Category: Law

BBB on drug price negotiations

The sweeping Republican policy bill that awaits President Trump’s signature on Friday includes a little-noticed victory for the drug industry.

The legislation allows more medications to be exempt from Medicare’s price negotiation program, which was created to lower the government’s drug spending. Now, manufacturers will be able to keep those prices higher.

The change will cut into the government’s savings from the negotiation program by nearly $5 billion over a decade, according to an estimate by the nonpartisan Congressional Budget Office.

…the new bill spares drugs that are approved to treat multiple rare diseases. They can still be subject to price negotiations later if they are approved for larger groups of patients, though the change delays those lower prices.

This is the most significant change to the Medicare negotiation program since it was created in 2022 by Democrats in Congress.

Here is more from the NYT. Knowledge of detail is important in such matters, but one hopes this is the good news it appears to be.

Genetic Counseling is Under Hyped

In an excellent interview (YouTube; Apple Podcasts, Spotify) Dwarkesh asked legendary bio-researcher George Church for the most under-hyped bio-technologies. His answer was both surprising and compelling:

What I would say is genetic counseling is underhyped.

What Church means is that gene editing is sexy but for rare diseases carrier screening is cheaper and more effective. In other words, collect data on the genes of two people and let them know if their progeny would have a high chance of having a genetic disease. Depending on when the information is made known, the prospective parents can either date someone else or take extra precautions. Genetic testing now costs on the order of a hundred dollars or less so the technology is cheap. Moreover, it’s proven.

Since the early 1980s the Jewish program Dor Yeshorim and similar efforts have screened prospective partners for Tay-Sachs and other mutations. Before screening, Tay-Sachs struck roughly 1 in 3,600 Jewish births; today births with Tay-Sachs have fallen by about 90 percent in countries that adopted screening programs. As more tests are developed they can be easily integrated into the process. In addition to Tay-Sachs, Dor Yeshorim, for example, currently tests for cystic fibrosis, Bloom syndrome, and spinal muscular atrophy among other diseases. A program in Israel reduced spinal muscular atrophy by 57%. A study for the United States found that a 176 panel test was cost-effective compared to a minimal 5 panel test as did a similar study on a 569 panel test for Australia.

A national program could offer testing for everyone at birth. The results would then be part of one’s medical record and could be optionally uploaded to dating websites. In a world where Match.com filters on hobbies and eye color, why not add genetic compatibility?

Do it for the kids.

Addendum: See also my paper on genetic insurance (blog post here).

The anti-alcohol campaign in the USSR

Although alcohol consumption remains high in many countries, causal evidence on its effects at the societal level is limited because sustained, society-wide reductions in alcohol consumption rarely occur. We take advantage of a country-wide 1985-1990 anti-alcohol campaign in the Soviet Union that resulted in immediate, substantial and sustained reductions in alcohol consumption. We exploit regional differences in precampaign alcohol related mortality in the Russian republic and show immediate declines in male and female adult mortality in urban and rural areas across the entire age distribution, which translate into a rise in life expectancy. The campaign led to a substantial decline in deaths that are both directly (alcohol poisoning, homicides and suicides) and indirectly linked to alcohol consumption (respiratory and infectious). We find a decline in infant mortality rates among boys and girls due to causes most affected by post-natal parental behavior (choking and respiratory). Finally, both divorce and fertility rates rose, while abortions and maternal mortality due to abortions declined. This study provides novel evidence that alcohol consumption not only directly affects the mortality of drinkers but can have spillover effects on family outcomes.

That is from a recent paper by Elizabeth Brainerd and Olga Malkova.

*Breakneck: China’s Quest to Engineer the Future*

Austin Vernon on taxes on solar (from my email)

I think your question about new taxes on solar and wind is an interesting one, and increasing taxation has been an ongoing process for years.

Some of these tax increases are normal, like ending property tax exemptions. These taxes don’t impact project economics too severely, and the breaks create a lot of ill will at the local level.

Solar has seen constant tax increases and quotas on imported panels. Uncompetitive domestic producers, other competing energy sources, anti-trade folks, and China hawks all favor these taxes. The important metric is that buying panels in the US is 2x-3x more expensive per watt than in the rest of the world.

Solar panel factories are easy to build, and technology changes quickly. There is a Dutch boy and the dam effect. We constantly have to add new tariffs on different countries and new technologies (although foreign production from US-owned companies has generally been exempt). These tariffs have to get stiffer to maintain the balance.

A recent change was that the IRA finally led everyone to start building factories in the US. An absolute avalanche of panel factories is/was on the way with less activity for cells, wafers, and polysilicon. These factories might be viable without subsidies considering US panel prices. Most of the interest groups listed don’t appreciate this outcome, especially because many are Chinese-owned factories. Foreign Entity of Concern content and ownership penalties are the obvious solution as the next hole to put a finger in because many subcomponents would still be imported and the general kludge laws like that add.

The solar installation lobby has been satisfied with tax credits that counteract some of the high panel costs. These rules tend to discourage new technology in the fine print and skew incentives. Simpler, denser solar farm designs make sense once panels are cheap. There is no reason to make the switch if panels are expensive and the tax credit is based on the total install cost. Roughly 90% of US utility-scale installations have trackers that add cost but increase per panel output. In China, there are almost no trackers. There are also some nasty effects in the residential business that encourage complex financial products over streamlining construction and permitting.

It is an interesting crossroads where the tax credits are gone, and there is now a reason to have a more direct confrontation on panel cost. The battery industry is in the early stages of a similar conflict, but it seems like they might retain the deal with the devil and keep tax credits for now.

Privatize Federal Land!

I’ve long advocated selling off some federal land—an idea that reliably causes mass fainting spells among the enlightened. How could we possibly part with our national patrimony, our land, our sacred wilderness? Calm down. Most of this “public land” is never used by the public. Selling some of it would actually make it more accessible and useful to real people.

Moreover, most of you wailing about selling some Federal land are probably very happy we sold the “public” airwaves for your private cell phone use. Privatizing the airwaves made them much more useful to the public. (Thank you Reed!).

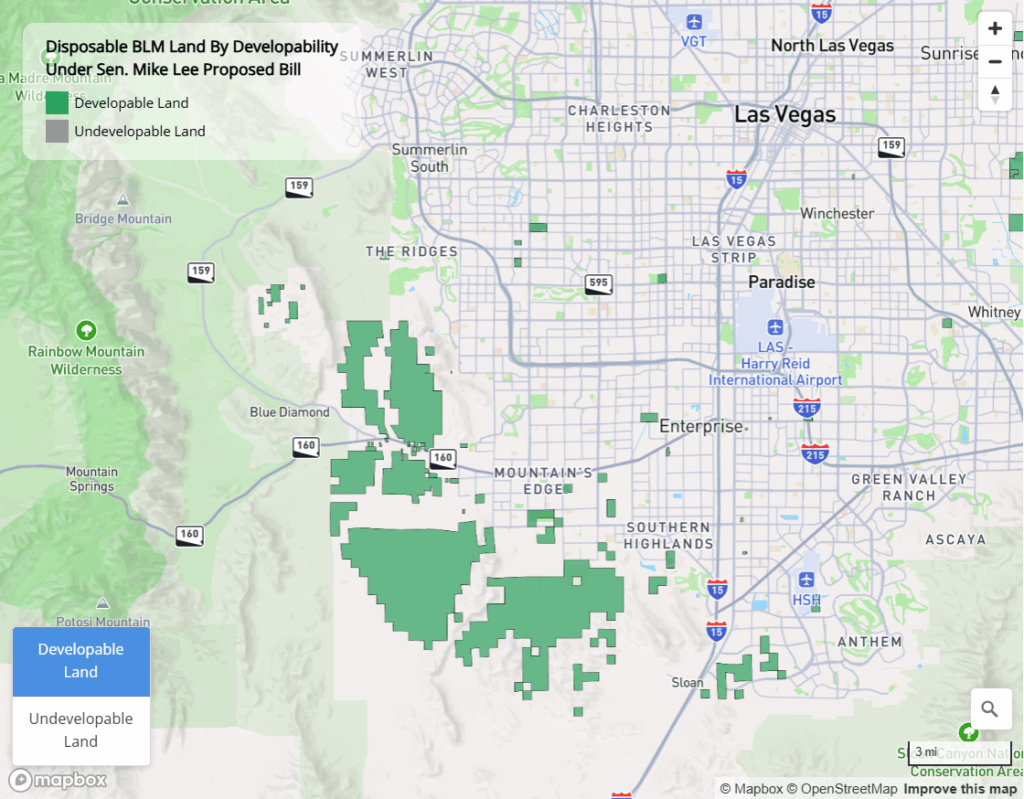

AEI has an excellent map of the lands that could be sold and developed in the Mike Lee bill. Here’s their conclusion:

The data show a significant opportunity. Our analysis finds that developing just 135-180 square miles of the most suitable BLM land, a minuscule fraction of the total, could yield approximately 1 million new homes over ten years. This would substantially address the West’s housing shortage while generating an estimated $15 billion for the U.S. Treasury from land sales.

Here’s an example of the some of the land potentially developable around Las Vegas.

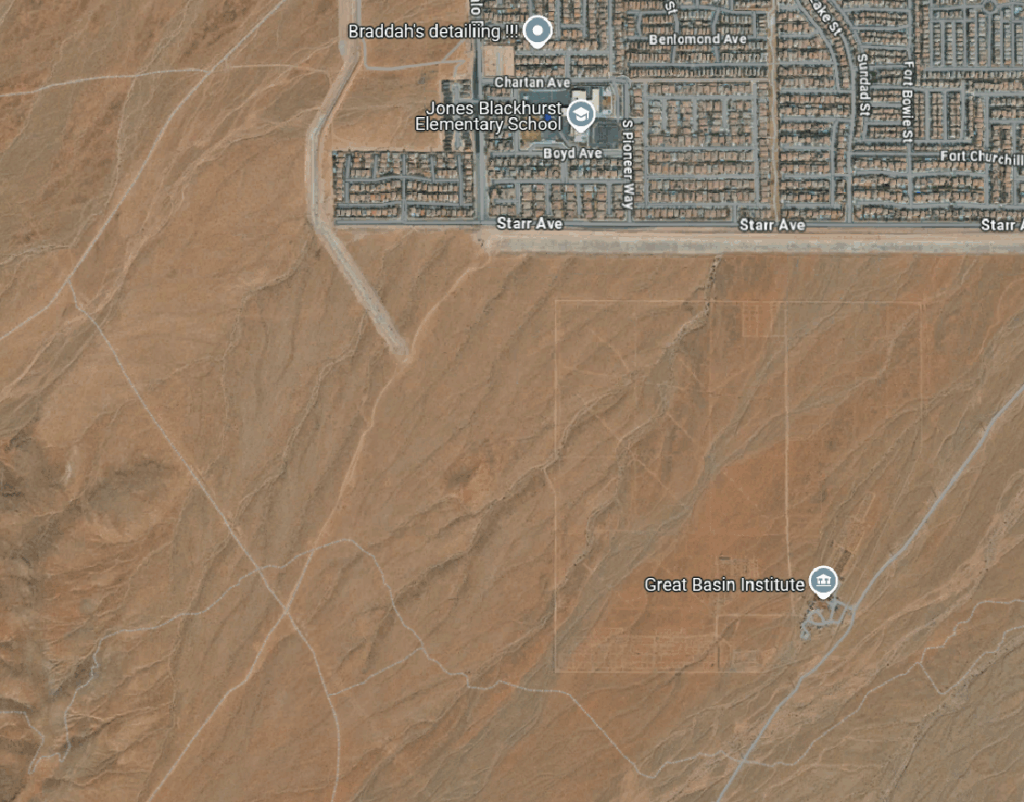

Here’s a Google satellite image of the bit around Mountain’s Edge. Enjoy your fishing on these public lands!

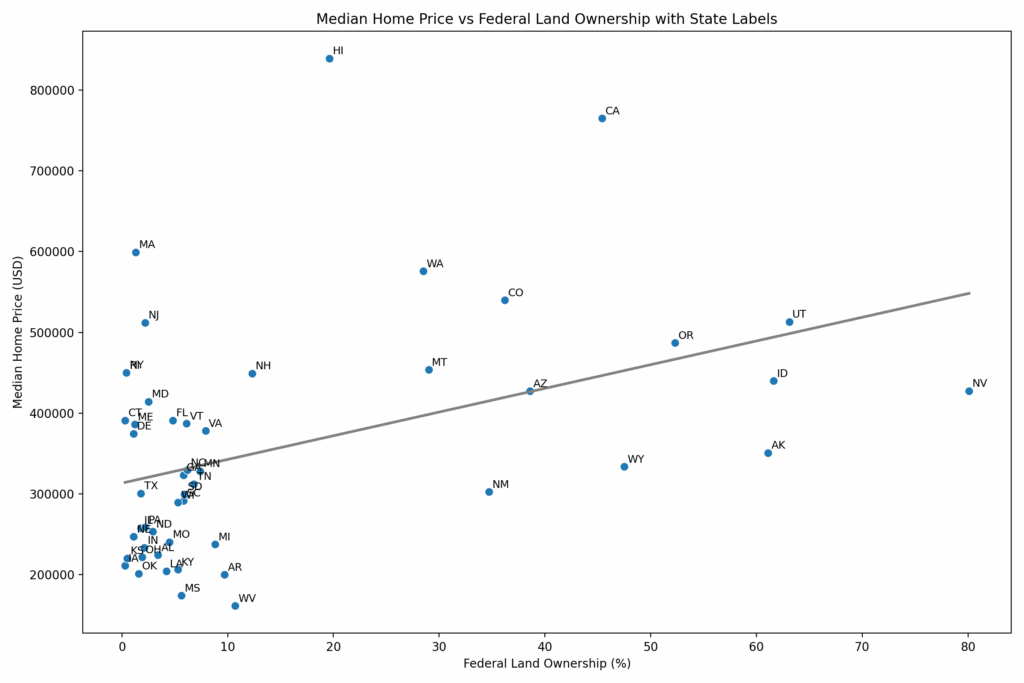

And here’s a very crude but useful scatter plot showing the correlation between median home prices in a state and Federal land ownership. Should home prices in Utah (63.1% Federally owned) really be 71% higher than in Texas (1.8% Federally owned)? Of course, Texas is famously an urban hellscape with no parks, no open space, and nowhere to hunt or fish.

C’mon British people, you can do better than this…

I’ve seen estimates that thirty people a day are arreested in the UK for things they say on social media. Other anecdotes of varying kinds continue to pile up:

Describing a middle-aged white woman as a “Karen” is borderline unlawful, a judge has said amid a bitter row at a mental health charity.

The slang term, used increasingly since the pandemic, refers to middle-aged white women who angrily rebuke those they view as socially inferior. Sitting in an employment tribunal, a judge has now said that the term is pejorative because it implies the woman is excessively and unreasonably demanding.

The woman who used the term nonetheless was acquitted, though barely. Here is the article from Times of London. And this:

The government’s new Islamophobia definition could stop experts warning about Islamist influence in Britain, a former anti-extremism tsar has warned.

Lord Walney said that a review being carried out by Angela Rayner’s department should drop the term Islamophobia, or risk “protecting a religion from criticism” rather than protecting individuals.

Ministers launched a “working group” in February aimed at forming an official definition of what is meant by Islamophobia or anti-Muslim hatred within six months.

Here is The Times link. British people, it is not just J.D. Vance who is upset. You are embarrassing yourselves with all this! Please stop. Even enemies of free speech think you are going about this in a pretty stupid way.

Who in California opposes the abundance agenda?

Labor unions are one of the culprits, environmental groups are another:

Hours of explosive state budget hearings on Wednesday revealed deepening rifts within the Legislature’s Democratic supermajority over how to ease California’s prohibitively high cost of living. Labor advocates determined to sink one of Newsom’s proposals over wage standards for construction workers filled a hearing room at the state Capitol mocking, yelling, and storming out at points while lawmakers went over the details of Newsom’s plan to address the state’s affordability crisis and sew up a $12 billion budget deficit.

Lawmakers for months have been bracing for a fight with Newsom over his proposed cuts to safety net programs in the state budget. Instead, Democrats are throwing up heavy resistance to his last-minute stand on housing development — a proposal that has drawn outrage from labor and environmental groups in heavily-Democratic California.

Here is the full story, via Josh Barro. To be clear, I am for the abundance agenda.

Flying on Frying Oil

The ever-excellent Matt Levine points us to the amusing economic policies that connect the international jet-set to Malaysian street hawkers of fried noodles. The EU and the US have created strong economic incentives to create sustainable aviation fuel (SAF) and a good way to do this is to recycle used cooking oil (UCO). What could be better, right? Take a waste product and turn it into jet fuel! The EU and US policies, however, are so strong that all the EU and US used cooking oil cannot meet the demand. Here’s a great sentence, “Europe simply cannot collect enough used cooking oil to fly its planes.”

In the US, credits under the Inflation Reduction Act can account for up to $1.75 to $1.85 per gallon of SAF. Meanwhile cooking oil is subsidized in some  parts of the world. The result?

parts of the world. The result?

It turns out that restaurants, street food stalls and home cooks in Malaysia — which is “among the world’s leading suppliers of both UCO and virgin palm oil” — will pay less for fresh cooking oil than the international market will pay for used cooking oil. Fresh cooking oil is more useful to cooks than used cooking oil (it tastes better), but it is less useful to refiners and airlines than used cooking oil (it doesn’t reduce their carbon impact). Also fresh cooking oil is subsidized by the government in Malaysia: “Subsidised cooking oil sells for RM2.50 per kg versus the UCO trading price of up to RM4.50 per kg.” So if you run a restaurant, you can buy fresh cooking oil for about $0.60 (USD), use it to fry food a few times, and then sell it to a refiner for $1, which is a nice little subsidy for the difficult, risky, low-margin business of running a restaurant.

The noodle hawkers in Kuala Lumpur are getting a nice little bump in profit but who is going stall to stall to check that the oil is in fact used? And what counts as used? One fry or two? Clever entrepreneurs have cut out the middleman. Virgin palm oil can be substituted for used cooking oil and voila! Sustainable aviation fuel is contributing to deforestation in Malaysia. Malaysia exports far more “used” cooking oil than oil that it uses. No surprise.

All of this illustrates a broader point: externalities suggest policy interventions may improve outcomes but markets are complex and politics is blunt. It’s easy to make things worse. If intervention is necessary, a uniform carbon tax beats a patchwork of production-specific subsidies. A price is a signal wrapped up in an incentive. Send everyone the same signal and the same incentive to ensure that the cheapest emissions are cut first and total costs are minimized.

Crucially, a carbon tax rewards any effective solution, even ones a planner would never think of–lighter planes and cleaner fuels sure but also operational tweaks like jet washes. In contrast, subsidies tether policy to specific technologies, like used cooking oil. That invites rent-seeking and inefficiency.

Tax carbon, not inputs. Avoid games with paperwork. One verification point at the fuel supply point is simpler than tracing global waste-oil chains. Don’t subsidize the fry oil and audit the street hawkers. Tax the emissions.

Canine supply was elastic, too, South Korea edition

South Korea has now banned the dog meat trade:

Chan-woo has 18 months to get rid of 600 dogs.

After that, the 33-year-old meat farmer – who we agreed to anonymise for fear of backlash – faces a penalty of up to two years in prison.

“Realistically, even just on my farm, I can’t process the number of dogs I have in that time,” he says. “At this point I’ve invested all of my assets [into the farm] – and yet they are not even taking the dogs.”

By “they”, Chan-woo doesn’t just mean the traders and butchers who, prior to the ban, would buy an average of half a dozen dogs per week.

He’s also referring to the animal rights activists and authorities who in his view, having fought so hard to outlaw the dog meat trade, have no clear plan for what to do with the leftover animals – of which there are close to 500,000, according to government estimates.

“They [the authorities] passed the law without any real plan, and now they’re saying they can’t even take the dogs.”

…A spokesperson from the Ministry of Agriculture, Food and Rural Affairs (Mafra) told the BBC that if farm owners gave up their dogs, local governments would assume ownership and manage them in shelters.

Here is the full BBC story, via Rich Dewey.

My excellent Conversation with Austan Goolsbee

Here is the audio, video, and transcript. Here is part of the episode summary:

A longtime professor at the University of Chicago’s Booth School and former chair of the Council of Economic Advisers under President Obama, Goolsbee now brings that intellectual discipline—and a healthy dose of humor—to his role as president of the Federal Reserve Bank of Chicago.

Tyler and Austan explore what theoretical frameworks Goolsbee uses for understanding inflation, why he’s skeptical of monetary policy rules, whether post-pandemic inflation was mostly from the demand or supply side, the proliferation of stablecoins and shadow banking, housing prices and construction productivity, how microeconomic principles apply to managing a regional Fed bank, whether the structure of the Federal Reserve system should change, AI’s role in banking supervision and economic forecasting, stablecoins and CBDCs, AI’s productivity potential over the coming decades, his secret to beating Ted Cruz in college debates, and more.

Excerpt:

COWEN: Okay, if the instability comes from the velocity side, that means that we should favor a monetary-growth rule to target the growth path of a nominal GDP, M times V, right?

GOOLSBEE: [laughs] Yes, and now you’re going to get me in trouble, Tyler. Here’s the thing I’ve known —

COWEN: You can just say yes. You’re not in trouble with me.

GOOLSBEE: I’m not going to say yes because, remember, I don’t like making policy off accounting identities. There’s no economic content in accounting identity. If you are trying to design a rule, that rule may work if the shocks are the same as what they always were in previous business cycles. I called it the golden path.

When we came into 2023, you’ll recall the Bloomberg economists said there was a 100 percent chance of recession in 2023. They announced it at the end of 2022. That’s when I came into the Fed system, the beginning of ’23.

That argument was rooted in the past. There had never been a drop of inflation of a significant degree without a very serious recession. Yet in 2023, there was. Inflation fell almost as much as it ever fell in one year without a recession. If you over-index too much on a rule that implicitly is premised on that everything is driven by demand shocks, I just think you want to be careful over-committing.

COWEN: I’m a little confused at the theoretical level. On one hand, you’re saying M times V is an identity, but on the other hand, it drives inflation dynamics.

GOOLSBEE: It’s why I started back from the . . . I bring a micro sentiment to the thinking about causality and supply and demand. I sense that you want to bring us to a, let’s agree on a monetary policy rule, and I’m inherently a little uncomfortable. I want to see what the rules say, but I fundamentally don’t want us to pre-commit to any given rule in a way that’s not robust to shocks.

COWEN: Now, you mentioned the post-pandemic inflation and the role of the supply side. When I look at that inflation, I see prices really haven’t come back down. They’ve stayed up, and I see service prices are also quite high and went up a lot, so I tend to think it was mostly demand side. Now, why is that wrong?

GOOLSBEE: There’re two parts to that. I won’t say why it’s wrong, but here are my questions. If you’re firmly a ‘this-all-came-from-demand’ guy, (A) you’ve got to answer, why did inflation begin soaring in the US when the unemployment rate is over 6 percent? Or we could turn it into potential output terms if you want, but output is below our estimate of potential. Unemployment is way higher than what we think of as the natural rate, and inflation is soaring. That already should make you a little questioning.

COWEN: I can cite M2. You may not like it. M2 went up 40 percent over a few-year period, right?

GOOLSBEE: Two, the fact that the inflation is taking place simultaneously in a bunch of countries of similar magnitudes that did not have the kind of aggregate demand, fiscal or monetary stimulus that we had in the US is also a little bit of a puzzle.

Then the third is, if you don’t think it was supply, then you need to have an explanation for why, when the stimulus rolls off, everything about the stimulus is delta from last year. We pass a big fiscal stimulus, we have substantial monetary stimulus that rolls off, the inflation doesn’t come down. Then in ’23, when the supply chain begins to heal, you see inflation come down. Those three things suggest there’s a little bit of a puzzle if you think it was all demand.

COWEN: No, I don’t think it was all demand, but you mentioned other countries. Switzerland and Japan — they import a lot. They were more restrained on the demand side. They had much lower rates of price inflation. That seems to me strong evidence for being more demand than supply.

GOOLSBEE: Wait a minute.

COWEN: I’m waiting.

GOOLSBEE: You’re going to bring in Japan?

COWEN: Yes.

GOOLSBEE: And you’re going to try to claim that Japan’s low inflation is the result of something in COVID? Japan had lower inflation all along, for decades before. They were going through deflation.

COWEN: But if it was mostly supply, a supply shock would’ve gotten them out of the earlier deflation, right? A demand shock would not have.

Recommended.

How constrained is the NYC mayor?

I thought to ask o3, here is the opening of its answer:

New York City has a “strong-mayor / council” system, but the City Charter, state law and an array of watchdog institutions deliberately fragment power. In practice the mayor can move fastest on implementation—issuing executive orders, running the uniformed services, writing the first draft of the budget, and appointing most agency heads—yet almost every strategic decision runs into at least one institutional trip-wire.

He does appoint all police commissioners and has direct control over the police. The mayor also has line item veto authority, although that can be overriden by the City Council. The entire response is of interest. More generally, who will and will not feel welcome in the city after this result?

Of Course We Should Privatize Some Federal Land (but probably won’t)

The Federal government controls a ridiculous amount of land in the West including more than half of Oregon, Utah, Nevada, Idaho and Alaska and nearly half of California, Arizona, New Mexico and Wyoming. See the map (PDF). The vast majority of this land is NOT parks!!! It is time for a sale to raise some funds and improve the efficiency of land allocation.

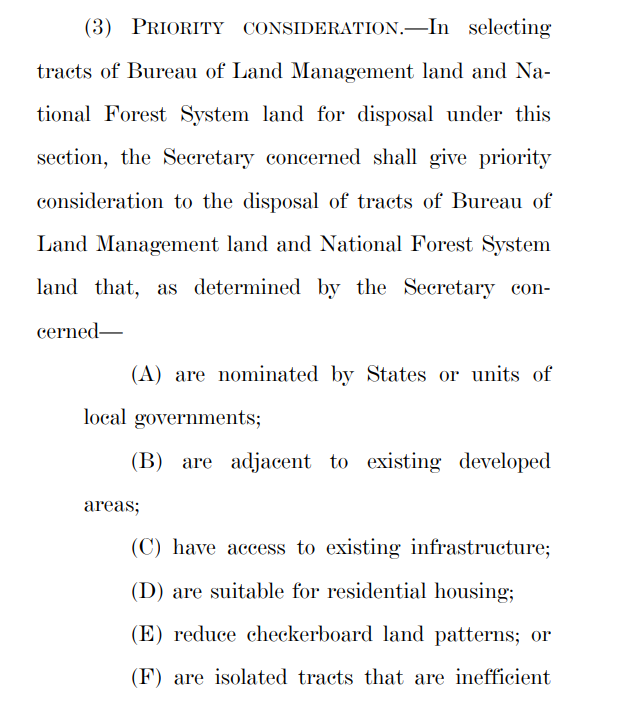

The conservative Mike Lee has a bill that would allow some sales. Great! The only problem with the bill is that it is loaded down with restrictions and qualifications. For example, there is a cap of 0.75% on total sales–that’s right, the land sales are capped at less than 1% of the total Federal land and that is a high cap because most of the rules prohibit any sale. The sales that are allowed have to be nominated by state or local governments, must be adjacent to developed areas and close to infrastructure. Moreover, the land can only be use for housing. Lyman Stone has a thread going into even more detail. The very modest goal–as you can see at right–is to rationalize some checkerboard land patterns.

The conservative Mike Lee has a bill that would allow some sales. Great! The only problem with the bill is that it is loaded down with restrictions and qualifications. For example, there is a cap of 0.75% on total sales–that’s right, the land sales are capped at less than 1% of the total Federal land and that is a high cap because most of the rules prohibit any sale. The sales that are allowed have to be nominated by state or local governments, must be adjacent to developed areas and close to infrastructure. Moreover, the land can only be use for housing. Lyman Stone has a thread going into even more detail. The very modest goal–as you can see at right–is to rationalize some checkerboard land patterns.

Even so, the bill is probably doomed. Just mentioning federal land sales triggers a moral panic, as if someone proposed auctioning off Yellowstone. Supposed conservatives like Lomez are fueling this hysteria (e.g. here, here and here). It’s nonsense. Here and here is the type of land we are actually talking about—notice the difference?

As Matt Darling pointed out, this is Everything Bagel Liberalism from Conservatives—a bloated mess of proceduralism that empowers special interests and kneecaps supply.

If we can’t even sell Federal scraps then we’ve abandoned any pretense of governing in the public interest. We should be building entirely new cities–freedom cities!–not whining about fishing and hunting on scraps of scrub. This is exactly the same as urban NIMBYs who lobby to save “historic” parking lots. Pathetic. The federal land monopoly is not sacred. Let it go. This is where the rubber hits the road: if MAGA means anything beyond vibes and grievance, it should mean cutting red tape and unlocking land for Americans to own and build upon.

The anti-abundance agenda?

It looks like a whole new shipping preference law is coming. The House overwhelmingly passed the American Cargo for American Ships Act that would require 100% of transportation project [DOT related] materials to go on US ships, driving up infrastructure costs.

Here is the Judge Glock tweet, here is the legislation itself. Appears to be worse than the Jones Act?

The antitrust case against U.S. higher education

Thirty prestigious independent American institutions of higher education were at some time members of the 568 higher education group (often labeled a cartel). Seventeen of them were sued by the U.S. Government and representative students who alleged that their meetings and deliberations resulted in collusion that caused students to pay higher prices. Twelve of the seventeen institutions subsequently settled their cases and by 2024 collectively had paid $284 million to do so. However, an inspection of these institutions’ pricing reveals that the median 568 Group institution lowered its average real net annual cost to its undergraduate students by 19.07% between 2009 and 2022. Further, this reduction was 1.70 times larger than the average real price reduction granted during the same period by the median institution among a sample of 475 other accredited, non-profit, independent four-year institutions and 11.63 times larger than the median price reduction granted by 78 public flagship state universities. The 568 group’s real price reductions stretched across every one of the five household income categories commonly used by the Government. Thus, there is little empirical support for the allegations that the Government has levied against the representative 568 group institution, and thus multiple members of this group appear to have paid unmerited fines to the Government to settle claims against them.

That is from a new paper by James V. Koch. Via the excellent Kevin Lewis.