of Justice and the Department of Labor both have pilot programs in the works and Massachusetts has issued a request for proposals. By the way, Pop bonds are said to be a new idea but the U.S. bounty hunter and bail bond system which works very well is a clear precursor as is the system of privateering.

Pop bonds have the potential to produce public goods with private innovation; they are an idea worth watching.

Middle East facts of the day

…according to the United States Census Bureau, Iran now has a similar birth rate to New England — which is the least fertile region in the U.S.

The speed of the change is breathtaking. A woman in Oman today has 5.6 fewer babies than a woman in Oman 30 years ago. Morocco, Syria and Saudi Arabia have seen fertility-rate declines of nearly 60 percent, and in Iran it’s more than 70 percent. These are among the fastest declines in recorded history.

That is from David Brooks. These societies will be old before they will be wealthy. Which means perhaps they will never be wealthy.

Walking Fast and Slow

In a famous paper psychologist John Bargh and collaborators gave students at NYU a test very similar to that described by Malcolm Gladwell in Blink:

In front of you is a sheet of paper with a list of five-word sets. I want you to make a grammatical four-word sentence as quickly as possible out of each set. It’s called a scrambled-sentence test. Ready?

- him was worried she always

- are from Florida oranges temperature

- ball the throw toss silently

- shoes give replace old the

- he observes occasionally people watches

- be will sweat lonely they

- sky the seamless gray is

- should not withdraw forgetful we

- us bingo sing play let

- sunlight makes temperature wrinkle raisins

The students were then sent to do another test in an office down the hall. Unbeknownst to them, walking the hall was the real experiment. Scattered in the sentences above are words like “worried,” “Florida,” “old,” “lonely,” “gray,” “bingo,” and “wrinkle.” Bargh reported that students who had been primed with these words took significantly longer to walk down the hall than those not primed with the “old” words.

In the original study there were only 60 participants and the subjects were timed with a stopwatch. A new paper doubles the sample size and uses more accurate infrared sensors. You will probably not be surprised to learn that the new paper fails to replicate the priming effect. As we know from Why Most Published Research Findings are False (also here), failure to replicate is common, especially when sample sizes are small. I haven’t yet described the real surprise, however.

The authors of the new paper, Doyen et al., then took the experiment meta; they ran the experiment again but this time they told half the people supposedly “running” the experiment that they expected the participants to walk slower and the other half they told that they expected the participants to walk faster. (A confederate provided evidence for this effect.) In the second experiment they again used the infrared sensors but they also asked the nominal experimenters to use a stopwatch as the sensors were said to be new and sometimes unreliable.

In the second experiment Doyen et al. were able to replicate the Bargh results. Namely, when using the stopwatch, the nominal experimenters reported that the group primed to walk slow did walk slow and they reported that the group primed to walk fast did walk fast. The results, however, were not entirely due to subtle experimenter bias because in the slow prime case the infrared sensors also found that the slow-primed group walked slow. The infrared sensors, however, did not report an increase in speed when the nominal experimenters expected an increase in speed.

Thus, the old-slow priming results appear to be due to a subtle mix of experimenter bias and standard priming which is cued or amplified via experimenter signaling. Given what are still relatively small sample sizes (50-60) the last should also be taken provisionally.

Important Addendum: Bargh has written a nasty attack on the new paper, the journal that published the paper, and Ed Yong who blogged the new paper for Discover Magazine. Bargh’s attack is a model of how not to respond to criticism new information. Ed Yong discusses Bargh’s response here. Like Yong, I am dismayed that Bargh quotes the new paper inaccurately. In his attack, Bargh also says things such as the overuse of elderly-related items reduces the effect of the prime. Yet in the methods paper he cites (and wrote) he says more prime stimuli generally results in bigger effects (p.11, effects can vary if the subjects consciously recognize the prime, a factor that the new paper tests). Bargh also entirely glosses over the main point which is that the authors did find priming effects when the experimenter knew and expected the effect to occur. Note that given the subtlety of the effects any experimenter bias appears to be entirely unintentional and Doyen never argue otherwise.

Sentences to ponder

There are all kinds of detailed facts to extract: like that the average fraction of keys I type that are backspaces has consistently been about 7% (I had no idea it was so high!).

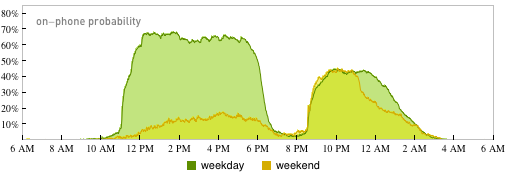

That is from Stephan Wolfram, and it is only the beginning. Here is his on-phone probability:

The entire post is interesting. There are these words too:

And as I think about it all, I suppose my greatest regret is that I did not start collecting more data earlier.

For the pointer I thank Brandon Robison.

Correlations on porn

Firstly (using the General Social Survey) I found no relationship between being pro the legality of porn, or propensity to watch porn, and pro social behaviors e.g. volunteer work, blood donation, etc.

We can dismiss the feminist (and sociological) charges of porn increasing sexual violence and leading to sexism. The USA, Sweden, Germany, Netherlands (2) and Japan were just some of the countries that suddenly went from no legal pornography to quite widespread availability and consumption of it. These studies all found that greater availability of, and exposure to, pornography does not increase the rate of sexual assaults on women, and probably decreases it (3). Japanese porn is quite frequently violent and yet even there rape decreased from an already very low base. It’s interesting that an increase in porn exposure decreases sexual violence only, and has no effect on other crime. Economists would put this down to a substitution effect.

Several countries have sex offender registers – mainly of pedophiles. A wide variety of professions are represented on these registers. Members of professions that supposedly promote morality e.g. clerics or teachers, are quite common on it yet conspicuously absent from such registers are men who have worked in the porn industry.

This study (1) found no relationship between the frequency of x-rated film viewing and attitudes toward women or feminism. From the GSS (controlling for IQ, education, income, age, race and ideology) I found that those who are pro the legality of porn are less likely to support traditional female roles, more likely to be against preferential treatment of either gender, and to find woman’s rights issues more frequently salient. Although I found that women’s rights issues are less salient to male watchers, and female watchers are less likely to think women should work, I also found that watching porn is unrelated to negative attitudes toward women and feminism.

In short exposure to and tolerance of pornography does not cause anti-social behavior (and may even reduce it in relation to sex) and does not get in the way of pro social behavior either.

The sociological and religious charge that pornography undermines monogamy and family values does however receive support. From GSS (and controlling for IQ, education, income, age, race and ideology) I found that men who are pro legalizing porn are less likely to marry and are more pro cohabitation. There was no such association for women. A higher propensity to watch porn movies is also associated with a lesser likelihood of marrying but is unrelated to cohabitation attitudes – in both men and women. So a pro porn attitude is consistent with a reduced respect for marriage.

Both genders also tend to have fewer kids in marriage, if they are pro the legalizing of porn. However, for men, a higher propensity to watch porn movies is associated with having MORE children within marriage. Note that pro legal porn attitudes and porn movie viewership is not associated with having children out of wedlock – for men its associated with a lower chance of that happening – so porn doesn’t lead to that kind of irresponsible behavior.

Possibly part of this general pattern, I found that both being pro the legality of porn and watching porn are related to lower voting rates in general elections.

I found no relationship to a variety of ‘family values’ type questions e.g. importance of family, or to the value of relationships and friendship.

Being pro the legality of porn, and porn viewing, are associated with unhappiness with the family or marriage – especially for men. Those who are pro porn also tend to have a greater number of sexual partners and are more likely to have a sexual affair. This supports the 1984 and 1988 discoveries of Dolf Zillman and Jennings Bryant (4) that the effects of repeated exposure to standard, non-violent, commonly available pornography includes: increased callousness toward women; distorted perceptions about sexuality; devaluation of the importance of monogamy; decreased satisfaction with partner’s sexual performance, affection, and appearance; doubts about the value of marriage; and decreased desire to have children. Later research studies further confirm their findings.

Garth’s excellent and underrated blog is here. I have put it in my RSS feed.

Famous middle initials

John F. Kennedy, Michael J. Fox, Franklin D. Roosevelt, Philip K. Dick, Cecil B. DeMille, George W. Bush, George C. Scott, William F. Buckley, John D. Rockefeller, Johnny B. Goode, James Q. Wilson, and who else?

Why is it so popular with Presidents?

A whole other line of obsession is to start with J. Edgar Hoover, F. Scott Fitzgerald, and so on, and see how many others you can come up with.

Then there is J.R.R. Tolkien, H.L.A. Hart, and their successors.

I am pleased to have no middle initial.

Addendum: Angus comments.

Facts about welfare transfers

In 1968, the in-kind share of assistance was 60 percent; now it is 85 percent.

That is from Ed Glaeser, who believes we should use more cash payments and less in-kind assistance.

Addendum: Kevin Drum comments.

New results on the missing women question

This paper (pdf) came out about two years ago, by Siwan Anderson and Debraj Ray, in the highly esteemed Review of Economic Studies, yet I haven’t seen it discussed in the blogosphere, so here goes:

Relative to developed countries and some parts of the developing world, most notably sub-Saharan Africa, there are far fewer women than men in India and China. It has been argued that as many as a 100 million women could be missing. The possibility of gender bias at birth and the mistreatment of young girls are widely regarded as key explanations. We provide a decomposition of these missing women by age and cause of death. While we do not dispute the existence of severe gender bias at young ages, our computations yield some striking new findings: (1) the vast majority of missing women in India and a significant proportion of those in China are of adult age; (2) as a proportion of the total female population, the number of missing women is largest in sub-Saharan Africa, and the absolute numbers are comparable to those for India and China; (3) almost all the missing women stem from disease-by-disease comparisons and not from the changing composition of disease, as described by the epidemiological transition. Finally, using historical data, we argue that a comparable proportion of women was missing at the start of the 20th century in the United States, just as they are in India, China, and sub-Saharan Africa today.

That is a very different interpretation from what one usually hears.

Excess Reserves and Intraday Credit

In my 2008 post, Interpreting the Monetary Base Under the New Monetary Regime, I argued that the massive increase in bank reserves was neither a necessary harbinger of inflation (as people on the right feared) nor a sure sign of a liquidity trap (as people on the left claimed) but rather represented, at least in part, a sensible aspect of the new regime of paying interest on reserves. I wrote:

When no interest was paid on reserves banks tried to hold as few as possible. But during the day the banks needed reserves – of which there were only $40 billion or so – to fund trillions of dollars worth of intraday payments. As a result, there was typically a daily shortage of reserves which the Fed made up for by extending hundreds of billions of dollars worth of daylight credit. Thus, in essence, the banks used to inhale credit during the day – puffing up like a bullfrog – only to exhale at night. (But note that our stats on the monetary base only measured the bullfrog at night.)

Today, the banks are no longer in bullfrog mode. The Fed is paying interest on reserves and they are paying at a rate which is high enough so that the banks have plenty of reserves on hand during the day and they keep those reserves at night. Thus, all that has really happened – as far as the monetary base statistic is concerned – is that we have replaced daylight credit with excess reserves held around the clock.

A post today at Liberty Street Economics, the blog of the New York Federal Reserve illustrates and explains how the excess reserves have reduced transaction costs in the payment system and risk to the Federal Reserve.

The last chart shows the level of intraday credit extended by the Federal Reserve to Fedwire participants, measured as the daily maximum amount extended by the Federal Reserve. There has been a dramatic decline in the amount of credit extended since the expansion of reserve balances in October 2008. The reduced level of daylight credit has the benefit of reducing the risk exposure of Federal Reserve Banks, as well as the Federal Deposit Insurance Corporation’s (FDIC) fund. Indeed, the expected losses to that fund would be greater if some of the assets of a failed bank had been pledged to a Federal Reserve Bank to collateralize a daylight overdraft, as the collateral would not be available to pay other creditors of the bank. With a greater amount of reserves in the system, banks largely “prepay” for their liquidity needs by maintaining large reserve balances with which to fund their outgoing payments.

China fact of the day

The richest 70 members of China’s legislature added more to their wealth last year than the combined net worth of all 535 members of the U.S. Congress, the president and his Cabinet, and the nine Supreme Court justices.The net worth of the 70 richest delegates in China’s National People’s Congress, which opens its annual session on March 5, rose to 565.8 billion yuan ($89.8 billion) in 2011, a gain of $11.5 billion from 2010, according to figures from the Hurun Report, which tracks the country’s wealthy. That compares to the $7.5 billion net worth of all 660 top officials in the three branches of the U.S. government.

The wealth gap between legislatures holds with statistically comparable samples. The richest 2 percent of the NPC — 60 people — had an average wealth of $1.44 billion per person. The richest 2 percent of Congress — 11 members — had an average wealth of $323 million.

The wealthiest member of the U.S. Congress is Representative Darrell Issa, the California Republican who had a maximum wealth of $700.9 million in 2010, according to the center. If he were in China’s NPC, he would be ranked 40th. Per capita income in China is about one-sixth the U.S. level when adjusted for differences in purchasing power.

That is via Shanghaiist, via @AlbertoNardelli via @AnnieLowrey.

From the comments, on the UK

This is from a loyal reader named “a”:

How high are marginal rates of deductions in the UK?:

Consider an employee paid £50,000 gross who gets a £1,000 pay rise.

Let’s assume they are yet to pay off their student loan and contribute 7.5% to a (underfunded*) pension scheme and get 8% employer contributions to their pension.

Our employee’s employer will also pay the government an extra £218 pension contributions and national insurance (payroll) contributions, 8% and 13.8% of gross earnings respectively.

So the total increase in cost to the employer is £1,218.

Of their pay rise our employee pays £75 pension contributions, £90 student loan repayments, and £370 in income tax, giving total employee deductions £555.

This gives a marginal deduction rate of 63.46% (£445/£1,218).

If our employee buys goods which are liable for VAT they will lose a further 20%, resulting in a 70.77% marginal rate of deductions.

Oh and our employee must pay a local government lump sum tax of around £1,500 from their net wages.

So our employee faces a marginal rate of deductions 63.46% on non-VAT items, 70.77% on VAT items, and an average rate of deduction of 52% of pre-deduction earnings.

A similar analysis on a worker paid the minimum wage (around £12,500 a year), or £1000 above the minimum wage results in a marginal rate of deduction of 32% and an average rate of deduction of 52%. This ignores the withdrawal of means tested benefits.

Might this be the supply side explanation Scott Sumner has been looking for?

* UK private pension schemes currently have a £265bn deficit.