Has Clothing Declined in Quality?

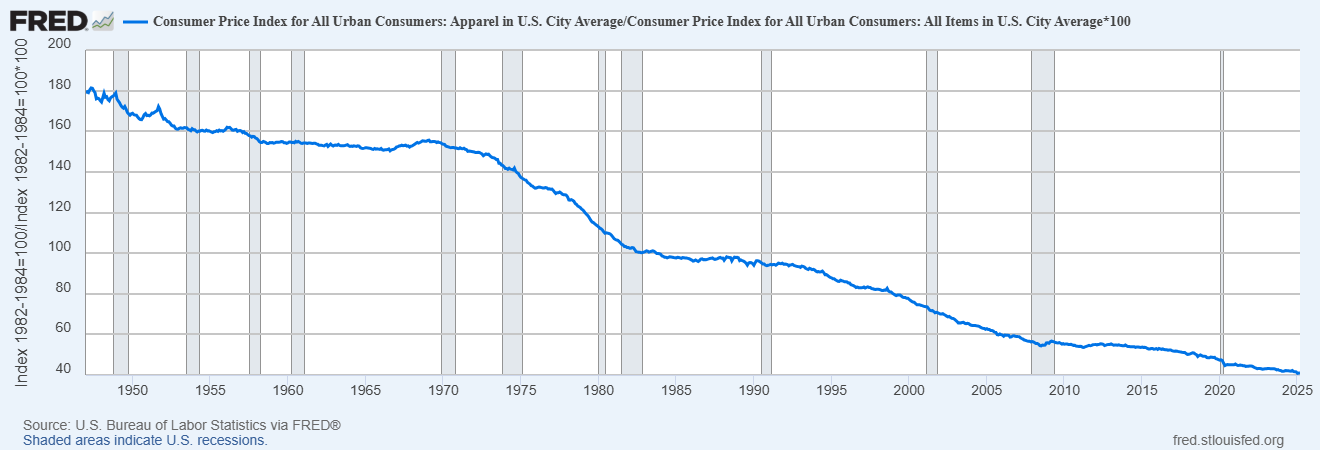

The Office of the U.S. Trade Representative (USTR) recently tweeted that they wanted to bring back apparel manufacturing to the United States. Why would anyone want more jobs with long hours and low pay, whether historically in the US or currently in places like Bangladesh? Thanks in part to international trade, the real price of clothing has fallen dramatically (see figure below). Clothing expenditure dropped from 9-10% of household budgets in the 1960s (down from 14% in 1900) to about 3% today.

Apparently, however, not everyone agrees. While some responses to my tweet revealed misunderstandings of basic economics, one interesting counter-claim emerged–the low price of imported clothing has been a false bargain, the argument goes, because the quality of clothing has fallen.

The idea that clothing has fallen in quality is very common (although it’s worth noting that this complaint was also made more than 50 years ago, suggesting a nostalgia bias, like the fact that the kids today are always going to hell). But are there reliable statistics documenting a decline in quality? In some cases, there are! For example, jeans from the 1960s-80s, for example, were often 13–16 oz denim, compared to 9–11 oz today. According to some sources, the average garment life is down modestly. The statistical evidence is not great but the anecdotes are widespread and I shall accept them. Most sources date the decline in quality to the fast fashion trend which took off in the 1990s and that provides a clue to what is really going on.

Fast fashion, led by firms like Zara, is a business model that focuses on rapidly transforming street style and runway trends into mass-produced, low-cost clothing—sometimes from runway to store within weeks. The model is not about timeless style but about synchronized consumption: aligning production with ephemeral cultural signals, i.e. to be fashionable, which is to say to be on trend, au-courant and of the moment.

It doesn’t make sense to criticize fast fashion for lacking durability—by design, it isn’t meant to last. Making it durable would actually be wasteful. The product isn’t just clothing; it’s fashionable clothing. And in that sense, quality has improved: fast fashion is better than ever at delivering what’s current. Critics who lament declining quality miss the point—it’s fun to buy new clothes and if consumers want to buy new clothes it doesn’t make sense to produce long lasting clothes. People do own many more pieces of clothing today than in the past but the flow is the fun.

So my argument is that the decline in “quality” clothing has little to do with the shift to importing but instead is consumer-driven and better understood as an increase in the quality of fashion. Testing my theory isn’t hard. Consider clothing where function, not just fashion, is paramount: performance sportswear and Personal Protective Equipment (PPE).

There has been a massive and obvious improvement in functional clothing. The latest GoreTex jackets, for example, are more than five times as water resistant (28 000 mm hydrostatic head) compared to the best waxed cotton technology of the past (~5 000 mm) and they are breathable (!) and lighter. Or consider PolarTec winter jackets, originally developed for the military these jackets have the incredible property of releasing heat when you are active but holding it in when you are inactive. (In the past, mountain climbers and workers in extreme environments had to strip on or off layers to prevent over-heating or freezing while exerting effort or resting.) Amazing new super shoes can actually help runners to run faster! Now that is high quality. Personal protective equipment has also increased in quality dramatically. Industrial workers and intense sports enthusiasts can now wear impact resistant gloves which use non-Newtonian polymers that stiffen on impact to reduce hand injuries.

Moreover, it’s not just functional clothing that has increased in quality. For those willing to look, there is in fact plenty of high-quality clothing readily available. From Iron Heart, for example, you can buy jeans made with 21oz selvedge indigo denim produced in Japan. Pair with a high-quality Ralph Lauren shirt, a Mackinaw Wool Cruiser Jacket and a nice pair of Alden boots. Experts like the excellent Derek Guy regularly highlight such high-quality options. Of course, when Derek Guy discusses clothes like this people complain about the price and accuse him of being an elitist snob. Sigh. Tradeoffs are everywhere.

Moreover, it’s not just functional clothing that has increased in quality. For those willing to look, there is in fact plenty of high-quality clothing readily available. From Iron Heart, for example, you can buy jeans made with 21oz selvedge indigo denim produced in Japan. Pair with a high-quality Ralph Lauren shirt, a Mackinaw Wool Cruiser Jacket and a nice pair of Alden boots. Experts like the excellent Derek Guy regularly highlight such high-quality options. Of course, when Derek Guy discusses clothes like this people complain about the price and accuse him of being an elitist snob. Sigh. Tradeoffs are everywhere.

Critics long for a past when goods were cheap, high quality, and Made in America—but that era never really existed. Clothing in the past was more expensive and often low quality. To the extent that some products in the past were of higher quality–heavier fabric jeans, for example–that was often because the producers of the time couldn’t produce it less expensively. Technology and trade have increased variety along many dimensions, including quality. As with fast fashion, lower quality on some dimensions can often produce a superior product. And, of course, it should be obvious but it needs saying: products made abroad can be just as good—or better—than those made domestically. Where something is made tells you little about how well it’s made.

The bottom line is that international trade has brought us more options and if today’s household were to redirect the historical 9 – 10 % share of income to clothing, it could absolutely buy garments that are heavier, better-constructed, and longer-lived than the typical mid-century mass-market clothing.

Tabarrok on the Movie Tariff

The Hollywood Reporter has a good piece on Trump’s proposed movie tariffs:

Even if such a tariff were legal — and there is some debate about whether Trump has the authority to impose such levies — industry experts are baffled as to how, in practice, a “movie tariff” would work.

“What exactly does he want to put a tariff on: A film’s production budget, the level of foreign tax incentive, its ticket receipts in the U.S.?” asks David Garrett of international film sales group Mister Smith Entertainment.

Details, as so often with Trump, are vague. What precisely constitutes a “foreign” production is unclear. Does a production need to be majority shot outside America — Warner Bros’ A Minecraft Movie, say, which filmed in New Zealand and Canada, or Paramount’s Gladiator II, shot in Morocco, Malta and the U.K. — to qualify as “foreign” under the tariffs, or is it enough to have some foreign locations? Marvel Studios’ Thunderbolts*, for example, had some location shooting in Malaysia but did the bulk of its production in the U.S, in Atlanta, New York and Utah.

…“The only certainty right now is uncertainty,” notes Martin Moszkowicz, a producer for German mini-major Constantin, whose credits including Monster Hunter and Resident Evil: The Final Chapter. “That’s not good for business.”

A movie producer is quoted on the bottom line:

“Consistent with everything Trump does and says, this is an erratic, ill conceived and poorly considered action,” says Nicholas Tabarrok of Darius Films, a production house with offices in Los Angeles and Toronto. “It will adversely affect everyone. U.S. studios, distributors, and filmmakers will suffer as much as international ones. Trump just doesn’t seem to understand that international trade is good for both parties and tariffs not only penalize international companies but also raise prices for U.S. based companies and consumers. This is an ‘everyone loses, no one gains’ policy.”

Lady Liberty of the Pacific

Instead of re-opening Alcatraz as super-max prison we should build a statue to America. I suggest “Lady Liberty of the Pacific”. The spirit of Columbia ala John Gast’s American Progress carrying a welcoming beacon-lamp in her raised right hand and a coiled fibre-optic cable in her left representing Bay Area technology.

Not De Minimis

Commerce Secretary Howard Lutnick:

Ending the “de minimis loophole” is a big deal. This rule allowed foreign companies to avoid paying tariffs on small shipments, giving them an unfair advantage over American small businesses. To small businesses across the country: we have your back.

The Value of De Minimis Imports by Fajgelbaum and Khandelwal:

A U.S. consumer can import $800 worth of goods per day free of tariffs and administrative fees. Fueled by rising direct-to-consumer trade, these “de minimis” shipments have exploded in recent years, yet are not recorded in Census trade data. Who benefits from this type of trade, and what are the policy implications? We analyze international shipment data, including de minimis shipments, from three global carriers and U.S. Customs and Border Protection. Lower-income zip codes are more likely to import de minimis shipments, particularly from China, which suggests that the tariff and administrative fee incidence in direct-to-consumer trade disproportionately benefits the poor. Theoretically, imposing tariffs above a threshold leads to terms-of-trade gains through bunching, even in a setting with complete pass-through of linear tariffs. Empirically, bunching pins down the demand elasticity for direct shipments. Eliminating §321 would reduce aggregate welfare by $10.9-$13.0 billion and disproportionately hurt lower-income and minority consumers.

In other words, eliminating the de minimis rule is a significant tax on poorer Americans.

Frankly, it’s also a pain in the ass to have your international shipments delayed at broker (who often charges you exorbitant rates, more than the customs tax) and then have to go down to the customs office to pay the stupid tax. Yes, I am speaking from experience.

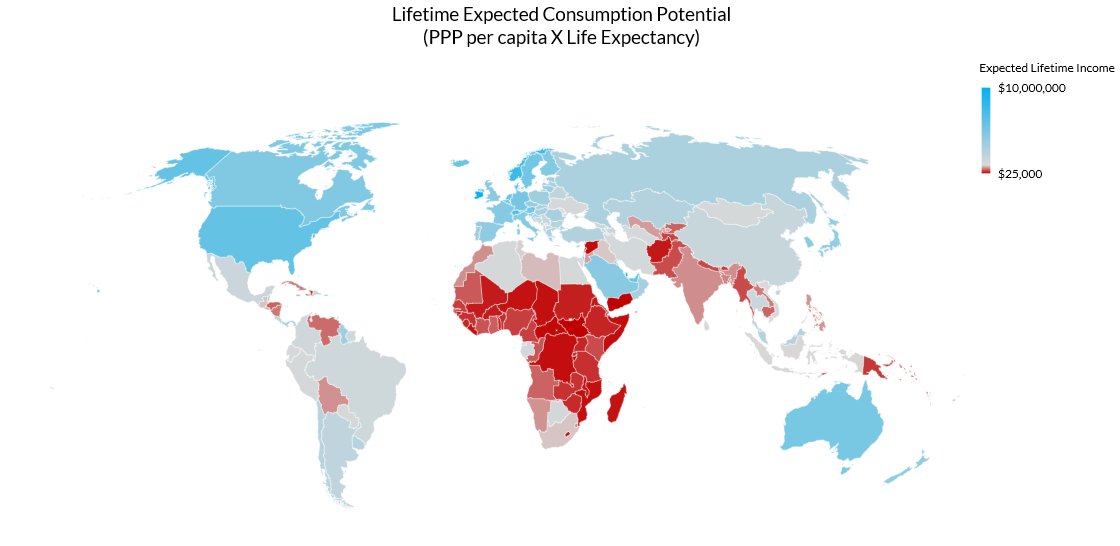

Lifetime Expected Consumption

What does it mean to be wealthy and how should we factor in say, life expectancy? Lyman Stone offers an interesting measure, lifetime consumption, taking in account (roughly) both years lived and how much one consumes in those years.

Tabarrok on the Not My Generation Podcast

Political Scientists James Davenport and Craig Dawkins interview me on everything from tariffs to the Borda Count. Here is one bit I wish to underline:

Q. In your opinion, what is the biggest economic myth or misconception that is holding the U.S. back?

What worries me most is that we’re treating China like an enemy—and that mindset risks becoming a self-fulfilling prophecy. What I want people to understand is this: we have a lot to gain from a rich China.

In my 2009 TED Talk, I gave one of my favorite examples. As China grows wealthier, it invests more in thinking—research, science, and development—that benefits the entire world. Richer countries face diseases of aging, not poverty. As China shifts its focus to diseases like cancer, it ramps up investment in drug development. That raises the odds of a cure—something worth trillions to humanity. If an American cured cancer, I’d be thrilled. If a Chinese citizen cured cancer, I’d be 99.9% as thrilled.

Yes, China is not a democracy. But by global standards, it hasn’t been especially militaristic. There have been border disputes, but no major invasions in over 50 years. China isn’t sending troops to the Middle East or Latin America.

That could change. But nothing inescapable says the U.S. and China must be enemies. We have far more to gain from peace, trade, and prosperity than from conflict.

What Should Classical Liberals Do?

My little contretemps with Chris Rufo raises the issue of what should classical liberals do? In a powerful essay, C. Bradley Thompson explains why the issue must be faced:

The truth of the matter is that the Conservative-Libertarian-Classical Liberal Establishment gave away and lost an entire generation of young people because they refused to defend them or to take up the issues that mattered most to them, and in doing so the Establishment lost America’s young people to the rising Reactionary or Dissident Right, by which I primarily mean groups such as the so-called TradCaths or Catholic Integralists and the followers of the Bronze Age Pervert. (See my essay on the reactionary Right, “The Pajama-Boy Nietzscheans.”)

I do not think Mr. Rufo would disagree with me on this point, but he has not quite made it himself either (at least not as far as I know), so I will make it in my own name.

The betrayal, abandonment, desertion, and loss of America’s young people by conservative and libertarian Establishmentarians can be understood with the following hypothetical.

Imagine the plight of, let us say, a 23-year-old young man in the year 2016. Imagine that he’s been told every single day from kindergarten through the end of college that he’s racist, sexist, and homophobic by virtue of being white, male, and heterosexual. Further imagine that he was falsely diagnosed by his teachers in grade school with ADD/ADHD and put on Ritalin because, well, he’s an active boy. And then his teachers tell him when he’s 12 that he might not actually be a boy, but rather that he might be a girl trapped in boy’s body. And let us also not forget that he’s also been told by his teachers and professors that the country his parents taught him to love was actually founded in sin and is therefore evil. To top it all off: he didn’t get into the college and then the law school of his choice despite having test scores well above those who did.

In other words, what this oppressed and depressed young man has experienced his whole life is a cultural Zeitgeist defined by postmodern nihilism and egalitarianism. These are the forces that are ruining his life and making him miserable.

Let’s also assume that said young man is also temperamentally some kind of conservative, libertarian, or classical liberal, and he interns at the Heritage Foundation, the Cato Institute, or the Institute for Humane Studies hoping to find solace, allies, and support to give relief to his existential maladies.

And how does Conservatism-Libertarianism Inc. respond to what are clearly the dominant cultural issues of our time?

Well, the Establishment publishes yet another white paper on free-market transportation or energy policy. The Heritage Foundation doubles down on more white papers on deficits and taxation policy. The Cato Institute churns out more white papers on legalizing pot and same-sex marriage. The Institute for Humane Studies goes all in to sit at the cool kids’ lunch table by ramping up its videos on spontaneous order featuring transgender 20-somethings.

Is it any wonder that today’s young people who have suffered the slings and arrows of outrageous fortune are stepping outside the arc of history yelling, “stop”? At a certain point, these young people let out a collective primal scream, shouting “I’m mad as hell and I’m not going to take it anymore.” And when the “youf” (as they refer to themselves online) realized that Establishment conservatives and libertarians did not hear them and lacked the vocabulary, principles, power, and courage to defend them from their Maoist persecutors, they went underground to places like 4chan, 8chan, and various other online discussion boards, where they found a Samizdat community of the oppressed.

Having effectively abandoned late-stage Millennials and Gen Z, Conservatism and Libertarianism Inc. should not be surprised, then, that today’s young people who might be otherwise sympathetic to their policies have left that world and become radicalized. News flash: Gen Z is attracted to people who are willing to defend them and attack social nihilism and egalitarianism in all their forms.

Hence the rise of what I call the “Fight Club Right,” which calls for a new kind of American politics. Gen Z rightism is done with what they call the Boomer’s “fake and ghey” attachment to the principles of the Declaration of Independence and the institutions of the Constitution. In fact, many young people who have migrated to the reactionary Right have openly and repeatedly rejected the principles of the American founding as irrelevant in the modern world.

More to the point, this younger generation is done with the philosophy of losing. They’re certainly done with the Establishment. They also seem to be done with classical liberalism and the American founding. (This is a more complicated topic.) Instead, what they want is political power to punish their enemies and to take over the “regime.” They want to use the coercive force of the State to create their new America.

…Conservatism and Libertarianism Inc. seemed utterly oblivious to the fact that the Left had pivoted and changed tactics after the fall of the Berlin Wall in November 1989. By the 1990s, the Left had abandoned economic issues and the working class and was doubling down on cultural issues. Rather than trying to take over the trade-union movement, for instance, the postmodern Left went for MTV and the Boy Scouts, while the major DC think tanks on the Right went for issues too distant from the lives of young people such as the deficit, taxation, and regulatory policy.

While socialism continues to be the end of the Left, the means to the end is postmodern nihilism. That’s where the Left planted its flag and that’s the terrain that it has occupied without opposition, whereas conservative and libertarian organizations such as the Heritage Foundation and the Cato Institute were fighting for ideological hegemony in the economic realm. Between 2000 and 2025, cultural nihilism and its many forms and manifestations is where the action is and has been for a quarter century. So powerful has postmodern nihilism become that even some left-wing “libertarian” organizations have simply become left-wing.

The Public Choice Outreach Conference

There are just a few spots left for the Public Choice Outreach Conference! Do encourage your students to apply!

Yale Faculty v. Administrators

Yale has approximately one administrator for every undergraduate student (see also here and here). Years of simmering tension about the growth of administration relative to faculty has now been brought forward. President Trump has threatened to cut funding to Yale, the Yale administration has threatened to stop hiring faculty and raises, some faculty are now threatening to revolt.

Over 100 Yale professors are calling for the University administration to freeze new administrative hires and commission an independent faculty-led audit to ensure that the University prioritizes academics.

In a letter written to University President Maurie McInnis and Provost Scott Strobel, signatories addressed the “collision of two opposing forces: extraordinary financial strength and runaway bureaucratic expansion.”

…Professor Juan de la Mora, a letter’s signee, said that a significant number of Yale professors believe that the institution is using funding for “improper” purposes and neglecting the school’s founding principles of emphasizing faculty and students.

…Professor of Philosophy Daniel Greco mirrored these sentiments, recognizing the increase in administrative spending in Yale’s budget.

Greco said these spending habits have faculty “puzzled,” as they hear of the money being spent but do not see a change in their day-to-day work.

Professor of Law Sarath Sanga, author of the letter, wrote to the News that over the last two decades, “faculty hiring has stagnated while administrative ranks have by some estimates more than doubled–outpacing peer institutions.”

University are supposed to be faculty-led but over the last several decades most have been taken over by administrators–perhaps we shall see some change.

AI Goes to College…for the Free Money

Last year, the state [CA] chancellor’s office estimated 25 percent of community college applicants were bots.

Everyone understands that students are using AI; sometimes to help them learn, sometimes to avoid learning. What I didn’t appreciate is that community colleges offering online courses are being flooded with AI bots who are taking the courses:

The bots’ goal is to bilk state and federal financial aid money by enrolling in classes, and remaining enrolled in them, long enough for aid disbursements to go out. They often accomplish this by submitting AI-generated work. And because community colleges accept all applicants, they’ve been almost exclusively impacted by the fraud.

The state has launched a Bladerunner-eque “Inauthentic Enrollment Mitigation Taskforce” to try to combat the problem. This strikes me, however, as more of a problem on the back-end of government sending out money without much verification. It’s odd to make the community colleges responsible for determining who is human. Stop sending the money to the bots and the bots will stop going to college.

Sam Altman, as usual, is ahead of the game.

The Library Burned Slowly

A powerful but grim essay by John McGinnis, Professor of Constitutional Law at Northwestern. For decades, the federal government—driven by the left—expanded its control over universities. The right, most notably Ronald Reagan, tried to resist, shielding civil society from state overreach. They failed. Now, a new right has turned to the left’s playbook and is imposing its own vision of the good society. Chris Rufo mocks classical liberals like myself and their naive ideas of neutrality, fairness and open institutions. Principles are for losers. Seize power! Crush your enemies. Rufo does know how to crush his enemies. But what happens when the devil turns? Bludgeoning your enemies is fun while it lasts but you can’t bludgeon your way to a civilization. Hayek’s civil society dies in the rubble.

It seems remarkable that seemingly antisemitic protests by undergraduates, such as those at my own university of Northwestern, could threaten the biomedical research funding of its medical school. But the structure of civil rights laws as applied to universities has long allowed the federal government to cut off funding to the entire university based on the wrongful actions of particular units or departments.

Ironically, the left, now alarmed by the federal government’s intrusive reach, bears direct responsibility for crafting the very legal weapons wielded against the universities it dominates. Almost four decades ago, progressive legislators demanded sweeping amendments to civil rights law, expanding federal oversight over higher education. The sequence of events reveals a cautionary tale of political hubris: progressive confidence that state power would reliably serve their ends overlooked the reality that governmental authority, once unleashed, recognizes no ideological master. Today’s circumstances starkly illustrate how expansive federal control over civil society, originally celebrated by progressives, returns to haunt its architects. The left’s outrage ought to focus not on this particular administration but on its own reckless empowerment of the state.

…Clumsy governmental dictates on contentious matters such as transgender rights do not merely settle disputes; they inflame societal divisions by transforming moral disagreements into winner-takes-all political battles. Civil society, by contrast, thrives precisely because it embraces diversity and facilitates compromise, allowing pluralistic communities to coexist peacefully without being conscripted into ideological warfare. The left, fixated upon uniform outcomes, consistently undervalues the power of voluntary cooperation and cultural persuasion. Their shortsightedness has delivered into the hands of their opponents the very instruments of coercion they forged, vividly confirming an enduring truth: the power you grant government today will inevitably be wielded tomorrow by your adversaries.

Read the whole thing.

The Prophet’s Paradox

The political problem of disaster preparedness is especially acute for the most useful form, disaster avoidance. The problem with avoiding a disaster is that success often renders itself invisible. The captain of the Titanic is blamed for hitting the iceberg, but how much credit would he have received for avoiding it?

Consider a pandemic. When early actions—such as testing and quarantine, ring vaccination, and local lockdowns—prevent a pandemic, those inconvenienced may question whether the threat was ever real. Indeed, one critic of this paper pointed to warnings about ozone depletion and skin cancer in the 1980s as an example of exaggeration and a predicted disaster that did not happen. Of course, one of the reasons the disaster didn’t happen was the creation of the Montreal Protocol to reduce ozone-depleting substances (Jovanović et al. 2019; Tabarrok and Canal 2023). The Montreal Protocol is often called the world’s most successful international agreement, but it is not surprising that we don’t credit it for skin cancers that didn’t happen. I call this the prophet’s paradox: the more the prophet is believed beforehand, the less they are credited afterward.

The prophet’s paradox can undermine public support for proactive measures. The very effectiveness of these interventions creates a perception that they were unnecessary, as the dire outcomes they prevented are never realized. Consequently, policymakers face a challenging dilemma: the better they manage a potential crisis, the more likely it is that the public will perceive their actions as overreactions. Success can paradoxically erode trust and make it more difficult to implement necessary measures in future emergencies. Hence, politicians are paid to deal with emergencies not to avoid them (Healy and Malhotra 2009).

Since politicians are incentivized to deal with rather than avoid emergencies it is perhaps not surprising to find that this attitude was built into the planning process. Thus, the UK COVID Inquiry (2024, 3.17) found that:

Planning was focused on dealing with the impact of the disease rather than preventing its spread.

Even more pointedly Matt Hancock testified (UK COVID Inquiry 2024, 4.18):

Instead of a strategy for preventing a pandemic having a disastrous effect, it [was] a strategy for dealing with the disastrous effect of a pandemic.

From my paper, Pandemic preparation without romance.

Smith Reviews Stiglitz

Vernon Smith reviews Joe Stiglitz’s book The Road to Freedom:

Stiglitz did work in the abstract intellectual theoretical tradition of neoclassical economics showing how the standard results were changed by asymmetric or imperfect information. He is oblivious, however, to the experimental lab and field empirical research showing that agent knowledge of all such information is neither necessary nor sufficient for a market to converge to competitive supply-and-demand equilibrium outcomes.

Consequently, both the standard and the modified theories are irrelevant because buyers and sellers in possession only of dispersed, private, decentralized, value information easily converge to competitive price-quantity allocations in experimental markets over time via learning in repeat transactions.

…The first experiments, showing that complete WTP/WTA information was not necessary, were reported in Smith (1962), and none of us could any longer accept the standard and Stiglitz-modified theories. Further experiments, showing that such information was not sufficient, and that equilibrium prices need not require that markets clear, were reported in Smith (1965). (For propositions summarizing and evaluating observed empirical regularities in these experimental markets, see Vernon L. Smith, Arlington Williams, W. K. Bratt, and M. G. Vannoni, 1982, “Competitive Market Institutions: Double Auctions vs. Sealed Bid-Offer Auctions,” American Economic Review 72, no. 1, 58–77; and Vernon L. Smith, 1991, Papers in Experimental Economics, Cambridge: Cambridge University Press.) It was natural, in the first market experiments, to investigate those questions, such as the information state of traders, that were central to the abstract economic theory of the time.

So, the Akerlof-Stiglitz modifications of theory were founded on a false conditional and thus were not germane to practical market performance. They were born falsified.

…The needed policy implications are quite clear, and they have nothing to do with Stiglitz’s market failure and everything to do with how markets function. Indeed, the appropriate policy recommendation is to fully support the market-system maximization of prosperity, as did Friedman and Hayek, then use incentive mechanisms to improve the relative positions of those who are disadvantaged in that system. Never kill the goose that lays eggs of gold.

Deregulation suggestions

If you have ideas for cutting regulations, the US government wants to hear from you! This could be important. Provide details on the exact regulation in the CFR.

Pandemic Preparation Without Romance

My latest paper, Pandemic Preparation Without Romance, has just appeared at Public Choice.

Abstract: The COVID-19 pandemic, despite its unprecedented scale, mirrored previous disasters in its predictable missteps in preparedness and response. Rather than blaming individual actors or assuming better leadership would have prevented disaster, I examine how standard political incentives—myopic voters, bureaucratic gridlock, and fear of blame—predictably produced an inadequate pandemic response. The analysis rejects romantic calls for institutional reform and instead proposes pragmatic solutions that work within existing political constraints: wastewater surveillance, prediction markets, pre-developed vaccine libraries, human challenge trials, a dedicated Pandemic Trust Fund, and temporary public–private partnerships. These mechanisms respect political realities while creating systems that can ameliorate future pandemics, potentially saving millions of lives and trillions in economic damage.

Here’s one bit:

…in the aftermath of an inadequate government response to an emergency, we often hear calls to reorganize and streamline processes and to establish a single authority with clear responsibility and decision-making power to overcome bureaucratic gridlock. By centralizing authority, it is argued that the government can respond more swiftly and effectively, reducing the inefficiencies caused by a fragmented system.

Yet, the tragedy of the anti-commons was also cited to explain the failure of the government after 9/11. Indeed, the Department of Homeland Security was created to centralize a fragmented system and allow it to act with alacrity. Isn’t a pandemic a threat to homeland security? And what about the Swine Flu pandemic of 2009? While not nearly as deadly as the COVID pandemic, 60 million Americans were sickened, some 274 thousand hospitalized with over 12 thousand deaths (Shresha et al. 2011). Wasn’t this enough practice to act swiftly?

Rather than advocating for a reorganization of bureaucracies, I propose accepting the tragedy of the anti-commons as an inevitable reality. The tragedy of the commons is an equilibrium outcome of modern-day bureaucracy. Bureaucracy has its reasons and some of those reasons may even be reasonable (Wittman 1995). It is too much to expect the same institution to respond to the ordinary demands of day-to-day politics and to the very different demands of emergencies. Indeed, when an institution evolves to meet the demands of day-to-day politics it inevitably develops culture, procedures and processes that are not optimized for emergencies.

Instead of rearranging organization charts we should focus on what has proven effective: the creation of ad-hoc, temporary, public–private organizations. Two notable examples are Operation Warp Speed in the United States and the British Vaccine Taskforce. These entities were established quickly and operated outside regular government channels, free from the typical procurement, hiring, or oversight rules that hinder standard bureaucracies.

…Operation Warp Speed exemplified the “American Model” of emergency response. Rather than relying on command-and-control or government production, the American Model leverages the tremendous purchasing power of the US government with the agility and innovation of the private sector.

The only problem with the “American Model” was its inconsistent application.

I am especially fond of this paper because it is the first, to my knowledge, to cite separate papers from Alex, Maxwell and Connor Tabarrok.

Addendum: This paper isn’t about lockdowns. It’s about avoiding lockdowns!