The High Cost of Self-Sufficiency

Mike Riggs and his wife dreamed of returning to the land. It wasn’t as easy as it looks on Tik-Tok:

How many square feet of raised beds do you need to meet a toddler’s strawberry demand? I still don’t know. We dedicated 80 square feet to strawberries last season. The bugs ate half our harvest, and the other half equaled roughly what our kid could eat in a week.

Have you ever grown peas? Give them something to climb, and they’ll stretch to the heavens. Have you ever shelled peas? It is an almost criminal misuse of time. I set a timer on my phone last year. It took me 13 minutes to shell a single serving. Meanwhile, a two-pound bag of frozen peas from Walmart costs $2.42. And the peas come shelled.

…In addition to possums and deer, we’ve faced unrelenting assaults from across the eukaryotic kingdoms: the tomato hornworm caterpillar, the cabbage looper caterpillar, the squash vine borer, the aphid, the thrip, the earwig and the sowbug; cucurbit downy mildew, powdery mildew, collar rot, black rot, sooty mold, botrytis gray mold and stem canker; the nematode, the gray garden slug, the eastern gray squirrel, the eastern cottontail rabbit and the groundhog. All of these organisms reside in the North Carolina Piedmont and like to eat what we eat. Many of them work toward this existential goal while humans sleep, which is why the North Carolina State Agriculture Extension advises growers to inspect their plants at night. No, thank you.

…. In the early 1900s, one of my paternal great-grandfathers moved from urban Illinois to a homestead in Oklahoma. Our only picture of him was taken shortly before the Dust Bowl destroyed his farm. After his farm failed, he abandoned my great-grandmother and their children and migrated to California with thousands of other Okies. When my crops fail, I go to Whole Foods.

Some good lessons here in self-sufficiency, comparative advantage and the productivity of specialization and trade. Of course, it might have been easier for Mike had he read Modern Principles:

How long could you survive if you had to grow your own food? Probably not very long. Yet most of us can earn enough money in a single day spent doing something other than farming to buy more food than we could grow in a year. Why can we get so much more food through trade than through personal production? The reason is that specialization greatly increases productivity. Farmers, for example, have two immense advantages in producing food compared with economics professors or students: Because they specialize, they know more about farming than other people, and because they sell large quantities, they can afford to buy large-scale farming machines. What is true for farming is true for just about every field of production—specialization increases productivity. Without specialization and trade, we would each have to produce our own food as well as other goods, and the result would be mass starvation and the collapse of civilization.

Oh, and by the way, don’t forget Adam Smith, “What is prudence in the conduct of every private family can scarce be folly in that of a great kingdom.”

Deport Dishwashers or Solve All Murders?

I understand being concerned about illegal immigration. I definitely understand being concerned about murder, rape, and robbery. What I don’t understand is being more concerned about the former than the latter.

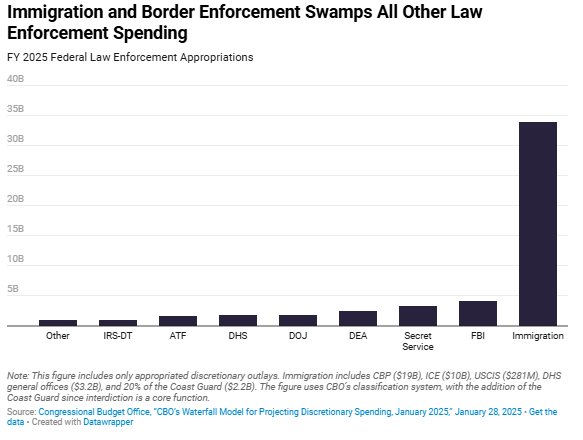

Yet that’s exactly how the federal government allocates resources. The federal government spends far more on immigration enforcement than on preventing violent crime, terrorism, tax fraud or indeed all of these combined.

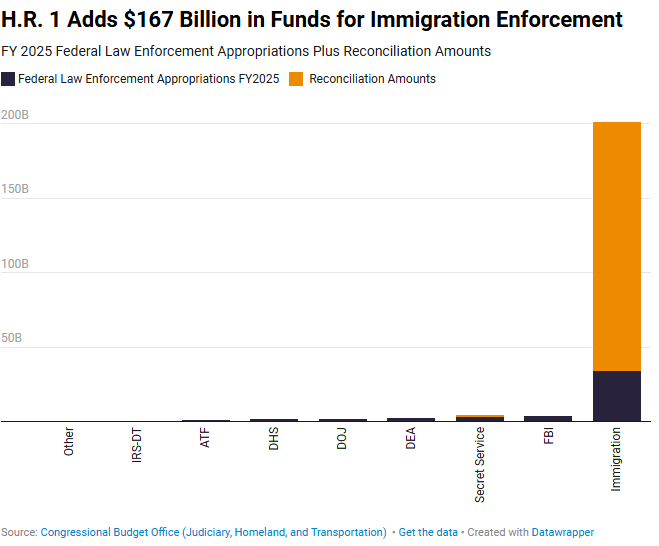

Moreover, if the BBB bill is passed the ratio will become even more extreme. (sere also here):

Don’t make the mistake of thinking that immigration enforcement is about going after murderers, rapists and robbers. It isn’t. Indeed, it’s the opposite. ICE’s “Operation At Large” for example has moved thousands of law enforcement personnel at Homeland Security, the FBI, DEA, and the U.S. Marshals away from investigating violent crime and towards immigration enforcement.

I’m not arguing against border enforcement or deporting illegal immigrants but rational people understand tradeoffs. Do we really want to spend billions to deport dishwashers from Oaxaca while rapes in Ohio committed by US citizens go under-investigated?

Almost half of the murders in the United States go unsolved (42.5% in 2023). So how about devoting some of the $167 billion extra in the BBB bill to say expand the COPS program and hire more police, deter more crime and to use Conor Friedersdorf’s slogan, solve all murders. Back of the envelope calculations suggest that $20 billion annually could fund roughly 150 k additional officers, a ~22 % increase, deterring some ~2 400 murders, ~90 k violent crimes, and ~260 k property crimes each year. Seems like a better deal.

Supersonics Takeoff!

In Lift the Ban on Supersonics I wrote:

Civilian supersonic aircraft have been banned in the United States for over 50 years! In case that wasn’t clear, we didn’t ban noisy aircraft we banned supersonic aircraft. Thus, even quiet supersonic aircraft are banned today. This was a serious mistake. Aside from the fact that the noise was exaggerated, technological development is endogenous.

If you ban supersonic aircraft, the money, experience and learning by doing needed to develop quieter supersonic aircraft won’t exist. A ban will make technological developments in the industry much slower and dependent upon exogeneous progress in other industries.

When we ban a new technology we have to think not just about the costs and benefits of a ban today but about the costs and benefits on the entire glide path of the technology

In short, we must build to build better. We stopped building and so it has taken more than 50 years to get better. Not learning, by not doing.

… I’d like to see the new administration move forthwith to lift the ban on supersonic aircraft. We have been moving too slow.

Thus, I am pleased to note that President Trump has issued an executive order to lift the ban on supersonics!

The United States stands at the threshold of a bold new chapter in aerospace innovation. For more than 50 years, outdated and overly restrictive regulations have grounded the promise of supersonic flight over land, stifling American ingenuity, weakening our global competitiveness, and ceding leadership to foreign adversaries. Advances in aerospace engineering, materials science, and noise reduction now make supersonic flight not just possible, but safe, sustainable, and commercially viable. This order begins a historic national effort to reestablish the United States as the undisputed leader in high-speed aviation. By updating obsolete standards and embracing the technologies of today and tomorrow, we will empower our engineers, entrepreneurs, and visionaries to deliver the next generation of air travel, which will be faster, quieter, safer, and more efficient than ever before.

…The Administrator of the Federal Aviation Administration (FAA) shall take the necessary steps, including through rulemaking, to repeal the prohibition on overland supersonic flight in 14 CFR 91.817 within 180 days of the date of this order and establish an interim noise-based certification standard, making any modifications to 14 CFR 91.818 as necessary, as consistent with applicable law. The Administrator of the FAA shall also take immediate steps to repeal 14 CFR 91.819 and 91.821, which will remove additional regulatory barriers that hinder the advancement of supersonic aviation technology in the United States.

Congratulations to Eli Dourado who has been pushing this issue for more than a decade.

Very Expensive Affordable Housing

In my post Affordable Housing is Almost Pointless, I highlighted how point systems for awarding tax credits prioritize DEI, environmental features, energy efficiency, and other secondary goals far more than low cost. A near-comic example comes from D.C., where so-called affordable housing units now cost between $800,000 and $1.3 million dollars each!

One such unit includes a “rooftop aquaponics farm to produce fresh fruits and vegetables for its tenants.” Another boasts “a fitness room to encourage physical activity, a library, a large café with an outdoor terrace, a large multi-purpose community room with a separate outdoor terrace, an indoor bike room, on-site laundry, lounges and balconies on every floor.”

The issue isn’t that the poor are getting better housing than many working-class D.C. residents. It’s that, with finite resources, the city could fund twice as many units at $400,000 than at $800,000. Secondary goals have overwhelmed affordability.

“There’s the desire of policymakers to ensure that affordable housing meets lots of other goals,” said Carolina Reid, an associate professor at the University of California at Berkeley who studies affordable housing costs. They tend to be worthy goals, she said, but they drive up costs, which results in fewer affordable housing units being built for those in need.

A report released in April by the nonprofit research organization Rand similarly said “unprecedented cost increases” in recent years have been due “in large part to the adoption of policies that prioritize factors other than the efficient production of affordable housing units.”

Of course, as costs rise, various groups along the way also get their slice of a bigger pie.

The kicker? Market-rate housing is cheaper to build than affordable housing!

Next door, the same developers built the Park Kennedy, for mostly market-rate tenants, at a per-unit cost of about $350,000, records show.

This is one reason I much prefer housing vouchers, aka Section 8, to government subsidized “affordable” housing.

No Exit, No Entry

In our textbook, Modern Principles, Tyler and I contrast basic U.S. labor law, at-will employment—where employers may terminate workers for any reason not explicitly illegal (e.g., racial or sexual discrimination), without notice or severance—with Portugal’s “just cause” regime, which requires employers to prove a valid reason, give advance notice, pay severance, and endure extensive regulatory and court involvement before terminating any workers.

Portugal’s laws look pro-worker until you realize that making it more difficult to fire also makes it more difficult to get hired: As we write in MP:

Imagine how difficult it would be to get a date if every date required marriage? In the same way, it’s more difficult to find a job when every job requires a long-term commitment from the employer.

As a result, European unemployment rates—especially for youth and high-risk groups (minorities, immigrants, the less-educated)—tend to exceed those in the U.S. and dynamism is lower.

Like Portugal, India makes it very difficult to fire workers, especially for firms with more than 100 employees. As a result, Indian firms are too small to succeed. Rajagopalan and Shah write:

India’s business regulatory framework consists of an overwhelming 1,536 laws, 69,233 compliance requirements, and 6,632 filings at the Union and state levels cumulatively, which Manish Sabharwal has dubbed India’s “regulatory cholesterol.” This regulatory cholesterol incentivizes firms to limit their size or operate in the informal sector to avoid compliance costs, thereby bifurcating the labor market into a small formal workforce and a large group left vulnerable in the informal sector. India’s labor laws are among the most rigid, contributing to jobless growth and increasing informality.

High hiring/firing costs aren’t the only exit barriers. British/American bankruptcy law, for example, aims to reduce the transaction costs of bankruptcy–quickly and efficiently shifting ownership to creditors, for example–in order to maximize the “scrap value” of a firm. Bankruptcy law in other countries often aims to discourage liquidation. Until ~2017, India had no well-specified bankruptcy law. Even today, the bankruptcy law is honored more in the breach as politicians and judges interfere in large bankruptcy proceedings. Thus, it can take more than 4 years to close a firm in India, if all goes well, and much longer if there are intervening factors. As a result, India has a very high percentage of “dormant firms,” firms–often with employees–but zero output.

In No Country for Dying Firms: Evidence from India, Chatterjee, Krishna, Padmakumar, and Zhao use firm‐level data and a structural model to estimate various exit costs and their effects. Their findings: exit barriers reduce entry, investment, and aggregate productivity.

Three points stand out. First, a simple but often overlooked point. Exit costs trap resources in unproductive firms, depriving more efficient firms of the inputs they need to grow. Second, governments typically focus on entry—offering tax breaks, land, and subsidies to attract firms—because ribbon-cutting is politically rewarding. But the author’s models suggest it’s more effective to subsidize exit. Picking winners is hard; picking losers is easier. Of course, direct subsidies for exit are unlikely and unwise but reforms like streamlined bankruptcy, faster courts, and lower firing costs achieve the same goal and the losers self-select.

Third, the authors argue that improving bankruptcy law—more broadly, reducing the cost of capital reallocation—should take time-priority over reducing firing costs. Capital reallocation raises employment by moving resources to more productive firms. Once that groundwork is laid, labor law reform is more likely to succeed and endure politically.

Thus, unusually, these economists offer not just policy prescriptions but politically savvy guidance on sequencing reform.

Sentence of the Day

FT: Analysis by Torsten Sløk, chief economist at Apollo, suggested that US government credit default swap spreads — which reflect the cost of protecting a loan against default — are trading at levels similar to Greece and Italy.

Yikes!

How America Built the World’s Most Successful Market for Generic Drugs

The United States has some of the lowest prices in the world for most drugs. The U.S. generic drug market is competitive and robust—but its success is not accidental. It is the result of a series of deliberate, well-designed policy interventions.

The 1984 Hatch-Waxman Act allowed generic drug manufacturers to bypass costly safety and efficacy trials for previously approved drugs by demonstrating bioequivalence through Abbreviated New Drug Applications (ANDAs). To spur competition, the Act also granted 180 days of market exclusivity to the first generic filer who challenges a brand-name patent—a mini-monopoly as a reward for initiative. Balancing static efficiency (P=MC) with dynamic efficiency (incentives for innovation) is hard, but Hatch-Waxman mostly got it right.

The Generic Drug User Fee Amendments (GDUFA), modeled after the very successful Prescription Drug User Fee Act (PDUFA), require generic manufacturers to pay user fees to the FDA. These funds allow the Office of Generic Drugs to hire more staff and meet stricter approval timelines. GDUFA dramatically reduced ANDA backlogs and accelerated market entry, especially under GDUFA II.

Generic Substitution Laws allow—or in some states even require—pharmacists to substitute a generic for a more expensive brand-name drug unless the prescriber writes “dispense as written.” This gives generics immediate access to the full market without the need for marketing to doctors or patients. The generic drug market has thus become focused on price as the means of competition. Pharmacists also often earn a bit more on generics due to reimbursement spreads, giving them a financial incentive to substitute. And while pharmacy benefit managers (PBMs) are often criticized, they have also been effective promoters of generics by steering patients toward lower-cost options via formulary design.

The FDA’s Division of Policy Development in the Office of Generic Drug Policy also played an underappreciated but vital role in producing recipes for generics, which has opened up the market to smaller firms. Former FDA commissioner Scott Gottlieb writes:

The division’s core responsibility was drafting, reviewing, and approving the policy guidance documents that defined precisely how generic versions of branded medications could be developed and brought to market. For many generic drugmakers, these documents were indispensable — step-by-step recipes detailing how to replicate complex drugs. Without these clear instructions, numerous generic firms could find themselves locked out of the market entirely…the dramatic increase in the quantity and sophistication of guidance documents issued by the FDA during Trump’s first term was instrumental to his administration’s record-setting approvals of generic drugs and the substantial cost savings enjoyed by patients.

Unfortunately, the Trump administration DOGEd this division—an unforced error that should be reversed. The generic drug market is one of the great policy successes in American healthcare. It works. And it should be strengthened, not undermined.

The Bank of Starbucks

Connor Tabarrok points out that Starbucks is also a bit of a bank:

In 2011, Starbucks rolled out the ability to load money onto a virtual card via their mobile app. purchases made with these pre-loaded dollars earned extra rewards points, which could eventually be redeemed for free drinks. According to their quarterly report from this March, through the app pre-payment system and physical gift cards, Starbucks owes almost $2 billion in coffee to it’s customers.

…The company can treat this money as a 0% interest loan, and with about 10% of funds eventually being forgotten, it’s actually a negative interest loan.

Starbucks can make money on the float and it makes more money as interest rates rise. At $2 billion and 4% they can earn about $80 million annually on the float. Moreover, breakage (some money on the cards is never redeemed) is running at about 10% so that’s another $200 million a year for a grand total of $280 million or a little over 5% of the $5 billion in operating profit. Not a game changer but also not bad for free money.

As interest rates rise, the value to Starbucks of pre-loaded cards increases. So does the cost to users but I suspect supply incentives will dominate here so you can expect to see Starbuck’s pushing these cards.

Affordable Housing Is Almost Pointless

What is the most important feature of affordable housing? Simple! It’s right there in the name, right? Affordable. But no. When the Illinois Housing Development Authority (IHDA) evaluates housing projects for tax credits it gives out points for desirable projects. Quoting Richard Day:

For the general scoring track, 10% of points are awarded for extra accessibility features, 13% are awarded for additional energy efficiency criteria, 15% are awarded based on the makeup of the development team, and an extra 4% are headed out to non-profit developers. Only 3% of scorecard points are awarded based on project cost.

Thus, when you look at what the affordable housing authority actually does it awards more than four times as many points to energy efficiency than cost which ultimately determines affordability and availability. “Development team” includes some mandatory requirements for experience, which makes sense, but also:

(a) incentivizing Black, Indigenous, or People of Color (“BIPOC”) and minority participation on the development team,

Indeed, a for-profit “certified” BIPOC-led business can earn up to 11 points (and a BIPOC-led non-profit up to 7 points) and you can get a few more points if you go the intersectionality route and have a certified female headed BIPOC team. Cost Containment in Project Design & Construction tops out at only 3 points (plus there are 8 more potential points for targeting to extremely poor residents which presumably also gets you some cost control).

Thus, rather than affordable housing what is actually being incentivized is some combination of:

- Racial equity goals

- Environmental sustainability

- Community development

- Supporting vulnerable populations

- Universal design for accessibility (7 points for going beyond code)

This is what Ezra Klein calls Everything Bagel Liberalism and what I called in one of my favorite posts the Happy Meal Fallacy.

The icing on the cake, by the way, is that Day argues that the IHDA is a better system than the even more convoluted and expensive system for affordable housing promoted by Chicago’s Department of Housing.

Hat tip: Ben Krauss writing at Slow Boring.

You Can See the End of the Great Stagnation Everywhere but in the Productivity Statistics

Eli Dourado continues to keep his eye on the most important number in the world, total factor productivity. It continues to be bad, -3.88% on an annual basis for the first quarter of 2025. It’s too early for Trump’s tariffs to have made an effect and too early for AI.

You can see the end of the great stagnation everywhere but in the productivity statistics.

Modern Principles of Economics!

A nice endorsement from a fellow who knows something about writing great books of economics. Ready to adopt a new principles of economics textbook? Modern Principles has got you covered with everything from tariffs to price controls to pandemics! MP also comes with Achieve, a powerful course management system, and over 100 high-quality, professionally produced videos.

No Brains

Back in 2011 I wrote in The Atlantic that “The No-Brainer Issue of the Year” was “Let High-Skill Immigrants Stay”:

We should create a straightforward route to permanent residency for foreign-born students who graduate with advance degrees from American universities, particularly in the fields of science, technology, engineering and mathematics. We educate some of the best and brightest students in the world in our universities and then on graduation day we tell them, “Thanks for visiting. Now go home!” It’s hard to imagine a more short-sighted policy to reduce America’s capacity for innovation.

We never went as far as I advocated but through programs like Optional Practical Training (OPT) we did allow and encourage high-skilled workers to stay in the United States, greatly contributing to American entrepreneurship, startup creation (Stripe and SpaceX, for example, are just two unicorns started by people who first came to the US as foreign students), patenting and innovation and job growth more generally. Moreover, there appeared to be a strong bi-partisan consensus as both Barack Obama and Donald Trump have argued that we should “staple a green card to diplomas”. Indeed in 2024 Donald Trump said:

What I want to do, and what I will do, is—you graduate from a college, I think you should get automatically, as part of your diploma, a green card to be able to stay in this country. And that includes junior colleges, too.

And yet Joseph Edlow, President Trump’s appointee to lead the U.S. Citizenship and Immigration Services (USCIS), said that he wants to kill the OPT program.

“What I want to see is…us to remove the ability for employment authorizations for F-1 students beyond the time that they’re in school.”

It’s remarkable how, in field after field, driven by petty grievance and the illusion of victimhood. the United States seems intent on undermining its own greatest strengths.

Rent Seeking for Four Generations

Amazing story in the Gothamist about a family that has occupied the same rent-controlled apartment for four generations and the last generation is not eager to give up the benefits:

For decades, Vines’ grandmother lived in the rent-stabilized, two-bedroom apartment around the corner from Fort Tryon Park. The unit has housed her family since 1977, Vines said, when her great-grandmother, a Cuban immigrant, moved in. Vines said she started living there part time in August 2021, when she enrolled in college in Westchester.

The building’s owner, Jesse Deutch, told Gothamist in an email that “an apartment is not an inheritance” and that Vines has not submitted the necessary documents to prove she has the right to succeed her grandmother as a tenant.

…Family members — by blood, marriage or emotional and financial dependence — can claim succession rights for a rent-stabilized apartment, but only if they can prove they lived there with the tenant for at least two years immediately before their death or permanent departure. There are exceptions to the two-year requirement, including for people who are full-time students, like Vines was when she says she was living with her grandmother.

Vines doesn’t contest that she lived part of the week in her dorm. But she said she spent long weekends, holidays and spring break with her grandmother and sometimes slept over when she had time in the middle of the week.

Now you might think you understand this story. The landlord wants to kick out the current tenant to raise the rent to the new tenant, right? No. Landlords are no longer allowed to raise the rents to new tenants (!!!). Unless the new tenant is themselves getting rental assistance!

…the owner might also be able to boost his income if a new tenant with a housing subsidy moves in. Property records for the building show the owner is allowed to collect more than the rent-stabilized amount for tenants receiving rental assistance….As of January 2024, the maximum amount the federal Section 8 program and the city’s own aid program would pay is $3,027. That’s more than three times the approximately $900 a month Vines said her grandmother paid.

Did you get that? The city’s rental subsidy programs (like Section 8 and CityFHEPS) will pay more than three times what the current tenant does — creating a surreal incentive where landlords prefer subsidized low-income tenants over potentially middle-class legacy-tenants. Note that whether Vines gets the apartment at the rent-controlled rate has nothing to do with her income. Vines could be middle-class or a multi-millionaire and still be entitled to inherit the apartment at the rent-controlled rate, assuming her claims of having lived in the apartment hold up.

New York has outdone itself with a rent control system so dysfunctional it manages to achieve the worst of all worlds. Not only does it suffer from the usual problems of reducing the supply of housing and dulling incentives for maintenance, but it has transformed over time from a safety net into a hereditary entitlement. Thanks to succession rights, what was meant to help the poor now functions as a kind of family heirloom — a subsidized apartment passed down like grandma’s china set.

Montana Bucks the FDA, Establishes Biotech and Longevity Hub

Longevity: The US state of Montana this week enacted a groundbreaking law that opens the door for clinics and physicians to provide experimental drugs and therapies that have not received approval from the US FDA. The new legislation, known as Senate Bill 535, was signed this week by Governor Greg Gianforte and builds upon the state’s recent expansion of so-called “Right to Try” laws.

Niklas Anzinger, the head of decentralized longevity initiative Infinita City, has long emphasized regulatory zones as a pathway to broader acceleration of therapies, and referred to the new law as a “groundbreaking moment.”

The original SB 422, passed in October 2023, expanded Right to Try access to all patients – not just the terminally ill,” he told us. “That was the first step in enabling a preventative, longevity-focused model of healthcare, rather than reactive sick care. But a major gap remained: there was no clear regulatory pathway. Uncertainty around liability, payments, insurance, and the blurred lines between drug development and clinical care left the field in limbo. SB 535 changes that.”

The new bill establishes a formal licensing framework for healthcare facilities to become experimental treatment centers. These centers can recommend and administer nearly any experimental drug manufactured within Montana, provided it has passed Phase 1 trials.

The law positions Montana as a potential hub for medical tourism and biotech innovation. The bill has been supported by libertarians and the life extension movement. Key backers saw Honduras’s Prospera (previous MR posts on Prospera) as a model. Note, however, that the law passed the Montana legislature with bipartisan backing, reflecting broad appeal for expanding medical access.

Maybe American Federalism isn’t dead yet.

H5N1 Hasn’t Gone Away

Trump dominates the news cycle but it’s important to remember that events continue even when not watched. In particular, we are not winning against H5N1. Here’s a summary of a recent paper in Science:

High-pathogenicity avian influenza subtype H5N1 is now present throughout the US, and possibly beyond. More cattle infections elevate the risk of the virus evolving the capacity to transmit between humans, potentially with high fatality rates. Nguyen et al. show that from a single transmission event from a wild bird to dairy cattle in December 2023, there has been cattle-to-poultry, cattle-to-peridomestic bird, and cattle-to-other mammal transmission. The movement of asymptomatic dairy cattle has facilitated the rapid dissemination of H5N1 from Texas across the US. Evolution within cattle, assessed using deep-sequencing data, has detected low-frequency sequence variants that had previously been associated with mammalian adaptation and transmission efficiency.